In the ever-evolving world of cryptocurrency, narratives shift fast — but fundamentals matter. Pi Network (PI) has made headlines in 2025 thanks to its unique mining model, sudden market volatility, and massive user base. But as an investor, you’re likely wondering: is Pi Network just another overhyped token, or does it offer real utility?

The founders focused on building Pi Network by harnessing social computing and blockchain technology to mobilize individuals worldwide, aiming to create an inclusive ecosystem that improves human lives on a global scale.

This article takes a grounded look at Pi Network’s fundamentals, ecosystem, and performance. We’ll explore what sets it apart, what challenges it faces, and whether PI belongs in your 2025 crypto portfolio.

What Is Pi Network?

Pi Network is a mobile-first cryptocurrency project that allows users to mine tokens directly from their smartphones. Unlike Bitcoin or Ethereum, which rely on power-hungry Proof of Work mining, Pi uses a more lightweight consensus model that supports mining without draining battery or processing power. Pi coin (PI) is the native digital asset of the network.

Founded by Stanford PhDs Nicolas Kokkalis and Chengdiao Fan, the goal was simple: make crypto accessible to anyone with a phone. Pi Network also aims to operate on a global scale, bringing blockchain technology and digital currency to users worldwide.

Key fundamentals:

- Token: PI

- Blockchain: Pi Mainnet (launched in 2023)

- Supply: Max supply capped at 100 billion

- Current Circulating Supply: 7.26 billion PI

- Mining: Mobile-based with daily activity checks

- Wallets: Native Pi Wallet, custodial exchanges

Pi coins are used for transactions and participation within the network.

Pi Network empowers users to exercise their own agency in the digital economy, enabling active and independent participation in its inclusive ecosystem.

Pi Network’s 2025 Surge: What Happened?

As of May 2025, Pi Network is trading at around $0.66, with over $148.8 million in 24-hour trading volume. The token hit an all-time high of $2.98 in February 2025, but quickly dropped to $0.40 after a massive token unlock event. These figures represent the highest and lowest price points for Pi Network so far, highlighting the token’s significant volatility.

Despite that, Pi has rebounded, supported by its enormous community of over 35 million users and multiple new listings on centralized exchanges —including Bitunix. The addition of new trading pairs on these exchanges has played a crucial role in increasing Pi Network’s liquidity and influencing its price movement.

Supply Model and Circulating Supply: How Scarce Is Pi?

Pi Network’s supply model is designed for transparency and fairness, with a maximum supply capped at 100 billion Pi tokens. The mining rewards issuance pace follows a declining exponential model, meaning that as more Pi is mined and distributed, the rate of new token creation slows down over time. This approach helps manage inflation and supports long-term value.

The total supply is allocated across community mining rewards, foundation reserves, liquidity pools, and the Core Team, ensuring a balanced distribution that supports both network growth and ongoing development. The circulating supply includes all migrated mining rewards—tokens that have been earned and successfully moved to the mainnet—as well as tokens released from other allocations. This ensures that the circulating supply reflects real, accessible Pi tokens in the ecosystem.

A unique aspect of Pi’s supply model is its variable effective total supply, which accounts for fewer Pi being issued when users do not complete identity verification or migrate their balances. This mechanism ensures that the total supply remains consistent with the maximum supply, while only including tokens that are actually in circulation. By structuring the supply model this way, Pi Network facilitates real world transactions, maintains network security, and provides a fair distribution of Pi tokens to its users.

Mining Mechanism and Total Supply: How Pi Is Created

Pi Network’s mining mechanism is built on a declining exponential model, ensuring that mining rewards decrease as the network matures and monthly supplies are reduced. Unlike traditional cryptocurrencies, Pi’s mining process is energy-efficient and accessible to anyone with a mobile phone, allowing users to participate in the network without specialized hardware or high electricity costs.

The total supply of Pi is capped at 100 billion tokens, with the majority reserved for community mining rewards. This allocation incentivizes users to join, contribute to network security, and help build the Pi ecosystem. Mining rewards are distributed in the same proportions as the maximum supply, ensuring fairness and transparency in how Pi tokens are earned.

By combining distributed systems with a user-friendly mining mechanism, Pi Network enables users to earn Pi tokens, participate in network governance, and support the growth of a secure, decentralized digital currency. The mining process not only rewards users but also strengthens the overall network, making it a core component of Pi’s long-term vision.

Real Utility or Just Another Meme Coin: The Case of Pi Coin?

Let’s break it down. Hype is common in crypto, but utility is what drives long-term value.

Where Pi shows utility:

- Mobile-first access: The only major cryptocurrency offering mining via smartphones without performance loss.

- Eco-friendliness: No need for massive energy consumption.

- Global reach: 35+ million active users mining across 150+ countries.

- Merchant testing: Pi’s ecosystem includes pilot programs for real-world usage in e-commerce and offline stores.

- Adoption Pi Network: The adoption of Pi Network is facilitating real-world transactions and encouraging merchant and user engagement across different regions.

Challenges:

- Token unlock risk: The drastic drop earlier this year showed how sudden supply increases can damage price stability.

- Still centralized: While the Pi mainnet exists, many network decisions are still led by the core team.

- Low developer adoption: Unlike Ethereum or Solana, Pi lacks a large DeFi or dApp ecosystem.

- The founders are actively working to turn and create utilities within the Pi Network ecosystem by leveraging blockchain and social computing, aiming to build practical applications and societal benefits.

Digital Currency and Use Cases: Where Can You Spend Pi?

Pi is more than just a digital currency—it’s designed for real world utility. Within the Pi ecosystem, users can transact Pi for online commerce, purchase goods and services, and participate in a growing network of merchants who accept Pi payments. The Pi Browser and Pi Wallet provide seamless tools for users to transact Pi, manage their balances, and interact with decentralized applications.

As adoption of Pi Network grows, more users and businesses are joining the ecosystem, expanding the range of utility-based Pi apps and facilitating real world transactions. Whether you’re buying digital goods, supporting creators, or shopping with participating merchants, Pi enables users to engage in the global economy with ease. The pi price and network price are influenced by this increasing adoption and the expanding use cases, making Pi a digital currency with tangible value and potential for future growth.

Community Strength and Market Sentiment

The Pi community is undeniably powerful. From Telegram to X, user groups across India, Southeast Asia, and Africa continue to grow. But the question remains, will Pi Network evolve into a real utility token with broader adoption, or will it fade as attention shifts?

Sentiment currently favors gradual optimism, especially as Pi Network partners with crypto exchanges and prepares for more token utility in e-commerce.

Technical Breakdown

- 2025 Price Range: $0.40 – $2.98

- Resistance levels: $1.45 and $2.20

- Support zones: $1.05 and $0.88

- Market Cap: $4.83 Billion

Pi’s mining rewards are distributed according to a supply model that influences the effective supply, with allocations mentioned for community mining rewards, foundation reserve, liquidity, and the core team. The monthly issued mobile balance is capped based on a system-wide base mining rate, and not all outstanding mobile balances are issued on-chain due to user dropoff during migration. Real Pi issuance depends on migration and KYC completion, resulting in actual token distribution being lower than the theoretical maximum. Migrated mining rewards are divided and tracked to determine the effective total supply, and allocation mentioned in the supply model ensures proportional consistency. The foundation reserve holds approximately 10% of the total supply as part of the overall token allocation structure. Total Pi supply is calculated by considering the maximum supply, effective total supply, and circulating supply, which are dynamically adjusted based on current mining rewards and allocations. Users can increase their mining rewards by running nodes and participating in security circles, which support network security and infrastructure.

Many traders use PI’s volatility for short-term gains. Others hold long-term in hopes of network growth. The coin’s price correlates strongly with token release schedules, which should be monitored closely. The mining rewards system is governed by a declining exponential model defined by a base mining rate, where each user’s reward is just a multiplier of this base rate, ensuring a controlled and predictable token issuance schedule.

Should You Invest in PI?

Here’s a quick breakdown for different investor types:

| Investor Type | PI Suitability |

| Long-term holder | Moderate (watch unlocks) |

| Short-term trader | High (volatile swings) |

| Utility-driven user | Low-Medium |

| Beginner investor | High (mobile-friendly) |

If you’re looking for a low-cost entry point, Pi could offer asymmetric upside. But treat it as part of a diversified strategy — and avoid overexposure to unlock-driven volatility.

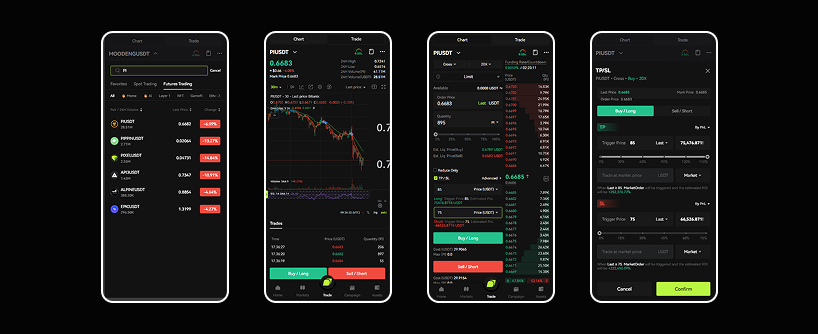

Buying PI on Bitunix

Buying Pi is now easier than ever:

- Log in to your Bitunix account

- Search for the PI/USDT trading pair

- Set your order (limit or market)

- Define SL/TP parameters with our advanced trading tools

- Confirm and manage your position

Bitunix also offers:

- Adjustable leverage

- SL/TP on entry

- Deep liquidity for Pi and altcoins

FAQs: Utility Based Pi Apps and Pi Network 2025

Is Pi Network a scam or legit project?

Pi Network is not a scam. It’s developed by a legitimate team and has a working mainnet and growing user base. The project uses identity verification (KYC) to authenticate user identities and ensure human verification, which helps in maintaining regulatory compliance and preventing fraud. But its token economics and long-term viability remain under watch.

Can I buy Pi Network tokens right now?

Yes. PI is listed on several centralized exchanges, including Bitunix, where you can trade it directly using USDT.

What makes PI different from Bitcoin or Ethereum?

Its mobile mining approach and eco-friendly design make it more accessible. However, it lacks the decentralized ecosystem of ETH or the scarcity of BTC.

What’s the main risk of investing in PI?

Token unlocks and centralized control are the biggest concerns. Price volatility has been significant post-listing.

Is PI worth holding in 2025?

That depends on your risk tolerance. It’s great for short-term trading and speculative exposure but still lacks proven infrastructure.

Final Thoughts: Pi Is Polarizing — and That’s OK

Pi Network offers something most cryptocurrencies don’t: accessibility. Its mobile-first model brought millions of new users into crypto. But that same simplicity raises questions about its long-term role in a fast-moving blockchain ecosystem.

For investors in 2025, PI is best treated as a speculative bet with strong community momentum but incomplete fundamentals. The potential for future utility is there — but it’s not guaranteed.

Want to explore other top tokens with real utility and hype-backed performance?

Check out our full guide to the Best Crypto to Buy in 2025

And remember to always DYOR. Pi might not be for everyone, but it’s a token you shouldn’t ignore.