As the landscape of futures trading grows more sophisticated in 2025, it’s not just about entry signals or technical setups. The difference between an average trader and a consistently profitable one often lies in post-trade analysis. That’s where a futures trading journal becomes your most valuable tool.

Whether you’re speculating on Bitcoin futures or managing macro positions on commodities, journaling transforms trades into actionable data, making each trade a lesson — not just a line item.

For Bitunix users, this level of discipline can be the missing piece between strategy and success. Our platform is designed not only for fast execution but for deep reflection. By pairing your trading behavior with consistent journaling, you gain clarity, reduce emotional bias, and dramatically improve your system over time.

Why Journaling Matters in Futures Trading

In leveraged environments like crypto or commodity futures, the margin for error is small and the consequences are magnified. A single mistake, repeated across multiple trades, can quickly derail your capital. Journaling helps mitigate that risk by highlighting your habits — both good and bad.

A futures trading journal is more than a diary. It’s a performance tracker, a behavior log, and a feedback loop all in one. It forces you to slow down, evaluate your decisions, and refine your system based on real outcomes. At Bitunix, we’ve seen traders who journal regularly reduce their loss streaks and increase profitable trades simply by identifying recurring patterns and execution errors early.

What to Record in Your Journal

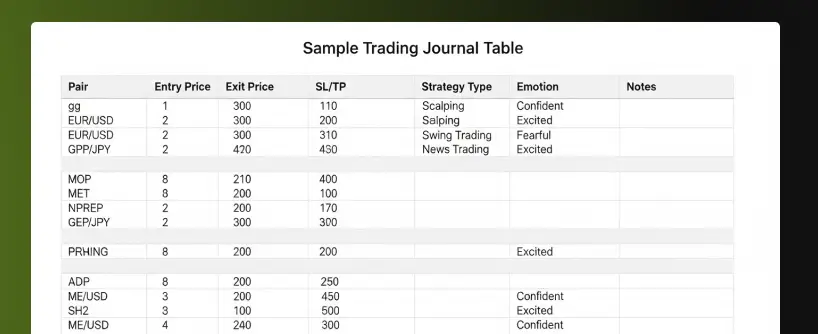

A complete futures trading journal captures more than just price points. At minimum, you’ll want to document your trade details: the pair, direction, leverage used, entry and exit price, and PnL outcome. But that’s just the surface.

What truly sharpens your strategy is recording why you entered the trade. Were you trading a breakout, a mean-reversion setup, or reacting emotionally after a previous loss? Did you follow your system, or did you improvise under pressure?

Also consider logging your emotional state at the time — anxious, confident, distracted. These notes are often more telling than the trade data itself. And when reviewed weekly, they reveal what no chart ever could: how your psychology affects your trading outcomes.

How Bitunix Supports Futures Traders Who Journal

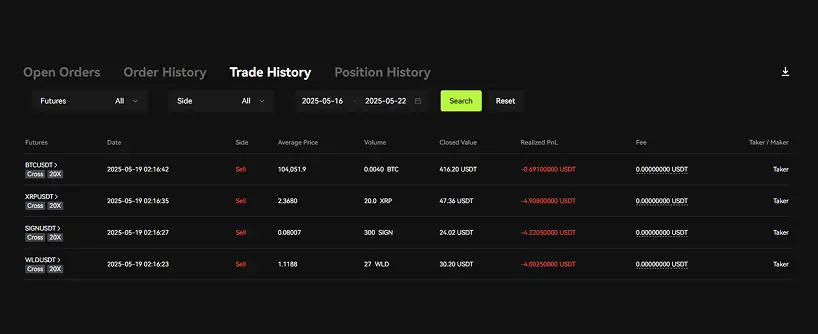

Bitunix offers several tools that make journaling more efficient and insightful. Each executed trade is logged with detailed information: margin used, leverage, funding rate, and PnL calculations. This data can be exported directly from your trade history panel, saving time on manual entry.

Additionally, our SL/TP functionality — available at a trade setup — helps traders clearly define their risk-reward upfront. This structure aligns perfectly with journal entries that seek to evaluate whether trades respected pre-defined plans.

And because Bitunix provides full feature parity on both desktop and mobile, you can journal from anywhere — whether you’re closing trades on the go or analyzing them post-session.

Best Practices for Structuring Your Journal

There’s no single format that works for every trader, but there are common elements that make futures trading journals more actionable. A spreadsheet is often a great place to start, especially for traders who want to calculate performance metrics over time. Columns might include trade ID, pair, entry/exit price, size, leverage, PnL, and strategy label.

For more visual learners, a note-taking app like Notion or Obsidian can pair screenshots of the chart with trade context and emotional notes. Some traders prefer to use Bitunix’s K-line Ultra charts to grab these images and annotate what they saw in real time.

The most effective journals are reviewed weekly. Not just for logging, but for pattern recognition. Are you more successful trading breakouts on high volatility days? Do you tend to skip your stop-loss after two losing trades? Only consistent journaling will answer those questions — and let you adjust before they cost you more.

From Journaling to Optimization

Once you’ve logged 30, 50, or even 100 trades, your journal becomes a goldmine. You’ll see which strategies yield the best win rate, which setups provide the highest reward-to-risk ratio, and where your discipline might need tightening.

Let’s say your journal reveals that your ETH/USDT scalps are consistently profitable on Thursdays during US hours, but you lose on BTC breakouts after high CPI prints. That information can lead you to filter trades more effectively — or pause during high-impact news.

This is where your futures trading journal begins to influence your system. At Bitunix, that transition is seamless. The data you collect feeds directly back into how you define your entries, your SL/TP placements, and your capital allocation per trade.

Avoiding Common Mistakes

Even the best traders fail to get value from journaling when they treat it like a chore. One of the biggest mistakes is only writing when a trade goes badly — or skipping it altogether when it’s a winner. This creates bias in your data.

Another mistake is being too vague. Writing “FOMO” or “market looked strong” doesn’t help much unless you can tie that observation to a pattern. Specificity is key. Over time, this leads to better decisions, clearer entries, and reduced emotional noise — the trifecta of strong futures trading.

Final Thoughts: Make Your Journal Your Edge

In 2025, the difference between traders who survive volatility and those who thrive in it is feedback. Real, honest, measurable feedback. Your futures trading journal is the bridge between your trades and your growth.

Bitunix provides tools. You provide the structure. Together, they can help you turn chaos into consistency — and volatility into calculated action.

So the next time you place a trade, don’t just click “Buy” or “Sell.” Take five minutes after and log it. Think of your journal not as homework, but as your edge. Because in futures trading, the edge doesn’t come from prediction — it comes from preparation.