Every crypto trader has felt it. Prices are climbing fast, social media is buzzing, and people everywhere are boasting about the massive gains they’ve made as crypto prices surge. You are sitting on the sidelines, watching opportunity slip away, and your heart starts racing. That is the fear of missing out, better known as FOMO. In the crypto world, especially within the volatile crypto market, FOMO is at its most intense, driving emotional decisions and risky trades.

In 2025, with Bitcoin near record highs and new tokens exploding overnight, FOMO remains one of the most dangerous psychological traps in crypto trading. Investors are drawn in by the potential for quick profits in the crypto market, often without proper research. It pushes traders to abandon logic and chase momentum at the exact wrong moment. This article explains what FOMO is, why it sabotages traders, and how you can defend yourself from its grip.

[ez-toc]

What is FOMO in Crypto

FOMO, or the fear of missing out, is the anxiety that arises when others are profiting from a move and you are not part of it. In crypto, where price surges can be dramatic, FOMO leads to irrational buying at tops and panic entries into questionable projects.

Unlike rational strategies that weigh risk and reward, FOMO-driven decisions are emotional decisions based on emotion and social pressure. Traders under the influence of FOMO abandon discipline, chase parabolic rallies, and often end up buying high and selling low. FOMO frequently results in impulsive buying and impulsive decisions, where traders act without proper research or planning, driven by hype or fear of missing out.

FOMO can also lead to panic selling when the market reverses, as traders react emotionally to sudden price drops.

Why FOMO is Stronger in Crypto

FOMO exists in all financial markets, but it is amplified in crypto because market conditions in cryptocurrency markets are often more volatile and emotional than in traditional markets:

- Extreme Volatility: Bitcoin or altcoins can rise 20 percent in a single day. Seeing huge gains missed creates intense regret.

- 24/7 Trading: Unlike stocks, crypto never sleeps. In contrast to stock markets, cryptocurrency markets operate around the clock, which intensifies FOMO as traders can wake up to see prices doubled overnight, making them feel left behind.

- Social Media Pressure: Crypto X, Reddit, and Telegram are filled with profit screenshots. Many investors compare themselves to others and feel inadequate if they are not part of the rally.

- Low Barriers to Entry: Anyone with a smartphone can trade crypto. This accessibility increases herd behavior and emotional decision-making.

The combination of volatility, constant access, and social influence makes crypto FOMO a constant threat.

How FOMO Sabotages Traders

FOMO damages traders in several predictable ways. Significant financial losses and significant losses are common outcomes for those who act impulsively without proper analysis.

Buying Tops

Traders often jump in after an asset has already surged, convinced the rally will never end. Inevitably, corrections follow, leaving them holding losses.

Ignoring Risk Management

FOMO clouds judgment. Traders enter with too much capital or use reckless leverage, thinking the move is a sure thing.

Chasing Unverified Projects

During hype cycles, new tokens launch daily. FOMO leads people to buy coins with no fundamentals, only to watch them collapse once attention fades.

Emotional Exhaustion

Constantly chasing trends leads to stress and poor decision-making. FOMO traders burn out, losing confidence and discipline.

Psychological Triggers Behind FOMO

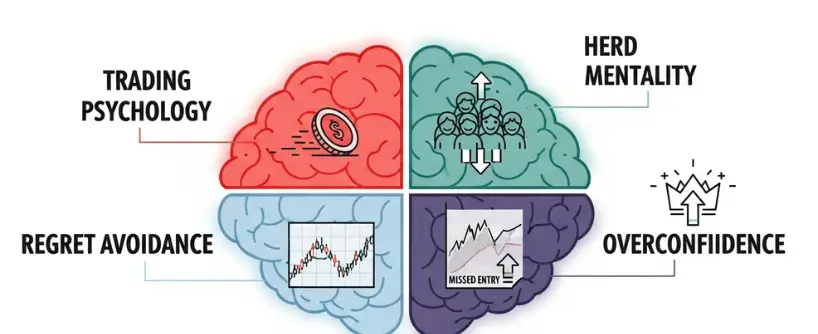

Understanding what triggers FOMO is the first step to resisting it. Uncertainty and doubt are major psychological triggers for FOMO, often causing investors to act impulsively.

- Loss Aversion: Losses feel twice as painful as gains feel rewarding. Missing a rally feels like losing money, even if you never risked any. The fear to miss out on potential gains can drive hasty decisions.

- Herd Mentality: People feel safer following the crowd. If everyone on Twitter says a token is going to the moon, the urge to join is strong. Many traders deal with uncertainty by following the majority, hoping to avoid being left behind.

- Regret Avoidance: Traders enter positions they know are risky, just to avoid the regret of not participating. Dealing with regret can cloud judgment and lead to further impulsive actions.

- Overconfidence in Trends: When markets run hot, people convince themselves this time is different. They ignore signs of exhaustion. Staying focused and maintaining focus on fundamentals is crucial to avoid being swept up by hype.

To resist FOMO, it’s important to understand these psychological triggers and how they influence your decisions.

Real Examples of FOMO in Crypto

Bitcoin 2017

As Bitcoin approached 20,000 dollars for the first time, retail traders piled in at the peak. Many bought near the top, only to suffer through the crash to 3,000 dollars.

Dogecoin 2021

Driven by social media hype, Dogecoin spiked over 10,000 percent. Countless late entrants bought near 70 cents, then watched the coin collapse below 10 cents.

Meme Tokens in 2025

Small-cap tokens still attract frenzied buying whenever they trend on social platforms. Most collapse within weeks, leaving FOMO buyers with heavy losses.

These cases illustrate how FOMO seduces traders into poor entries that end badly.

How to Defend Against FOMO

Create a Trading Plan

Write down your strategy before entering. Define entry points, exit levels, and stop losses. If a move does not fit your plan, avoid it.

Use Position Sizing

Risk only a small portion of capital on speculative trades. This reduces the impact of FOMO-driven mistakes.

Rely on Data, Not Hype

Check technical and fundamental analysis. Ignore social media screenshots of profits. Ask whether the trade aligns with your system.

Practice Patience

Remind yourself that new opportunities will always come. Crypto never runs out of volatility. Missing one move is not the end.

Keep a Trading Journal

Document every trade and the emotions that drove it. Seeing the cost of FOMO mistakes in writing helps reinforce discipline.

Turning FOMO into an Advantage

Not all FOMO signals are useless. If you can recognize when the crowd is in full panic buying mode, it may indicate the end of a rally. FOMO has often led traders to make impulsive decisions that lead to losses, especially when following the crowd without proper analysis. Contrarian traders sometimes short assets when FOMO peaks.

For example, when funding rates become extremely positive and social media is full of bullish posts, smart traders anticipate corrections. Knowing when to sell to lock in profits is crucial, as emotional peaks can lead to poor timing and missed opportunities. While risky, this strategy works if paired with strict stops and careful risk management.

Focusing on cumulative growth over time, rather than chasing short-term gains, can help investors build wealth more consistently and avoid the pitfalls of emotional trading.

How Bitunix Academy Helps Traders Avoid FOMO

Bitunix provides futures, margin, and spot markets where FOMO often leads to bad trades. To help traders build discipline, Bitunix Academy offers structured learning on trading psychology, emotional control, and strategy building. Bitunix Academy provides resources for crypto investing and supports the crypto community by sharing knowledge and best practices. Courses explain how to recognize emotional triggers, manage leverage responsibly, and stick to a trading plan.

By combining real market tools with education, Bitunix helps traders shift from emotional to rational decision-making. The Academy also helps the investor deal with emotional triggers that can impact trading decisions. You can search the web for Bitunix Academy resources to strengthen your mindset and avoid costly FOMO mistakes.

Frequently Asked Questions

What does FOMO mean in crypto trading?

It stands for fear of missing out, the anxiety of not participating in profitable moves, which pushes traders into irrational entries.

Why is FOMO dangerous in crypto?

Because it often causes people to buy at market tops, use excessive leverage, and ignore risk management. Additionally, changes in interest rates and overall interest set by central banks can impact the crypto market, influencing investor sentiment and increasing the risk of emotional trading decisions.

Can FOMO ever be useful?

Yes. Extreme FOMO often signals the late stage of a rally, giving contrarian traders opportunities to position for corrections.

How do I stop trading on FOMO?

Create a written strategy, use small position sizes, and avoid letting social media dictate your decisions. Focus on the fundamentals of a particular cryptocurrency rather than hype to make more rational trading choices.

Does Bitunix help with trading psychology?

Yes. Bitunix Academy offers educational content on mindset and discipline, helping traders learn to control emotions like FOMO.

Conclusion

FOMO is one of the most powerful forces in crypto trading. It pushes traders to chase rallies, overcommit capital, and ignore risk. Left unchecked, it sabotages accounts and destroys confidence. FOMO can also undermine your investments and erode the long-term value of your crypto assets by encouraging impulsive decisions rather than strategic, goal-oriented planning.

In 2025, with crypto more accessible and social media louder than ever, resisting FOMO is critical. By understanding its triggers, creating a trading plan, and learning from structured resources like Bitunix Academy, traders can keep emotions in check.

The market will always provide another opportunity. The real edge comes not from chasing what you missed but from preparing calmly for what comes next.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.