Raydium has rapidly become one of the most influential decentralized finance (DeFi) protocols on the Solana blockchain. With a total value locked (TVL) exceeding $944 mn and a market cap of $420.82 mn, it stands out as a powerhouse for decentralized trading, yield farming, and project launches.

At its core, Raydium is an automated market maker (AMM) that integrates with Solana’s infrastructure and the Serum DEX (now replaced by OpenBook) to deliver fast, scalable, and low-cost DeFi services.

In this article, we will take you through what Raydium does, how it works and how you can trade in $RAY on Bitunix.

Raydium is a decentralized exchange and AMM built on the Solana blockchain, designed to provide fast, efficient, and low-fee trading. Unlike traditional AMMs that solely rely on internal liquidity pools, Raydium connects directly to OpenBook’s central limit order book, enabling it to tap into broader liquidity across the Solana ecosystem.

Staking Rewards: RAY tokens can be staked to earn rewards derived from protocol fees. This staking mechanism incentivizes users to lock their tokens, contributing to the platform’s liquidity and stability. Stakeholders receive a share of transaction fees generated by Raydium, providing a passive income stream.

Additionally, staking RAY grants access to exclusive Initial DEX Offerings (IDOs) via the Raydium AcceleRaytor launchpad, allowing early participation in promising blockchain projects. These IDOs often require users to hold or stake a minimum amount of RAY tokens

Liquidity Mining: Liquidity mining is another major utility of RAY tokens. Users are encouraged to provide liquidity to Raydium’s pools by depositing token pairs, such as SOL-RAY or USDC-RAY. In return, they receive LP (Liquidity Provider) tokens, which can be staked further in Raydium Farms to earn additional rewards in RAY tokens. This mechanism ensures robust liquidity for trading pairs on the platform and offers users a way to generate passive income through yield farming

Governance: RAY token holders play an active role in shaping the future of the Raydium ecosystem through decentralized governance. They can vote on proposals related to protocol upgrades, fee adjustments, new feature introductions, and even decisions regarding IDOs on the AcceleRaytor platform. This governance model ensures community-driven development and decentralization, empowering users to influence the protocol’s trajectory

Transaction Fees: RAY tokens are integral to Raydium’s fee structure. Trading fees on the platform are paid using RAY tokens, with a portion redistributed as rewards for liquidity providers and stakers. For example, 0.22% of swap fees are allocated to liquidity pools as rewards, while 0.03% is used to buy RAY for staking rewards. This fee mechanism ensures that token holders benefit directly from the platform’s activity while fostering liquidity and engagement.

Built on Solana: Raydium benefits from Solana’s high throughput and scalability. With transaction speeds exceeding 65,000 per second and negligible fees compared to Ethereum-based platforms, Solana ensures efficiency for users interacting with Raydium.

Integration with Serum: By connecting directly to Serum’s order books, Raydium offers broader liquidity access than standalone AMMs. This integration enhances trading efficiency and makes it a preferred choice among DeFi traders.

Innovative Technology: Raydium’s architecture supports advanced features like limit orders within AMM pools and dynamic pricing models via bonding curves. These features make it highly adaptable for diverse trading needs.

Raydium (RAY) is the native token of the Raydium decentralized exchange (DEX), which operates on the Solana blockchain. It plays a central role in governance, staking, liquidity provision, and rewards within the Raydium ecosystem. Below is a detailed breakdown of its tokenomics:

The allocation of RAY tokens is designed to ensure long-term participation and ecosystem development:

| Category | Percentage | Total Tokens | Details |

| Mining Reserve | 34% | 188,699,680 RAY | Incentives for liquidity mining |

| Partnership & Ecosystem | 30% | 166,499,718 RAY | Support for collaborations and integrations |

| Team | 20% | 110,999,812 RAY | Subject to a lockup period of 1–3 years |

| Liquidity | 8% | 44,399,925 RAY | Facilitates trading stability |

| Community & Seed | 6% | 33,299,944 RAY | Locked for one year |

| Advisors | 2% | 11,099,981 RAY | Locked for 1–3 years |

RAY serves multiple purposes within the Raydium ecosystem:

Raydium employs a competitive fee structure:

12% of trading fees collected by Raydium are used to buy back and support the value of RAY tokens.

Raydium DEX was founded by a team of anonymous developers who use pseudonyms ending with “Ray.” The key members are:

These individuals come from diverse professional backgrounds, including marketing, algorithmic trading, blockchain development, and mathematics.

TradingView

Raydium is working on a new governance model that includes liquidity mining gauges, bribing mechanisms, and levers for adjusting protocol parameters. This will allow for more decentralized decision-making and flexibility in managing liquidity pools.

The platform is focusing on improving its oracle services and overall user experience through continued upgrades to its dApp. This will ensure more accurate price feeds and a smoother user interface.

Raydium is developing tools for pool creators, including lock LP functionality and the ability to separate fees from LP tokens. These features will improve liquidity management and provide more options for pool operators.

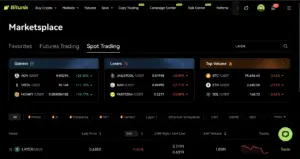

To Buy and Sell Raydium tokens on Bitunix, log in to your Bitunix account and navigate to the Markets tab on the main menu. Next, choose spot trading and look up for RAY.

Next, choose spot trading and look up for RAY.

Next, click on Trade to open the trading window for RAY/USDT.

You can place a buy and sell order on RAY. Also, you can choose to set a limit price for selling or buying RAY tokens.

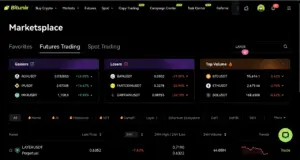

To trade in RAY/USDT on Bitunix, head over to the Markets Tab and click on Marketplace from the drop down menu.

Click on Futures Trading and look up for RAY

Next, click on trade to open the RAY/USDT futures pair trading panel.

Now, you can place a long or short order on RAY/IUSDT futures.

RAY is used for staking, governance, rewards, trading fee payments, and access to token launches via the AcceleRaytor platform.

Raydium ($RAY) is trading at $1.63. As per the technical readings , $RAY could rise if the current momentum climbs back up. With the overall market sentiment, one must vary the pros and cons before investing in utility coins.

Raydium generates revenue primarily through transaction fees within its decentralized finance (DeFi) ecosystem. The dex charges a 0.25% fee on swaps conducted through its liquidity pools. Of this, 0.22% is redistributed to liquidity providers as rewards, while the remaining 0.03% goes to stakers who lock RAY tokens on the platform. Furthermore, Raydium leverages Serum’s order book for liquidity, Raydium charges a default fee of 0.22% on Serum transactions.

Raydium benefits from Solana’s high transaction throughput (up to 50,000 transactions per second) and low fees (average $0.00025 per transaction). This makes trading faster and more cost-effective compared to Ethereum-based DEXs, which often face congestion and high gas fees. The platform enables seamless swaps of SPL tokens with minimal delay, leveraging Solana’s scalability for frictionless trading experiences