When it comes to trading crypto, two approaches dominate: spot trading and margin trading. In 2025, more platforms are offering both, but the big question remains — is spot trading really the safer option?

Social media and beginner guides often claim that spot trading crypto carries less risk, while margin trading crypto is reserved for advanced users due to its volatility and leverage. But is the safety difference based on data or outdated assumptions?

In this article, we compare the facts and break down the myths around crypto spot trading, margin risk, and how proper risk management in crypto can change the game for any strategy.

What Is Spot Trading in Crypto?

Spot trading crypto involves buying and selling assets at the current market price. When you buy 1 ETH using USDT on a spot exchange, the coins are yours immediately. You can transfer them to a wallet, hold them long term, or trade them again at your discretion.

Key features of spot trading:

- No borrowing or leverage involved

- You fully own the asset you purchase

- No liquidation risk if the price moves against you

- Trades are settled instantly at market or limit price

Platforms like Bitunix offer high-speed crypto spot trading for Bitcoin, altcoins, and stablecoins. It is ideal for long-term investors, new users, and anyone seeking direct ownership of digital assets.

What Is Margin Trading in Crypto?

Margin trading allows you to borrow funds to open larger positions than your actual capital. If you use 5x leverage, a $1,000 deposit gives you exposure to $5,000 worth of cryptocurrency.

Features of margin trading:

- Enables amplified profits from small price movements

- Carries the risk of liquidation if the market moves against you

- Requires active monitoring and stop-loss settings

- Commonly used in short-term and day trading strategies

Crypto margin trading is more complex than spot, but for skilled traders, it offers faster returns and better capital efficiency.

Spot Trading vs Margin Trading: What the Data Says in 2025

Let’s compare based on real-world data and platform performance.

| Factor | Spot Trading | Margin Trading |

| Asset Ownership | Yes | No (borrowed capital) |

| Liquidation Risk | None | High (if price drops below margin) |

| Leverage | None | 2x to 125x depending on platform |

| Profit Potential | Linear | Amplified with leverage |

| Risk Level | Lower | Higher |

| Strategy | Long-term | Short-term or high-frequency |

| Ideal For | Beginners, holders | Experienced traders, scalpers |

Crypto spot trading is still seen as safer because your losses are limited to what you invest. In contrast, margin trading crypto introduces the possibility of losing your entire balance or being liquidated due to price volatility.

Myth: Spot Trading Is Always Safe

While spot trading avoids liquidation, it is not risk-free.

Common risks include:

- Price crashes in high-volatility markets

- Illiquid assets becoming hard to exit

- Emotional buying and selling at tops and bottoms

- Loss of private keys or exchange hacks if coins are not self-custodied

That is why even spot traders must learn risk management in crypto. This includes diversification, stop-limit orders, and using cold wallets for storage.

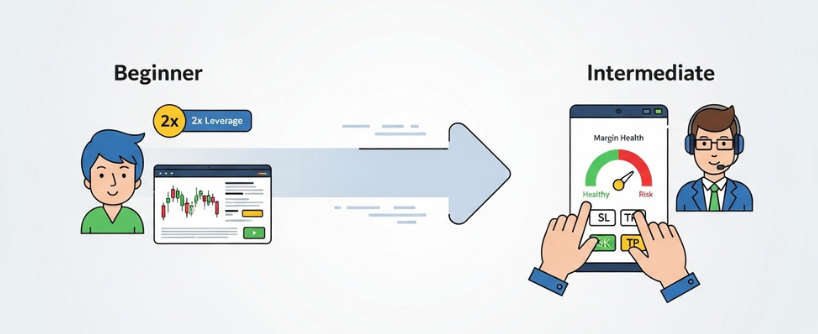

Myth: Margin Trading Is Only for Experts

Another common misconception is that margin trading crypto is too dangerous for anyone but professionals.

The reality? Margin trading becomes manageable with:

- Proper stop-loss and take-profit usage

- Limiting leverage (2x to 5x instead of 50x or 100x)

- Tracking margin call crypto levels to avoid forced liquidation

- Using platforms that offer risk calculators and built-in protections

Bitunix, for example, allows users to test their strategies using low leverage with access to real-time margin health indicators and SL/TP tools. This has made margin trading crypto more accessible to mid-level and active retail traders.

What the Experts Say About Risk Management

Institutional traders and funds entering the crypto space do not avoid margin. Instead, they manage risk with advanced tools.

Here are a few strategies you can adopt:

1. Set a Risk Limit Per Trade

Never risk more than 1 to 2 percent of your total capital on a single margin position. This keeps you in the game even if the trade fails.

2. Always Use a Stop Loss

A stop loss is a non-negotiable part of any margin position. It limits downside exposure and prevents emotional holding during downtrends.

3. Use Partial Leverage

Just because your platform offers 100x doesn’t mean you should use it. Many successful traders operate with 3x to 5x leverage only.

4. Monitor Margin Call Levels

Know at what price your position would be liquidated and avoid overextending your trade size.

5. Trade Liquid Pairs Only

Choose coins with high trading volume to avoid slippage and ensure fast order execution during volatile moves.

Which Should You Choose in 2025?

If you’re new to trading, start with spot. Use it to understand crypto price cycles, trading pairs, and volatility.

If you’re confident and want to amplify your strategy, margin trading on a regulated and secure platform can accelerate profits. The key is to manage your downside and never trade more than you’re prepared to lose.

For many, a hybrid approach works best — spot for long-term holds and margin for fast-moving market opportunities.

Conclusion

Crypto spot trading remains the go-to for safety, ownership, and simplicity. But in 2025, margin trading crypto is no longer reserved for experts. With the right risk management techniques and platform features, even intermediate traders are unlocking new levels of performance.

Safety is not defined by the product — it’s defined by how you use it.

Before you commit, ask:

- Do I have time to watch the market daily?

- Do I understand margin calls and liquidation risk?

- Can I stay disciplined with my stop-loss?

If yes, both margin and spot trading can play a role in your crypto portfolio.

FAQs

Is spot trading crypto safer than margin trading?

Yes. Spot trading does not involve leverage, so you only lose what you invest. Margin trading involves borrowing, which increases both profit potential and risk.

What is a margin call in crypto?

A margin call is triggered when your account value drops below the required margin level. If you do not add funds or close positions, liquidation occurs.

Can beginners use margin trading safely?

Beginners should start small and use very low leverage. Many platforms now offer educational tools, demo accounts, and real-time risk indicators.

What platforms are best for spot and margin trading?

Platforms like Bitunix offer both spot and margin trading with features like SL/TP, cross and isolated margin modes, and high-speed execution.

Should I trade with leverage in a bear market?

Only if you know how to short the market and have a solid strategy. Leverage increases both reward and risk, especially during market downturns.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.