Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

Smart contracts might sound like some complex technical invention, but if you’ve used any DeFi platform or bought an NFT, you’ve already used one — whether you realized it or not. These contracts are the invisible backbone behind many blockchain-based tools.

They don’t just store information. They do things. They act, they enforce, and they execute. And they’re being used across the crypto world to speed up transactions, reduce risk, and get rid of unnecessary middlemen. This guide takes a real-world look at what smart contracts are, how they operate, and what makes them useful — especially when integrated into platforms like Bitunix.

[ez-toc]

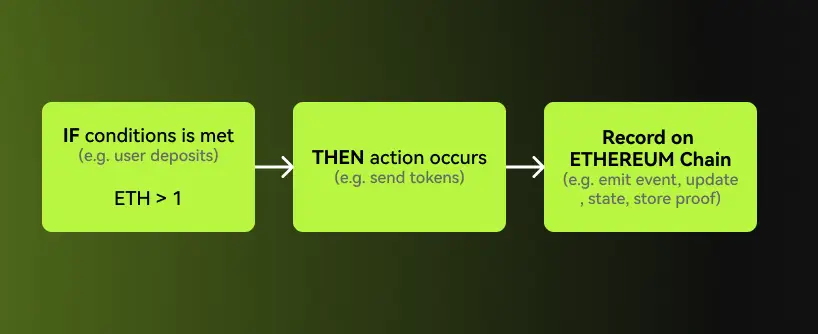

To put it simply, a smart contract is a piece of code that runs on a blockchain. It follows a rule: “If this happens, then do that.” It sounds basic, but the applications are anything but. That line of logic can run a billion-dollar lending platform or distribute NFT royalties automatically — no human required.

The original idea came from Nick Szabo in the early ’90s, long before Ethereum was created. But Ethereum was the first to make it practical and scalable. Since 2015, these contracts have become the core of how decentralized apps operate.

What makes them different from traditional contracts is that once they’re live, they don’t wait on anyone. They just execute. Automatically. No emails, no signatures, no follow-ups. They either run or they don’t — based strictly on the conditions coded in.

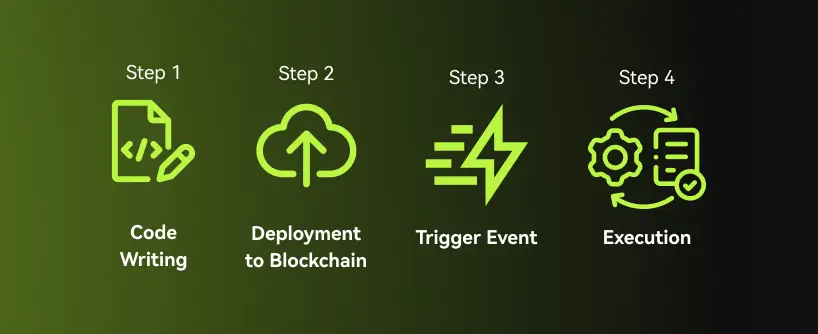

Every smart contract starts with code. A developer writes the instructions that define what the contract should do. For example, “If someone sends 1 ETH, then release access to a certain token.” The language most often used is Solidity (for Ethereum), but other chains have their own systems too.

Once the code is ready and tested, it’s uploaded to a blockchain. That’s where it lives — permanently. After deployment, the contract can’t be edited. It’s public, transparent, and verifiable.

The contract doesn’t run all the time. It just sits there until something sets it off — like receiving a transaction or meeting a certain block number. Once that condition is hit, the contract moves into action.

Now the magic happens. The code carries out the instructions immediately. Whether it’s transferring assets, minting tokens, or processing a loan, the smart contract finalizes it, records the outcome on-chain, and ends the task. No external approvals needed.

Once they’re live on-chain, smart contracts can’t be modified. That permanence means nobody — not even the original developer — can go in and tweak the terms later. It’s locked.

You can read any smart contract’s code. You can see every action it takes. This openness makes it easy to build trust, especially in finance, where hidden conditions are common.

Smart contracts react the moment something happens. No delay. No approval needed. If the rule is met, the result follows. It’s fast and consistent, which is perfect for trading environments or time-sensitive actions.

These contracts don’t need a lawyer, bank officer, or any third party to step in. That removes unnecessary fees and cuts down on all the slow-moving admin work that usually comes with agreements.

Most DeFi platforms — like Aave, Compound, or Uniswap — wouldn’t exist without smart contracts. These protocols use them to automate everything from loan repayments to token swaps. No one manages these processes manually; it’s all pre-coded logic running in real-time.

NFT platforms use smart contracts for minting, bidding, and transferring ownership. When you buy an NFT on OpenSea or Rarible, there’s no middleman — just a smart contract ensuring the token changes hands securely.

Insurance platforms are experimenting with smart contracts to automate claims — for example, auto-payments after a natural disaster. In real estate, they’re starting to be used for things like rental agreements or escrow handling.

When a user confirms a trade on Bitunix, that transaction is processed through a smart contract. What that means is once it’s confirmed, it’s final — no reversing, no editing. The rules that govern the trade are already locked in before you even hit the button. Once executed, the transaction can’t be changed by anyone, which is a big win for user trust.

Smart contracts on Bitunix are also behind some of the platform’s protective tools. For example, if you’ve set a stop-loss or are using margin, the smart contract is what makes sure your trade closes out before losses pile up. These tools don’t rely on staff or manual monitoring. They react instantly to market changes and protect your position before it’s too late.

On Bitunix, fees aren’t hidden. They’re not adjusted mid-trade either. Before you even complete a transaction, the smart contract shows you exactly what you’ll be charged. Once you agree, the contract locks it in. No surprises.

Smart contracts aren’t there to make things fancy. They’re there to make things fair, transparent, and fast — and that’s what we aim for at Bitunix. — Bitunix Team

Smart contracts are more than just a crypto trend — they’ve become essential. They automate agreements, prevent tampering, and reduce friction across all kinds of digital transactions. Whether you’re taking a loan, buying an NFT, or placing a trade on Bitunix, a smart contract is likely what’s making it all happen.

Bitunix isn’t using smart contracts just for show. It’s using them to create a smoother, safer experience for users — one where terms are clear, trades are final, and tools react faster than you ever could manually. If you’re serious about crypto, understanding smart contracts isn’t just helpful — it’s necessary.