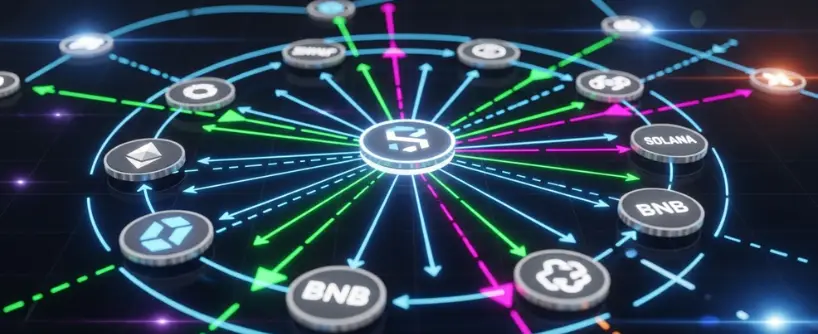

Decentralized finance no longer lives on a single network. Traders chase lower fees on BNB Smart Chain, NFT collectors mint on Ethereum, and yield farmers experiments on Arbitrum, Optimism, Base, and Solana. This is multi-chain crypto, a landscape where value and applications are spread across many blockchains. To move value between them, you need a cross-chain bridge.

If you are new, the concept can feel mysterious. This crypto bridge beginner guide explains what a cross-chain bridge is, how cross-chain bridges work, and how to complete a safe cross-chain asset transfer from one network to another. We will cover the main bridge designs, fees, finality times, security trade-offs, and the practical steps to avoid common mistakes.

What Is a Cross-Chain Bridge?

A cross-chain bridge is a set of smart contracts and off-chain services that enable cross-chain asset transfer. It connects two or more blockchains that normally cannot talk to each other. Bridge contracts are the core smart contracts that facilitate cross-chain transfers, but can be a source of vulnerabilities. When you use a bridge, you lock, burn, or swap an asset on the source chain and receive a corresponding asset on the destination blockchain.

At a high level, a cross-chain bridge does three things:

- Detects a deposit or swap on the source chain.

- Verifies that action through validators, relayers, or on-chain proofs.

- Releases or mints the target asset on the destination chain and credits it to your address.

Bridge hacks have historically targeted vulnerabilities in bridge contracts, leading to significant losses.

A bridge operator may act as a third-party entity that manages transfers between blockchains, introducing trust risks. Some bridges are managed by centralized entities, while others are decentralized. Some bridges have a single point of failure, which can be a security risk. Cross-chain bridges are essential for enabling users to access new applications and liquidity. Trustless bridges use algorithms and smart contracts to minimize reliance on centralized entities. External audits are important for ensuring the security of bridge contracts. Crypto bridging is the process of moving assets across different blockchain networks. Some bridges operate without a centralized authority, relying on decentralized protocols. Bridges employ various security and validation mechanisms, and each bridge has its own set of risks and features.

Without bridges, multi-chain crypto would feel like a group of isolated islands. Bridges build the ports and ferries. The bridging function is the core mechanism that enables asset and data transfer between different networks.

Cross-Chain Interoperability: Why It Matters

Cross-chain interoperability is rapidly becoming a cornerstone of the blockchain ecosystem. As more blockchain networks emerge, each with their own unique features and communities, the ability to transfer assets and data between different blockchain networks is essential. Cross-chain bridgesalso known as blockchain bridges, are the key infrastructure that makes this possible. By connecting otherwise isolated chains, these bridges enable users to move assets, such as tokens or NFTs, from one blockchain to another, unlocking new opportunities and use cases.

This seamless transfer of assets across different blockchain networks is vital for the growth of decentralized applications (dApps) that want to reach users on multiple chains. For example, a DeFi protocol that operates on several blockchains can attract more users and liquidity if it supports cross-chain functionality. Cross-chain bridges also help to prevent liquidity from becoming siloed on a single chain, instead enabling cross chain liquidity to flow freely throughout the blockchain ecosystem. This interconnectedness not only benefits users by providing more options and flexibility, but also strengthens the entire ecosystem by fostering innovation and collaboration across different blockchain platforms.

Ultimately, cross-chain interoperability powered by cross chain bridges ensures that the blockchain ecosystem remains open, dynamic, and accessible, allowing users and developers to take full advantage of the diverse capabilities offered by different blockchain networks.

How Cross-Chain Bridges Work

There is no single architecture. To understand how cross-chain bridges work, it helps to group them into four common models. Each model solves the same problem with different trade-offs in security, speed, and cost. Lock and mint bridges are a common model where assets are locked on the source chain and minted as equivalent tokens on the destination chain, enabling transfer tokens across networks.

Liquidity Network Model: In this model, bridge contracts are used to manage the transfer process, and liquidity pools are essential for fast settlement. Users can transfer tokens between chains by interacting with these pools, which provide the necessary liquidity for quick swaps.

Canonical or Native Bridge: These bridges are typically built by the protocol team and may have a bridge operator responsible for managing the bridge. Locked assets are held in smart contracts on the source chain, and the bridge operator facilitates the transfer to the destination chain.

Proof-Based or Light-Client Bridges: These bridges employ cryptographic proofs for validation, allowing for secure and trust-minimized transfers. The bridging function is implemented through mechanisms that verify transactions across chains without relying on a centralized party.

Wrapped or Synthetic Asset Bridge: In this model, wrapped assets are created through the lock and mint process. When a user deposits tokens on the source chain, equivalent tokens are minted on the destination chain, representing the original asset and enabling cross-chain interoperability.

Each bridge model has its own set of trade-offs and operational costs, including gas fees, which can impact the efficiency and cost-effectiveness of cross-chain transfers.

Liquidity Network Model

A liquidity network deploys token pools on multiple chains. Liquidity providers deposit native assets on each side. When you request a cross-chain asset transfer, the bridge releases tokens from its destination pool to you and later rebalances inventory.

- How it works:

- You send USDC to the bridge contract on Ethereum, which manages your deposit and interacts with the liquidity pool.

- A bridge operator (relayer) observes the deposit and instructs the destination liquidity pool on Arbitrum to release USDC to your Arbitrum address.

- The protocol later moves inventory to restore balance, often using market makers or incentives.

- Pros: Fast settlement, often under a few minutes. Delivery of native assets on both sides. Pricing can account for pool depth and slippage.

- Cons: Requires trust in relayers or a validator set that confirms messages. Pools can temporarily run out of inventory when flows are one-sided.

The bridging function in this model relies on liquidity pools and bridge operators to facilitate fast transfers between chains. Bridge contracts play a key role in managing deposits, but can introduce security risks if not properly designed.

Canonical or Native Bridge

Canonical bridges are a type of lock and mint bridges, where assets are deposited into a vault and locked on the source chain, and equivalent tokens are minted on the destination chain. These locked assets are held in smart contracts during the bridging process, and a bridge operator may be responsible for managing the bridge and overseeing transfers. When you later return, the equivalent tokens are burned and the original assets are unlocked.

- Pros: Aligned with the network’s core security model. Usually maintained by the team that runs the chain or rollup.

- Cons: Withdrawals can be slow because the system waits for a challenge or validity window. Often limited to specific chain pairs.

- Best for: Large transfers where you want the network’s official route and are willing to wait for finality.

Proof-Based or Light-Client Bridges

A proof-based bridge verifies cryptographic proofs from the other chain directly on the destination chain. These bridges employ cryptographic proofs for validation, ensuring that only valid transactions are processed. No special relayers or committees are needed because a verification contract checks block headers and Merkle proofs. Transfer tokens are moved securely and programmatically across chains using this model, supporting seamless cross-chain interoperability. The bridging function in this model relies on on-chain verification, which enhances the integrity and trustworthiness of token and data transfers.

- Pros: Strong trust model. Security depends on cryptography and consensus rather than external signers.

- Cons: Higher gas cost and more engineering complexity. Support depends on chain compatibility.

- Best for: High-value treasury moves that favor trust minimization over speed.

Wrapped or Synthetic Asset Bridge

In this model, wrapped assets are created through the lock and mint process, where the bridge locks original tokens with a custodian and mints equivalent tokens, a wrapped representation on the destination chain. The locked assets are held in custody during the transfer, enabling cross-chain interoperability.

- Pros: Works across very different chains and virtual machines. Easy to integrate with DeFi on the target chain.

- Cons: Custody risk if keys are compromised. Wrapped tokens can trade at a discount during stress.

- Best for: Long-tail assets that do not have native liquidity on the target chain.

These four patterns cover most bridges you will encounter. When choosing a route, ask which model is in use and decide whether its trade-offs match your needs.

Why Cross-Chain Bridges Matter in Multi-Chain Crypto

The shift to multi-chain crypto is not a passing trend. Different chains specialize in different strengths: some deliver low fees, others provide strong security, and others attract specific applications. Each blockchain has its own approach to scalability, security, and interoperability, which shapes how they interact within the broader ecosystem. Cross-chain bridges connect multiple networks, creating an interconnected network that enables seamless communication, asset transfer, and access to new markets. A trader might hold ETH on mainnet for security, deploy USDC to Arbitrum for low-fee DeFi, and mint NFTs on Polygon. Users may need to interact with specific chains to access certain applications or qualify for rewards. Moving between those islands quickly and safely is the difference between opportunity and frustration.

Bridges enable:

- Capital mobility. Move stablecoins and collateral where yields or borrowing rates are best across different networks.

- Application access. Join ecosystems that live on other networks, such as a new DEX, game, or staking service.

- Treasury rebalancing. DAOs and funds maintain positions across many chains and must shift inventory with accounting proof.

- User onboarding. New users can move assets from a low-fee network to the network where a specific app requires them.

Without bridges, liquidity would fragment and network effects would stay locked inside each chain. Bridges are the connective tissue of Web3.

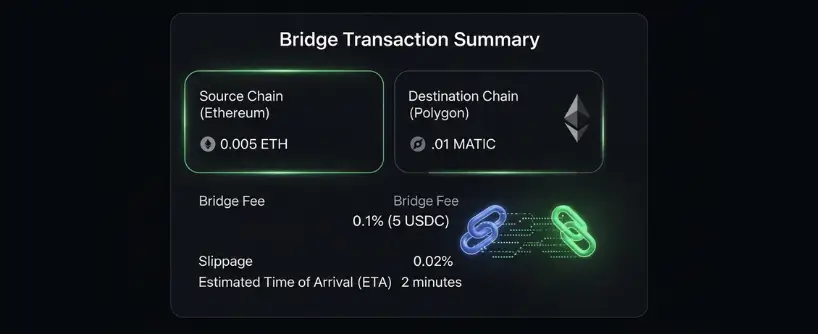

Fees, Slippage, and Finality

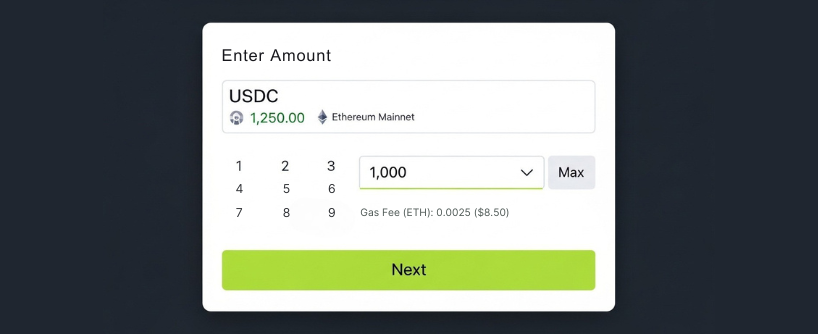

Before you click transfer, check these costs and timings:

- Gas fees on the source chain. Gas fees are a key component of operational costs, as you pay to approve and send the deposit.

- Gas fees on the destination chain. Some bridges require a claim transaction. Keep a small amount of the destination chain’s native token ready.

- Bridge fee or relayer fee. Paid to validators or LPs.

- Trading fee. Liquidity networks often include a swap to rebalance pools.

- Slippage. The difference between the quoted amount and what you actually receive if pool inventory shifts.

- Finality time. Liquidity networks can deliver in a few minutes, canonical bridges may take hours, and proof-based designs vary by route.

The Ethereum network is known for high gas fees, especially during periods of network congestion, which can significantly increase the operational costs of cross-chain transfers.

A good bridge interface shows the expected output, all fees, and the estimated time to finality. If any part is unclear, try a different route.

Security Risks and How to Reduce Them

Bridges concentrate value and logic, so they are frequent targets for exploits. Bridge hacks have often targeted vulnerabilities in bridge contracts, resulting in significant financial losses. Understanding risk is part of learning how cross-chain bridges work.

Some bridge models introduce a single point of failure, making them susceptible to attacks if that point is compromised. Centralized authority over bridge contracts can further increase security risks, as users must trust a central entity to manage assets securely.

External audits are crucial for identifying and fixing vulnerabilities in bridge contracts, helping to prevent exploits and build user trust. Additionally, a robust risk management network can monitor and secure cross-chain transactions, providing a decentralized security layer that enhances overall protocol safety.

In the case of wrapped asset custody risk, locked assets held in smart contracts are at risk if the keys controlling those contracts are compromised.

Main Risk Categories

- Smart contract bugs. Flaws in locking, minting, pricing, or accounting can drain funds. Bridge contracts are a common target for bridge hacks, which have resulted in significant financial losses due to vulnerabilities and exploits.

- Validator or relayer compromise. A small committee can sign invalid messages and release funds to an attacker. Some bridge models introduce a single point of failure, increasing the risk if validators or relayers are compromised.

- Liquidity exhaustion. If one-way traffic empties a destination pool, transfers queue or settle at poor prices.

- Wrapped asset custody. If keys for original tokens are lost, wrapped tokens can depeg. Locked assets held in custody are at risk if these keys are compromised.

- Phishing and fake UIs. Imitation sites capture approvals or route funds to attacker contracts.

- Centralized authority risks. When a centralized authority controls bridge contracts, it increases security risks and requires users to trust a single entity, which can undermine decentralization.

How To Protect Yourself

- Use bridges with published audits and, importantly, those that have undergone external audits by reputable third parties. Look for active bug bounties and visible governance.

- Prefer proof-based or canonical bridges for high-value transfers.

- When possible, use a single bridge for direct transfers. Combining this with a strong risk management network, a decentralized security layer that monitors and secures cross-chain transactions can significantly enhance security and reduce complexity.

- Always do a small test transaction first.

- Verify the destination token. Confirm it is the true native token or a supported wrapped version.

- Bookmark official URLs and avoid links shared by strangers.

- Monitor route health. Many bridges show pool inventory and current delays. Avoid depleted routes.

- Keep records. Store transaction hashes and screenshots for support or accounting.

Security requires a small routine. Once you build it, transfers become predictable.

Step-by-Step: Your First Cross-Chain Asset Transfer

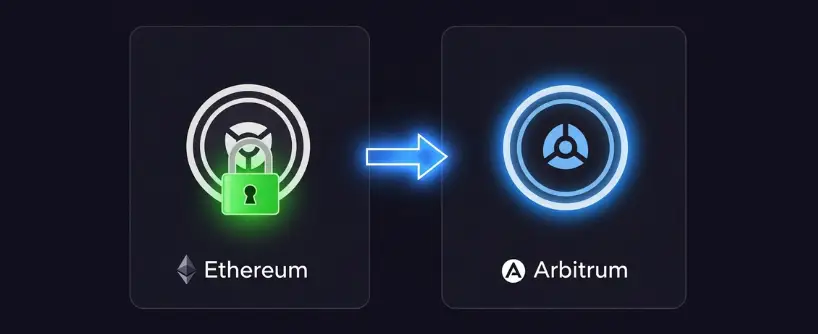

This practical walkthrough shows how to move USDC from Ethereum to Arbitrum using a typical liquidity network. The same checklist applies to most bridges. Cross-chain bridges are essential for enabling users to access new applications and liquidity across different blockchain ecosystems.

- Prepare your wallet. Make sure your wallet holds USDC on Ethereum and a small amount of ETH for gas. Add the Arbitrum network to your wallet if needed.

- Choose a reputable bridge. Select a well-known bridge provider that connects multiple blockchains, with audits and a clear fee breakdown.

- Connect your wallet. Confirm the site requests only basic permissions.

- Enter the route and amount. Choose Ethereum as the source, Arbitrum as the destination blockchain, and select USDC. You are transferring tokens securely to the destination blockchain.

- Check the quote. Review the expected output, all fees, and the estimated time.

- Send a test. Start with a small amount. Confirm the deposit transaction on Ethereum.

- Wait for delivery. Watch the bridge UI for status updates and confirm receipt on Arbitrum.

- Complete the full transfer. If the test looks correct, repeat with the larger amount.

- Verify token type. Ensure the USDC you received is the official token used by Arbitrum apps.

- Save records. Store transaction hashes from both chains and a screenshot of the quote.

This footprint becomes muscle memory and protects you from most errors.

Cross-Chain Swaps vs Simple Transfers

A cross-chain swap goes one step further than a simple transfer. Instead of just transferring tokens from chain A to chain B, a cross-chain swap allows you to send one asset (like ETH on Ethereum) and receive a different asset (like USDC on Arbitrum) on another blockchain. The bridge will swap ETH to USDC on the source chain, route through its cross-chain pools, and deliver USDC on the destination. The bridging function in these swaps enables complex operations such as asset conversion and transfer tokens across different blockchains, supporting seamless interoperability.

- Pros: Complete a multi-step action in one flow.

- Cons: Additional trading fees and slippage at each step. Compare against doing part of the trade locally if liquidity is better.

When you see the word “swap,” read the quote carefully and ensure the minimum output is acceptable for your plan.

How To Evaluate a Cross-Chain Bridge

Use this simple scoring checklist before you commit size.

- Security model: Liquidity network, canonical, proof-based, or wrapped.

- Audits and bounties: Recent external audits from reputable firms and a live bug bounty.

- Validator transparency: For committee models, who are the members and how are keys managed.

- Liquidity depth: Total value locked on the route and how often pools run low.

- Quote clarity: All fees itemized and a guaranteed minimum output shown.

- Past incidents: Any outages, depegs, or pauses. How the team handled them.

- User operations: Whether a destination claim transaction is needed and if gas on the destination will be provided.

- Governance: Visible parameters, a DAO, and safety delays before upgrades.

- Documentation: Clear guides, FAQs, and active support channels.

- Community reputation: Consistent positive reports from real users over time.

- Risk management network: Presence of a risk management network that provides a decentralized security layer to monitor and secure cross-chain transactions.

- Own set of risks and features: Each bridge or network has its own set of risks, challenges, and features. It’s important to understand these unique characteristics when evaluating interoperability and security.

A route that looks cheap but fails several questions is not a good choice for a large transfer.

Real-World Examples and When To Use Them

- Official L2 bridges such as the Ethereum mainnet to Optimism or Arbitrum path. They are ideal for moving ETH and canonical tokens when security alignment matters, although withdrawals to mainnet can be slow.

- Stablecoin liquidity networks that focus on USDC or USDT across Ethereum, Base, Arbitrum, BNB Smart Chain, and Binance Smart Chain. They are strong for routine, fast transfers.

- Ecosystem bridges like Avalanche bridge and Polygon bridge are key tools for connecting different blockchain networks and facilitating cross-chain transfers. Binance bridge is a prominent example of a centralized bridge that enables asset transfers between major ecosystems.

- Proof-based research bridges between chains that share compatible light clients. These routes are used by projects and treasuries that require trust minimization.

- Wrapped asset systems that bring BTC or long-tail tokens to EVM chains. They unlock DeFi utility but require attention to custody and redemption rules.

Some bridges also connect non EVM chains, such as Solana, Tron, or Sui, enabling seamless asset transfers and communication across diverse blockchain ecosystems. Users may need to interact with specific chains to access certain features or qualify for rewards.

Match the tool to the job. There is no single best bridge for every situation.

Best Practices for Safer Cross-Chain Activity

- Start with a small test every time. The habit costs little and catches most mistakes.

- Verify the token contract on the destination. Use official documentation and explorers.

- Keep native gas on all networks you touch. A few dollars of ETH, MATIC, or BNB avoids getting stuck.

- Avoid tight deadlines and travel emergencies. Bridges sometimes queue during high load.

- Use a hardware wallet for approvals. Reduce the chance of signing a malicious transaction.

- Split large transfers. Several smaller moves lower the impact of a failure and sometimes improve pricing.

- Store backups of addresses and transaction hashes. Good records help support teams help you.

- Stay on official URLs. Bookmark and use direct links from project docs or trusted aggregators.

- Watch status pages. If a chain or bridge is degraded, wait until the status turns green.

- Learn the reverse route. Test the path both ways if you plan to return capital later.

- Choose bridges that have undergone external audits. External audits by reputable third parties help identify vulnerabilities and improve the security and trustworthiness of the bridge.

- Whenever possible, use a single bridge for transfers. Using a single bridge streamlines the process, reduces the risk of errors, and can lower operational costs by minimizing transaction fees and avoiding unnecessary steps.

The Future of Cross-Chain Technology

The future of cross-chain technology is set to transform how users and applications interact across the blockchain ecosystem. As the demand for seamless cross chain interoperability grows, we are seeing rapid advancements in both the security and efficiency of cross chain bridges. New cross-chain messaging protocols are being developed to enable more reliable and secure cross chain communication, reducing the risks and friction traditionally associated with bridging assets between different blockchain networks.

One of the most exciting trends is the integration of smart contracts and decentralized oracles into the bridging process. These technologies allow for more automated, trustless, and transparent token transfers, making it easier for users to interact with multiple blockchain networks without relying on centralized intermediaries. The emergence of standardized frameworks, such as the Cross-Chain Interoperability Protocol (CCIP), promises to further streamline cross-chain communication and provide a consistent, secure experience for users and developers alike.

As cross chain bridges and interoperability solutions continue to evolve, we can expect to see deeper liquidity pools, more robust risk management, and the rise of new applications such as cross-chain decentralized finance (DeFi) platforms and NFT marketplaces that operate across several chains. This will not only enhance the user experience but also drive greater adoption of blockchain technology by making it more accessible and interconnected. The ongoing innovation in cross-chain technology is paving the way for a future where blockchain ecosystems are no longer isolated, but instead form a unified, collaborative network that supports a wide range of digital assets and use cases.

Frequently Asked Questions

What is a cross-chain bridge in simple terms?

A cross-chain bridge is a tool that lets you move value between blockchains, a process often referred to as bridge crypto. You deposit or swap an asset on the source chain, and the bridge uses bridge contracts, specialized smart contracts that facilitate the bridging function, to verify that action. Then, it releases or mints the corresponding asset on the destination blockchain, which is where you receive the equivalent asset. That process is the core of cross-chain asset transfer.

How fast are cross-chain bridges?

It depends on the model. Liquidity networks, which use a liquidity pool to hold reserves of assets, usually settle in a few minutes because they release tokens from existing pools. These liquidity pool models rely on a bridge operator for fast settlement, but users should be aware of the trust and security risks involved. Canonical bridges can take hours if they require a challenge window. Proof-based designs vary by route and may cost more gas fees to verify proofs, which can impact both the speed and cost of transfers, especially during periods of network congestion.

Are cross-chain bridges safe?

They can be safe when well engineered and audited, but risk is not zero. Bridge hacks have historically targeted vulnerabilities in bridge contracts, often exploiting contract bugs or weaknesses in validator sets. In some bridge models, a single point of failure can exist, making them susceptible to attacks. Centralized authority over bridge contracts can further increase security risks and require users to trust a central entity. External audits are crucial, as they help identify and fix vulnerabilities, enhancing the security and trustworthiness of bridges. The use of a risk management network as a decentralized security layer can also enhance security by monitoring and securing cross-chain transactions. Reduce risk by using reputable bridges, sending a test transaction, and avoiding new or unaudited routes for large transfers.

Will I receive native tokens or wrapped tokens?

It depends on the bridge. Liquidity networks and canonical L2 bridges often deliver native tokens. Some systems use lock and mint bridges, where your original tokens become locked assets held in a smart contract on the source chain. In this process, wrapped assets are created by minting equivalent tokens on the destination chain, representing the original tokens. Always check which token you will receive and whether it is widely supported in the destination ecosystem.

What fees should I expect?

Expect gas fees on the source chain, sometimes gas fees on the destination, a bridge or relayer fee, and possibly a trading fee if a rebalancing swap is included. Gas fees are a key component of operational costs, especially for frequent users and traders. The Ethereum network is particularly known for high gas fees, which can significantly increase operational costs during periods of network congestion. Interfaces should show a total and the expected output. If they do not, reconsider the route.

What is slippage in cross-chain transfers?

Slippage is the difference between the quoted output and what you actually receive when pool inventory or prices change during the transfer. When a liquidity pool is depleted or has low reserves, slippage can increase, directly affecting the bridging function and the transfer tokens you receive. The bridging function, which enables the movement of assets across blockchains, is impacted by the available inventory in liquidity pools. To manage slippage, choose routes with deep liquidity and avoid very large single transfers in shallow pools, as transfer tokens may be more susceptible to slippage in these scenarios.

Can I cancel a bridge transaction?

Once the source transaction confirms, it is usually irreversible. Whether a transaction can be canceled often depends on the rules set by the bridge contracts, which may limit cancellation options. If your transaction is still pending because you submitted a very low gas fee, you may be able to replace it with a higher fee and cancel, but success is not guaranteed, as high gas fees during network congestion can make this difficult. Additionally, the bridge operator may have limited ability to intervene once the transaction is in progress.

How do I avoid fake bridge sites?

Use links from official documentation, verified social feeds, or reputable aggregators. Bookmark those URLs. Never follow random airdrop links or ads. Before signing, confirm that contract addresses match the ones listed in docs.

Choose a reputable bridge provider, as these multichain platforms are less likely to be impersonated and typically offer enhanced security features. Prefer bridges that have undergone external audits, as third-party reviews help identify vulnerabilities and reduce risk. Be aware that fake sites can introduce a single point of failure, increasing the risk of loss if you trust an unverified source.

What happens if the destination pool runs out of liquidity?

If the liquidity pool on the destination chain runs out of assets, transfers may queue until the pool is refilled, as liquidity pools are essential for fast transfers. In such cases, your assets may become locked assets and held in the smart contract until liquidity is restored. The bridging function can also be delayed if pools are depleted, affecting the speed and efficiency of cross-chain transfers. Alternatively, you may be offered a worse price if you accept higher slippage. Good bridges display pool health. If you see a warning about low inventory, wait or use another route.

Is it possible to swap one asset on one chain to a different asset on another chain?

Yes. Many bridges support cross-chain swaps, which involve using the bridging function to transfer tokens from one blockchain to another. For example, you can send ETH on Ethereum and receive USDC on Arbitrum. During this process, tokens are often burned on the source chain and equivalent tokens are minted on the destination chain to facilitate the asset transfer. The bridging function enables complex swaps and supports seamless cross-chain interoperability. This convenience adds trading steps, so compare the final quote against doing part of the trade locally.

What is the safest way for a beginner to bridge for the first time?

Use a well known bridge with external audits, as these third-party reviews help identify and fix vulnerabilities, increasing security and trustworthiness. Whenever possible, opt for a single bridge to simplify the process and avoid unnecessary steps. Trustless bridges, which rely on decentralized algorithms and smart contracts rather than a central authority, can further enhance security. Start with a small amount, and choose a route that delivers native tokens. Keep a few dollars of gas token on the destination chain, verify the token contract, and save your transaction hashes.

Does bridging have tax consequences?

Rules vary by jurisdiction. In some places, a transfer that does not change economic exposure such as moving the same asset across different blockchain networks may not be taxable, but a cross-chain swap that changes assets may be. However, the same asset may be treated differently depending on the jurisdiction, especially after bridging or wrapping. Additionally, operational costs, such as transaction fees saved by using more efficient networks or Layer 2 solutions, and the use of transfer tokens for cross-chain interoperability, may have tax implications. Keep detailed records and consult a professional who understands digital asset taxation.

Glossary

Cross-Chain Bridge: A system that connects two blockchains and enables cross-chain asset transfer.

Mempool: The public list of pending transactions on a blockchain.

Relayer: An off-chain agent that observes deposits and submits messages to destination contracts.

Validator Set: A group of signers that attest to events across chains for some bridges.

Light Client: A contract that verifies the state of another chain using cryptographic proofs.

Canonical Bridge: The official bridge backed by a network or rollup team.

Liquidity Network: A bridge architecture that releases tokens from destination pools and rebalances inventory later.

Wrapped Token: A representation of a token from another chain that is backed by locked originals.

Finality: The point at which a transaction is effectively irreversible.

Slippage: The difference between the quoted output and the executed output caused by price or inventory changes.

TVL (Total Value Locked): The amount of assets held by a protocol, often used as a proxy for adoption and depth.

Multi-Chain Crypto: An ecosystem where applications and assets live across many blockchains.

Cross-Chain Swap: A transfer that changes asset type between chains in one routed transaction.

Bridge Contracts: Smart contracts that facilitate cross-chain transfers, often holding or verifying assets during the process and representing a potential security risk if exploited.

Bridge Operator: A third-party entity responsible for managing and executing transfers between blockchains, often requiring user trust and introducing security considerations.

Lock and Mint Bridges: Bridges that enable cross-chain asset transfer by locking assets in a vault on the source chain and minting equivalent tokens on the destination chain.

Liquidity Pool: A reserve of assets maintained by a bridge or protocol to facilitate cross-chain transfers, allowing users to deposit on one chain and withdraw equivalent assets on another.

External Audits: Independent third-party security reviews of smart contracts and protocols to identify and address vulnerabilities, enhancing trust and safety.

Wrapped Assets: Tokens created by locking original assets on one blockchain and issuing a programmable representation (wrapped token) on another, enabling cross-chain interoperability.

Locked Assets: Assets deposited and held in a smart contract during the bridging process, often in the lock-and-mint model, which can pose security risks if large amounts are stored.

Transfer Tokens: Tokens that are moved across different blockchain networks, often via cross-chain bridges or protocols, enabling seamless asset transfer and interoperability.

Bridging Function: The core feature of a cross-chain bridge that enables the transfer of tokens and data between different blockchain ecosystems.

Equivalent Tokens: Tokens minted on a destination chain to represent assets burned or locked on the source chain, facilitating asset transfer without locking up liquidity.

Risk Management Network: A decentralized security layer that monitors and secures cross-chain transactions and off-chain messaging, improving security standards for protocols like CCIP.

Bridge Provider: A multichain platform that connects various blockchains, facilitating token transfers, stablecoin swaps, and providing liquidity pools and yield opportunities.

Single Point: Refers to a single point of failure or trust in custodial bridge frameworks, where reliance on one entity or component can introduce significant security risks.

Centralized Authority: A central entity controlling a bridge or protocol, which can introduce security vulnerabilities and require users to trust the operator.

Own Set: The unique set of risks, challenges, or characteristics inherent to a specific cross-chain bridge or blockchain network, important for understanding interoperability and security.

Operational Costs: The ongoing expenses associated with using blockchain networks and bridges, including transaction fees, which can be reduced by efficient Layer 2 solutions.

Conclusion

You now understand what a cross-chain bridge is, the main bridge designs, and how cross-chain bridges work behind the scenes. In a world of multi-chain crypto, bridges are essential infrastructure. They let you move capital where it is most productive, reach the applications you want, and rebalance treasuries across networks.

Use the checklists in this guide whenever you plan a cross-chain asset transfer. Choose a reputable bridge, read the quote carefully, send a small test, verify the destination token, and keep good records. With this routine, cross-chain activity becomes safe, fast, and repeatable.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.