If Bitcoin is often called digital gold, Ethereum is better described as the engine of programmable money. Yet, this powerful engine has a unique fuel that makes it run: gas fees. For anyone who has ever interacted with Ethereum, from minting NFTs to using DeFi protocols, gas fees are an unavoidable part of the experience.

As Ethereum continues to dominate the decentralized application space in 2025, understanding ETH gas fees and their role in Ethereum economics is crucial for both developers and traders. This article explains how Ethereum gas works, why fees fluctuate, and how users can track and manage costs efficiently.

[ez-toc]

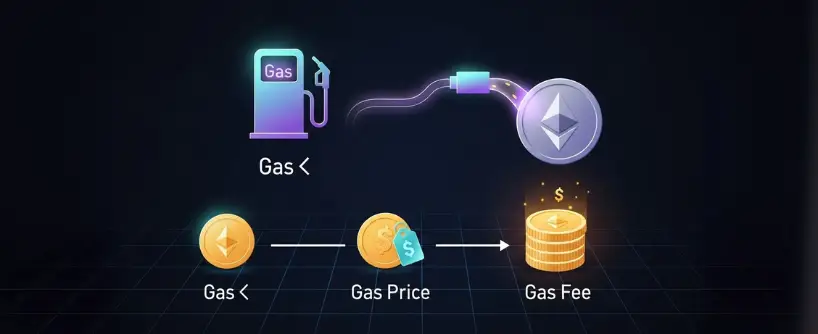

Ethereum gas fees are the transaction costs required to use the Ethereum blockchain. Every action on Ethereum whether sending ETH, swapping tokens, or deploying a smart contract consumes computing resources. Gas fees compensate validators who process these actions and secure the network.

For example:

Gas fees are not just costs — they are central to Ethereum’s economic model.

Gas fees fluctuate based on network activity. During periods of high demand — such as NFT launches, DeFi farming, or meme coin surges — competition for block space increases fees.

Key factors affecting gas fees Ethereum users pay:

Because fees change constantly, users rely on ETH gas trackers to optimize their costs.

Popular Ethereum gas trackers include:

By using an eth gas tracker, traders can save significantly by executing transactions during off-peak hours.

Ethereum pioneered gas economics, but gas fees in crypto exist on multiple blockchains. Each network handles fees differently:

Ethereum remains the benchmark because of its complexity and ecosystem scale.

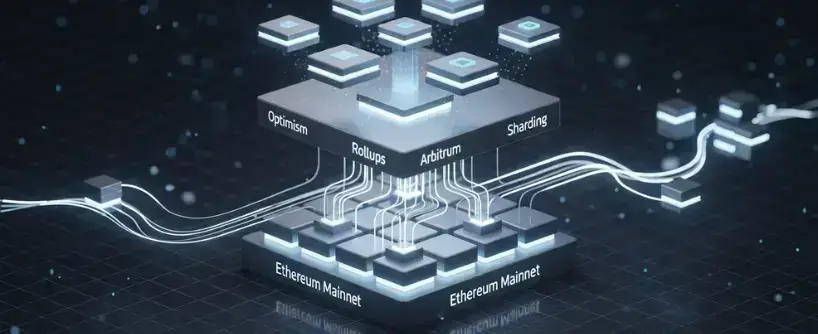

Ethereum’s developers are continuously working to reduce fees while maintaining decentralization and security. The Ethereum roadmap includes:

These scaling methods make Ethereum more accessible, lowering the cost barrier for DeFi and NFTs.

Let’s look at a practical crypto gas fee example:

If ETH trades at $3,000, the fee is about $18. This shows how high-demand activity like NFT trading can carry noticeable transaction costs.

In decentralized finance (DeFi), gas fees play a crucial role in user behavior.

Ethereum traders and developers often adopt strategies to minimize fees:

What are ETH gas fees?

ETH gas fees are payments made to Ethereum validators to process transactions and smart contracts.

Why are Ethereum gas fees so high?

Gas fees rise when network demand is high, especially during NFT drops, DeFi activity, or market volatility.

What is Ethereum gas?

Ethereum gas is a unit that measures computational effort needed for blockchain operations.

What is an ETH gas tracker?

An ETH gas tracker is a tool that monitors live gas prices, helping users choose the best time to transact.

Are gas fees only on Ethereum?

No. Other blockchains like Bitcoin, Solana, and Polygon also charge transaction fees, though Ethereum’s are among the most notable.

How do gas fees work on Bitunix?

When trading on Bitunix, users see estimated gas or transaction costs integrated in the platform interface, ensuring transparency before execution.

Ethereum gas fees are often criticized, but they are essential to the blockchain’s design. They secure the network, allocate scarce block space, and fuel Ethereum’s economic model. While fees can be high, solutions like rollups, sharding, and improved fee structures are reshaping Ethereum’s future.

For traders and developers, mastering ETH gas fees and using tools like eth gas trackers is key to participating effectively in the Ethereum economy. As the blockchain continues to evolve, gas fees remain not just a cost but the very fuel that powers Ethereum’s innovation.