In 2025, crypto markets move faster than ever and not every trader has the time, skill, or experience to keep up. That’s why copy trading is booming. Copy trading provides access to a wide variety of financial markets, including cryptocurrencies, forex, stocks, and commodities, allowing you to diversify and leverage expert strategies. Whether you’re new to crypto or looking for smarter ways to trade, learning how to start copy trading can put you on the path to smarter, data-driven profits without managing every trade manually.

This guide will walk you through what copy trading is, how to set it up, and the best copy trading apps and features available — especially through platforms like Bitunix that are purpose-built for both beginners and serious traders. Consider this article the first step in your copy trading journey, giving you the knowledge and confidence to start trading with the guidance provided here.

What Is Copy Trading?

Instead of learning charts, indicators, or strategies from scratch, copy trading allows beginners to follow professional traders and benefit from their insights — in real time. In addition to copying other traders, some systems use a signal provider, who generates and distributes trading signals for followers to act on, which is different from simply copying trades.

Mirror trading is a related but distinct method, where you automatically replicate predefined trading strategies, often created by professional traders or algorithms, rather than copying individual trades.

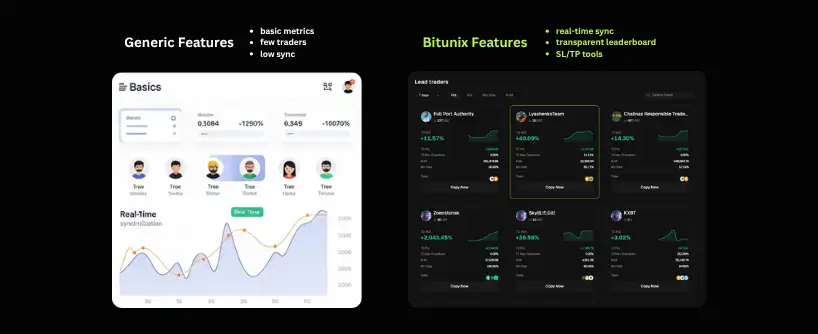

Unlike bots that rely solely on coded strategies, copy trading combines human trading behavior with automation, offering a balance of logic and market intuition. We now offer a trading platform designed for copy trading, with advanced filters to help users pick the right traders based on ROI, risk profile, trading pair preference, and strategy style.

Why Is Copy Trading Ideal for Beginners?

- No trading experience required – Prior trading experience is not necessary; even complete beginners can start copy trading with ease.

- Faster learning through observation – By following and analyzing the strategies of more experienced traders, you can improve your own trading skills over time.

- Reduced emotional decision-making

- Access to real-time performance data

- Customizable risk management settings

In short, it’s one of the most accessible ways to step into live trading, allowing beginners to learn from successful traders while staying in control of your exposure.

Step 1: Choose a Reliable Copy Trading App

Your first step is selecting a copy trading app or platform that offers the features you need. Most copy trading platforms provide a similar onboarding process, making it easy for beginners to get started. On Bitunix, the process is beginner-friendly and secure — designed for fast onboarding.

When selecting a platform, here are features to look for:

- Transparent trader stats (win rate, drawdown, ROI)

- Adjustable risk allocation

- Multiple assets (spot, futures, altcoins)

- Instant execution replication

- Real-time trade sync

Bitunix offers these essentials and goes further with 24/7 monitoring tools, trade alerts, and full support on both mobile and desktop.

Step 2: Open a Copy Trading Account

- Registering a free trading account

- Verifying your identity (KYC)

- Funding your account (USDT, BTC, ETH)

- Navigating to the Copy Trading dashboard

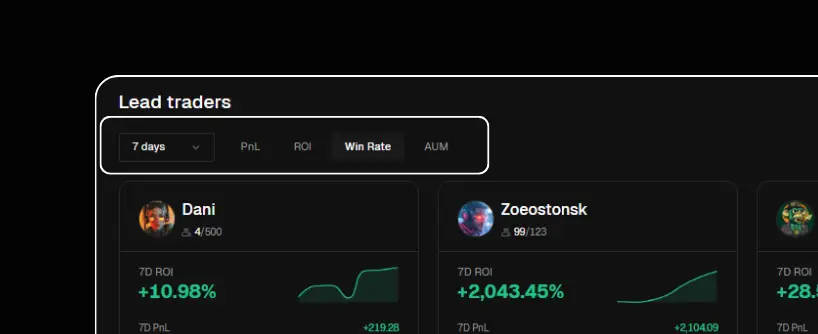

Once you’re in, you’ll be able to view a full leaderboard of professional traders — ranked by ROI, consistency, number of followers, and trading style. You can review each trader’s trading history and trade history to analyze their past performance and strategies before making a selection. While past performance is visible and can help inform your decision, it should not be the only factor in choosing a trader, as historical results do not guarantee future outcomes.

Step 3: Select a Trader to Copy

Choosing the right trader is critical. Don’t go straight for the top ROI. Look for balance between return and risk by carefully evaluating a trader’s performance and their risk levels.

Important filters to use:

- Risk Score: Does the trader use high leverage or safer setups? Assess their risk levels to ensure they align with your investment goals.

- Win Rate: Are they consistent or volatile? Consider this as part of the trader’s performance evaluation.

- Strategy Focus: Scalping, swing trading, futures, or spot? Understanding the trader’s trading strategy is important to see if it matches your preferences.

- Max Drawdown: How much have they lost during downturns?

- Trading Frequency: Do they trade daily or weekly?

Make sure to match your own risk tolerance to the trader you select. Avoid copying only a single trader or relying on one trader, as this can increase your risk. Instead, diversify by following more than one trader with different trading strategies and risk levels to better manage your overall risk.

Our copy trading feature allows you to preview each trader’s historical trades, PnL charts, and recent activity — helping you avoid blind copying.

Step 4: Set Your Risk Parameters

- Capital allocation: Choose how much USDT to allocate to a trader. This helps control your risk exposure by limiting the amount you put at risk with each trader.

- Stop-loss settings: Set limits to stop copying after a certain loss

- Trade ratio: Decide if you want to copy full-size trades or scaled down versions

Most platforms also offer risk management tools, such as position sizing and capital allocation limits, to help you further manage your risk exposure and protect your investment.

Step 5: Monitor, Learn, and Adjust

Copy trading doesn’t mean “set and forget.” The best copy trading beginners review their trading results weekly and make adjustments. Regularly assessing your trading results helps you evaluate the profitability and performance of the traders you follow. Be prepared to adjust your strategy in response to changing market conditions, as these can impact trading outcomes and may require you to periodically review or diversify your copying approach.

Use Bitunix features to:

- Pause or resume copying

- Switch traders anytime

- Reallocate funds between traders

- Download trading logs for review

If you want to learn even faster, keep a copy trading journal. Logging your performance not only helps you track what worked and understand why trades succeed or fail, but also improves your market analysis and market research skills. It’s how beginners become skilled investors.

Why Bitunix Stands Out for Copy Trading Beginners

Many trading platforms claim to support copy trading but Bitunix stands out as a dedicated copy trading platform.

Here’s why beginners prefer Bitunix:

- Smart Copy Engine: One-click setup, real-time sync, and reliable trade execution with latency-free processing

- Risk Control Layer: Built-in SL/TP and emergency stop-copy buttons

- Pro Trader Leaderboard: Transparent metrics across 30+ trading pairs

- Mobile-Friendly Design: Seamless switching between traders on the go

FAQ

What is copy trading?

Copy trading is a form of automated investing where your trades replicate the positions of an experienced trader in real time.

How do I start copy trading?

Choose a copy trading app (like Bitunix), open an account, fund it, pick a trader, and start copying their trades based on your chosen risk level.

Is copy trading profitable?

It can be — but success depends on choosing the right trader, using risk controls, and reviewing performance consistently.

Can I stop copy trading at any time?

Yes. Bitunix allows you to pause or stop copying a trader instantly without penalty.

What’s the best copy trading app for beginners?

Bitunix offers one of the most beginner-friendly copy trading apps in 2025, with clear stats, SL/TP settings, and demo testing.