Crypto trading requires tools that help traders cut through volatility and identify reliable signals. One of the most trusted and widely used indicators is the Moving Average Convergence Divergence (MACD). Developed by Gerald Appel in the late 1970s, MACD is a trend-following momentum indicator that highlights changes in strength, direction, and duration of price movements.

In the fast-paced world of digital assets, the MACD indicator is especially useful for spotting entry and exit points, confirming trends, and managing risk. This guide explains what MACD is, how it works, and how traders can apply it effectively in crypto markets with the help of Bitunix’s advanced trading features.

What is MACD in Crypto Trading?

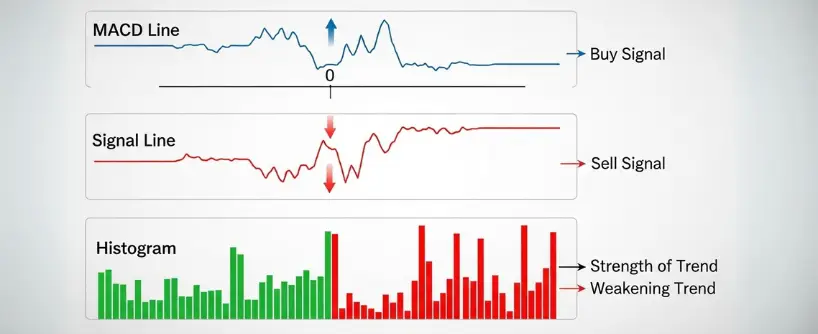

The MACD indicator is based on moving averages, specifically exponential moving averages (EMAs), which place more weight on recent prices. It consists of three components:

- MACD Line: The difference between the 12-period EMA and the 26-period EMA.

- Signal Line: A 9-period EMA of the MACD line, used as a trigger for buy and sell signals.

- Histogram: A visual representation of the difference between the MACD line and the signal line. It shows momentum strength.

Traders use the interaction between these components to analyze momentum shifts and confirm trend strength.

How to Read MACD Signals

MACD Line and Signal Line Crossovers

- Bullish Crossover: When the MACD line crosses above the signal line, it indicates a potential buy opportunity.

- Bearish Crossover: When the MACD line crosses below the signal line, it indicates a potential sell opportunity.

Zero Line Crossovers

- When the MACD line crosses above zero, it confirms upward momentum.

- When the MACD line crosses below zero, it confirms downward momentum.

Histogram Analysis

The histogram grows as the distance between the MACD line and signal line increases. A rising histogram suggests strengthening momentum, while a shrinking histogram indicates weakening momentum.

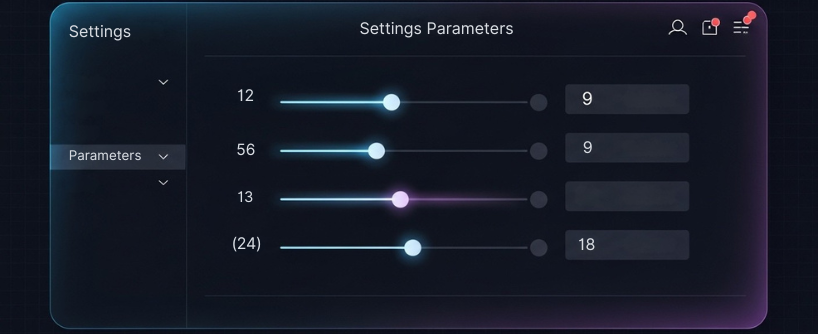

MACD Settings for Crypto

The default MACD settings are 12, 26, 9, which work well in many markets. However, crypto traders sometimes adjust settings to suit shorter timeframes due to volatility:

- Fast settings (5, 13, 9): Useful for scalping or day trading.

- Default settings (12, 26, 9): Balanced for swing trading.

- Longer settings (24, 52, 18): Better for long-term trend analysis.

On Bitunix charts powered by TradingView, traders can customize MACD settings to match their strategy.

MACD Trading Strategies for Crypto

Basic Crossover Strategy

- Buy Signal: MACD line crosses above the signal line.

- Sell Signal: MACD line crosses below the signal line. This simple approach works well in trending markets.

Zero Line Cross Strategy

- Buy when MACD crosses above zero.

- Sell when MACD crosses below zero. This strategy is effective for confirming the strength of a trend.

Histogram Reversal Strategy

Watch for histogram bars shrinking toward the zero line. This often signals weakening momentum and a possible trend reversal.

MACD Divergence Strategy

- Bullish Divergence: Price makes lower lows, while MACD makes higher lows.

- Bearish Divergence: Price makes higher highs, while MACD makes lower highs. Divergence can signal upcoming reversals and is particularly powerful when confirmed with other indicators.

Combining MACD with RSI provides stronger confirmation. For example, if MACD gives a bullish crossover and RSI shows oversold conditions, the probability of a profitable trade increases.

Real-World Examples of MACD in Crypto

- Bitcoin 2021 bull market: Multiple bullish crossovers on the daily MACD chart confirmed upward momentum, giving traders confidence to hold positions during rallies.

- Ethereum 2022 bear market: Bearish crossovers helped traders identify downward momentum and avoid false rallies.

- Altcoin volatility 2023: MACD divergences highlighted early reversals in coins such as Solana and Cardano, giving traders opportunities to enter before major trend changes.

Benefits of Using MACD

- Identifies momentum shifts early.

- Confirms trends with clear visual signals.

- Flexible across timeframes and trading styles.

- Works well when combined with other indicators.

- Provides both entry and exit signals.

Limitations of MACD

- Can give false signals in ranging or sideways markets.

- Lagging nature means signals may appear after a move has already begun.

- Requires confirmation with other tools like RSI, support and resistance, or volume analysis.

How Bitunix Enhances MACD Trading

The MACD indicator is powerful on its own, but execution and analysis tools make it more effective. Bitunix provides traders with features designed to optimize MACD-based strategies:

- TradingView charts: Professional charting with customizable MACD settings and multiple timeframes.

- Order types: Limit, stop, and conditional orders to act quickly when MACD crossovers occur.

- Copy trading: Follow experienced traders who use MACD strategies effectively.

- Price alerts: Get notified when MACD crossovers or divergences occur.

- Mobile app: Analyze MACD signals and place trades on the go.

- Futures trading integration: Apply MACD to perpetual contracts with leverage, maximizing strategic opportunities.

These tools allow traders to connect analysis directly to execution, ensuring they can act on MACD signals without delay.

FAQ

What are the best MACD settings for crypto trading?

The default 12, 26, 9 works well, but traders often adjust to faster settings like 5, 13, 9 for short-term trading.

Is MACD reliable in volatile markets?

MACD can be effective, but it should be combined with other indicators to reduce false signals in highly volatile conditions.

Can MACD be used for futures trading on Bitunix?

Yes. MACD strategies work in both spot and futures markets. Futures traders often rely on shorter settings and quick execution.

How do MACD divergences help traders?

Divergences between MACD and price often signal weakening trends and potential reversals, giving traders an early advantage.

How does Bitunix help traders apply MACD strategies?

Bitunix offers TradingView charts, advanced order tools, alerts, and copy trading features to make MACD strategies easier to implement effectively.

Conclusion

The Moving Average Convergence Divergence indicator remains a cornerstone of technical trading. By identifying momentum shifts, confirming trends, and spotting divergences, MACD gives traders the ability to navigate volatile crypto markets with more confidence.

Although MACD is not foolproof and can generate false signals in sideways conditions, its reliability increases when combined with other tools and strong risk management.

With Bitunix’s charting, order management, alerts, and futures integration, traders can apply MACD strategies more effectively and with greater precision. Whether you are a beginner or an experienced trader, MACD remains one of the most important tools to master in crypto trading.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.