Crypto trading moves fast. The charts never sleep, markets react in seconds, and opportunities appear and vanish all day. But not everyone has the time — or the technical confidence — to trade manually. That’s exactly why copy trading exists.

On Bitunix, you can skip the complex setups and plug directly into the strategies of seasoned professionals. It’s not hype — it’s a fully integrated product that allows you to mirror live trades from proven performers, complete with full transparency.

If you’re curious about how it works, whether it’s safe, and how to make the most of it, this guide has you covered.

[ez-toc]

What Copy Trading Actually Does

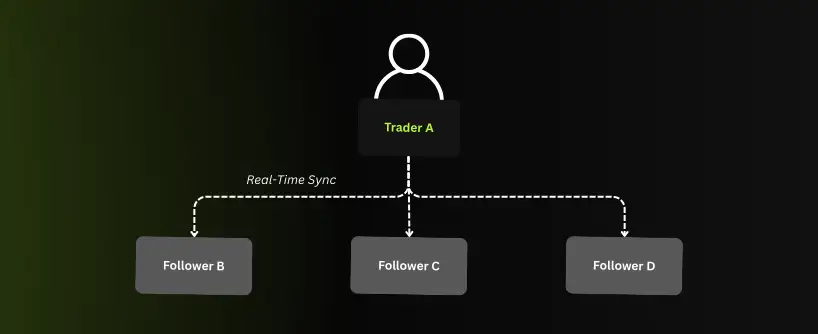

This isn’t about signals or group chats. With copy trading, your account replicates another trader’s actions automatically.

They buy ETH? You buy ETH. They close a position? You close it too — proportionally, and based on your risk preferences.

There’s no need to understand chart patterns or calculate moving averages. The strategy runs in the background, synced in real time.

How to Get Started on Bitunix (Step-by-Step)

Bitunix makes this process beginner-friendly. Here’s how it works on the platform:

-

Create and Verify Your Account

To access copy trading, your Bitunix account must be fully verified.

-

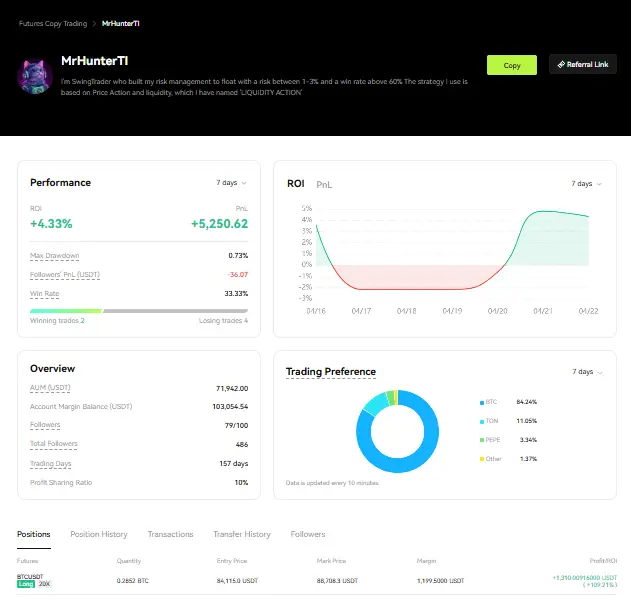

Explore the Leaderboard

Inside the dashboard, you’ll see a range of lead traders ranked by:

This gives you the context to choose someone who fits your profile.

-

Choose a Trader to Follow

You can click into any profile and see live stats before committing. Go with someone whose risk matches your comfort zone.

-

Configure Your Copy Settings

You define how much capital to allocate and your copy mode (fixed or proportional). Bitunix also lets you set:

-

Stop-loss thresholds

-

Max drawdown limits

-

Capital lock-in rules

-

Go Live

Once you activate, your account mirrors the selected trader’s positions in real time. You remain in full control and can pause, stop, or switch traders at any point.

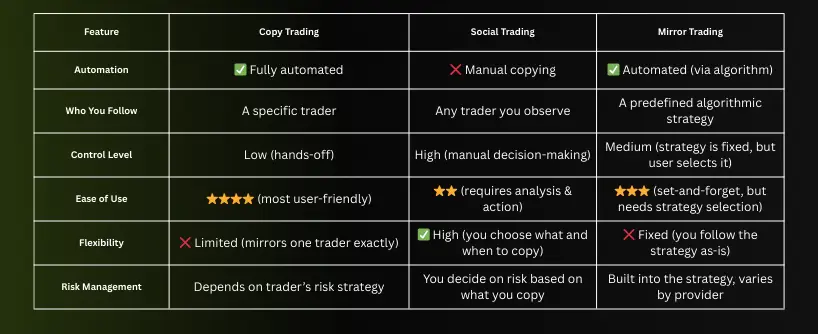

Copy, Social, Mirror — What’s the Difference?

The terms get thrown around, but here’s a breakdown:

-

Copy Trading: Fully automatic. You’re not notified — your trades match the pro’s actions exactly.

-

Social Trading: You can view and learn from trades, but you choose if and when to copy manually.

-

Mirror Trading: You’re following a set of algorithmic rules or a prebuilt trading system — not a human trader.

Copy trading is the most beginner-friendly of the three — no decision-making needed after setup.

Why So Many Traders Are Copying in 2025

It’s not just a trend. Here’s why the model works for a wide range of users:

-

No Technical Skills Required

You don’t need to analyze charts or use complex indicators.

-

Time-Saving

You set it once. Professionals do the trading. You simply monitor outcomes.

-

Built-In Diversification

Follow multiple traders with different strategies to balance your risk.

-

Transparent Performance

Bitunix shows each trader’s historical performance — no hidden data.

-

Passive Learning Opportunity

Even if you’re not actively trading, you can observe strategies in action and understand what decisions are being made and why.

Risks You Should Be Aware Of

Copy trading isn’t magic. It carries risks just like any other trading method. Be especially mindful of the following:

-

There Are No Guarantees

Even the best traders have losses. Don’t expect perfection.

-

Over-Allocation Can Hurt

If you commit too much to one trader — especially a high-risk one — your losses could multiply.

-

You May Get Complacent

Automation can create a false sense of safety. You still need to monitor and adjust as needed.

-

Slippage Exists

Your trades may execute slightly differently in price due to latency, especially in high-volume markets.

Bitunix mitigates these risks with real-time execution, allocation caps, and copy ratio controls.

What Makes Bitunix’s Copy Trading Different

There are plenty of copy trading platforms, but Bitunix stands out in a few key ways:

-

Real-Time Execution

Trades are mirrored instantly — not with lag.

-

Only Pay for Profits

No subscription or fixed fees. Bitunix only charges you after profitable trades.

-

Granular Risk Controls

Define how much you want to risk, how much to cap per trader, and when to auto-pause.

-

Fully Mobile-Ready

You can manage everything from the Bitunix app — ideal for on-the-go investors.

How to Use Copy Trading Effectively

Copy trading isn’t just “set and forget” if you want to be smart about it. Here are some best practices:

-

Start with a Small Allocation

Test the waters. You can always increase later.

-

Look Beyond ROI

High returns aren’t everything. Check for consistency and reasonable drawdowns.

-

Don’t Chase Trends

Switching traders too often based on short-term gains usually backfires.

-

Diversify

Follow traders with different approaches to reduce the impact of a single underperformer.

-

Monitor Weekly

Even passive strategies benefit from small adjustments.

Why Copy Trading Has Gone Mainstream in 2025

What used to be a niche tactic has become a core strategy for thousands of retail traders — and not without reason:

-

Verified Trader Stats Are Standard

You no longer need to guess — platforms like Bitunix show it all upfront.

-

Mobile UX Has Improved

Most users can now control strategies, pause copying, and monitor trades from their phones.

-

Built-In Education

Many platforms offer dashboards, tutorials, and tooltips to help users get better over time.

-

AI Matching Tools

Bitunix and others use machine learning to recommend traders who align with your risk appetite and goals.

It’s not hype. It’s an evolution in how traders manage time, risk, and capital.

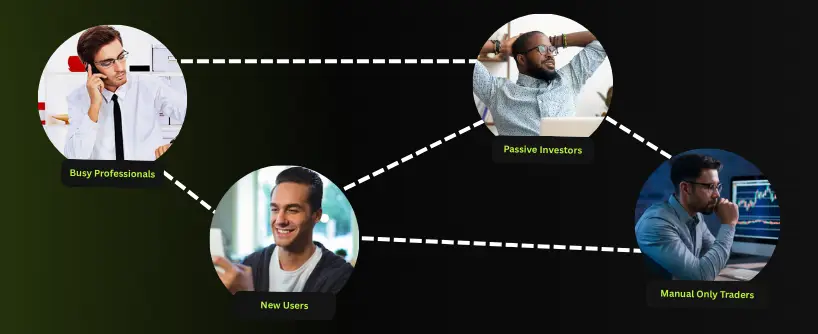

Who Should Use Copy Trading?

This model works best for:

-

Busy professionals who can’t sit at a trading desk

-

Beginners looking to get exposure without diving into TA

-

Passive investors with capital to deploy but limited time

-

Active traders looking to diversify part of their strategy

It’s less suited for:

Frequently Asked Questions

- Is it available on mobile? Yes — full copy trading is built into the Bitunix app.

- Can I stop copying a trader anytime? Absolutely. Pause or disconnect at any time — no lock-ins.

- What’s the minimum capital required? It varies by trader, but many allow entry from just $10–$50.

- How are fees charged? You only pay when copied trades are profitable. No fixed or hidden charges.

- Can I copy more than one trader? Yes — and we recommend it. Diversifying across multiple profiles spreads your exposure.

What to Do Next

If you’ve ever wanted to trade crypto but didn’t know where to start — or simply didn’t have the hours to sit at the screen — copy trading might be your bridge. Start small. Review trader profiles. Set clear boundaries. Let their experience work for you — while you stay in full control.

Visit Bitunix. Open your dashboard. And start copying your first top trader today.