Want to make your first crypto trade but unsure where to start?

You’re not alone. Crypto trading might seem like a maze of charts, jargon, and risk. But it doesn’t have to be that way, especially if you start with spot trading.

Spot trading in crypto is the most straightforward form of trading digital assets. You buy a cryptocurrency at its current market price and take direct ownership of it. Simple, right?

In this guide, we’ll explore exactly how spot trading works, how it compares to futures trading, what strategies can help you succeed, and what risks you need to watch out for.

[ez-toc]

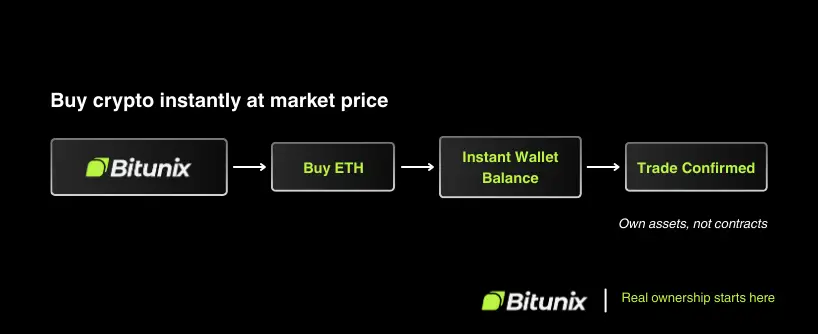

Spot trading refers to the immediate purchase or sale of a cryptocurrency for delivery “on the spot.” That means once your buy or sell order is executed, you receive the asset instantly. No waiting, no future obligations.

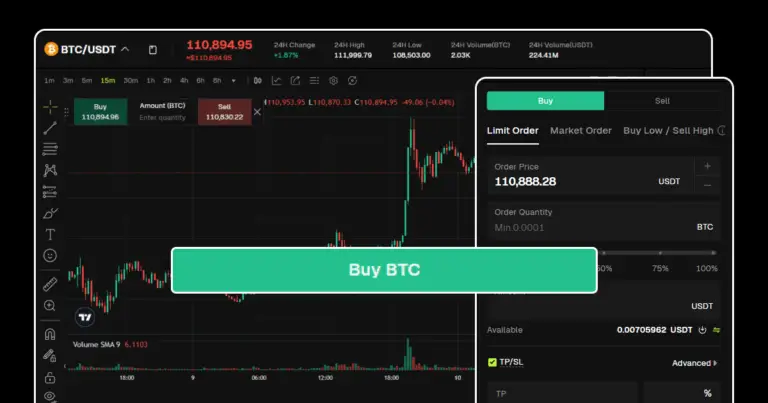

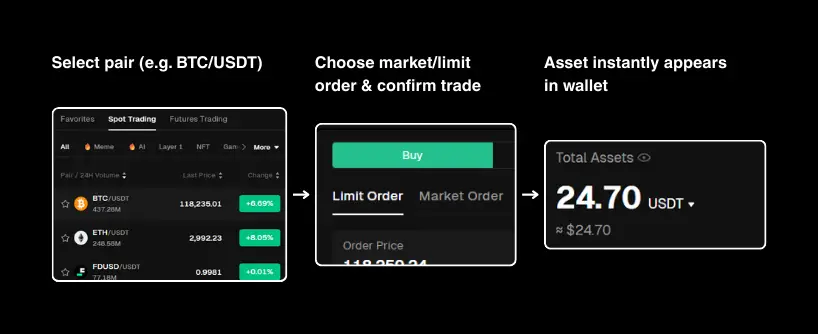

This method is most often used on crypto exchanges like Bitunix, Binance, Coinbase, or Kraken, where trades are made using a market order or limit order, based on the current price of the asset (known as the spot price).

Think of it like buying coffee at Starbucks. You walk in, see the menu price, pay the current price, and immediately receive your coffee. Spot trading works the same way – you see Bitcoin’s current market price, decide to buy it, and instantly own that Bitcoin in your wallet.

Here’s what happens when you make a spot trade:

To start spot trading, a trader must select a platform, create an account, deposit fiat currency or crypto from an external wallet, and choose the cryptocurrency pair they wish to trade. The beauty of this process lies in its simplicity, no complex contracts, no future dates to worry about, just straightforward buying and selling.

You want to buy 1 ETH at $3,000. If the market price is $3,000, your order fills instantly. If you set a limit order at $2,900, you wait until ETH drops to that price.

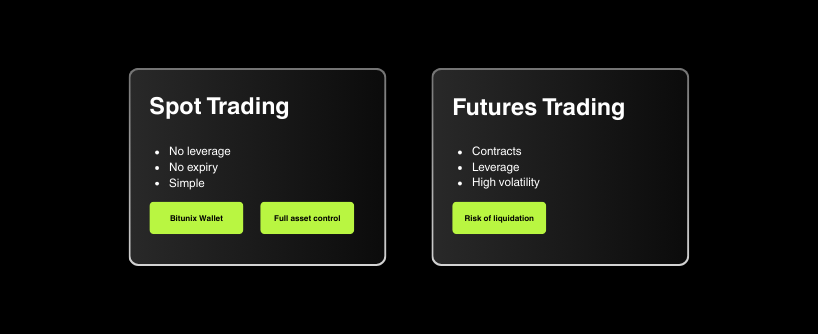

Here’s where many new traders get confused. he distinction is crucial because it determines not just your trading strategy, but your entire risk profile. Spot vs futures trading represents two fundamentally different approaches to the cryptocurrency market:

Futures trading involves contracts that obligate you to buy/sell an asset at a predetermined price at a future date. This introduces leverage, margin requirements, and the risk of liquidation.

With spot trading, what you see is what you get. You’re dealing with the current market value – no predictions, no leverage traps.

Spot trading might not sound as flashy as derivatives trading, but it offers some clear advantages:

No trading method is completely risk-free. Here are a few things to keep in mind:

Crypto is famously volatile. Short-term price fluctuations can result in sudden losses if you panic sell or misjudge a trend.

Mitigation strategies:

Your digital assets need protection. Leaving your funds on a centralized exchange puts you at risk if that exchange gets hacked.

Security best practices:

The cryptocurrency regulatory landscape is constantly evolving. Government decisions can significantly impact crypto prices and market access.

While major cryptocurrencies typically have high liquidity, smaller altcoins may have limited trading volume, making it difficult to buy or sell quickly.

Liquidity management:

Fear and greed can lead to poor trading decisions. Emotional trading often results in buying high and selling low – the opposite of what you want to do.

Emotional control techniques:

Owning crypto in a spot wallet doesn’t mean it’s secure. You must withdraw it to a private wallet you control to ensure true ownership and security.

To make the most of spot trading, you need a game plan. Let’s explore proven spot trading strategies that can help you operate in the cryptocurrency market more effectively. But remember, these aren’t get-rich-quick schemes – they’re methodical approaches that require patience and discipline.

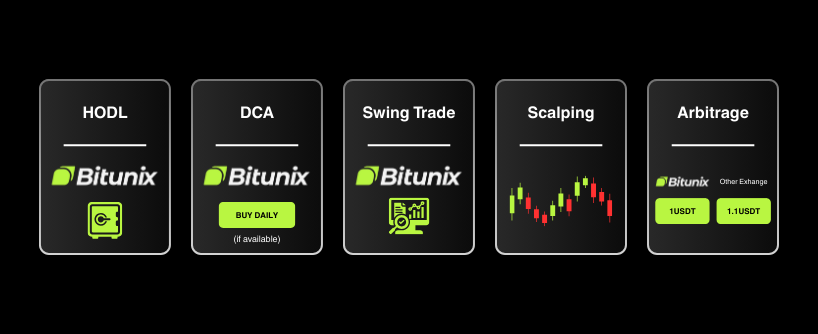

Hold On for Dear Life – The classic crypto strategy! You buy a cryptocurrency at a lower price and hold it long-term, betting on its value increasing over time. This works well for assets with strong fundamentals, like Bitcoin or Ethereum.

Best For: Long-term investors who believe in the crypto’s growth potential.

Tip: Use fundamental analysis to pick assets with strong use cases, like Ethereum’s role in DeFi or Solana’s high-speed blockchain.

This strategy involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. For example, buying $100 worth of Bitcoin every week for a year. This approach helps smooth out short-term price movements and reduces the impact of market volatility.

How to implement DCA:

Swing traders aim to profit from short-term price movements over days or weeks. They buy when the price is low and sell when it spikes, capitalizing on market trends.

Best For: Traders who can monitor market conditions and have time to analyze charts.

Tip: Use technical analysis tools like moving averages or RSI to spot entry and exit points.

Scalping involves making dozens of small trades daily to capture tiny price changes. It’s high-frequency trading that relies on high liquidity and low trading costs.

Best For: Advanced traders with access to low-fee exchanges and automated tools.

Tip: Focus on highly liquid assets like BTC or ETH to ensure quick order execution.

Arbitrage traders exploit price differences across exchanges. They buy crypto at a lower price on one exchange and sell it at a higher price on another.

Best For: Traders with accounts on multiple exchanges and fast execution skills.

Tip: Watch out for trading fees and transfer times, which can eat into profits.

Even experienced traders make mistakes. Here are the most common pitfalls in spot trading and how to avoid them:

Seeing a cryptocurrency’s price skyrocket can trigger FOMO, leading to impulsive buying decisions at peak prices.

FOMO prevention:

Excessive trading can erode profits through fees and poor decision-making.

Overtrading prevention:

Failing to implement proper risk management can lead to significant losses.

Risk management essentials:

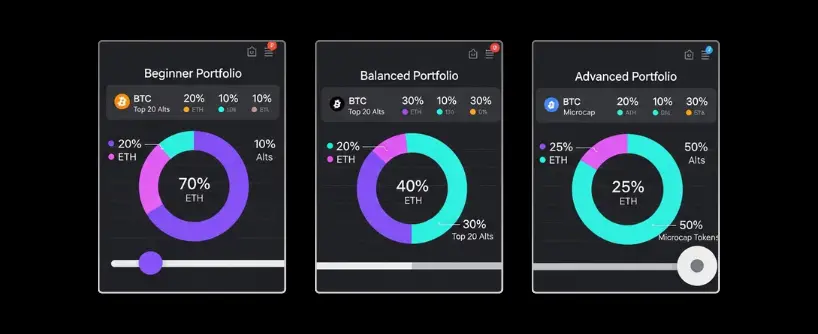

Creating a balanced portfolio is essential for long-term success in crypto spot trading. Think of your portfolio as a well-balanced meal – you need different ingredients in the right proportions to create something both satisfying and nutritious for your financial health.

Your risk tolerance should determine how you distribute your investments across different cryptocurrencies. A conservative approach might allocate 60% to Bitcoin as your foundation, 25% to Ethereum for growth potential, 10% to established top-10 altcoins for diversification, and just 5% to experimental positions where you can afford higher risk. This strategy prioritizes stability and steady growth over explosive gains.

For those comfortable with moderate risk, consider shifting the balance slightly. You might reduce Bitcoin to 40% while increasing Ethereum to 30%, dedicate 20% to top-10 altcoins, and allocate 10% to smaller-cap coins with higher growth potential. This approach seeks a middle ground between security and opportunity.

Aggressive traders often utilize a more dynamic allocation, perhaps limiting Bitcoin to 30% while matching Ethereum at 25%. The remaining 45% gets split between established altcoins (25%) and small-cap or emerging projects (20%). This strategy accepts higher volatility in exchange for potentially greater returns.

Successful portfolio management requires regular attention and adjustment. Monthly reviews help you track how your allocations have shifted due to market movements. When Bitcoin surges while altcoins lag, your carefully planned percentages can quickly become unbalanced. Rebalancing involves selling some of your outperforming assets and buying more of the underperforming ones to restore your target allocation.

However, rebalancing isn’t just about mathematics; it’s about strategy and timing. Consider the tax implications before making moves, as frequent trading can create short-term capital gains that face higher tax rates. Document your rebalancing decisions and reasoning, creating a paper trail that helps you learn from both successful and unsuccessful adjustments. This historical record becomes invaluable for refining your approach over time.

If you’re:

Then yes, spot trading is a great starting point. It’s also widely used by institutional traders, DeFi users, and those who want to build a crypto portfolio over time.

The spot market involves buying or selling crypto at prevailing market prices for immediate delivery. In contrast, other trading strategies like futures or margin trading involve contracts, leverage, or speculating on future price movements.

Spot trading is based on the current market price, not future predictions. However, traders often analyze future price movements to make better buying or selling decisions.

Yes. Many succeed in the crypto market using only spot trading, especially when focusing on long-term growth and avoiding complex, high-risk methods.

You can sell assets anytime in the spot market, depending on prevailing market prices. Timing your exits depends on your goals and market analysis.

For most beginners, yes. While cryptocurrency trading includes futures and margin trading, spot trading is simpler, lower-risk, and offers direct asset ownership.

Disclaimer: Trading cryptocurrencies involves risk. This article is for informational purposes only and not financial advice. Always do your own research and trade responsibly.