Nowadays, buying Bitcoin is as easy as buying yogurt in a grocery store. But should you always go the easy route?

In 2025, you can buy BTC with a credit card, use Apple Pay, or even purchase Bitcoin instantly with a debit card. There’s a world of options – so which one is best for you? And more importantly, when should you not buy BTC with a card at all?

Whether you’re new to crypto or a seasoned investor, keep reading to uncover the best ways to purchase BTC and the costly mistakes to avoid.

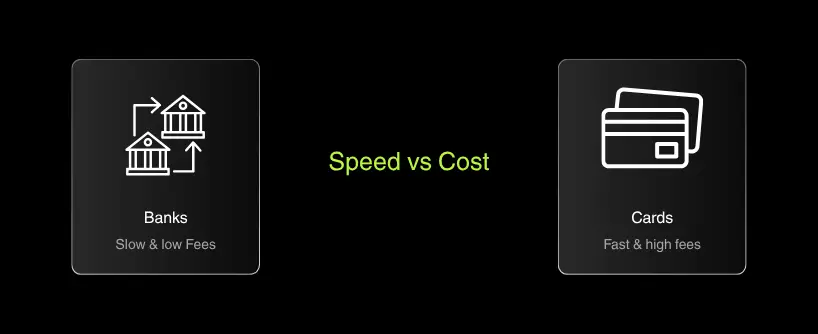

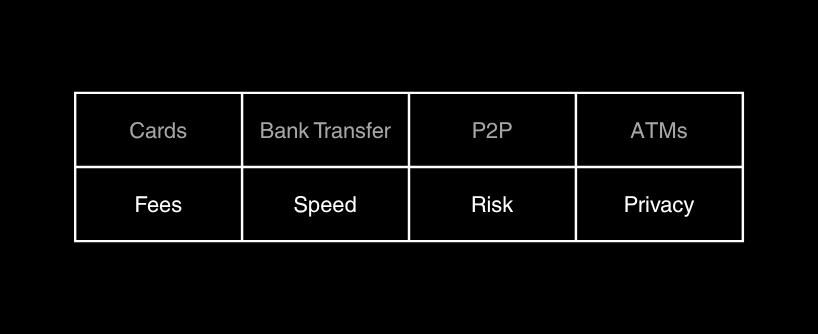

Why does the payment method matter when buying Bitcoin? Whether you’re using a Visa card, PayPal, or a bank transfer, each option impacts transaction speed, fees, and security. Credit and debit cards offer instant purchases but often come with higher fees.

Bank transfers might save money, but take longer. Knowing the pros and cons helps you choose the best platform to buy BTC with a credit card or debit card, ensuring a hassle-free experience.

Understanding when to use your cards and when to avoid them could be the difference between a smart investment and an expensive mistake. Why does this matter? Because choosing the wrong payment method can eat into your Bitcoin investment before you even start.

Let’s discover which method aligns with your crypto goals and why to use cards for buying BTC:

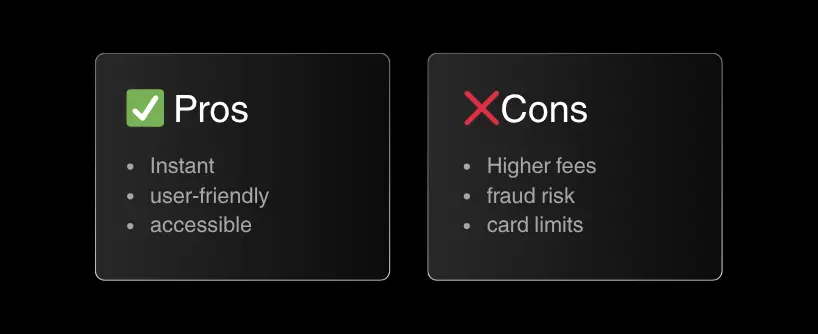

When Bitcoin’s price is moving fast, every minute counts. Credit and debit cards offer instant purchase capabilities that can be crucial during market volatility. Unlike bank transfers that can take days to process, card transactions typically complete within minutes, allowing you to capitalize on price movements immediately.

For newcomers to cryptocurrency, using a familiar payment method reduces friction. Most people already know how to use their cards online, making the entry into Bitcoin ownership feel less intimidating. This familiarity factor has made card purchases one of the most popular methods for first-time Bitcoin buyers.

You can acquire a range of tokens, including Bitcoin and Ethereum, all through a single platform like Bitunix using card payments. Major cryptocurrency exchanges support card payments, recognizing that this payment method serves as a gateway for mainstream adoption.

Modern payment integration extends beyond traditional cards. Many platforms now support Apple Pay, Google Pay, and other digital wallet services, creating seamless purchase experiences across different devices and platforms.

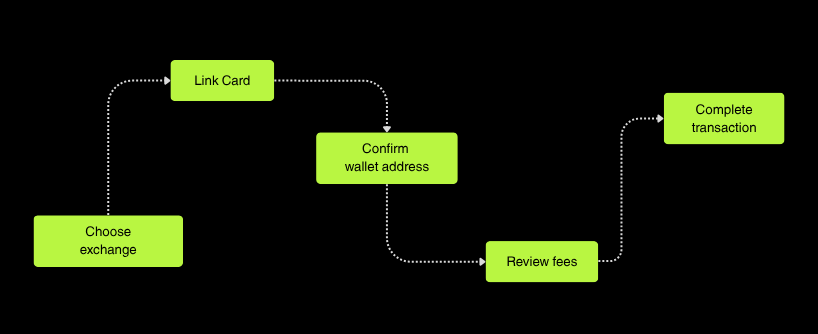

Let’s outline the steps needed for purchasing BTC:

Opt for a platform like Bitunix, known for security, low fees, and support for multiple payment options.

Enter your card details, wallet address, and the amount of BTC you want to buy. Always double-check your Bitcoin wallet address. Funds sent to the wrong address cannot be recovered.

Transaction limits range from $5 to $25,000, depending on the platform and verification level. Always review the exchange rate and hidden fees before confirming.

Ready to weigh the benefits against the risks? Let’s look at the pros and cons.

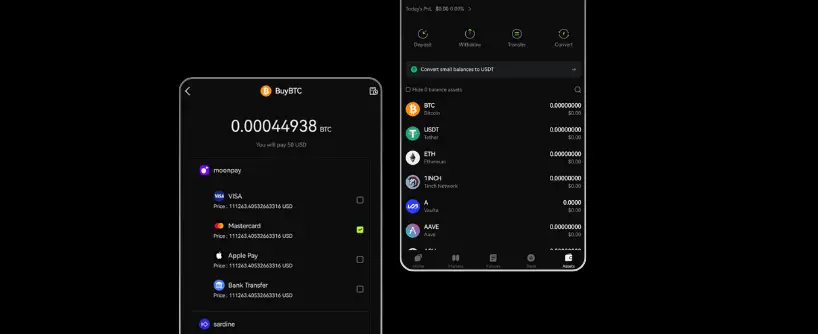

Bitunix stands out in 2025 for its seamless card payment integration. Supporting Visa, Mastercard, Apple Pay, and Google Pay, it ensures fast, secure transactions. Its intuitive interface makes buying BTC with a debit card instantly a breeze, even for beginners.

Beyond Bitcoin, Bitunix allows you to diversify your crypto portfolio with over 700+ cryptocurrencies, including Ethereum (ETH), Tether (USDT), and Dogecoin (DOGE). Swap BTC for other digital assets directly on the platform.

Bitunix collaborates with trusted provider like MoonPay, ensuring competitive exchange rates and no hidden fees. These partnerships enhance transaction speed and reliability, delivering BTC to your wallet in minutes.

With AES-256 encryption and PCI-DSS compliance, Bitunix prioritizes security. Its non-custodial wallet option lets you control your private keys, reducing hacking risks. User reviews praise its 24/7 support and hassle-free experience.

Not sold on cards? Let’s explore other ways to buy Bitcoin.

Bank transfers, including SEPA in Europe, are cost-effective for large purchases but can take 1-3 days. Platforms like MoonPay and CEX.IO support SEPA and SWIFT, offering lower fees (1-2%) than cards. Ideal for patient investors.

P2P platforms like Paxful connect you directly with sellers, accepting payments like PayPal or gift cards. They offer anonymity but carry higher scam risks. Always use escrow services for safety.

Bitcoin ATMs allow cash or card purchases but often charge high fees (5-11%) and may require ID. Use CoinATMRadar to find one near you, but compare costs with online platforms first.

Still tempted to use your credit card? Here’s when you should think twice.

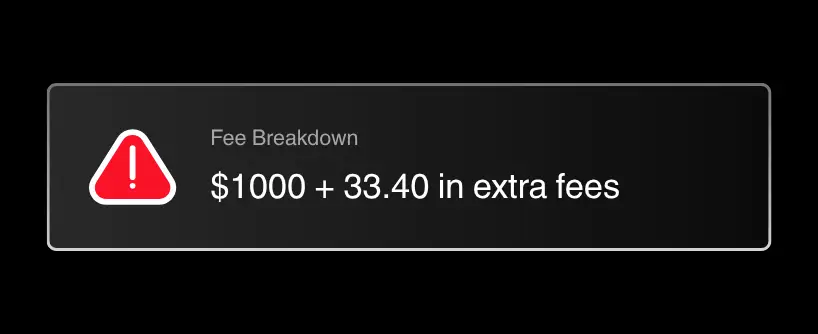

The main red flag is situations with high fees. If your bank charges Bitcoin cash advance fees or high interest (17.99–29.99% APR), card purchases can become costly. For example, a $1,000 BTC purchase could incur $33.40 in extra fees on platforms like Coinmama. Opt for bank transfers for larger investments.

Some countries restrict crypto purchases, and banks like Wells Fargo may block card transactions for crypto. Check local regulations and your bank’s policies to avoid declined payments.

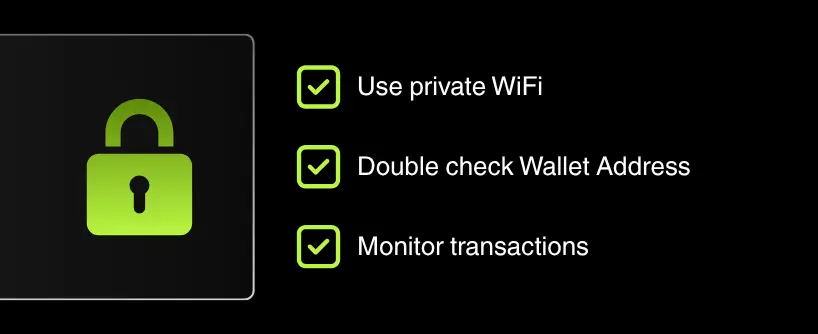

Always use a private, secure Wi-Fi network when entering card details or wallet addresses. Public networks increase the risk of data theft.

Check your bank account and crypto wallet transaction history regularly for unauthorized charges. Platforms like Bitunix offer real-time transaction details for peace of mind.

Buying Bitcoin with a card in 2025 is fast, easy, and accessible, but not always wise. It’s perfect for small, quick purchases, but high fees, privacy trade-offs, and fraud risks should make you pause for larger or frequent transactions.

Final Recommendations:

And most importantly, never invest blindly. Stay informed, secure your data, and always keep learning. Bitcoin isn’t just a purchase. It’s a strategy.

1. Can I buy Bitcoin instantly with a credit or debit card in 2025?

Yes, many platforms like Bitunix and MoonPay allow you to buy Bitcoin instantly using credit or debit cards. These services support Visa, Mastercard, and even digital wallets like Apple Pay. However, be aware of higher fees and always verify your bank details and wallet address before purchasing.

2. Is it safe to buy Bitcoin with a credit card instantly?

It can be safe if you use regulated platforms with strong security like AES-256 encryption and PCI-DSS compliance. To buy Bitcoin safely, avoid public Wi-Fi, use external wallets, and monitor for unauthorized transactions. Card fraud is a real risk if your data isn’t protected.

3. How much Bitcoin can I buy with a debit card?

Limits vary by platform and verification level. Most exchanges let you buy from $5 up to $25,000 per transaction. Always check how much BTC you’re getting after fees and conversion rates to ensure you’re not overpaying.

4. Can I sell Bitcoin or convert BTC to fiat using the same platform?

Yes. Platforms like Bitunix let you sell Bitcoin, convert BTC to fiat currency, and sell cryptocurrency directly to your linked card or bank account. Just ensure your bank details are correct and that the platform supports your region.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.