Turning a modest balance into a six figure crypto portfolio is a structured exercise in planning, discipline, and risk control. Successful investors do not chase every token. They define clear goals, assign roles to each position, measure outcomes, and refine processes over time. This guide provides the full playbook for building, scaling, and safeguarding a crypto portfolio from $1,000 to $100,000. It explains how to split capital between core assets and stable reserves, when to introduce mid caps and DeFi exposure, how to rebalance without overtrading, how to monitor performance with objective metrics, and how to protect everything with professional custody practices. You will also learn where Bitunix tools, including Bitunix Earn and Spot Auto-Invest, can support a systematic approach.

This is not a set of price predictions. It is a step by step method that converts market noise into a durable plan. Follow it consistently, and your results will depend less on luck and more on repeatable habits.

[ez-toc]

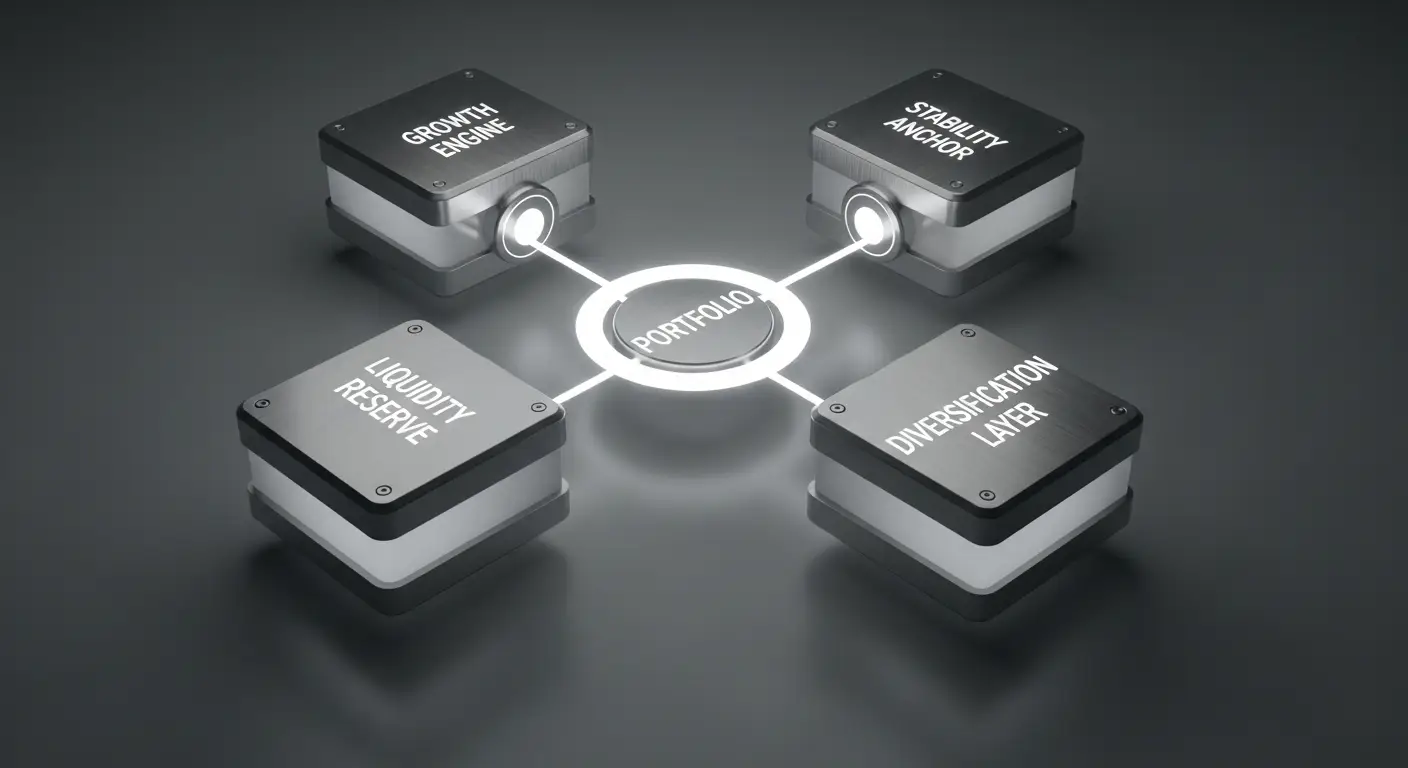

A dark 3D diagram shows a central circle labeled Portfolio, connected to four labeled blocks: Growth Engine, Stability Anchor, Liquidity Reserve, and Diversification Layer.

A crypto portfolio is a plan expressed as positions. Each position has a purpose, a size, and a rule for maintenance. When you treat your holdings this way, you shift from speculation to management.

The objective is simple. Build a structure that can stay invested through bear phases, capture upside during expansions, and compound steadily across cycles.

A gauge reading DRAW DOWN sits below a stone structure with Bitcoin and Ethereum logos, connected by a slab labeled Market Depth & Settlement, symbolizing cryptocurrency market conditions.

Large caps are the foundation. Bitcoin and Ethereum offer the deepest markets, the broadest institutional recognition, and the strongest developer ecosystems. Bitcoin functions as a store of value within the crypto universe. Ethereum operates as a settlement platform for smart contracts, tokens, and decentralized finance. Together they provide exposure to the two most important sources of long-term demand: store-of-value adoption and on-chain economic activity.

Practical guidance:

Mid caps such as Solana, Avalanche, Chainlink, Arbitrum, and Optimism represent meaningful networks with active users and builders. They introduce higher variance than BTC and ETH but add important sector exposure, for example high-throughput execution, interoperability, or data services. Review tokenomics and treasury transparency to ensure incentives align with long-term holders.

Emerging assets include early stage DeFi protocols, modular data layers, new rollups, or tokens linked to compute and storage. Potential is high, but risk is elevated. Treat this as research capital and limit exposure until you have clear, verifiable adoption data.

Stablecoins are the operating cash of crypto. USDC, USDT, and DAI allow you to rebalance, earn conservative yield, bridge between chains, and pay fees without touching volatile assets. A healthy buffer prevents forced sales during market stress and creates dry powder for opportunities.

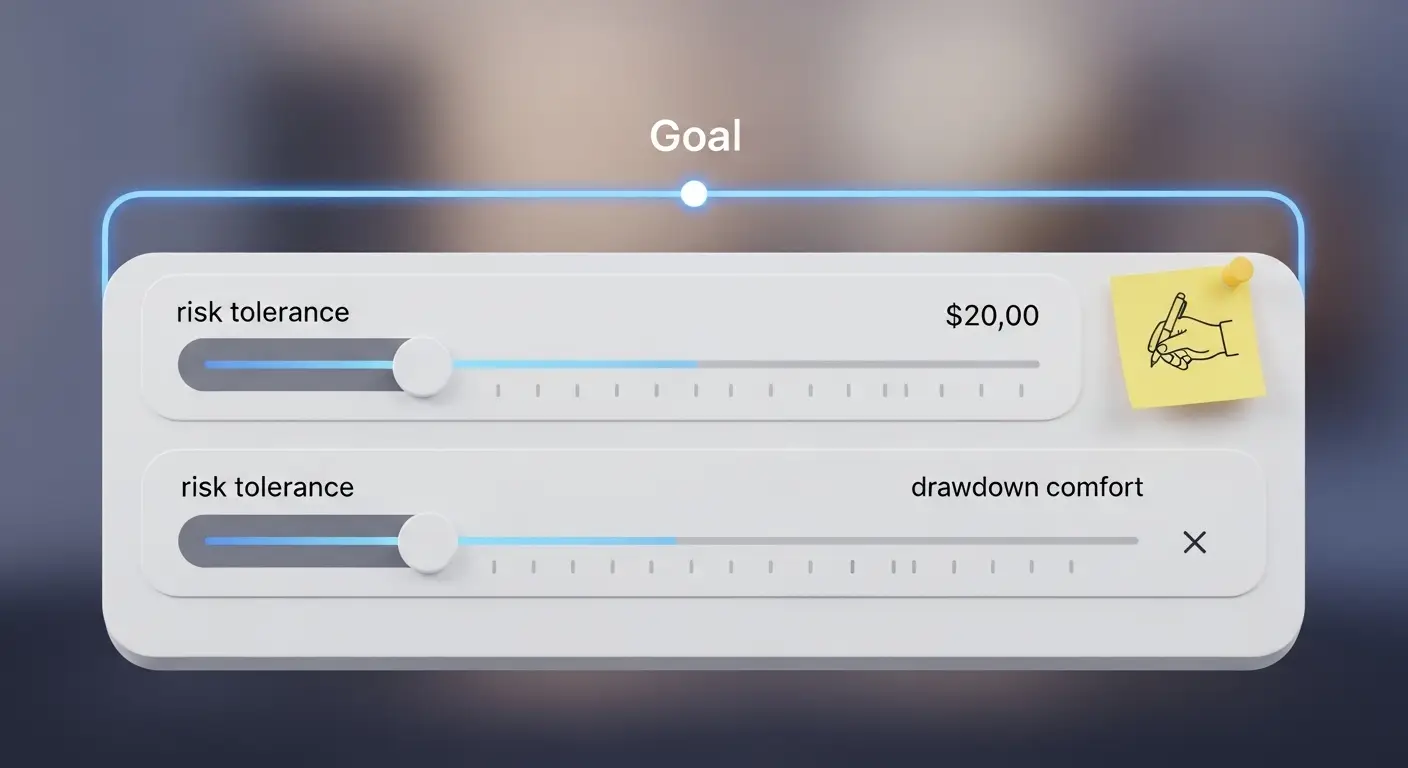

A user interface with two sliders labeled risk tolerance under the heading Goal. The top slider shows $20.00 with a sticky note drawing, and the bottom slider is labeled drawdown comfort with an X on the right.

A one-sentence goal keeps decisions aligned. Examples: build a long-term position for financial independence, generate steady yield on idle balances, or systematically accumulate core assets with periodic rebalancing.

| Profile | Primary aim | Typical starting mix | What to expect |

| Conservative | Preserve capital and earn modest yield | 70 percent BTC and ETH, 20 percent stablecoins, 10 percent mixed altcoins | Lower variance, slower compounding, easier to hold through drawdowns |

| Balanced | Blend of growth and protection | 50 percent BTC and ETH, 30 percent mid caps, 20 percent stablecoins | Moderate variance, flexibility to add staking and DeFi |

| Aggressive | Maximize upside with active management | 30 percent BTC and ETH, 50 percent mid and emerging caps, 20 percent stablecoins | Higher variance, requires strict review cadence and risk controls |

Your allocation should match how you actually react to volatility. A conservative plan that you hold is superior to an aggressive plan that you abandon during the first correction.

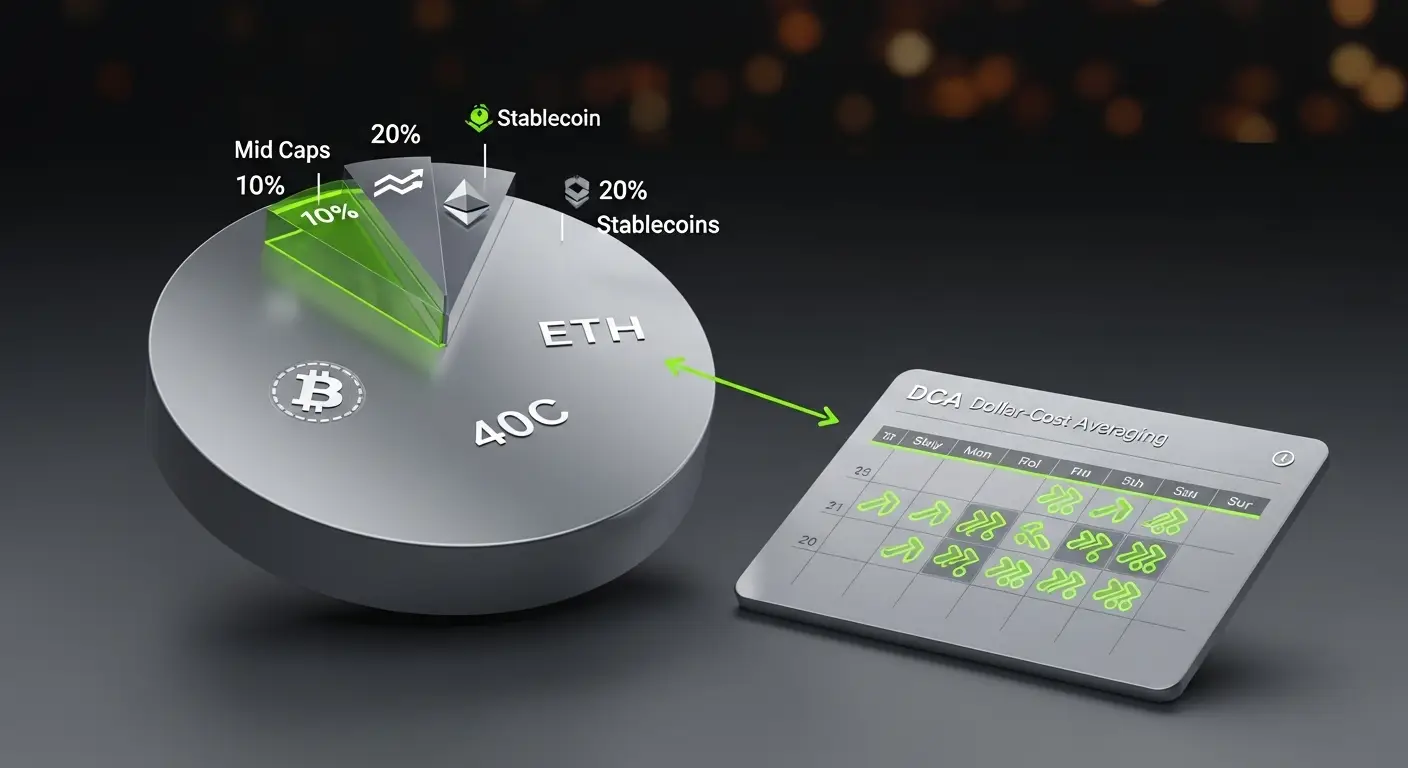

A 3D pie chart shows a portfolio with 40% in ETH, 20% in stablecoins, 20% in another stablecoin, and 10% in mid caps. An arrow points to a calendar marked DCA Dollar-Cost Averaging with highlighted buy dates.

This structure gives you the dominant assets, a cash buffer, and a small amount of growth exposure for learning.

Commit to a fixed purchase schedule. DCA reduces timing risk and builds emotional discipline. With an automated plan you avoid chasing local tops and you continue buying during fear, which is when positioning improves.

At the end of each month record total value, cost basis, current allocation weights, and notes about any changes. If a position has grown beyond its target range, consider a small rebalance so you remain close to your plan.

A 3D diagram with concentric rings labeled main portfolio and keep it simple, leading to icons for Yield, Sectors, and Cross-chain on a black background. Arrows connect the rings and icons.

You now have enough capital to add yield, sector diversification, and cross-chain exposure while keeping the structure simple. The challenge is to add these elements without creating complexity that you cannot monitor.

Use a five-point checklist:

Staking converts a core position into a yield-bearing asset. On networks like Ethereum, Solana, and Cardano, staking rewards are paid in the native token. Native staking requires you to delegate or run a validator. Liquid staking gives you a derivative that represents your staked position and can be used in DeFi, but it adds contract risk. Keep records of rewards for accounting and tax purposes.

Start with conservative products: lending markets for BTC, ETH, and stablecoins, and stablecoin liquidity pools. Limit DeFi exposure to a minority share of the portfolio until you understand protocols and their risk models. Avoid complex strategies or high advertised yields that lack transparent revenue.

Hold assets on more than one chain to reduce operational concentration risk. Keep a small balance of each chain’s gas token so that you can transact immediately when funds arrive. For transfers, use canonical bridges where available or a reputable router. Verify contract addresses before approving spending.

Rebalance by time and by threshold. Review quarterly and also when a holding drifts more than 10 percentage points away from target. Rebalancing locks in partial gains, refreshes your stablecoin buffer, and keeps portfolio risk consistent with your plan.

A glowing digital shield with holographic icons and a central globe, surrounded by futuristic security symbols and a large padlock, representing advanced cybersecurity and data protection.

Move long-term holdings to cold storage. For shared assets or larger balances, use a multi-signature wallet such as Safe so that one lost key cannot move funds. Maintain an inventory of wallets, seed backups, and balances in a private document. For families or teams, specify who can sign and the recovery steps if a signer is unavailable.

Consider coverage for custodian or contract risk if you rely on a small set of providers. Keep duplicate seed backups in two secure locations and test a recovery procedure with a small account so that you know the steps during an emergency.

Write short playbooks for common actions: rebalancing, claiming staking rewards, bridging to a new chain, exiting a DeFi position, and rotating stablecoins. A runbook reduces mistakes when markets move quickly and makes your process teachable to a colleague.

Three panels: coins stacked with plants and an upward arrow, a core-satellite investment diagram, and a barbell with cryptocurrency logos, symbolizing different investment strategies.

The core includes BTC and ETH with a multi-year horizon. Satellites rotate between mid caps, infrastructure tokens, and DeFi positions. The core provides stability, while satellites target excess return. Rebalance satellite gains back into the core every quarter.

One side holds very conservative positions such as BTC, ETH, and tokenized money markets. The other side holds carefully sized higher beta experiments. The middle is intentionally thin so that you always know which half is responsible for growth and which half protects capital.

Half the portfolio is placed in productive assets like staked ETH, conservative lending, and fixed savings. The other half sits in growth assets with clear catalysts. Gains from growth rotate back to yield on a schedule, which ratchets total value upward.

Pick one model and commit through a full market cycle so that outcomes reflect process rather than luck.

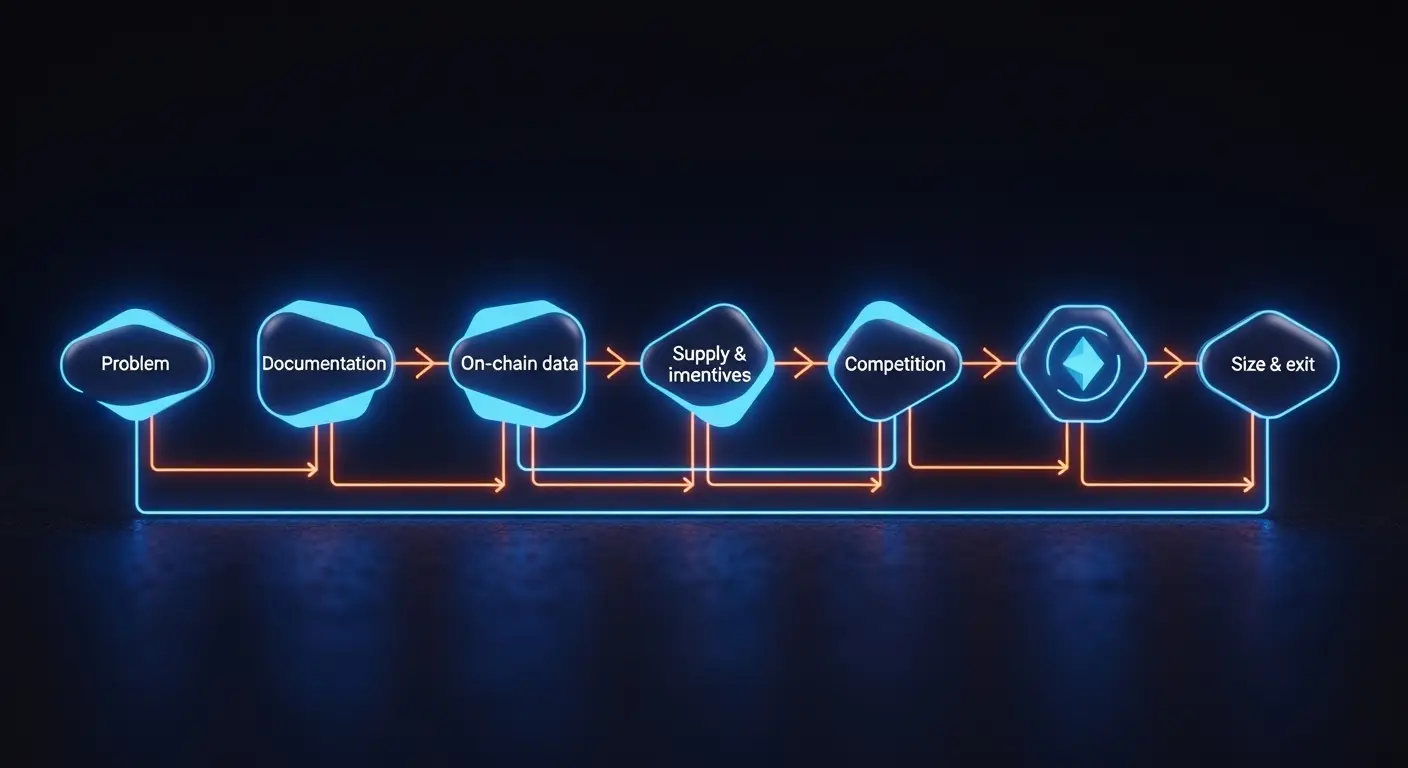

A neon-style flowchart with six stages: Problem, Documentation, On-chain data, Supply & incentives, Competition, and Size & exit, connected by arrows against a dark background.

Identify what real problem a project solves and who the user is. Real users pay fees, lock value, or save time. If demand is only subsidy-driven, reassess.

Good documentation explains architecture, security assumptions, token distribution, and governance. If documentation is thin or out of date, treat that as a risk and reduce size.

Check daily active addresses, transactions, fees, and protocol revenue. Use more than one analytics source. Look for steady improvement, not just spikes during incentive programs.

Understand emissions, unlock schedules, and the split between community, team, and investors. Supply expansion can offset price gains if adoption lags.

Identify substitutes and competing networks. If a project requires heavy incentives to keep users while peers retain users organically, durability is questionable.

Translate conviction into an initial size that fits your risk limits. Increase allocation only as evidence accumulates. Predefine your exit if adoption or transparency degrades.

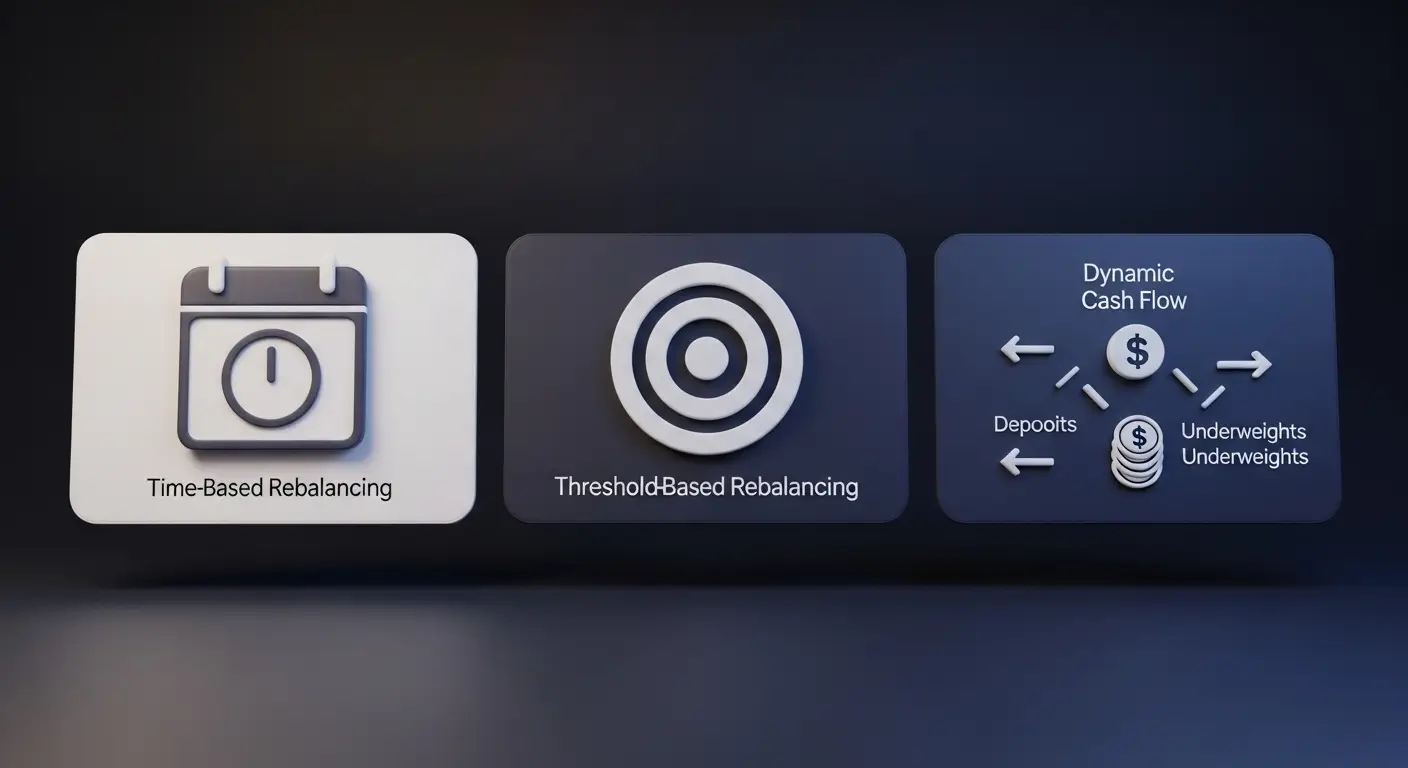

Three panels show icons representing investment strategies: a calendar for time-based rebalancing, a target for threshold-based rebalancing, and arrows with labeled flows for dynamic cash flow rebalancing.

Rebalance on a fixed cadence, typically quarterly. On each date, move weights back to targets with the smallest number of transactions. This method is predictable, easy to automate, and tax efficient for many jurisdictions.

Rebalance when a holding deviates beyond a band around its target, for example plus or minus 10 percentage points. Thresholds react to market movement between calendar dates and help capture mean reversion.

When you add new money, direct it toward underweight assets rather than buying everything proportionally. When you withdraw, sell overweight assets first. This reduces trading and taxable events.

Use time-based as the default, layer thresholds for your largest positions, and use cash flows to fine tune. Document the rules, then follow them precisely.

Numbers enforce discipline and remove guesswork.

Use a password manager, long unique passwords, and two factor authentication everywhere. Secure email accounts linked to exchanges and wallets because attackers often target email first.

Use one device for general browsing and a second device for crypto transactions. Keep firmware and wallet software up to date. Avoid browser extensions you do not understand.

Regularly review token approvals on each chain and revoke access you no longer need. This reduces the attack surface if a dApp is compromised later.

Simulate device loss and restore access with your seed phrase to confirm backups. Document the steps in your runbook so that recovery is calm and predictable.

Bitunix offers account-level yield features that help different stages of the plan without sacrificing clarity. Products vary by liquidity profile and settlement rules. Always read the current product page before subscribing.

Flexible Savings prioritizes access to funds. You can subscribe and redeem at any time, which makes it ideal for the liquidity buffer you keep in stablecoins. Interest is calculated by the platform according to product terms and credited on a regular schedule. This fits the Foundation and Expansion phases where fast access is valuable.

Where it fits

Fixed Savings targets a higher rate in exchange for a defined lock period. You select the term at subscription and receive interest at maturity according to the offer. Fixed products are suitable for the portion of reserves that you do not plan to deploy for one to three months.

Positioning tip: Ladder subscriptions so maturities fall on different dates. A ladder lets some funds come due every few weeks, which maintains flexibility without sacrificing rate.

Spot Auto-Invest automates dollar cost averaging in spot markets. You configure a recurring buy plan for a chosen asset and amount. This tool supports the Foundation and Expansion phases because it builds positions without second-guessing market timing. It is also useful for disciplined accumulation of BTC and ETH inside a Core Satellite structure.

Dual Investment pairs a target price with a settlement date for BTC, ETH, or USDT. You subscribe with one asset, choose a strike and a date, and earn a quoted estimated rate. At expiry you receive settlement in one of the two assets depending on the market relative to your target. There are no trading fees or slippage inside the product. This is an advanced tool that requires comfort with settlement in either asset. Size it carefully and use it only when the target aligns with your predefined buy or sell levels.

Risk note: Dual Investment is not principal protected. Always review strike, settlement calendar, and payoff examples before subscribing.

Write a one-page investment policy that lists goals, target weights, rebalancing rules, and security procedures. Fund the portfolio and activate Spot Auto-Invest for BTC and ETH.

Learn a new chain or protocol using a small test position. Add one mid cap that passes your checklist. Park remaining stablecoins in Flexible Savings.

Quarterly rebalance. Export records from your tracker. If you have fixed savings maturing, roll a fraction forward to maintain a ladder.

Review staking positions. Claim rewards and restake if it fits your plan. Verify validator health and delegation terms.

Security drill. Rotate passwords, verify backups, and revoke unused token approvals. Update the runbook with any changes.

Research a new theme such as data availability, restaking, or tokenized treasuries. Start with a small size under the satellite bucket.

Second rebalance of the year. If winners have grown far beyond targets, lock in gains and refresh the stablecoin buffer.

Tax preparation and performance review. Calculate annual return, drawdown, and Sharpe ratio. Decide adjustments for the next year and document them in your policy.

| Stage | Portfolio value | Core strategy | Allocation example | Estimated timeline |

| Foundation | $1,000 to $10,000 | Build structure and habits | 70 percent BTC and ETH combined, 20 percent stablecoins, 10 percent mid caps | 12 to 18 months |

| Expansion | $10,000 to $50,000 | Add staking, DeFi, and cross-chain exposure | 50 percent BTC and ETH, 30 percent mid caps, 20 percent stablecoins with Flexible and Fixed Savings | 18 to 36 months |

| Optimization | $50,000 to $100,000 | Improve custody, add conservative yield, formalize runbooks | 40 percent BTC and ETH, 30 percent mid caps and infrastructure, 20 percent conservative yield including Fixed Savings, 10 percent research capital | 36 to 60 months |

Timelines depend on contributions, market conditions, and adherence to process. The constant is discipline. The portfolio grows because you continue to execute the plan through every cycle.

How much money do I need to start a crypto portfolio?

You can begin with any amount, but $1,000 provides enough flexibility to build a balanced structure. With $1,000 you can allocate to Bitcoin, Ethereum, a small mid cap, and a stablecoin buffer for fees and opportunities. The goal at this level is to learn operations and develop habits rather than maximize return. As you contribute regularly through dollar cost averaging, the structure scales without needing dramatic changes, which keeps decisions simple and consistent.

Is it better to buy everything at once or to invest gradually?

Invest gradually. Dollar cost averaging reduces entry risk and builds emotional discipline. A fixed weekly or monthly plan removes the urge to time short-term moves and ensures you continue buying during fear. Over a full cycle this habit usually produces a more attractive average price than sporadic lump sum buys. If you receive a bonus or windfall, you can deploy part of it immediately and schedule the rest through Auto-Invest to smooth the entry.

What percentage of my portfolio should be in stablecoins?

A reasonable range is 10 to 20 percent. The buffer acts as operating cash for gas, fees, and new opportunities. In uncertain markets you can raise the buffer to protect principal. When momentum strengthens you can redeploy part of the buffer into productive assets. Keep most of the buffer in Flexible Savings so it earns while remaining available, and ladder a portion in Fixed Savings if you do not need immediate access for the next one to three months.

How do I choose which altcoins to include?

Use a checklist that screens for real adoption and transparent economics. Favor tokens attached to networks or protocols with visible usage, audited code, and clear revenue or fee sinks. Study token supply schedules and unlock calendars to understand dilution. Avoid assets that rely primarily on promotional incentives to attract users or that publish vague documentation. Start with a small position, track fundamental metrics for a quarter, and only increase size if the thesis continues to hold.

Is staking safe, and how should I size it?

Staking on established networks is relatively conservative, but it is not risk free. Risks include validator slashing, smart contract bugs for liquid staking, and liquidity constraints during exit windows. Start with a small percentage of ETH or other stakeable assets, verify validator reputation, and keep a record of rewards. If you use liquid staking tokens, understand that you add protocol risk in exchange for flexibility. As a rule, avoid placing more than a third of any single asset into a single staking provider.

How often should I rebalance my crypto portfolio?

Rebalancing quarterly works for most investors and pairs well with tax and reporting cycles. Add threshold triggers so that large moves do not run unchecked between calendar dates. For example, you might rebalance earlier if a holding moves more than 10 percentage points from its target weight. When adding new money, direct it first to underweight assets. When withdrawing, sell overweight assets first. This reduces trading and keeps the plan efficient.

How can I tell if my portfolio is performing well?

Measure returns and risk together. Track total return, volatility, maximum drawdown, and Sharpe ratio. Compare results to simple benchmarks such as a 50-50 BTC and ETH mix. If your portfolio is keeping pace with or outperforming the benchmark at similar or lower volatility, you are likely allocating effectively. If you lag the benchmark with higher volatility, reduce exposure to small caps and simplify the structure. Numbers, not headlines, should drive your adjustments.

Where does Bitunix Earn fit in a professional allocation?

Use Flexible Savings for the liquid stablecoin buffer that you plan to keep available. Ladder a portion of reserves in Fixed Savings to capture higher rates with scheduled maturities. Use Spot Auto-Invest to automate core accumulation in BTC and ETH. Advanced users may employ Dual Investment only when the strike and expiry match predefined buy or sell levels. Treat all Earn allocations as part of the cash and yield sleeve and size them within your risk policy.

Can I combine crypto with traditional investments?

Yes. Many investors manage a total portfolio where crypto represents 10 to 30 percent alongside equities, bonds, or gold. This blended approach lowers overall volatility and improves the probability of staying invested through difficult periods. When you measure performance, evaluate the crypto sleeve and the total portfolio separately so that you see how each contributes to household risk and return. If your non-crypto holdings already carry high risk, keep your crypto sleeve conservative.

How long does it usually take to grow from $1,000 to $100,000?

Timelines depend on contribution rate, yield, market conditions, and adherence to process. A disciplined investor who contributes monthly, stakes appropriately, and rebalances on schedule can reach six figures within three to five years across typical cycles. The fastest path is not aggressive trading. The fastest path is consistent execution, protection of principal, and steady compounding. Avoid the temptation to abandon the plan when markets turn emotional. The plan is what makes the outcome predictable.

Address: A public identifier where crypto assets can be received.

Allocation: The percentage of total capital assigned to each asset or strategy.

Altcoin: Any cryptocurrency other than Bitcoin.

APR: Annual Percentage Rate, interest without compounding.

APY: Annual Percentage Yield, interest with compounding.

Auto-Invest: A tool that schedules recurring purchases for a chosen asset and amount.

Bear Market: A period of declining prices and negative sentiment.

Bridge: Software that transfers assets or messages between blockchains.

Cold Wallet: An offline device used for secure long-term storage.

DeFi: Decentralized finance, financial services built on public blockchains.

Diversification: Spreading investments across assets to reduce the impact of any single position.

Dollar Cost Averaging: Investing a fixed amount at regular intervals regardless of price.

Drawdown: The decline from a portfolio’s peak to its subsequent low.

Dual Investment: A product that pairs a target price with a settlement date and pays an estimated rate, with settlement in one of two assets at expiry.

ETH Staking: Locking Ether to help secure the Ethereum network and earn rewards.

Flexible Savings: A yield product that allows deposit and redemption at any time.

Fixed Savings: A yield product with a specified lock period and rate terms.

Gas: Network fee required to process a blockchain transaction.

Hit Rate: Percentage of profitable trades or investments in a given period.

Hot Wallet: A wallet connected to the internet, convenient but less secure.

Liquidity: The ability to buy or sell quickly without moving the price significantly.

Mid Cap: A crypto asset with significant adoption that is smaller than BTC and ETH but larger than emerging tokens.

Multi-Signature Wallet: A wallet that requires more than one approval to move funds.

Portfolio Policy: A written document that defines goals, allocations, and procedures.

Profit Factor: Total gains divided by total losses for a strategy.

Rebalancing: Adjusting holdings to bring weights back to target levels.

Research Capital: A small allocation dedicated to testing new themes or assets.

Risk Budget: The amount of portfolio volatility an investor is willing to tolerate.

Sharpe Ratio: A measure of risk-adjusted return relative to a risk-free benchmark.

Stablecoin: A token designed to maintain a stable value, commonly one U.S. dollar.

Stop Loss: A predefined exit level that limits loss on a position.

TVL: Total value locked in a protocol, a proxy for usage and trust.

Validator: A participant who secures a proof-of-stake network and earns rewards.

Volatility: The degree of variation in an asset’s price over time.

Yield: Income generated by an asset, for example staking rewards or interest.

A portfolio that grows from $1,000 to $100,000 is built on structure, not luck. The structure is simple to describe and demanding to execute. Define a clear goal, assign roles to each position, maintain a stablecoin buffer, and buy steadily through dollar cost averaging. Add staking and conservative DeFi as you learn. Rebalance on schedule so that winners do not distort risk. Measure performance with numbers rather than headlines. Protect everything with professional security and documented runbooks.

Use Bitunix tools to support the plan. Flexible Savings and Fixed Savings keep cash productive, Spot Auto-Invest builds core positions without emotion, and the exchange environment provides the execution venue for rebalancing and additions. Keep your process transparent and repeatable. Over time the combination of discipline, risk control, and compounding will do the heavy lifting.

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 125x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.