The world of digital assets is undergoing a profound transformation, driven by the integration of artificial intelligence. In the fast-paced world of crypto trading, the ability to respond to changing market conditions with speed and precision is paramount.

Our crypto trading platform offers a robust framework for traders of all levels. We will explore key features that make our software a reliable tool for automated trading. It helps users navigate the inherent risks of the crypto market. The platform also maximizes their potential for profit.

Trading Bot Technology: The Core of Automation

At the heart of our platform is a powerful AI trading bot designed to manage the complexities of crypto trading. This bot uses machine learning algorithms to analyze historical and real-time data, determining optimal entry and exit points for a trade. The bot’s performance is continuously evaluated and fine-tuned to adapt to the extreme volatility of the cryptocurrency market. This is achieved through a multi-faceted approach:

- Data Analysis: the bot processes vast amounts of information, including price trends, trading volumes, and technical indicators, to identify patterns that a human trader might miss;

- Continuous Learning: machine learning models allow the bot to learn from its past trades, constantly improving its strategies and making more accurate predictions over time;

- Rapid Execution: the bot can execute a trade in a fraction of the time it takes a human, which is a significant advantage in the fast-moving crypto market.

For example, a user can create a bot with a specific set of trading strategies and have the software backtest it against a large number of historical data points to evaluate its potential profitability.

Artificial Intelligence in Crypto Trading

AI crypto trading platform leverages artificial intelligence and machine learning to create dynamic trading strategies. The machine learning component of our software allows the bot to learn from past trades and adapt its approach. This continuous learning process is what makes our automated trading so powerful.

A user can create a portfolio of digital assets, and the bot will manage the risk for each asset in the portfolio. The bot can use various indicators to determine when to buy or sell, based on its analysis of market conditions. This development has been a long process, but the performance of our bot has achieved a high degree of reliability.

The role of artificial intelligence in mitigating risk cannot be overstated. By analyzing market data, the bot can predict potential price movements and adjust its strategies.

For example, a bot might determine that a particular trade has a high risk of loss and automatically apply a limit order to control the potential downside. This proactive risk management is a key feature of our platform. A user can set specific parameters to manage their portfolio, and the bot will ensure all trades adhere to these limits. The ability to fine tune these strategies gives the user full control while still benefiting from the speed and accuracy of the bot.

As we’ve seen, the foundation of successful trading isn’t just about making a profit—it’s about protecting your capital. This brings us to the most crucial aspect of our platform: risk management.

Risk Management: The Cornerstone of Successful Crypto Trading

We believe that effective strategies are built on a solid foundation of risk management. The performance of a trading bot isn’t just measured by its profit, but by its ability to manage risk. Our support team is always available to help you understand these metrics and adjust your trading strategies.

Theory is one thing, but real-world results are what truly matter. Let’s explore how our crypto trading platform has helped a number of our users navigate market volatility and achieve their goals through a series of practical examples.

Automated Trading Strategies and Market Volatility

The practical application of our AI crypto trading platform is demonstrated through a number of successful user scenarios. Let’s look at some examples of how our users have achieved success:

Example 1: The Scalping Bot for Bitcoin

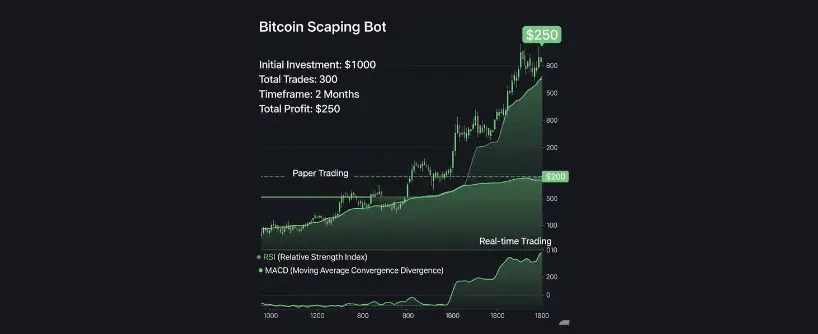

A user with a small initial investment of $1,000 wanted to capitalize on minor price fluctuations in Bitcoin (BTC). They used our platform to create a scalping bot. The bot’s trading strategies were simple: use a 1-minute chart, a combination of the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators to identify entry and exit points, and a tight trailing stop loss to protect profits. The machine learning model was trained on historical data from the past year. The bot’s performance in paper trading was promising, showing a 0.5% average profit per day with a low risk profile.

Over two months of real-time trading, the bot made over 300 trades, generating a total profit of $250. This example shows that even small-scale trading can be profitable with the right tools and effective strategies. The user was able to log every trade and see a clear evaluation of the bot’s performance. The risk management was a key factor in this success, as the bot was set to automatically close positions to limit risk. The user’s account grew steadily, demonstrating the reliability of the bot.

Example 2: The Portfolio Manager for Altcoins

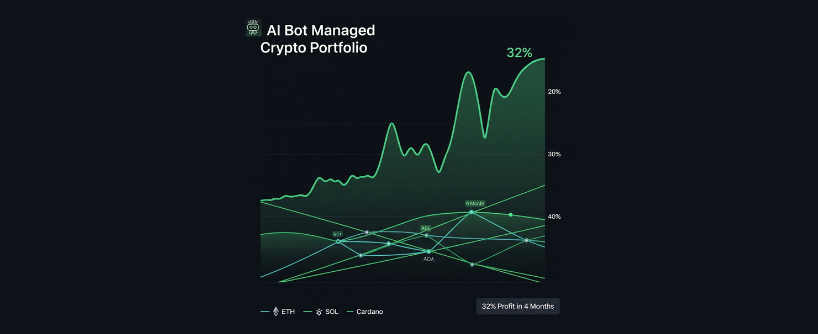

Another user wanted to manage a diversified portfolio of digital assets, including altcoins – Ethereum (ETH), Solana (SOL), and Cardano (ADA). Their main goal was to manage the risk associated with these assets and respond to changing market conditions. They created a bot that used a more complex set of trading strategies. This bot’s artificial intelligence component was designed to constantly evaluate the market conditions for each asset, predicting which ones were likely to outperform others.

The bot’s ability to create dynamic trading strategies allowed it to sell assets that showed a decline in momentum and automatically reallocate funds to those with a stronger outlook. The user’s log showed that over a period of four months, the bot rebalanced the portfolio 12 times. The profit achieved was 32% on the initial investment, a performance that would have been difficult to match manually. This case is a perfect example of how our AI crypto trading platform helps users manage their entire portfolio with a focus on mitigating risk. The user was able to monitor the bot’s decisions, giving them expert insights into the market.

Example 3: The Arbitrage Bot for Exchange Accounts

A third example involves a user who wanted to exploit the minor price differences of a single asset across multiple exchange accounts. Trading bot that have access to accounts on two different exchanges. The bot’s core function was a constant search for price discrepancies. Its trading strategies were straightforward: if the price of a digital asset on one exchange was lower than on the other, the bot would simultaneously buy on the lower-priced exchange and sell on the higher-priced one, pocketing the small profit. The development of this specific bot required the ability to seamlessly connect to and manage multiple exchange accounts.

Over a month, the bot executed a large number of trades, with each trade yielding a small profit. The cumulative profit was over $500, with an extremely low risk due to the nature of arbitrage. The bot’s ability to respond in real time to price changes was key to its profitability. This feature is a great example of how our software can be used for automated trading that is otherwise impossible for a human to perform. We provide the tools to manage these complex strategies and mitigate risk effectively.

These examples highlight the current strength of our platform, yet the role of artificial intelligence in financial markets is only beginning to unfold. The journey toward more advanced, intelligent trading solutions is ongoing. At Bitunix, we remain committed to driving innovation and leading at the forefront of this transformation.

Conclusion

The financial markets are entering a new era shaped by the rapid advancement of artificial intelligence and machine learning. These technologies are paving the way for increasingly sophisticated and adaptive trading strategies.

At Bitunix, we believe the future of cryptocurrency trading will be defined by the synergy between human expertise and artificial intelligence. This partnership combines human judgment with AI precision, creating a foundation for smarter, safer, and more effective trading.

FAQs

Is AI crypto trading safe?

Yes, with proper risk management. Our platform provides tools like paper trading and daily loss limits to help users test and manage their strategies without risking real capital.

Can I customize my trading bot’s strategies?

Absolutely. Our platform allows users to create and fine-tune custom trading strategies. You can set specific parameters and indicators for the bot to follow.

What is the benefit of paper trading?

Paper trading is a key feature that allows you to test your strategies and evaluate a bot’s performance using historical and simulated data. This lets you confirm profitability and manage risk before you commit real money.

How does the AI trading bot handle market volatility?

The bot uses machine learning to continuously analyze real-time market data and adapt its strategies to volatile conditions. It can also apply proactive risk management tools like stop-loss orders and limit orders.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.