A Comparative Analysis of PNUT, MOO & PI in 2025

In a market driven by headlines and speculation, the question that matters most in 2025 is simple: which altcoins offer real utility, and which are just hype in disguise? Investors are no longer satisfied with vague roadmaps or empty promises — they’re demanding use cases, ecosystems, and impact. Only a few altcoins have become widely accepted as having real utility. This sets them apart from other cryptocurrencies that lack clear use cases or adoption.

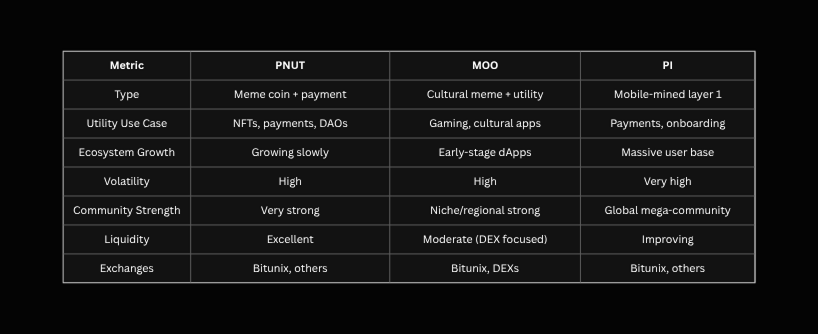

In this deep dive, we compare three leading altcoins — Peanut (PNUT), Moo Deng Solana (MOO), and Pi Network (PI) — across critical dimensions: real-world utility, user adoption, market traction, and growth potential. Investors generally look for coins with strong fundamentals and adoption. These coins are often referred to as examples of utility-driven projects. These tokens have made noise this year — but do they have substance?

Let’s separate the signal from the noise. The importance of real utility has been mentioned frequently in the crypto community.

Why Utility Matters More Than Ever

In 2025, the crypto market is maturing. Tokens that survive this cycle aren’t just viral — they’re usable. Whether it’s payment solutions, dApps, or infrastructure improvements, utility is the new alpha. Investors aren’t just chasing hype — they’re chasing relevance. Investors commonly prioritize utility when deciding where to invest. The decision to invest in altcoins is often influenced by both the potential for real-world purchases and the fear of missing out.

Real utility = real value. Tokens with real utility are increasingly being used for purchases, especially when paired with stablecoins pegged to USD.

PNUT: Hype-Driven or Community-Powered Utility?

What utility does PNUT offer?

- Payment Token: Used in several NFT marketplaces for animal-themed drops

- Community DAOs: Supports funding for wildlife preservation efforts, with the sum of community contributions making a measurable impact

- Exchange Functionality: Listed with deep order books, allowing practical trades; the process of trading PNUT on major exchanges is straightforward, involving account setup, deposit, and order execution

- Narrative Power: Politically and emotionally charged, creating real user stickiness

- PNUT is represented in memes and social media, helping to boost its visibility

- There is a strong connection between PNUT’s story and its community engagement

Verdict: PNUT is still driven by hype — but its community activity and use as a payment token give it emerging utility.

MOO: Cultural Currency or Flash in the Pan?

What utility does MOO bring?

- DEX Ready: Traded on Raydium, leveraging Solana’s blazing speed

- Cultural Ecosystem: Built around regional identity (Thailand and SEA), with real traction. MOO’s popularity is reflected in high community engagement and trading activity, and has inspired creative writing and meme content within the community.

- Token Use in Gaming/NFTs: Early stage integrations with food-themed mini-games and meme dApps, shaped by the values of inclusivity, humor, and collaboration that drive the MOO community.

MOO has low fees, strong meme power, and regional loyalty — which makes it more than just a passing joke.

Verdict: Cultural utility is real utility — MOO is on track to become a key operator in the Solana-native niche economy.

PI: Mobile Mining, Global Reach — But Is It Enough?

Pi Network is a unique altcoin mined through mobile devices. With over 35 million users and a capped total supply, PI is making a strong case for accessible crypto onboarding.

Real utility highlights:

- Mobile-First Mining: No expensive rigs, just a smartphone; PI’s mining ecosystem takes the form of a decentralized, mobile-first network.

- Merchant Pilots: Pi is already testing in e-commerce and brick-and-mortar environments, showing positive growth metrics in transaction volume and merchant participation.

- Eco-Friendly Design: No massive energy consumption, unlike BTC/ETH; features enabled by PI’s low-energy approach include broader accessibility and reduced environmental impact.

- Community-Powered Growth: Viral adoption through referrals and gamification; PI’s user base is validated through a referral system that helps ensure genuine participation.

Challenges? Token unlock events have shaken investor confidence, and ecosystem development is still behind Ethereum or Solana. The business model for PI is still evolving and must compete with more established altcoins. PI’s performance may also be influenced by broader market cycles, such as Bitcoin season, which can shift investor attention. Key issues, such as regulatory clarity and mainnet utility, need to be resolved for PI to reach its full potential.

Verdict: PI has real-world potential but must prove its user base can be scaled to support broader adoption beyond user onboarding.

Comparative Breakdown: PNUT vs MOO vs PI Market Cap

These coins are commonly referred to as emerging altcoins in the market, each with unique features and communities. For example, PI is used for onboarding millions of users into crypto through mobile mining, demonstrating real-world adoption. The sum of users and trading volume for PI far exceeds the others, highlighting its global reach.

Security and Risk Management for Altcoin Investors

Navigating the altcoin market comes with its own set of risks, making security and risk management essential for investors. The market is characterized by high volatility, with prices that can swing dramatically in short periods. To manage these risks, investors should conduct thorough research before making any investments, carefully analyzing the code and underlying technology of each project. Diversifying across multiple coins can help reduce exposure to any single asset’s downturn. Using secure wallets and reputable exchanges is crucial, as the increasing reliance on computer algorithms and smart contracts can introduce vulnerabilities. Staying informed about the latest security threats and adapting strategies as the market evolves are key steps to protecting your investments in this dynamic environment.

Where Can You Buy These Altcoins in the Cryptocurrency Market?

All three altcoins — PNUT, MOO, and PI — are tradable on Bitunix.

With advanced tools like SL/TP orders, adjustable leverage, and mobile-first UX, Bitunix is ideal for exploring both high-risk meme coins and emerging utility tokens. These altcoins can also be used for purchases on supported platforms, making them versatile for different types of transactions. For more detailed information, visit the Bitunix trading page.

Are These Altcoins Worth Holding?

Here’s how to think about them in your 2025 portfolio:

- PNUT = Short-term volatility, long-term if community gains formal utility projects

- MOO = Medium-term hold for cultural relevance + Solana growth

- PI = Long-term speculation based on ecosystem rollout and merchant support

Use available market data—such as trading volumes and price trends—to inform your holding decisions. Recent price movements are often reflected in the Altcoin Season Index, showing shifts in market sentiment and investor behavior.

Diversification is key. Consider small allocations to each if you’re testing altcoin waters — but always pair with Bitcoin, ETH, or SOL for balance. When you invest in these altcoins, think about related coins or strategies to further diversify your portfolio and manage risk as part of a broader investment approach.

Investment Tips: Navigating the Altcoin Landscape

Successfully investing in altcoins requires a strategic approach grounded in research and adaptability. Start by using tools like the altcoin season index to monitor market trends and identify periods when altcoins are likely to outperform. Analyze graphs and charts to calculate the value of different coins and estimate their growth potential. Keep up with news and updates in the altcoin market to spot emerging opportunities and risks. Diversification remains a cornerstone of risk management, helping to balance potential rewards against market volatility. Ultimately, a combination of diligent research, careful risk assessment, and the ability to adapt to changing conditions will position investors to make the most of the ever-evolving altcoin season.

FAQ: Altcoin Season and Utility in 2025

How do I know if an altcoin has real utility?

Check for actual use cases: payments, smart contracts, merchant integrations, or dApp support. Look for measurable values such as transaction volume, active users, and real-world adoption. If it’s just hype or meme-only, it may not last.

Can meme coins like PNUT become utility tokens?

Yes. As mentioned earlier, memecoins with large communities often evolve — like SHIB adding a DEX. PNUT shows early signs of becoming more than a meme, and creative writing or meme content can help drive its evolution and community engagement.

Why should I care about cultural coins like MOO?

Cultural narrative drives adoption. MOO’s regional backing and low-fee ecosystem give it legs, especially in Southeast Asia. In the market, these coins are often referred to as “cultural coins” due to their strong community identity and unique positioning.

What makes Pi Network different from traditional tokens?

It’s mined via mobile, doesn’t require energy-heavy rigs, and is onboarding millions of users who otherwise wouldn’t enter crypto. For example, Pi Network allows users to participate in mining simply by verifying their identity and tapping a button daily.

Where should I buy and trade these altcoins?

Bitunix supports all three tokens, with fast execution, low fees, and strong risk controls — perfect for new and experienced altcoin investors.

Final Verdict: Which Altcoin Has the Most Utility?

Each of these leading altcoins represents a different corner of crypto culture:

- PNUT brings narrative-driven finance and has built a strong connection with its creative community.

- MOO channels culture into code, fostering a unique connection between developers and users.

- PI makes onboarding easier for the masses and is among the most widely accepted projects in the market.

The term ‘altcoin’ refers to these projects as alternatives to Bitcoin, each offering distinct value and innovation. The sum of their impact on the crypto world is significant, shaping trends and expanding adoption.