Decentralized finance reimagined how markets work. Instead of matching buyers and sellers through a central order book, many decentralized exchanges rely on liquidity pools that quote prices automatically. This choice did not happen by accident. It solved a set of problems that on-chain order books struggled with, such as thin liquidity, high gas cost, and the need for ultra fast matching engines.

This guide explains order books vs liquidity pools with plain language and detailed examples. You will learn how order book trading sets prices, how automated market makers quote trades from a pool, why DeFi liquidity models favor pools, and when an order book still makes sense.

What Is an Order Book

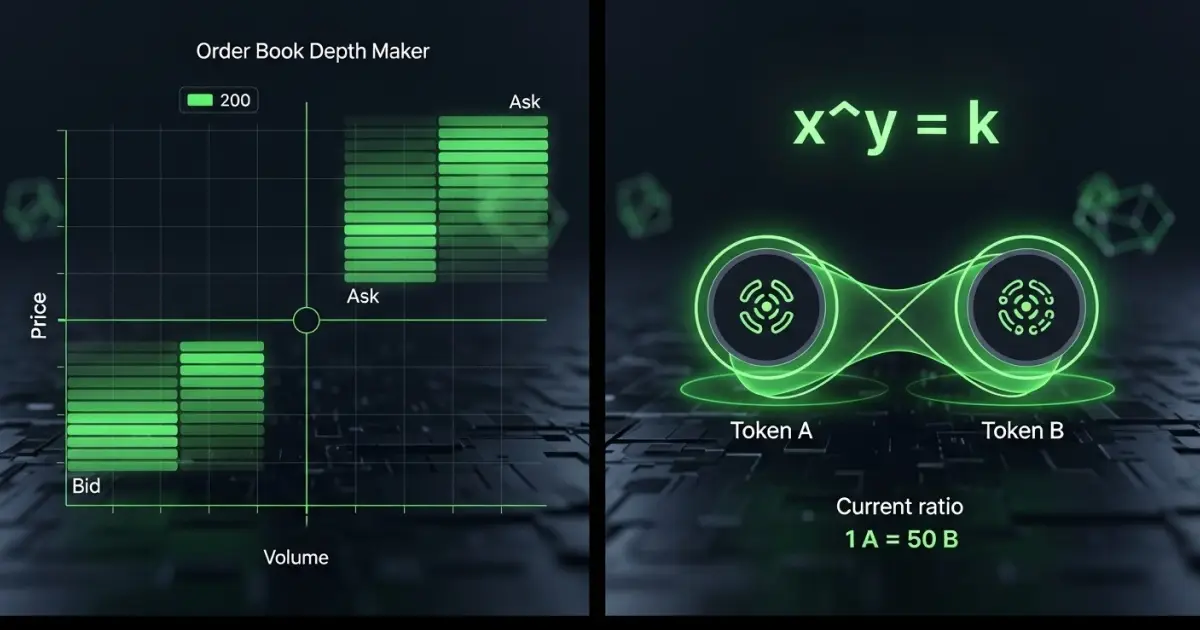

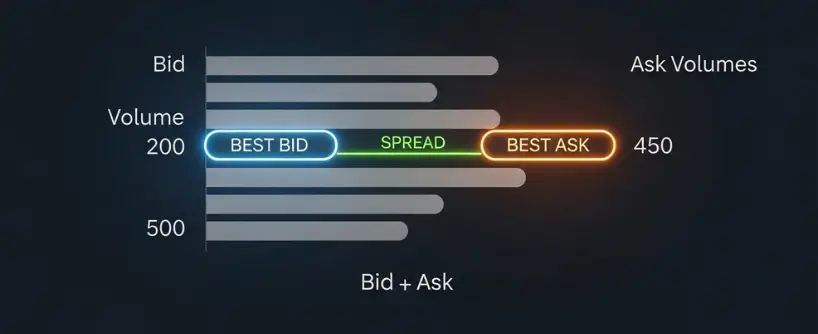

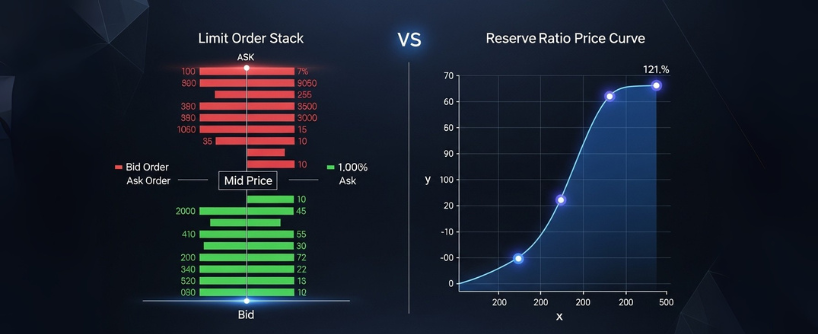

An order book is a list of buy and sell orders for a particular asset. Each order specifies a price and a quantity. The order book displays these buy and sell orders, facilitating trading activities by matching buyers and sellers for the asset. The best bid is the highest price someone will pay. The best ask is the lowest price someone will sell. The difference between them is the spread. When a new order arrives, a matching engine compares it to the current book. If there is a compatible order on the other side, the engine executes a trade and removes or updates the filled orders.

Characteristics of order book trading:

- Price discovery is continuous: The book shows the market’s view of a fair price through bids and asks at many levels.

- Depth and spread matter: Tight spreads and large depth reduce trading costs. Thin books cause slippage when a market order eats through several levels.

- Market makers are essential: Specialists place limit orders on both sides to keep spreads tight and collect the spread and rebates.

- Speed is central: Modern centralized exchanges process thousands of updates per second. Fast connectivity and co-location are typical in professional environments. Professional traders rely on this speed for executing complex trading activities efficiently.

Order books can face challenges in illiquid markets or when there are low trading volumes, which can result in higher slippage and decreased efficiency in executing trades.

Order books dominate in traditional finance and on traditional centralized exchanges because those platforms can operate high performance servers and maintain custody of balances while orders rest. Traditional centralized exchanges use order books to match buy and sell orders for specific assets, providing transparency and efficient execution for a wide range of trading activities.

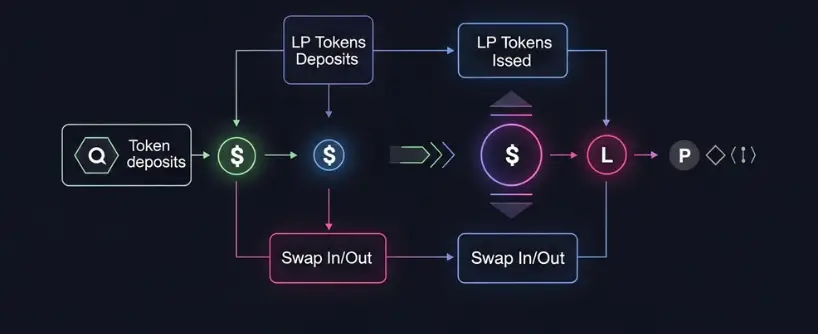

What Is a Liquidity Pool

A liquidity pool is a smart contract that holds reserves of two tokens and quotes a price based on an algorithm. This is how liquidity pools work: users provide liquidity by depositing assets into the pool, and the assets deposited are then used to facilitate trades between other users. Anyone can deposit equal values of the two tokens into the pool and become a liquidity provider. In return, they receive a share of trading fees and are also issued LP tokens representing their share of the assets deposited. The pool does not need to search for a counterparty. It is the counterparty.

Why this matters on-chain:

- You do not need a central order book or a custodian to rest orders.

- Fees for posting, canceling, and reshuffling orders are avoided.

- Transactions settle atomically in a single blockchain transaction, which fits the block by block nature of public chains.

This model gave DeFi a practical way to build markets while keeping custody with users.

Automated Market Makers in Action

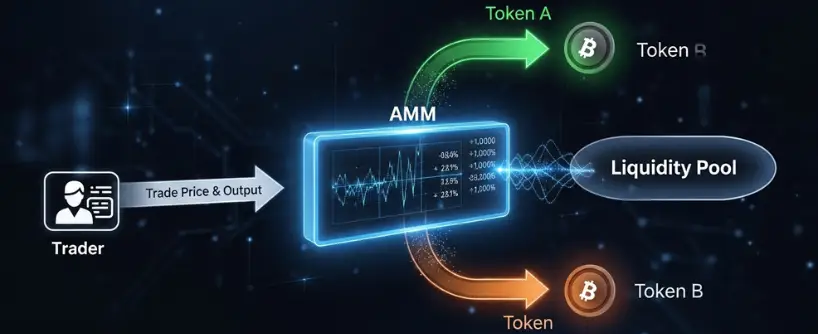

The automated market maker or AMM, also known as automated market makers (AMMs), is the algorithm that a pool uses to quote prices and facilitate trades. AMMs automatically set the exchange rate for token swaps based on the current reserves in the liquidity pool, eliminating the need for traditional order books. This mechanism enables efficient and continuous trading by allowing users to swap tokens directly with the pool.

In section 3.1, AMMs do not require matching buyers and sellers, which allows for seamless token swaps at any time, regardless of market participant activity.

Constant Product Market Maker

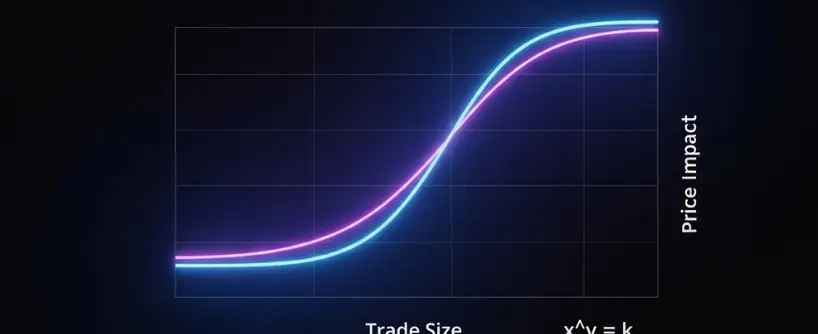

The first popular design used the rule x · y = k, where x and y are the token reserves and k is constant. If a trader buys token X, the pool’s X reserve decreases and the price rises because the product must remain constant. The more you buy in one transaction, the higher the price you pay. This is price impact. The fee that the trader pays stays in the pool and compensates liquidity providers.

Properties:

- Simple and trustless

- Works for any token pair

- Price impact rises smoothly with trade size

- Capital inefficient when prices stay in a narrow band

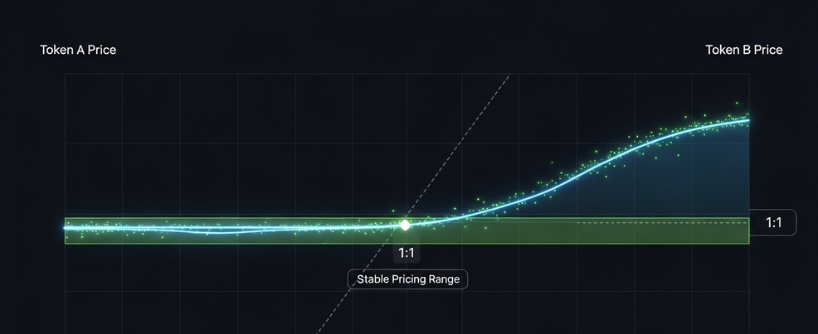

Stableswap Curves

Stablecoin pairs or assets that track each other, such as USDC and DAI, benefit from a different curve. A stableswap AMM keeps the price near one while still allowing large trades with very low slippage. It does this by blending a constant sum region around the peg with a constant product region away from the peg.

Properties:

- Low slippage near the target ratio

- Efficient for assets that should trade at parity

- Less suitable for volatile pairs

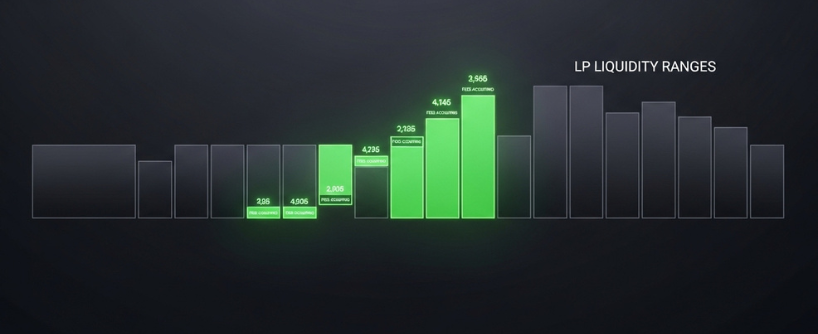

Concentrated Liquidity

Uniswap V3 introduced concentrated liquidity. Liquidity providers choose specific price ranges where their funds are active, concentrating their assets within those intervals. Inside the selected range, trades use only the liquidity allocated there. This increases capital efficiency because funds are not spread across prices that rarely occur. If the market price leaves your range, your position stops earning fees until you rebalance.

Properties:

- High fee capture per dollar of liquidity in active ranges

- Requires management or automation

- Makes pools function more like a grid of tiny order books

These DeFi liquidity models power most decentralized exchanges today.

Order Books vs. Liquidity Pools at a Glance

| Feature | Order Book Trading | Liquidity Pools Explained |

| Counterparty | Another trader’s order | The pool itself |

| Price formation | Bids and asks placed by traders and market makers | Algorithmic pricing from reserves and an AMM curve |

| Capital source | Market makers and resting orders | Liquidity providers deposit funds |

| Settlement | Matching engine, often off-chain, finalizes then updates balances | Single on-chain transaction updates pool and balances |

| Trading pairs | Supports a wide range of trading pairs, typically curated for liquidity and market demand | Enables a variety of trading pairs, including long-tail or permissionless pairs, often without centralized approval |

| Best for | Mature markets with deep liquidity, complex order types, derivatives | On-chain spot swaps, long tail tokens, permissionless market making |

| Main costs | Spread, taker fees, maker fees, funding for leverage | Price impact, swap fee, gas, impermanent loss for LPs |

| Primary risks | Custody on a centralized exchange, order book spoofing, exchange downtime | Smart contract risk, MEV, impermanent loss, oracle issues for hybrids |

Why DeFi Uses Liquidity Pools

Blockchains do not handle millions of order updates per second. Each update costs gas, and every cancel or refresh is a transaction. Early attempts at on-chain order books suffered from massive overhead, poor user experience, and thin books. Liquidity pools solved these issues in several ways. Decentralized exchanges (DEXs) and DeFi platforms use liquidity pools as a core mechanism to facilitate trading and liquidity provision. Decentralized finance (DeFi) and the broader DeFi ecosystem rely on these innovations to enable decentralized trading, allowing users to trade directly from their wallets without intermediaries.

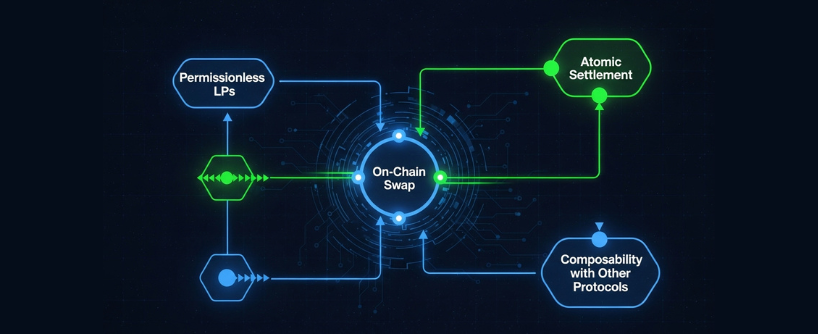

Permissionless market making

Anyone can become a liquidity provider by depositing assets. This crowdsources market making and avoids the need to recruit professional firms.

Atomic settlement

A swap happens in one transaction. There is no risk of orders resting in the book without being matched.

Composability

Pools are smart contracts that other contracts can integrate with. Lending protocols, yield vaults, and aggregators all plug into AMMs. This is core to the DeFi design philosophy.

Simplicity

An AMM requires only token transfers and math on reserves. The chain handles ordering. There is no separate matching engine to operate.

Resilience

Because liquidity and pricing live on-chain, as long as the network is live, the market can operate.

Growth and accessibility of the crypto market

Liquidity pools are fundamental to the growth and accessibility of the crypto market, allowing users to participate in decentralized finance (DeFi) without intermediaries and supporting the ongoing innovation of the DeFi ecosystem.

These advantages explain why DeFi uses liquidity pools for most spot trading. Decentralized exchanges, as a key part of decentralized finance DeFi, leverage these pools to enable decentralized trading and empower users within the crypto market.

What Liquidity Pools Improve and What They Sacrifice

Benefits to traders

- Always available counterparty: You can swap at any time against the pool provided there is liquidity in your size.

- Increased liquidity: User participation in pools leads to increased liquidity, resulting in better pricing and lower slippage for traders.

- Transparent pricing: The AMM formula is public. Anyone can simulate expected output.

- Permissionless access: No account creation, and custody remains with the user’s wallet.

Costs and tradeoffs

- Price impact: Large trades move the pool price. Traders must split trades or seek deeper routes to control impact.

- MEV exposure: Because transactions sit in a public mempool before inclusion, searchers can reorder transactions or sandwich a trade. Private relays and batch auctions help mitigate this.

- Limited order types: AMMs offer swaps at current price. Conditional orders, iceberg orders, or complex algo trading typically require specialized protocols.

Benefits to liquidity providers

- Fee income: Providers earn a share of swap fees, allowing them to generate passive income through ongoing trading fees and rewards.

- Programmable exposure: In concentrated liquidity, LPs choose ranges that align with their views and risk tolerance.

- Non custodial control: Funds live in a smart contract rather than with an exchange.

Costs and tradeoffs for LPs

Providing liquidity involves certain risks, including impermanent loss and smart contract vulnerabilities.

- Impermanent loss: If the price changes relative to the deposit ratio, the value of the position may underperform holding the tokens.

- Smart contract risk: A bug can affect funds.

- Operational tasks: Concentrated liquidity positions need monitoring and rebalancing.

Price Discovery: How Each Model Finds a Fair Price

Order books discover price from human or algorithmic intent expressed as limit orders. If many buyers want to pay slightly less than the last traded price, the bid side stacks up. If sellers rush in, the ask side grows. The intersection of supply and demand at many levels creates a detailed picture of value. Order books provide detailed data on price movements, which is essential for informed trading decisions. Market makers update orders constantly to reflect on new information.

Liquidity pools infer price from reserve ratios. In a constant product pool, the marginal price of token X in terms of token Y is y divided by x. When a trade happens, reserves shift, and the price adjusts. Pools track external prices indirectly through arbitrage. If the pool price deviates from other markets, arbitrageurs trade until the AMM price realigns.

Both methods work. Order books rely on explicit quotes. AMMs rely on implicit quotes shaped by arbitrage and user flow.

When an Order Book Still Wins

Although pools dominate DeFi spot swaps, order books have strengths that do not disappear.

- Large single trades in deep markets. A mature order book with professional market makers can fill a huge order with modest impact compared to a pool with limited depth.

- Advanced order types and derivatives. Perpetual futures, options, and complex strategies require features like stop orders, post only flags, and conditional triggers that AMMs do not natively provide.

- Latency sensitive trading. Professional strategies need sub millisecond response. On-chain pools cannot deliver that.

For these reasons, centralized exchanges and some high performance decentralized platforms continue to maintain order books.

Worked Examples

Example 1: Swapping 100,000 USDC to ETH

- Order book: The best ask is 20 orders totaling 100,000 USDC worth of ETH with a spread of 0.02 percent. A market order fills the top of book and maybe one or two levels. Trading cost equals spread plus taker fee.

- Liquidity pool: The ETH USDC pool has 20 million USDC and equivalent ETH. Using the constant product rule and a 0.3 percent fee, a 100,000 USDC trade might move the price by several basis points depending on depth. An aggregator may split the trade across several pools to minimize price impact.

Example 2: Stablecoin swap

- Order book: Market makers keep a very tight spread given the stable nature of the assets.

- Stableswap pool: The curve is designed for this pair. Slippage near one is extremely low. For most users the pool is cheaper and simpler.

How Aggregators Choose Routes

Modern DeFi traders often use DEX aggregators. These services query multiple pools and sometimes order book platforms, then split a swap across them to minimize expected cost. Some aggregators also interact with hybrid models that combine features of AMMs and order books for optimal execution. They consider:

- Pool depth and current price

- Swap fee levels

- Gas cost for extra hops

- Expected price impact

- MEV protection if available

Aggregators are one reason AMM-based exchanges handle large volume smoothly. They abstract away the need to understand every pool and connect to the best combination available.

Risk Management for Traders

Even with strong models, execution requires care. Security measures, such as using audited platforms and secure wallets, are essential to mitigate risks and maintain trust in trading. Use these practices to reduce cost and risk.

- Set a realistic slippage tolerance: Large trades or volatile markets require tighter control. For stablecoin swaps you can set slippage very low.

- Use private relays when available: Some platforms accept private transactions that bypass the public mempool and reduce sandwich risk.

- Split large orders: Breaking a trade into parts over time or across pools can reduce impact.

- Check the token contract: Ensure you receive the correct token on the correct chain, especially when bridging or swapping wrappers.

- Understand fee tiers: Pools often offer several fee tiers. Choose the one that matches volatility and volume.

Risk Management for Liquidity Providers

If you plan to provide liquidity rather than trade, keep these points in mind.

- Know your pair: Volatile pairs carry more impermanent loss risk. Stable pairs reduce it but pay lower fees.

- Choose ranges that match your thesis: In concentrated liquidity, pick a range where you expect price to live for a while.

- Automate with care: Strategy vaults can rebalance automatically. Choose reputable providers with audits and clear documentation.

- Track performance: Use tools that separate fee income from price exposure, so you know whether the position is beating a simple hold.

- Diversify pools and chains: Spread exposure to reduce the impact of a single incident.

- Consider liquidity mining: Liquidity mining is another way for liquidity providers to earn rewards by supplying assets to pools, often receiving platform tokens as incentives. This strategy is related to, but distinct from, earning trading fees through Automated Market Makers (AMMs).

How to Choose Between an Order Book and a Liquidity Pool

Use this quick decision framework:

Both models offer numerous benefits depending on user needs and market conditions.

Asset type and volatility

- Stable pairs or long tail tokens are ideal for pools.

- Highly liquid majors with mature market maker support can suit order books.

Trade size and urgency

- Small to medium spot swaps are efficient in AMMs.

- Huge single fills may be cheaper on a deep order book or through an RFQ service.

Needed features

- For conditional orders or derivatives, choose an order book.

- For simple spot swaps and composability with DeFi apps, choose pools.

Cost considerations

- Compare spread and taker fees on order books to swap fee and price impact in pools, plus gas in both cases.

Risk tolerance

- For non custodial trading with transparent math, pools fit well.

- For professional environments that require special order types and monitoring, an exchange with an order book may be better.

Frequently Asked Questions

What is the simplest way to understand order books vs liquidity pools

An order book is a marketplace of quotes from buyers and sellers. A liquidity pool is a vault of tokens that quotes prices based on math. Order books depend on humans or bots placing limit orders. Pools depend on an algorithm and on arbitrage to keep the price aligned with the rest of the market.

Why did early on-chain order books struggle?

Every order update is a transaction. On public chains, this is slow and expensive compared to a centralized server. As a result, the book was thin, spreads were wide, and trading felt clumsy. Liquidity pools avoided constant updates by using a formula that only changes when someone trades.

Do liquidity pools set prices fairly?

Yes, within the limits of their design. The formula sets a price from reserves at all times. If that price drifts away from external markets, arbitrage brings it back. Deep pools and active arbitrage make pools accurate and hard to manipulate.

What is impermanent loss?

Impermanent loss is the value difference between holding your tokens and providing them to a pool when the price changes. If one asset rises relative to the other, you end up with more of the weaker asset and less of the stronger one. Fees can offset this, but providers should understand the effect before depositing.

Can order books and liquidity pools coexist?

They already do. Many ecosystems offer both. Aggregators route orders to the best platform, and some protocols combine order book depth with AMM liquidity to improve execution.

How does an automated market maker handle very large trades?

The price impact rises with trade size because the reserves move. For very large trades, aggregators split the order across multiple pools or use a request for quote system that sources better pricing from professional market makers.

Are liquidity pools vulnerable to manipulation?

Pools can be targeted during very low liquidity periods or when a stale oracle feeds a protocol that uses pool prices. Healthy pools with active arbitrage and deep liquidity are resilient. Many designs integrate time weighted average price checks to reduce manipulation.

When should I prefer an order book?

If you need advanced orders, access to derivatives such as perpetuals and options, or you are executing very large size in a mature market with professional market makers, an order book is likely the better choice.

Glossary

Order book trading: A market structure where limit orders from buyers and sellers are matched by price and time priority.

Liquidity pools: Smart contracts that hold token reserves and use an AMM to quote prices for swaps.

Automated market maker: The formula or algorithm that determines pool pricing, such as constant product or stableswap.

DeFi liquidity models: The various designs used for on-chain markets, including constant product AMMs, stableswap curves, and concentrated liquidity.

Traditional markets: Conventional financial trading environments, such as stock exchanges, that rely on order books and centralized exchanges. Traditional markets typically involve institutional market makers and specific structures for matching trades, in contrast to the decentralized and automated systems used in DeFi.

Cryptocurrency market: The overall environment for trading digital assets, including various models like order books and AMMs. The cryptocurrency market encompasses both centralized and decentralized trading systems, impacting market accessibility, liquidity, and the evolution of digital asset trading.

Spread: Difference between the best bid and best ask in an order book.

Price impact: Change in the quoted price caused by a trade against a pool or by consuming multiple levels of an order book.

Impermanent loss: The value shortfall that liquidity providers may face when the relative price of pooled assets changes.

Arbitrage: Buying an asset where it is cheap and selling where it is expensive to align prices.

MEV: Maximal Extractable Value, which includes profits earned by reordering or inserting transactions in a block.

Concentrated liquidity: A model where LPs allocate funds to a custom price range to increase capital efficiency.

Conclusion

DeFi markets chose liquidity pools because they fit the reality of blockchains. Pools do not need ultrafast matching engines, they allow anyone to supply liquidity, and they settle atomically on-chain. Order book trading remains essential in many contexts, particularly for complex instruments and very large orders. Rather than choosing a single winner, modern crypto markets use both and connect them with aggregators so that users receive the best available outcome.

Understanding the strengths and limits of each DeFi liquidity model will make you a smarter trader or liquidity provider. Use pools when you value permissionless access, composability, and predictable on-chain execution. Use order books when you need advanced control, deep professional liquidity, and low spreads in mature markets. With the right choice for each job, you will spend less on fees and slippage while taking only the risks you intend to take.

In conclusion, liquidity pools play a crucial role in the DeFi ecosystem by enabling decentralized trading and yield opportunities, but they also come with risks such as impermanent loss and smart contract vulnerabilities.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.