Crypto trading rely on technical indicators to simplify decision-making in highly volatile markets. Among the most recognizable signals are the Golden Cross and the Death Cross. These moving average crossover patterns are widely used in both traditional finance and cryptocurrency trading to identify potential long-term trend reversals.

In 2025, these signals remain powerful tools for traders who want to confirm market direction, manage risk, and plan entries or exits more effectively. This article explains what Golden and Death Crosses are, how they work in crypto trading, and how Bitunix platform features can help traders act on these signals with confidence.

What is a Golden Cross in Crypto?

A Golden Cross occurs when a short-term moving average crosses above a long-term moving average. It signals the potential start of a bullish trend.

The most common combination is:

- 50-day moving average crossing above the 200-day moving average.

When this happens, it suggests momentum is shifting from bearish to bullish, and many traders interpret it as a strong buy signal.

What is a Death Cross in Crypto?

A Death Cross is the opposite pattern. It occurs when a short-term moving average crosses below a long-term moving average.

- Typically, the 50-day moving average crossing below the 200-day moving average.

This signals a potential bearish trend and is often considered a warning to reduce exposure or prepare for price declines.

Why Moving Average Crossovers Matter

Moving averages smooth out price data to highlight the overall direction of the market. Crossover events are powerful because they combine short-term momentum with long-term trend signals.

- Golden Crosses reflect growing bullish sentiment.

- Death Crosses highlight weakening momentum and potential downtrends.

Although not perfect, these signals often align with significant market cycles in Bitcoin, Ethereum, and major altcoins.

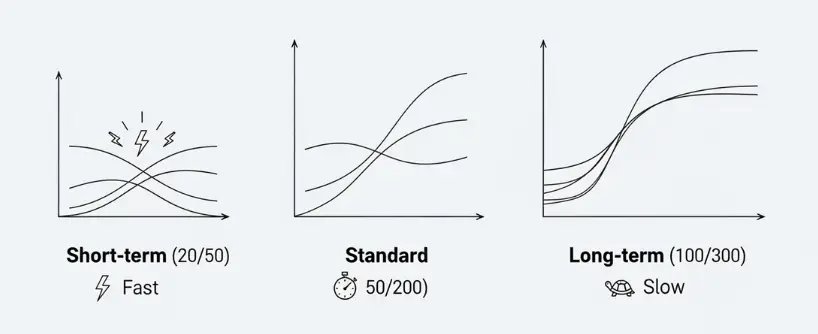

Types of Golden and Death Crosses

Standard Golden Cross

The classic 50-day moving average crossing above the 200-day moving average.

Short-Term Crosses

Traders may also watch 20-day vs 50-day crossovers for faster signals.

Long-Term Crosses

100-day vs 300-day moving average crossovers are used by long-term investors for broader trend analysis.

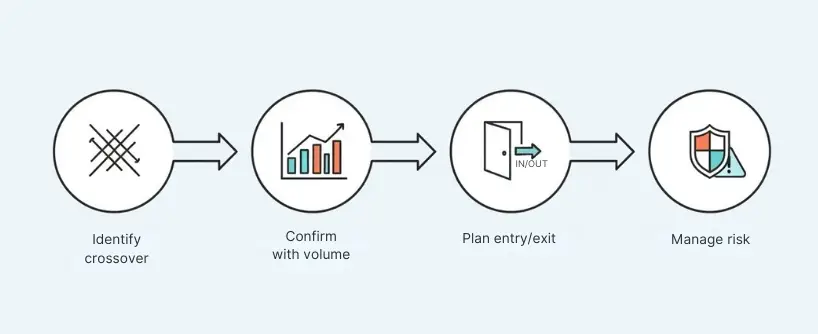

How to Trade Golden and Death Cross Signals

Step 1: Identify the Crossover

Use TradingView-powered charts on Bitunix to monitor moving average crossovers in real time.

Step 2: Confirm the Signal

Combine crossover signals with volume analysis. A Golden Cross with strong trading volume is more reliable than one with weak volume.

Step 3: Plan the Entry or Exit

- Golden Cross: Consider entering long positions or adding to existing ones.

- Death Cross: Consider reducing exposure, entering short positions in futures, or using stop-losses.

Step 4: Manage Risk

Crossovers are lagging indicators, so they can produce false signals. Always use proper risk management, such as stop orders or diversification.

Real-World Examples

Bitcoin Golden Crosses

- 2019: A Golden Cross occurred when Bitcoin moved from $4,000 toward $13,000.

- 2021: Another Golden Cross signaled strength as Bitcoin surged to all-time highs.

Bitcoin Death Crosses

- 2020 COVID crash: A Death Cross appeared before Bitcoin dropped sharply below $4,000.

- 2022 bear market: Multiple Death Crosses aligned with extended downtrends.

Altcoins

Ethereum, Solana, and Cardano have all experienced Golden and Death Cross patterns, often signaling significant shifts in long-term direction.

Benefits of Golden and Death Cross Trading

- Easy to identify and widely recognized.

- Useful for confirming long-term market direction.

- Can be applied across multiple timeframes.

- Works well when combined with other indicators like RSI or MACD.

Limitations of Crossovers

- Signals are lagging and often appear after a trend has already started.

- False signals can occur in sideways or choppy markets.

- Crossovers are more effective for long-term traders than scalpers.

Using Bitunix Tools with Golden and Death Cross Strategies

Bitunix provides traders with features that improve the reliability and execution of crossover strategies:

- K-Line Ultra charts: Apply moving averages of different lengths and track crossovers on multiple timeframes.

- Alerts and notifications: Get instant updates when a crossover occurs.

- Futures trading: Take advantage of Death Cross signals by opening short positions with leverage.

- Order types: Use limit and stop orders to plan entries and exits in advance.

- Mobile trading app: Monitor Golden and Death Cross signals and manage trades anytime, anywhere.

- Copy trading: Follow experienced traders who specialize in crossover strategies.

These tools give traders the precision and speed needed to act on moving average signals effectively.

FAQ

How reliable are Golden and Death Crosses in crypto?

They are useful indicators of long-term trend shifts but should not be used in isolation. Confirmation with volume and other technical indicators improves accuracy.

Can Golden and Death Crosses be applied to short timeframes?

Yes. Traders often use shorter moving averages, such as the 20-day and 50-day, for quicker signals. However, these are less reliable than longer-term crossovers.

Do Golden and Death Crosses work for futures trading?

Yes. On Bitunix, traders can use Golden Crosses to open long futures positions or Death Crosses to open short positions with leverage.

What is the difference between a moving average crossover and a simple moving average trend?

A crossover combines short-term and long-term averages, creating a stronger signal than relying on a single moving average.

How can I avoid false crossover signals?

Always confirm with volume analysis, RSI, or MACD. Also, check broader market conditions before making decisions.

Conclusion

Golden Cross and Death Cross patterns remain some of the most important signals in crypto trading. They highlight shifts in long-term momentum and provide traders with a framework for making informed decisions.

Although these crossovers are lagging and can generate false signals in sideways markets, they remain highly valuable when used alongside other indicators and strong risk management practices.

On Bitunix, traders can take full advantage of Golden and Death Cross strategies using advanced charting, customizable alerts, futures trading, and copy trading features. By combining these platform tools with disciplined analysis, traders can apply moving average signals more effectively and with greater confidence.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.