Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

Liquidity provision is no longer a single chain, single pool activity. You might provide stablecoin liquidity on Curve, a concentrated ETH range on Uniswap v3, a Balancer boosted pool, and a vault on an optimizer. Those positions live across multiple networks with different fee tiers, gauges, and reward tokens. Liquidity pools are responsible for creating a liquid trading environment in DeFi by allowing users to deposit assets managed by smart contracts. Without a reliable portfolio tracker you cannot see true profit and loss, the value of unclaimed fees, or the effect of impermanent loss in one place.

With the increasing complexity of DeFi positions, there is a growing demand for accurate portfolio trackers for liquidity pools to help users manage and monitor their assets effectively.

This guide reviews how to select a portfolio tracker for LP positions in 2025, then profiles the leading choices, and concludes with workflows you can put into practice immediately. The goal is to help you monitor positions, harvest rewards on time, prepare records for tax and accounting, and reduce operational risk.

[ez-toc]

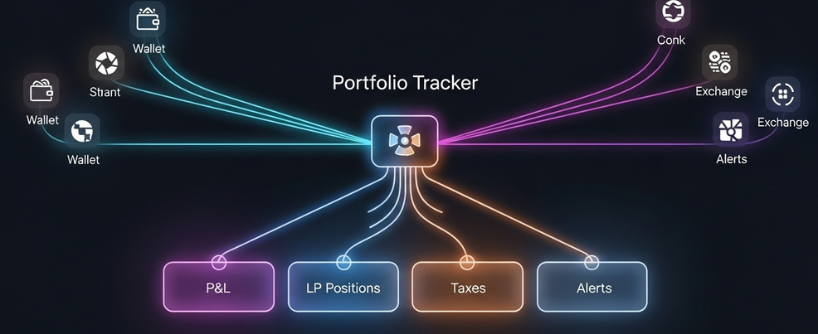

Portfolio tracking is a foundational practice for anyone managing digital assets in the DeFi ecosystem. As DeFi investors interact with liquidity pools, exchanges, and wallets across multiple platforms, keeping an accurate and up-to-date overview of all assets becomes increasingly complex. A robust crypto portfolio tracker connects to various wallets and exchanges, aggregating data from all your assets into one dashboard. This unified view allows investors to monitor their crypto portfolio in real time, track gains and losses, and make informed decisions about rebalancing or holding positions. With live price updates and comprehensive tracking features, portfolio tracking tools empower users to stay ahead in the fast-moving DeFi landscape, ensuring that every trade, pool, and asset is accounted for and up to date.

For liquidity providers, tracking liquidity pools is essential to maximizing returns and managing risk. Liquidity pools are the engine behind decentralized exchanges and DeFi platforms, enabling seamless trading by providing the necessary liquidity for various trading pairs. By closely monitoring these pools, investors can analyze pool performance, calculate trading fees earned, and assess the impact of impermanent loss on their assets. Effective tracking allows liquidity providers to adjust their strategies in response to market conditions, optimize yields, and ensure their portfolio is performing as expected. Understanding the data behind each pool—such as fee generation, pool composition, and historical performance—enables investors to make smarter decisions and respond quickly to changes in the DeFi ecosystem.

#image_title

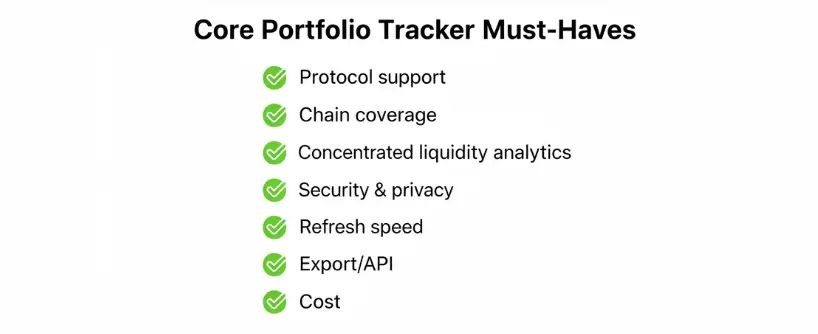

A modern LP tracker needs to solve five hard problems well.

A tracker must read the underlying smart contracts and compute the market value of LP tokens, uncollected fees, and any staked rewards. For concentrated liquidity, it must value the position inside and outside range. For stableswap pools, it should understand the amplification parameter so that slippage and value are correct.

Liquidity providers need to know whether fees have compensated for divergence from a simple hold. Good trackers calculate gross returns, fee income, token incentives, and impermanent loss over time. The analytics should work on a per position basis and across a portfolio.

In 2025 nearly every active provider uses more than one network. The tracker must support major layer 1 and layer 2 chains, and it must do so with consistent labeling and currency conversion.

Harvests, rebalances, migration transactions, and reward claims all affect taxable income and cost basis. Trackers should keep a full history and export it to CSV or a tax tool. Trackers should offer both automatic data import from exchanges and wallets, as well as manual entry options for unsupported platforms. Comprehensive export features are essential for accurate taxes and crypto taxes reporting.

You need notice when a concentrated range goes out of bounds, when a pool’s gauge weight changes, or when an emissions schedule ends. The best tools offer alerts by email, Telegram, or webhook.

With these needs defined, we can examine the platforms that meet them.

Before choosing a platform, apply these criteria.

These features are especially valuable for active traders who require comprehensive portfolio management.

Tracking LP positions across multiple decentralized exchanges and blockchain networks presents significant challenges for liquidity providers. Without a centralized portfolio tracking tool, managing assets becomes fragmented and inefficient, making it difficult to maintain a clear overview of your portfolio. The absence of historical data and impermanent loss calculators can lead to misleading APR figures, causing investors to overestimate potential returns. For example, a liquidity provider might be drawn to a pool advertising high APR, only to discover that impermanent loss has eroded much of the expected profit. To address these challenges, investors need access to advanced tools that consolidate data from various platforms, provide real-time and historical performance analytics, and accurately calculate metrics like impermanent loss and net returns. This comprehensive approach is crucial for making informed decisions and optimizing LP performance.

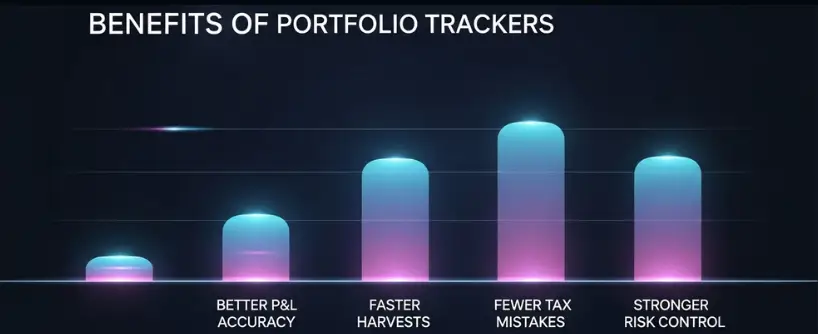

Utilizing a portfolio tracker offers a range of benefits for DeFi investors, streamlining the management of liquidity pools and digital assets. With all your assets displayed in one dashboard, you can easily monitor portfolio performance, track gains and losses, and compare returns from providing liquidity versus simply holding tokens. Many portfolio trackers also feature built-in tax reporting tools, simplifying the process of generating crypto tax reports and ensuring compliance with tax regulations. Automated tracking of crypto transactions and income helps investors save time and reduce errors during tax season. For example, a platform like CoinLedger can automatically calculate capital gains, losses, and income from liquidity pool activity, making tax reporting straightforward and stress-free. Enhanced security features, such as read-only wallet connections, further protect your assets while providing comprehensive data and performance monitoring. In short, a reliable portfolio tracker is an indispensable tool for any DeFi investor seeking to optimize returns, manage risk, and stay compliant in the evolving world of digital assets.

Below are the platforms most liquidity providers rely on in 2025. The list is organized by primary strength. Many of these platforms are designed to track positions on automated market makers, which are decentralized trading protocols that facilitate DeFi liquidity pools. Many users combine two or three tools to cover all needs.

What it does well

DeBank aggregates balances, LP tokens, staked positions, and debts across a large set of chains. The interface shows token holdings, DeFi positions, and NFTs at a glance. It is ideal for a quick health check of all addresses you manage, including hot wallets and multisigs. DeBank tracks liquidity pool tokens on major DEXs and vaults on yield platforms, then values them in your chosen currency.

LP specific features

Limitations

Fine-grained analytics for concentrated liquidity are basic. For Uniswap v3 you will see position value and fees, but not detailed range analytics or impermanent loss curves.

Best for

Managers who want a daily dashboard for every wallet, with simple tracking and low maintenance.

What it does well

Zapper offers a clean portfolio view with task-oriented flows to add, remove, or migrate liquidity. It is strong for users who prefer to manage positions from one interface rather than hopping across protocol UIs.

LP specific features

Limitations

Analytics for concentrated liquidity are limited. Advanced reporting features may require a paid tier.

Best for Hands-on users who want a workflow tool as well as a tracker.

What it does well

Zerion focuses on a wallet-first experience. You can monitor multiple addresses, receive notifications, and perform common DeFi actions. The mobile app is reliable, which makes Zerion a strong choice for operators on the move.

LP specific features

Limitations

Analytics depth is lighter than specialized LP platforms. Concentrated liquidity insights are basic.

Best for

Users who need fast mobile visibility for multiple addresses and simple actions.

What it does well

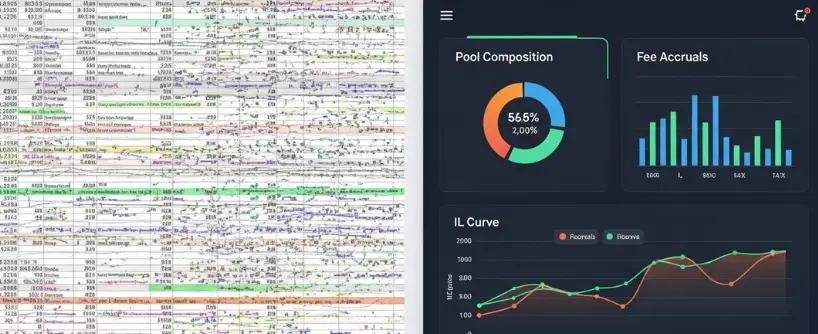

APY.Vision was built to track LP returns. It supports classic AMMs and concentrated liquidity designs, calculates fees earned, and estimates impermanent loss over time. Providers can import historical transactions and get a performance chart that separates fee income from divergence.

LP specific features

Limitations

Coverage for newer protocols sometimes lags. The best analytics sit behind a subscription.

Best for

LPs who care about true performance metrics and need reports for investment committees or accounting.

What it does well

Revert focuses on concentrated liquidity. It reads your Uniswap v3 or compatible positions and shows fee accruals, active liquidity, and strategy performance. Revert also offers automation for certain strategies like auto-compounding or range management using non-custodial smart contracts.

LP specific features

Limitations

Scope is narrow. If you hold many non-Uniswap positions you will still need a general tracker.

Best for Active Uniswap v3 providers who need deep insight into range behavior.

What it does well

LlamaFolio reads your wallets and quickly displays balances and DeFi positions across chains. It leans on the DeFiLlama data stack, which has excellent coverage for protocols and yields. The interface is fast and uncluttered.

LP specific features

Limitations

Impermanent loss analytics are lighter than specialist tools. Exports are basic.

Best for

Users who want a free, fast overview that covers most positions and chains.

What it does well

Rotki is an open source, local-first portfolio and accounting tool. Your data lives on your machine. Rotki ingests wallets and exchange accounts, tags transactions, values positions, and exports tax reports. It is not flashy, but it is reliable and privacy friendly.

LP specific features

Limitations

Setup takes time. Real-time dashboards are less polished than cloud products.

Best for

Teams with strict privacy requirements and anyone who needs tax-ready records.

What it does well

Dune allows you to query blockchain data and build custom dashboards. Many community dashboards already track LP returns for major protocols. If you need a custom metric or a cross-protocol view not offered elsewhere, you can build it.

LP specific features

Limitations

Learning SQL or hiring an analyst is required for custom work. Data freshness depends on the chain and the connector.

Best for

Funds, treasuries, and advanced users who want an exact report rather than a generic template.

Many protocols offer their own LP dashboards. Examples include Uniswap analytics, Curve gauges and claim pages, Balancer veBoost and pool stats, Arrakis and Gamma for managed Uniswap strategies, and optimizer vault pages such as Beefy or Yearn.

What they do well

Limitations

They are not portfolio trackers. You must visit each protocol to see the full picture. Use them alongside a general tracker.

Best for

Action and verification at the protocol level.

The table below summarizes the strengths at a glance.

For most providers the best setup is a general tracker for coverage, a specialist tool for concentrated liquidity analytics, and a self-hosted or exportable option for accounting.

Portfolio trackers should only ever have read access. It is essential to follow best practices for security when using portfolio trackers and managing liquidity pools to safeguard your assets. Follow these rules.

To trust a tracker you must verify it. Stay aware of potential discrepancies and risks when evaluating the accuracy of portfolio trackers.

Free tools provide wide coverage. Paid tools offer depth and convenience. A simple budgeting framework:

Which tracker gives the most accurate view for Uniswap v3 positions?

Revert and APY.Vision are the most precise for concentrated liquidity. Both read tick ranges and show whether your position is active. Revert is particularly strong on alerts and automation for range management. APY.Vision is stronger on historical performance charts that separate fee income from impermanent loss. Many providers use one of these alongside a broad portfolio tool.

Do I need a paid plan for reliable tracking?

You can track basic positions with free tools such as LlamaFolio and DeBank. If you want impermanent loss attribution, fee capture effectiveness, or alerts for out-of-range events, a paid plan from a specialist tool is often worth the cost. The fee is small relative to missed harvests or poorly managed ranges.

How do I track LP positions spread across a dozen wallets?

Create watchlists in your primary tracker and name each address according to its role, such as trading hot wallet, cold store, or team multisig. For reporting, build a Dune dashboard that sums positions across all addresses. If you prefer local software, Rotki can group wallets and generate consolidated reports.

Can portfolio trackers interact with my positions or move funds?

No. A genuine tracker does not require spending approvals. It reads on-chain data and may allow you to initiate actions through the protocol UIs using your wallet. Treat any tracker that asks for token approvals as unsafe.

How often should I harvest fees or rewards?

Set a schedule that balances gas cost, reward volatility, and compounding benefits. Weekly harvests are common for large positions. Some protocols allow auto-compounding through non-custodial strategy contracts. Even with automation, continue to monitor positions and confirm that claims are occurring as expected.

What if a tracker shows a very different value from the protocol?

First, refresh and confirm you are viewing the correct chain and address. Next, check whether prices have moved, or whether a pending transaction has not settled. If the gap persists, report the issue to the tracker and rely on the protocol’s own dashboard until it is resolved. Keeping two views prevents costly mistakes.

How do I prepare tax records for LP activity?

Export transactions monthly from your tracker or directly from a block explorer. Include adds and removes of liquidity, fee claims, reward harvests, swaps, and bridge events. Send the CSV into Rotki or a tax solution that understands DeFi activity. Accurate labeling during the year reduces end-of-year work.

Can I track vault positions from optimizers?

Yes. Most trackers recognize vault tokens from major optimizers. You will see the vault token balance, vault share price, and pending rewards if the protocol exposes them on chain. For detailed strategy performance, combine the tracker with the optimizer’s native dashboard.

How do alerts work for concentrated liquidity?

In tools such as Revert and APY.Vision you set tick bounds or price thresholds. The tool monitors on-chain prices and sends an alert by email, Telegram, or push notification when your range is at risk. Set a buffer so you have time to act before fees stop accruing.

Is it safe to monitor a hardware wallet with these platforms?

Yes. Paste the public address into the tracker. There is no need to connect the hardware device for read-only monitoring. Never approve token spending from a tracker site. If you need to claim rewards, connect the device directly to the protocol’s official interface.

How is my portfolio value displayed in trackers?

Most portfolio trackers show the value of your holdings in your chosen fiat currency. Many trackers display the value in dollars, making it easier to compare your portfolio’s worth and understand profits or losses for tax purposes.

Can I track my trading activity and swaps?

Yes, most trackers allow you to monitor all trades executed through liquidity pools and exchanges, so you can keep track of your trading activity and history.

Do I need to deposit tokens of equal value when providing liquidity?

Yes, when providing liquidity to most pools, you need to deposit two tokens of equal value. This means the dollar value of each token you deposit should be equal to ensure balanced liquidity provision.

Portfolio tracker: A tool that reads blockchain data for one or more addresses and presents positions, balances, and history in a unified dashboard.

LP position monitoring: The process of tracking the value, fee accrual, and risk status of liquidity positions across protocols and chains.

Impermanent loss: The shortfall that occurs when the price of pooled assets diverges relative to a simple hold. Good trackers estimate it over time.

Concentrated liquidity A design where liquidity is supplied within a chosen price range, common on Uniswap v3 and similar AMMs.

Gauge: A mechanism used by protocols such as Curve and Balancer to allocate emissions and fees to pools based on governance weight.

Vault optimizer: A contract that automates compounding or strategy management for LP positions and distributes shares to depositors.

CSV export: A comma-separated file containing transactions and positions that can be imported into accounting or tax software.

Tax reporting: The process of preparing and submitting information about crypto transactions for tax purposes. Tax reporting typically requires detailed transaction records and can be simplified with the right tools.

Read-only wallet: An address added to a tracker without granting any spending approvals. It allows monitoring without custody risk.

Out-of-range: A state in concentrated liquidity where the current price is outside your chosen bounds, which stops fee accrual.

Rebalance: Adjusting a concentrated liquidity position by moving the range, adding or removing liquidity, or swapping assets to reset ratios.

Monitoring liquidity positions is not optional. It is the core operational discipline that separates consistent earners from casual depositors. In 2025 the best approach combines three layers. Use a broad portfolio tracker such as DeBank or LlamaFolio for daily visibility. Add a specialist like Revert or APY.Vision for concentrated liquidity analytics and alerts. Maintain a privacy-focused or exportable solution such as Rotki or a custom Dune dashboard for accounting and institutional reporting.

Adopt the workflows in this guide, label every wallet, set harvest schedules, and test exports each month. With the right liquidity pool tracking tools and habits, you can manage complex DeFi portfolio management tasks, reduce risk, and make decisions based on clear performance data rather than guesswork.

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.