In crypto trading, choosing between cross margin vs isolated margin is one of the most important decisions a trader can make. In 2025, as volatility and leverage become more common, the margin model you choose directly impacts your risk exposure, liquidation potential, and capital efficiency. This article breaks down both approaches and reveals what the smartest traders on platforms like Bitunix are doing now.

Cross Margin Vs Isolated Margin: What Is Cross Margin Trading?

Cross margin trading uses all the funds in your margin account to support any open positions. This shared pool of margin allows gains from one trade to help cover potential losses in another. Cross margin uses your entire account balance as collateral, which implies that all funds are at risk if trades go against you.

Benefits of cross margin:

- Efficient use of capital across multiple trades

- Reduces the chance of forced liquidation when one trade is temporarily negative

- Preferred by experienced traders managing multiple positions at once

Downsides:

- A single bad trade can consume your entire available margin, increasing the risk of total account liquidation and liquidation risk, especially during a significant price drop

- Harder to control risk on individual positions

- If you get liquidated, all open trades may be affected

If your account balance falls below the maintenance margin level, you may face a margin call or forced liquidation.

Cross margin is ideal for traders running multiple correlated positions who need flexibility. But without strong risk management, a volatile asset can trigger a chain reaction that wipes out your account. Cross margin requires careful monitoring of margin requirements to avoid liquidation risk.

What Is Isolated Margin Trading?

Isolated margin trading assigns a fixed amount of margin to each position. Isolated margin offers traders the ability to allocate collateral individually to each particular position, providing precise risk management and risk control. If that trade goes against you, only the collateral assigned to that particular position is at risk, protecting other positions.

Benefits of isolated margin:

- Limits your losses to the margin allocated for that trade

- Offers better control over individual position risks, allowing you to carefully manage position sizes and ensuring that only the collateral assigned to a particular position is at risk, which protects other positions in your portfolio

- Easy to manage for beginner or part-time traders

Downsides:

- If margin is too small, you can get liquidated fast

- Doesn’t allow gains in one trade to buffer losses in another

- Requires more active monitoring

The isolated margin trading strategy requires more active management and is favored by isolated margin traders who want to precisely manage risk.

In isolated mode, you can still manually add margin or adjust leverage mid-trade, but your downside is confined to each trade individually. Managing collateral and adjusting the isolated margin amount for each trade is a key part of how isolated margin works.

Cross Margin vs Isolated Margin

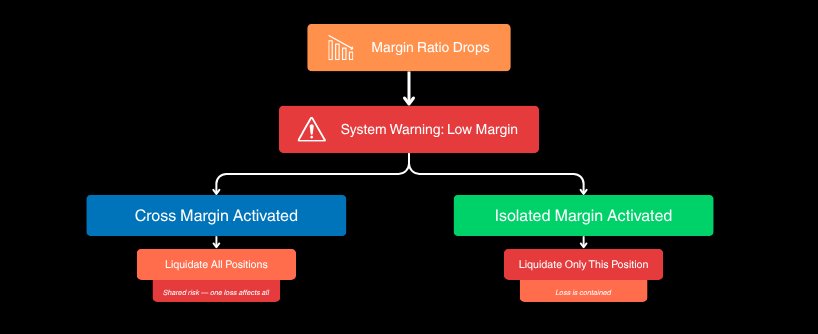

Key differences between cross margin and isolated margin include how margin requirements, collateral allocations, and margin assigned to each trading position are handled. In cross margin, the margin and collateral are shared across your entire portfolio, meaning losses in one position can impact your whole trading account. In contrast, isolated margin assigns a specific margin to each trading position, limiting risk to that position and protecting the rest of your entire portfolio. The choice of margin type directly affects your risk exposure, margin requirements, and how you manage your trading account.

How Margin Call Events Work in Crypto

A margin call in crypto happens when your account equity drops below the required maintenance margin. Traders must satisfy maintenance margin requirements to avoid margin calls and potential liquidation. If you do not add funds or reduce your position, the system will liquidate your position.

In cross margin trading, if one of your trades moves deep into loss territory, it can drain your total margin balances, causing a margin call crypto event. If margin balances are insufficient, the system may initiate partial position closures to protect the account and reduce risk, potentially liquidating all open trades.

With isolated margin trading, only the position that fails to meet maintenance margin requirements is liquidated. The rest of your trades remain untouched, making it more suitable for traders who want a lower-risk approach.

Why Cross Margin Is Popular in 2025

Institutional traders and advanced users favor cross margin trading for a few key reasons: Cross margining allows traders to use multiple assets as collateral and automatically transfer excess margin between margin accounts to optimize exposure and manage risk across various margin positions.

- They can hedge positions effectively across pairs

- Their capital is used more flexibly

- Many run automated systems or multiple correlated positions

- Cross margining can reduce initial margin requirements and help manage margin positions during periods of market volatility

Bitunix offers enhanced cross margin settings with real-time PnL updates and adjustable leverage per trade. This helps larger portfolios operate with better capital efficiency. When using cross margin amounts, it is crucial to have a solid risk management plan in place to avoid liquidation, especially during periods of high market volatility.

Why Isolated Margin Trading Is Gaining Ground Too

Many retail users, especially on mobile platforms, are choosing isolated margin trading because:

- Isolated margin reduces risk to one position and protects the trader’s entire portfolio by limiting potential losses to the collateral allocated for each trading pair

- It prevents overexposure to one market move

- It helps enforce emotional discipline

Isolated margins are especially useful in crypto trading, where each trading pair can be managed separately for better risk control.

If you’re a newer trader or focusing on just one or two assets, isolated margin is easier to manage. Bitunix supports one-click isolated margin switching and even recommends it for high-volatility assets.

In a volatile crypto market, using isolated margin as a risk management strategy can help prevent losses from spreading across the entire portfolio.

The Rise of Hybrid Strategies

The smartest traders in 2025 are not picking sides. They are using both margin models based on their overall trading strategy. The choice between cross margin and isolated margin as part of a trading strategy depends on the trader’s risk tolerance and need for active management of positions and collateral.

For example:

- Hedging ETH/USDT and BTC/USDT positions using cross margin

- Opening aggressive short-term meme coin trades in isolated margin (note: using isolated margin may require more active management and precise risk management strategies)

- Switching from isolated to cross margin mid-trade if hedging opportunities arise

Bitunix allows real-time switching between isolated and cross modes for eligible contracts. Whether isolated margin ultimately depends on the trader’s approach to risk, risk tolerance, and portfolio diversification, as well as their willingness to engage in active management of their positions.

Tips to Avoid Margin Call Crypto Risks

- Set tight stop-loss levels

- Monitor your margin ratio frequently

- Use Bitunix’s “reduce only” feature to scale out of risky trades

- Avoid maxing out leverage, especially in volatile markets

- Know your liquidation price before entering any position

- Regularly monitor your trader’s entire account balance to avoid unexpected liquidations and ensure you are not risking more than you intend.

Even with great tools, margin trading always carries risk. Protecting your overall account balance is crucial in margin trading, especially in volatile financial markets. Knowing how your margin model works is the first step in managing it.

Final Verdict: Which Margin Model Wins in 2025?

It depends on your goals.

- Choose cross margin if you’re managing multiple positions, using hedges, need capital efficiency, or are handling multiple margin trading accounts to prevent forced liquidations and optimize margin utilization.

- Choose isolated margin if you want lower risk per trade, simpler management, and more control over each position, especially when your initial investment is limited and you want to manage risk on each trade.

The choice between cross margin and isolated margin is crucial for leveraged trading and should be based on your initial investment, trading strategy, and whether you are managing multiple margin trading accounts. Both models are widely used in crypto trading for different risk profiles and market conditions.

Both models have a role in smart trading strategies. Bitunix provides both options with full transparency, making it easier to adapt your trading approach without compromise.

FAQs

Can I switch from cross margin to isolated on Bitunix?

Yes. Bitunix allows switching between margin types for supported contracts before entering a trade.

Is cross margin better for leverage trading?

It can be, but only if managed carefully. Cross margin works well when running multiple strategies that offset each other. With cross margin, your total account balance is used as collateral for all trading positions, which can help avoid forced liquidations but also increases risk if not managed properly.

What happens during a margin call crypto event?

If your margin ratio falls too low, the system will liquidate your position to prevent further loss.

Do professional traders prefer cross or isolated margin?

Many professionals prefer cross margin, but they combine it with strict risk controls and stop-losses.

Which model should I use as a beginner?

Start with isolated margin. It protects your account from total liquidation and makes learning easier. Isolated margin assigns collateral to individual margin positions, so only the margin allocated to a specific trade is at risk, safeguarding the rest of your account’s total balance.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.