On September 22, a proposal surfaced to impose a new 100,000 US dollars application fee on H-1B visa petitions. The announcement immediately triggered legal review across technology, healthcare, and higher education employers, and drew criticism from India, whose nationals receive the largest share of H-1B approvals. Indian IT shares experienced a fall in value as investors marked up expected labor costs and staffing friction. At the same time, the United States arrived at the United Nations General Assembly with multibillion dollar arrears, reviving discussion of Article 19 and its voting rights trigger. Together, these developments increased near term political risk and reinforced a cautious tone across risk assets. BTC pulled back from recent local highs, with traders now focused on well defined liquidity clusters above and below spot.

What Changed On September 22–23

The H-1B fee proposal created an immediate corporate planning problem. Large U.S. platforms can absorb one-off costs when hiring key talent, but mid-cap integrators, hospitals, and universities face tighter budgets and slower procurement cycles. Because H-1B filings occur on a defined calendar, the timing of any effective date matters as much as the headline number. Employers are now reviewing whether the fee would apply only to new cap-subject petitions, how it would interact with existing statutory fees, and whether premium processing timelines could change for affected filings. Attorneys expect clarification through guidance, litigation, or legal challenges.

The proposed fee increase could significantly impact employment opportunities and labor market stability for both U.S. and foreign workers, as higher costs may influence hiring decisions and workforce planning.

Markets responded quickly where exposure is visible. India’s NIFTY IT sector fell as investors considered higher onshore staffing costs in the United States and the potential need to rebalance delivery toward India or third countries. Currency traders also watched the rupee as part of a broader risk-off impulse.

At the UN, attention turned to arrears and the mechanics of Article 19. The rule is straightforward in language, but application depends on exact payment timing and the interpretation of what qualifies as contributions due for the previous two full years. Historically, large contributors have timed partial payments to remain below the formal threshold. That does not remove risk. It simply pushes the debate into a window where rhetoric, budget politics, and payment schedules drive sentiment.

Crypto traded as a barometer of this broader uncertainty. After several failed attempts to hold above 117,000 to 118,800, BTC reversed, triggered liquidations, and stabilized around an area of prior demand. This sequence is consistent with leverage building into resistance followed by a reset when the tape refuses to break higher.

Why The H-1B Proposal Matters For Tech, FX, And Growth

Program scale and concentration

H-1B is a leading channel for high skill migration into U.S. roles in software, engineering, and healthcare. India accounts for a large share of H-1B beneficiaries. A six figure application cost, even if paid by the employer and amortized across multiyear engagements, changes hiring calculus. Enterprises will reevaluate whether to place roles in the United States, shift capacity to nearshore hubs, or expand teams in India and other jurisdictions. None of those adjustments is costless or instantaneous.

Corporate responses and delivery risk

For Fortune 100 platforms, the immediate response is likely to be triage. Critical roles proceed, while discretionary or borderline roles face delays or relocation. Systems integrators and mid-market vendors may pass a portion of costs to clients through higher rates or longer delivery timelines. For example, a mid-market vendor might delay onboarding new hires or renegotiate project delivery schedules to offset the increased H-1B fee. Public sector employers and nonprofits, which operate under constrained budgets and pay scales, could see pipelines narrow. These dynamics feed into earnings guidance and may also influence demand for graduate programs that rely on U.S. work opportunities after completion.

Legal exposure and timing

Every immigration policy shift produces a legal trail. The scope of a new fee rests on the text of the proclamation and subsequent implementing guidance. President Trump issued the proclamation that introduced the new H-1B fee, making him the authority behind this policy change. Filings around the effective date become test cases. Historically, litigation timelines stretch across months. That means headline risk dominates in the near term while definitive answers emerge slowly. It also means equity and FX traders will trade each draft, court filing, and agency note as a discrete event.

Macro channels

Raising the cost of importing specialized human capital can slow productivity growth at the margin if firms cannot fill key roles quickly. Slower productivity tends to weigh on growth forecasts and can support the U.S. dollar on risk-off days. When uncertainty rises, analysts mark down forward hiring plans and trim margin assumptions for the most exposed vendors. Investors then ask whether those vendors will localize roles faster or pass costs through to clients.

International linkages

The proposal intersects with U.S.-India relations across trade, education, and digital services. India can raise the issue in bilateral talks, and both sides have incentives to manage fallout. Any signal of phased application, carve-outs, or cooperative review could soften market stress. Conversely, a hard line without clarifications can extend the uncertainty premium.

UN Arrears, Article 19, And Why Optics Move Markets

The ledger and the rule

Reports indicate that the United States owes more than 3 billion US dollars across current and past-due contributions. Article 19 states that a member in arrears equal to or exceeding contributions due for the previous two full years shall have no vote in the General Assembly. The Assembly can allow a member to vote if the failure to pay is due to circumstances beyond the member’s control. The rule does not affect the Security Council. This text is not new, but the combination of high arrears and a high profile UNGA amplifies focus.

Why markets care during UNGA

Even absent an immediate risk of losing the vote, markets react to the optics of arrears and the tone of speeches. When narratives shift toward institutional conflict or budgetary standoffs, investors often trim risk and add safe liquid instruments. A pledge of partial payments can change the tone quickly. The result is a sensitivity to headlines where a single phrase in a speech or a procedural statement can shift flows between cash, Treasuries, gold, and risk assets.

Context and precedent

Multiple countries have lost voting rights in recent years under Article 19. Larger contributors have historically timed payments to avoid crossing the threshold. That precedent lowers the probability of an abrupt vote suspension for a large contributor in the near term. It does not eliminate the possibility that arrears become a recurring negative headline, especially if domestic budget politics complicate payment timing.

Cross-Asset Pathways That Link Policy To Prices

Labor cost pass-through and earnings

If a 100,000 US dollars fee applies to new H-1B petitions for the 2026 cycle, the initial effect is on budgeting and guidance rather than on current quarter hiring. Companies are navigating the challenges posed by the new H-1B fee and related policy uncertainty by reassessing workforce planning and cost structures. Mega-cap platforms can absorb the cost with modest margin impact. Mid-caps, integrators, and public sector employers face tougher tradeoffs. Equity volatility typically increases as analysts rework staffing models and delivery timelines. If vendors attempt to pass part of the cost through, U.S. enterprise clients may sequence projects differently, which affects revenue recognition timing.

Rates, the dollar, and safe havens

Budget politics around UN arrears combined with a contentious immigration shift can produce a classic flight-to-quality response. Front-end U.S. yields can firm if markets expect slower or more conditional easing. The U.S. dollar tends to benefit from risk aversion, especially when uncertainty rises abroad at the same time. Gold and longer duration debt often attract hedging flows. When this mix appears, crypto frequently sees intraday pressure as liquidity thins and leveraged positions are forced to adjust.

Correlation to crypto

Crypto is sensitive to the path of the dollar, real yields, and global liquidity. When policy uncertainty rises, rallies near obvious resistance often fade unless there is a clear catalyst. When uncertainty cools and safe haven demand eases, crypto can re-engage risk. This week’s setup, with UNGA headlines and an immigration proposal, fits the pattern where narratives dictate day-to-day direction while the larger structure depends on whether BTC can reclaim and hold above critical bands. In this environment, having a clear strategy for managing risk and adapting to evolving policy and market conditions is essential.

Bitcoin Technical Outlook

Trend and structure

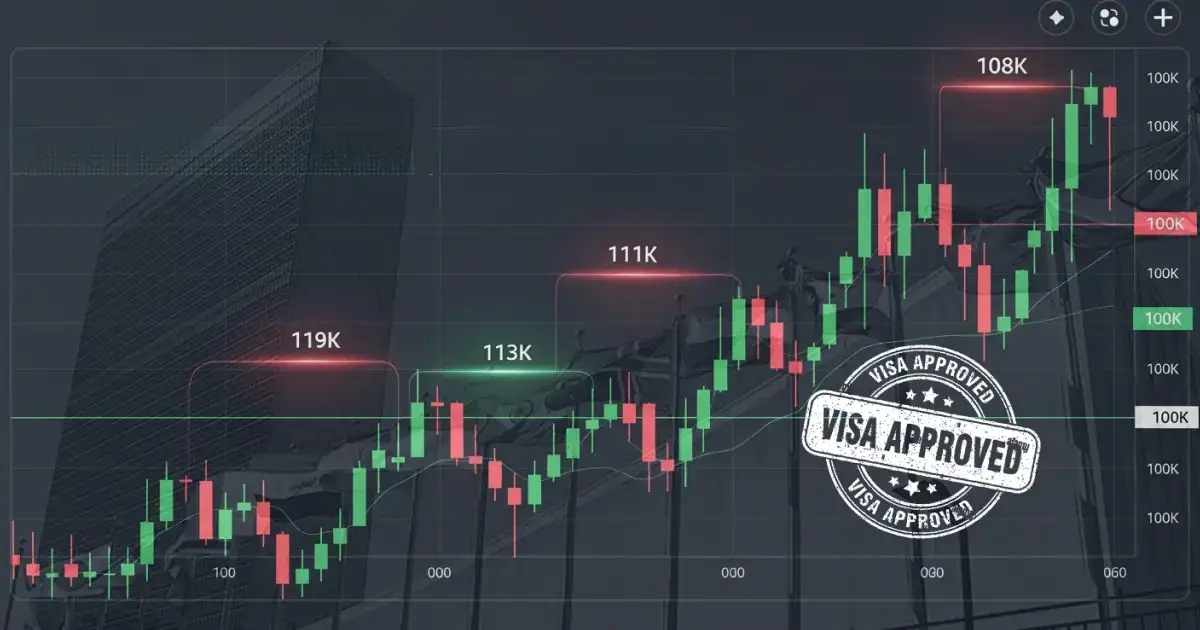

BTC attempted to build above 116,000 to 118,800 but failed to secure acceptance. Price then swept into the 114,000 to 112,000 pocket, consistent with a stop-run through a well advertised support zone. The move came with a broad liquidation event that reset a portion of leveraged positioning. Funding cooled, and open interest started to rebuild. Recently, bitcoin’s price has responded to macroeconomic events such as the Federal Reserve’s policy decisions and technical resistance levels, leading to increased volatility and short-term price swings.

Key resistance

119,000 sits as the first major level, followed by 120,500 as a psychological marker. A daily close above 118,500 to 119,000 would suggest acceptance and open room to probe 120,000 to 120,700. If that upper band holds as support on a retest, the bias shifts toward a grind higher. A rise above these key resistance levels could trigger bullish momentum and set the stage for further upside. If it rejects quickly with rising funding and falling spot volumes, the setup resembles a bull trap and argues for caution.

Key support

113,000 and 111,000 form a layered support zone. A clean, high volume break through 111,000 puts secondary interest near 108,000, which aligns with prior demand and visible liquidity. If sellers drive price into 108,000 and absorption appears on spot venues, the level can act as a springboard for a reflexive bounce. If liquidity at 108,000 is thin, the risk of overshoot increases. Additionally, a reduction in spot volume or liquidity at these levels could increase downside risk and accelerate price declines.

Why these levels matter

Public heatmaps and desk commentary identify concentrated liquidation clusters near the resistance and support bands above. When price touches a cluster, forced unwinds can add velocity beyond what discretionary traders intend. Historical data has yielded certain average returns after price interacts with these resistance or support levels, highlighting the importance of monitoring these zones. This is why it is often better to plan entries around patience and confirmation rather than trying to predict every headline. Let the level trade, watch how funding and open interest behave, and adjust position size accordingly.

What could move the tape

- Any legal guidance that clarifies scope, exemptions, or timing for the H-1B fee proposal

- UNGA speeches that reference arrears or payment schedules

- High frequency macro prints, including jobless claims and inflation, that change the path of policy easing

- ETF flow inflections that either offset or amplify spot demand

- A sharp move in the dollar that coincides with a test of BTC resistance or support

Ethereum Technical Outlook

ETH remains range bound, with BTC setting the tone. Bulls want a sustained move through the upper band on expanding spot volume and stable funding. Bears will lean on any weak retest that coincides with a firmer dollar or wobbling equities. Until BTC resolves the 113,000 to 119,000 corridor, ETH is likely to echo the same rhythm with slightly higher beta. For traders, that means anchoring ETH decisions to BTC acceptance or rejection near the named bands and avoiding oversized positions inside noisy mid-range conditions.

Structural signals to watch include the ETH-BTC ratio near recent lows, breadth across large cap altcoins, and whether spot demand leads futures on green days. If spot leads and funding stays neutral, confidence in upward breaks improves. If futures lead with rising funding and decaying spot volume, rallies are more fragile.

Sentiment And Positioning

Retail versus institutional posture

Retail interest tends to climb near obvious resistance, while larger accounts often trim risk into those same zones. The September 22 flush cooled funding and shook out weak longs. As open interest rebuilds, the quality of that rebuild matters. Rising open interest with flat to slightly positive funding after a downside clean-up is usually constructive. Rising open interest with sharply positive funding and no spot leadership is less healthy and raises the chance of another squeeze.

Flows to monitor

- ETF net flows. Stabilizing outflows or a return to modest inflows supports attempts to reclaim resistance.

- Futures basis on major venues. A stable or modestly positive basis, without spikes, indicates healthier positioning.

- Exchange reserves and on-chain stablecoin flows. A steady build in stablecoin balances on exchanges often precedes stronger risk appetite.

- Spot order book depth on leading venues. Thinner books near key levels increase the chance of overshoot on headlines.

Narrative risk

Headline sensitivity is high. Markets will react not only to formal policy texts but also to offhand remarks, draft guidance, and procedural statements. Traders who specialize in news-driven markets often plan for both positive and negative headline outcomes by setting conditional orders or by keeping position sizes small until price confirms direction.

Scenarios And Levels

1) Breakout above 119,000

A clean break and hold above 119,000, ideally confirmed by a daily close, should trigger short liquidations toward 120,500 to 120,700. For tactical traders, the objective is to join strength only after confirmation and to monitor funding for signs of overcrowding. If spot volumes lead and funding stays contained, an extension is more likely. If funding spikes while spot stalls, fade risk increases.

2) Breakdown below 111,000

A decisive move through 111,000 on expanding volume can push BTC toward 109,000 to 108,000 where prior demand sits. If absorption is visible at 108,000 and liquidations spike, a reflexive bounce is common. If buyers fail to defend, the path opens to deeper levels. Manage risk with predefined invalidation and avoid averaging down into cascading liquidations.

3) Range continues

BTC chops between 113,000 and 118,500 while markets wait for policy clarity. Mean-reversion strategies with reduced size and tight stops tend to perform best in this environment. The edge comes from discipline and execution rather than from directional conviction. Traders can reduce error by avoiding leverage near the center of the range and by focusing on fades at the edges only when liquidity conditions are favorable.

Bitunix Analyst Recommendation

Treat the H-1B proposal as a catalyst, not a conclusion

This story will evolve through guidance, comments from agencies, and potential court actions. The plain language and filing dates will ultimately govern who pays and when. Until that becomes clear, headline risk will dominate. Size positions so that unexpected clarifications do not force reactive liquidations.

Respect UNGA optics and Article 19 mechanics

Arrears headlines trade like risk events even if no formal trigger is near. Watch for any timetable or commitment to payments that could calm sentiment. Fade claims of immediate voting loss unless the formal two-year threshold is explicitly met. Monitor the dollar and gold for early signals of safe-haven demand.

Trading posture for crypto

- Keep leverage conservative while BTC sits between 113,000 support and 119,000 resistance.

- Use limit orders around known liquidity clusters to reduce slippage during headline minutes.

- If 111,000 fails on rising volume, assume a fast test of 108,000 is possible and plan entries accordingly.

- If 118,500 to 119,000 breaks and holds, let winners run toward 120,500 while trailing stops to protect gains.

- Keep a close eye on funding, open interest, and spot leadership to judge the quality of any break.

Portfolio context

Maintain a core plan that does not depend on policy reversals. Use optionality or staggered entries rather than oversized directional bets. Map scenarios in advance, define invalidation, and execute without hesitation when levels provide confirmation. This is a headline driven market where patience and risk control matter more than prediction.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.