Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

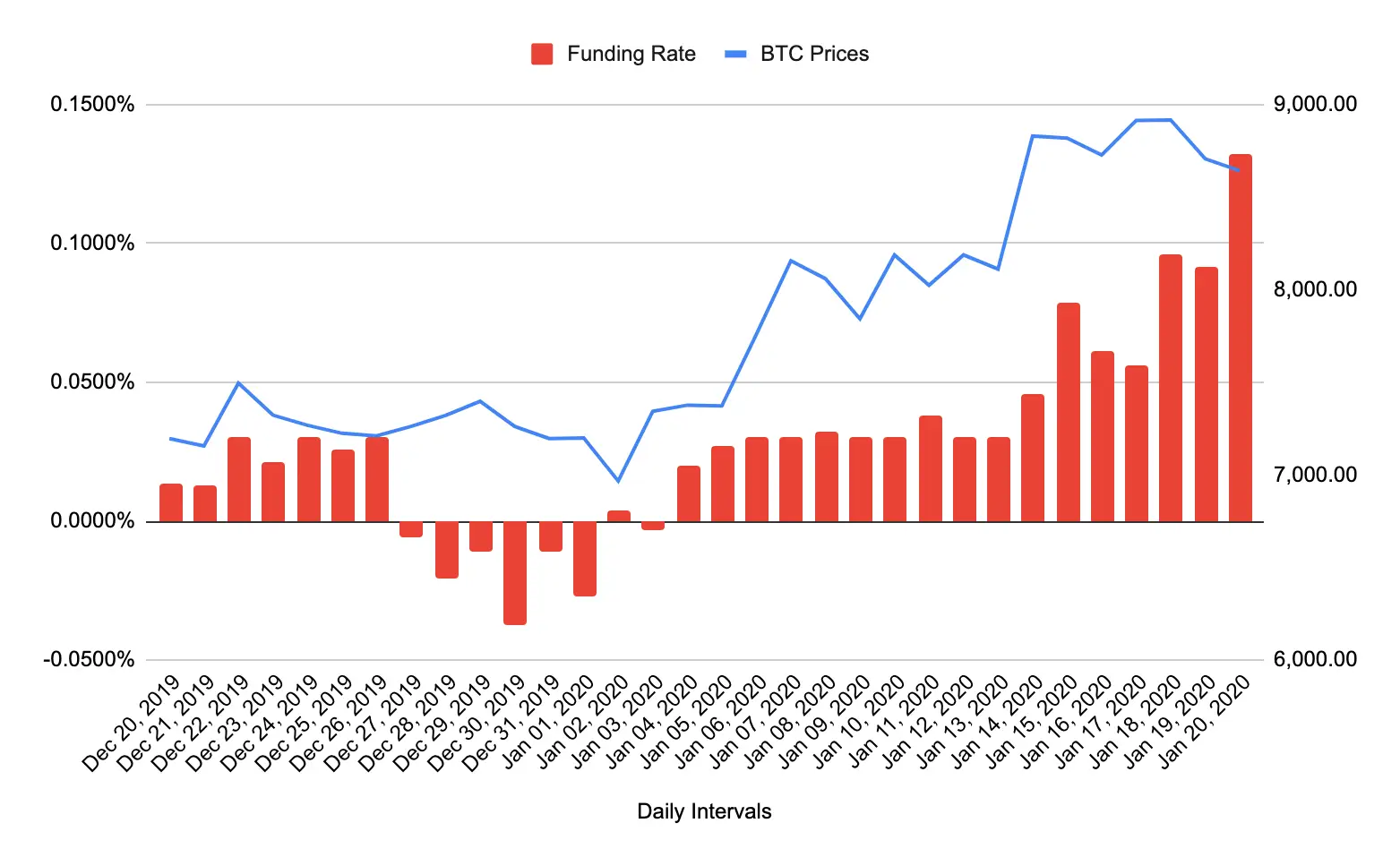

The funding rate in crypto is a recurring payment exchanged between long and short traders in perpetual futures contracts. It is designed to keep the contract price aligned with the spot price of the underlying asset.

When the perpetual contract trades at a premium to the spot price, the funding rate becomes positive and long traders pay shorts. When the contract trades at a discount, the funding rate becomes negative and short traders pay longs.

This system ensures that BTC perpetual swaps and other perpetual futures do not drift too far from the actual spot market.

Unlike traditional futures, perpetual contracts never expire. Without a funding mechanism, their price could diverge significantly from the real spot market.

The funding rate serves three main purposes:

Example:

| Factor | Effect |

| Profitability | High rates reduce profits for paying side, increase for receiving side. |

| Liquidation Risk | Higher costs may push leveraged positions closer to liquidation. |

| Market Sentiment | Positive = bullish sentiment, negative = bearish sentiment. |

| Price Convergence | Prevents contract and spot prices from diverging significantly. |

Funding rates are usually based on two components:

Formula (simplified):

Funding Rate = Premium Index + Interest Rate

Most exchanges update funding rates every 8 hours (00:00, 08:00, 16:00 UTC).

If the trader closes the position before the funding interval, no payment is made.

| Exchange | Funding Interval | BTC Funding Rate Range | ETH Funding Rate Range |

| Bitunix | Every 8 hours | 0.01% – 0.05% | 0.01% – 0.04% |

| Bybit | Every 8 hours | 0.01% – 0.05% | 0.01% – 0.05% |

| KuCoin | Every 8 hours | 0.01% – 0.06% | 0.01% – 0.05% |

Note: Rates vary by market conditions and may spike during volatility.

Traders can check live funding rates on:

The funding rate can act as a sentiment indicator, providing insights into market trends and trader behavior. A high funding rate indicates a strong interest in long trades on leverage, while a low or negative funding rate suggests a crowded short market.

Traders can use this information to gauge market sentiment and make more informed trading decisions.

For instance, if the funding rate increases with the price, it indicates a crowded trade and might be moderately bearish. Conversely, a decreasing funding rate while the price increases can be a strong buy signal, as it suggests that the majority is countertrading an upward move.

Traders can use funding rates to develop various trading strategies. For instance, a high funding rate might indicate an overcrowded long trade, suggesting a potential price correction.

Conversely, a negative funding rate during a price increase can signal a strong buy opportunity, as it indicates short traders trying to countertrade an upward movement.

It means that funding rates can introduce arbitrage. Because funding rates are different across exchanges, one type of trading strategy is to go long a given exchange and short another.

The difference in funding rates can produce profits and does not involve the direction of the market risk.

Understanding and monitoring funding rates is essential for effective risk management. High funding rates can erode profits or increase liquidation risks. By timing trades around funding intervals and considering funding fees, traders can optimize their positions and mitigate risks.

The funding rate is typically positive, causing long traders to pay short traders. This scenario reflects traders’ confidence in the market’s upward trajectory. However, prolonged high funding rates can erode long traders’ profits if not managed carefully.

The funding rate is usually negative, causing short traders to pay long traders. This scenario indicates traders’ anticipation of a market decline. Negative funding rates can offset some losses for long traders, making it a crucial factor in their risk management strategy.

Understanding and monitoring funding rates are essential for successful crypto futures trading. These rates influence profitability, liquidation risk, market sentiment, trade timing, and price convergence.

Funding rates are used by traders as signs, sources of profit through arbitrage, and managing risk tools. Still, funding rate analysis must be complemented with other factors and approaches for successful and efficient trading The primary issue is to understand what other parameters correlated with the funding rate can be instrumental in making wise trading decisions.

The funding rate is a fee exchanged between long and short traders in perpetual swaps to keep contract prices aligned with spot prices.

They are recurring payments (usually every 8 hours) between longs and shorts, based on price differences between perpetual contracts and spot markets.

They use a formula based on the premium index and a fixed interest rate. The result is applied to open positions at set intervals.

Rates change with market demand. A 0.05% spike signals extreme crowding on one side of the trade, often warning of corrections.

They reduce profits for the paying side and add costs to leveraged positions. Ignoring them can result in unexpected losses.

On the Bitunix futures dashboard or external trackers like Coinglass.

They prevent large price gaps between perpetual futures and spot markets, ensuring fair trading conditions.

Typically every 8 hours, though some platforms offer shorter intervals.

Each exchange has its own formula, liquidity levels, and trader activity, which create slight differences in rates.

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.