In 2025, choosing between Solana vs Ethereum is one of the biggest decisions crypto traders and investors face. Both blockchains are foundational to Web3 but they serve different strengths. Ethereum remains the industry titan in decentralized applications and DeFi, while Solana offers unrivaled speed and low fees, making it ideal for trading and high-volume transactions. Bitunix is a trading platform that supports leveraged trading on both SOL and ETH.

This guide explores the key differences between the two, compares ecosystem strength, and offers insights on how traders can benefit from each, especially on platforms like Bitunix, which supports leveraged trading on both SOL and ETH. Additionally, it highlights how Ethereum serves as a platform for other cryptocurrencies and decentralized applications, supporting a diverse ecosystem of digital assets and tokens.

Solana vs Ethereum: Overview for 2025

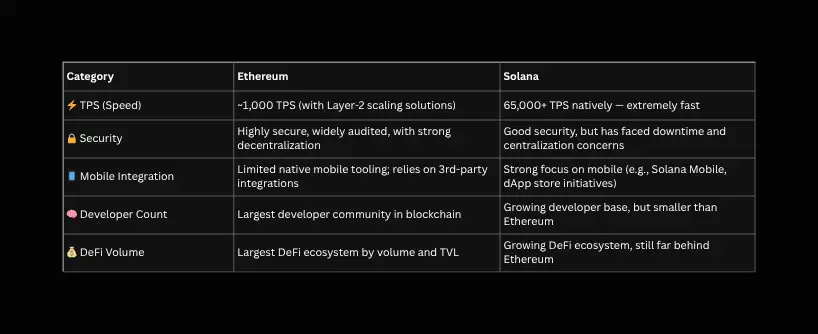

Ethereum continues to lead in developer count, decentralized finance (DeFi), and smart contract adoption. Following the success of Ethereum 2.0, it now runs on a Proof-of-Stake (PoS) model, drastically reducing energy use and increasing scalability.

Solana, however, is designed for speed. Built on a hybrid proof-of-history and proof-of-stake mechanism, it can handle over 65,000 transactions per second (TPS) — dwarfing Ethereum’s ~1,000 TPS with Layer-2s.

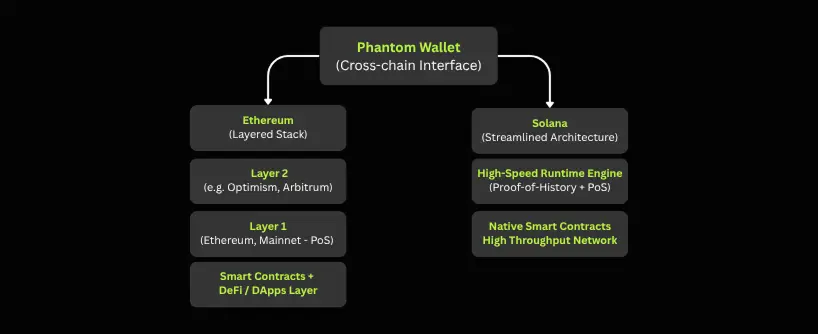

Blockchain Architecture: How Solana and Ethereum Stack Up

Solana and Ethereum each bring unique strengths to the blockchain landscape, shaped by their underlying architecture. The Solana blockchain is engineered for speed and scalability, leveraging a proof-of-stake (PoS) consensus mechanism that enables rapid transaction processing and ultra-low transaction fees. This design supports the expanding Solana ecosystem, making it ideal for users who want to manage assets, stake tokens, and interact with a wide range of decentralized apps—all with minimal friction.

Ethereum, while also operating on a PoS model, features a more intricate architecture that powers a vast array of DeFi protocols, NFT platforms, and other blockchain applications. Its robust ecosystem attracts developers and users seeking flexibility and security across multiple chains. For those managing assets on both Solana and Ethereum, a crypto wallet like Phantom Wallet is invaluable.

Phantom Wallet allows users to seamlessly access and manage their crypto across different blockchains, making it easy to stake, transfer, and monitor assets while keeping transaction fees in check. Whether you’re deep in the Solana ecosystem or exploring other blockchains, having one wallet to manage it all streamlines your experience and puts you in control.

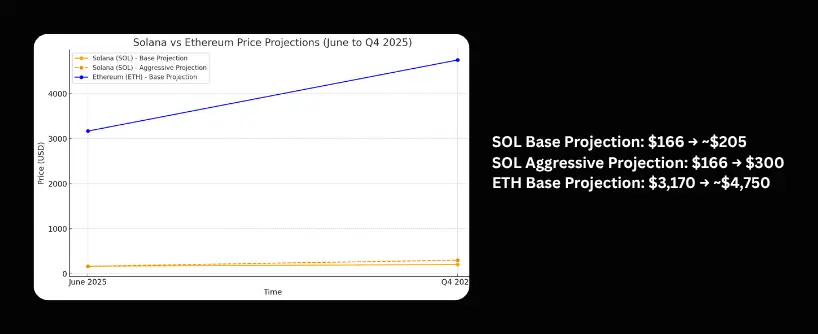

Solana Price Prediction 2025

- Expansion of the Solana Mobile ecosystem

- Integration of high-speed DeFi apps and Solana DApps

- Growing support for Solana meme coins and NFT marketplaces

- Launch of new projects and new features on Solana, such as innovative DeFi protocols or NFT tools, contributing to its ecosystem growth

Some aggressive projections even put Solana’s price prediction closer to $300 if momentum continues across Asia and emerging markets.

Ethereum Price Prediction 2025

- ETH staking growth (Lido, Coinbase)

- ETF approvals in major jurisdictions

- Leadership in DeFi TVL and DAO ecosystems

Ecosystem Showdown: DApps, DeFi, and Developer Activity

- Mature DApps like Uniswap, Aave, and OpenSea

- Institutional finance (e.g., ETH ETFs, CME futures)

- Secure smart contract infrastructure

- High-frequency DeFi (Jupiter, Raydium, with Raydium operating as an automated market maker that provides on-chain liquidity and facilitates decentralized trading)

- User-friendly wallets (Phantom)

- Mobile-native apps via Solana Mobile Stack

- NFT marketplaces (Magic Eden, Tensor)

Trading Tools and Resources for Solana and Ethereum Traders

To get the most out of trading Solana and Ethereum, having the right tools is essential. A reliable crypto wallet is at the heart of every trader’s toolkit, enabling users to swap tokens super fast and with low fees. Phantom Wallet stands out by offering powerful tools for managing your NFT collection, accessing the largest NFT marketplaces, and connecting your Ledger hardware wallet for enhanced security. With Phantom, you can easily manage your tokens, track transactions, and keep your assets safe—all from one intuitive interface.

For those trading Solana-based tokens, automated market makers (AMMs) like Raydium provide an efficient and cost-effective way to swap tokens and access liquidity. These platforms are designed for speed and low fees, making them ideal for active traders.

To facilitate seamless transactions, it’s also helpful to link your wallet to a bank account or other payment method, ensuring you can move funds in and out of the crypto ecosystem with ease. Whether you’re trading NFTs, swapping tokens, or managing your portfolio, these tools empower you to stay ahead in the fast-moving world of crypto.

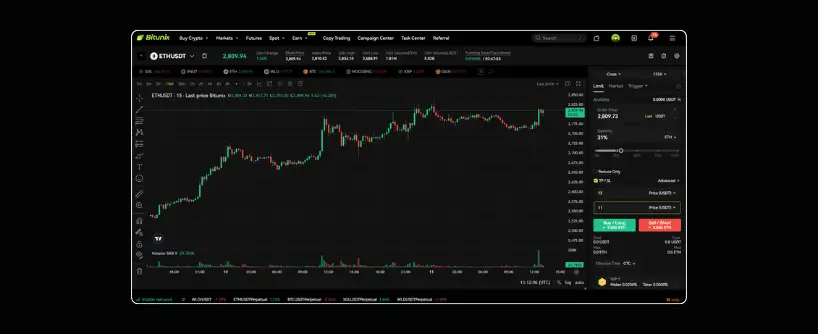

Trading Experience: Solana vs Ethereum on Bitunix

- Up to 125x leverage on both ETH/USDT and SOL/USDT

- Full support for SL/TP settings on mobile and desktop

- Real-time K-line Ultra charting and margin control

- Lightning-fast order execution

Bitunix provides real-time notifications for trade execution and portfolio changes, so you never miss important updates. Users can monitor their balances across multiple assets with no limits on the number of tokens or transactions, supporting flexible trading strategies.

Solana’s low fees and speed make it perfect for micro-scalping and meme coin swings. Ethereum offers deeper liquidity, better for long-term trades and larger positions.

Want deeper strategies? Read our 2025 Futures Trading System Guide

Trading Strategies for Solana and Ethereum in 2025

As the Solana and Ethereum ecosystems evolve, traders in 2025 will need to adapt their strategies to maximize returns and minimize risk. One effective approach is to focus on staking and yield farming, which allow users to earn rewards by holding and staking their tokens. This not only provides passive income but also supports the security and growth of the network.

The rise of Solana Mobile opens new opportunities for both developers and users. Developers can build decentralized applications (dApps) without restrictions, while users gain greater control and ownership over their experience and the value they help create. When trading, it’s crucial to stay vigilant against malicious transactions.

Utilizing scam detection features and relying on a trusted companion like Phantom Wallet ensures your funds remain secure and you maintain full control over your assets. By combining these strategies—staking, leveraging new platforms, and prioritizing security—traders can unlock the full potential of Solana and Ethereum in 2025.

Risk Management: Navigating Volatility on Solana and Ethereum

Crypto markets are known for their volatility, and both Solana and Ethereum can experience rapid price swings. To navigate this environment, traders need a solid risk management plan. Using a crypto wallet like Phantom Wallet, which offers low fees and the ability to swap tokens super fast, can help you react quickly to market changes and minimize transaction costs.

Implementing tools such as stop-loss orders and careful position sizing allows you to limit potential losses and protect your rewards. Staying informed with up-to-date data and analytics is also key—making decisions based on real-time information helps you stay ahead of the curve. By combining these strategies and leveraging wallets that prioritize speed, security, and low fees, traders can better manage risk and maximize their potential returns in the ever-changing crypto landscape.

Which Blockchain Should You Choose?

Both blockchains offer secured environments for trading, but users should also consider their private data and privacy needs when choosing a platform.

But you don’t have to pick just one. Bitunix lets you trade both — with consistent execution and risk management tools designed for all user types.

Security and Reliability

- Ethereum has the longest uptime history, with very few network halts and a large validator base.

- Solana faced reliability issues in the past but has stabilized significantly in 2025. The recent upgrade spread validator nodes across more global locations, improving decentralization and security. Users can now securely store their assets, including tokens and NFTs, using trusted wallets on both blockchains.

Regulatory Environment: What Traders Need to Know in 2025

As the regulatory landscape for Solana and Ethereum continues to evolve, staying compliant is more important than ever. In 2025, increased attention to anti-money laundering (AML) and know-your-customer (KYC) requirements means traders must be prepared to verify their identity, often including providing a phone number and other personal information. Using a trusted and compliant crypto wallet like Phantom Wallet helps ensure your assets are secure and that you’re meeting all necessary regulatory standards.

It’s also crucial to keep an eye on updates to the Solana blockchain and Ethereum network, as changes to these protocols can impact the broader ecosystem and the value of your assets. By staying informed and using wallets that prioritize security and compliance, traders can confidently navigate the regulatory environment and protect their investments in both Solana and Ethereum.

Future Outlook: Solana vs Ethereum in 2025 and Beyond

- Ethereum will likely remain the institutional backbone — a “Wall Street” of crypto

- Solana may continue its run as the “Robinhood” — fast, fun, and made for traders

We’re also seeing a shift where multichain strategies dominate. Smart investors use Solana for fast execution and Ethereum for long-term DeFi positioning.

The next wave of blockchain innovation will see Solana and Ethereum integrating more deeply with the internet and Web3 ecosystems, enabling broader access and new on-chain experiences.

FAQ

Q: Can I trade both Solana and Ethereum on Bitunix?

A: Yes. Bitunix supports high-leverage trading on SOL/USDT and ETH/USDT with full SL/TP support, mobile access, and real-time market data.

Q: Which chain is cheaper to trade on?

A: Solana has lower transaction fees and faster settlement, making it cheaper for frequent trades.

Q: Which coin will go higher in 2025?

A: Solana may offer higher % gains due to smaller market cap. Ethereum remains a blue-chip asset with broader adoption.

Q: Can I stake ETH or SOL on Bitunix?

A: Bitunix allows staking for both assets under Earn section with flexible APY options.

Q: Which is better for NFT trading?

A: Solana wins on speed and cost. Ethereum has broader NFT brand recognition.

Q: Is my privacy protected when using wallets for Solana or Ethereum?

A: Most leading wallets do not require a phone number, email, or other personal information, ensuring your data remains private.

Q: Can I manage my NFTs directly in my wallet?

A: Yes, you can pin, hide, or burn NFTs within supported wallets to organize and control your collection.

Conclusion: Use the Right Tool for the Right Trade

The Solana vs Ethereum debate doesn’t have a one-size-fits-all answer. In 2025, Solana excels in trading, NFT activity, and speed. Ethereum continues to be the foundation for complex DeFi, staking, and institutional adoption.

Whether you’re a day trader, investor, or builder, make sure your strategy aligns with the chain’s strengths. Bitunix supports both ecosystems with fast execution, transparent fee structures, and advanced futures tools.