November was a volatile month for the crypto market, with Bitcoin driving sentiment across major digital assets. As traders reassessed the outlook for U.S. monetary policy and absorbed fresh regulatory headlines, risk appetite cooled and price action turned choppy. At the same time, Ethereum’s Layer 2 ecosystem continued to evolve, and prediction markets drew increased attention as trading activity reached new highs.

This November crypto report highlights the key narratives that shaped market direction and sets the context for what investors may watch heading into December.

Key Takeaways

- Bitcoin traded in a wide range between $100,000 and $90,000 as the broader crypto market entered a deeper November pullback.

- Markets remained sensitive to U.S. interest rate expectations ahead of the next Federal Reserve policy decision.

- U.S. Regulatory discussion around crypto asset classification continued to develop, keeping compliance and policy risk in focus.

- Ethereum’s Layer 2 ecosystem pushed further on interoperability efforts, with the goal of making cross L2 usage feel seamless for users.

- Prediction markets such as Kalshi and Polymarket recorded strong momentum, with monthly trading volume reaching new highs.

- A closely watched trader known as “Machi Big Brother” was treated as a contrarian signal after multiple liquidations in November.

Bitcoin: Digital Gold

Bitcoin began November holding above $110,000 and consolidating at elevated levels. As expectations around interest rate cuts were reassessed, risk appetite weakened and selling pressure increased across crypto. Bitcoin’s decline accelerated during the month, with price sliding below $90,000 at its weakest point.

By late November, Bitcoin approached the low $80,000 range during the selloff before stabilizing and rebounding into month end. The move underscored how quickly leveraged positions can unwind in fast markets and why macro expectations and liquidity conditions remain key drivers of short term crypto volatility.

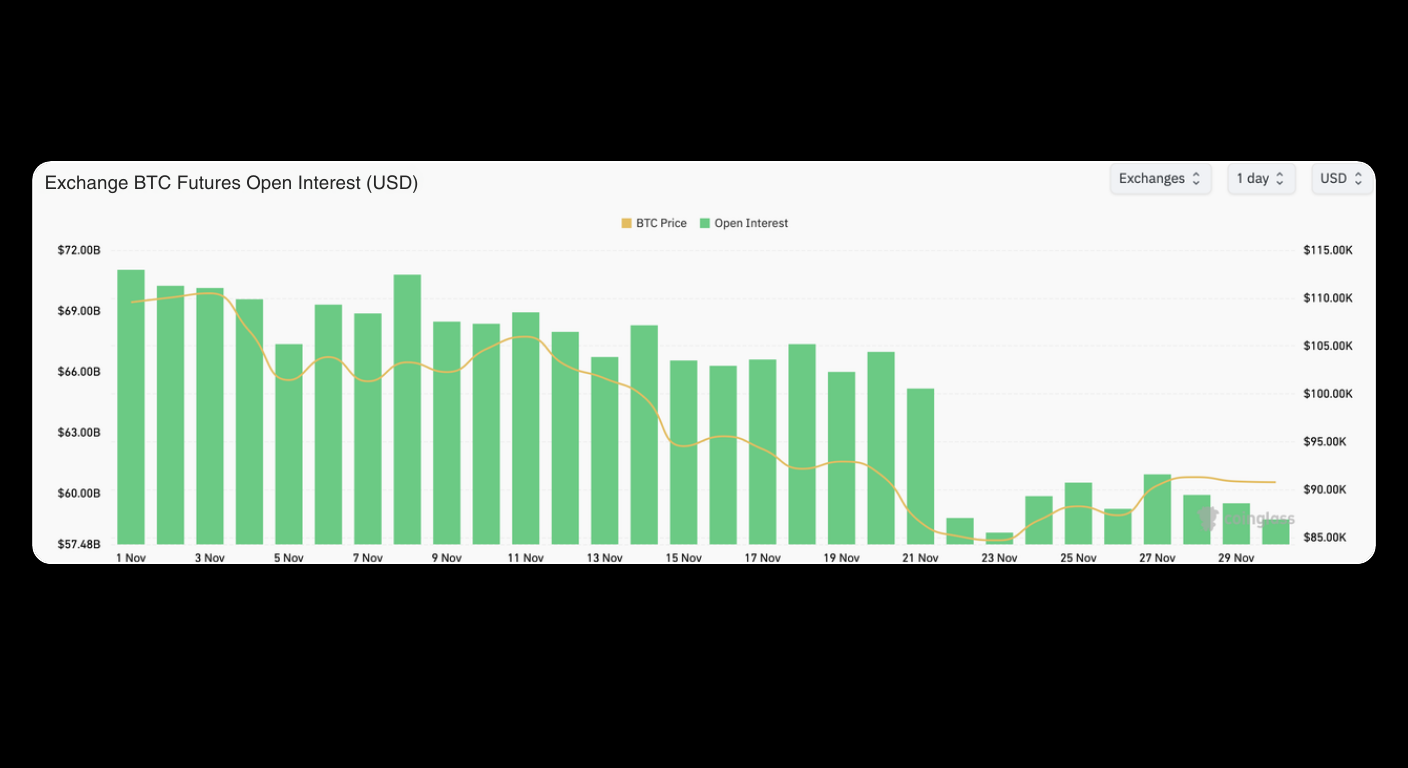

Bitcoin Futures Market

As Bitcoin fell through key psychological levels near $110,000, $100,000, and $90,000, BTC futures open interest stayed relatively stable, suggesting there was no broad, simultaneous reduction in leverage across the market. That changed on November 22, when Bitcoin dropped from roughly $86,000 to $81,000 within one hour. The sharp move triggered a wave of forced liquidations and a rapid deleveraging event.

As a result, total BTC futures open interest fell from about $65.1 billion on November 21 to about $58.7 billion on November 22. After this flush, open interest gradually stabilized and recovered to around $60 billion by the end of November.

Funding rates also remained broadly resilient. Even as Bitcoin broke below multiple support levels, BTC perpetual funding stayed mostly positive, reflecting that bullish positioning did not fully unwind. Funding briefly turned negative only on November 25, 27, and 29. As Bitcoin rebounded toward $92,000 near month end, funding recovered again, ending November around 0.007%.

Bitcoin Institutional Holdings

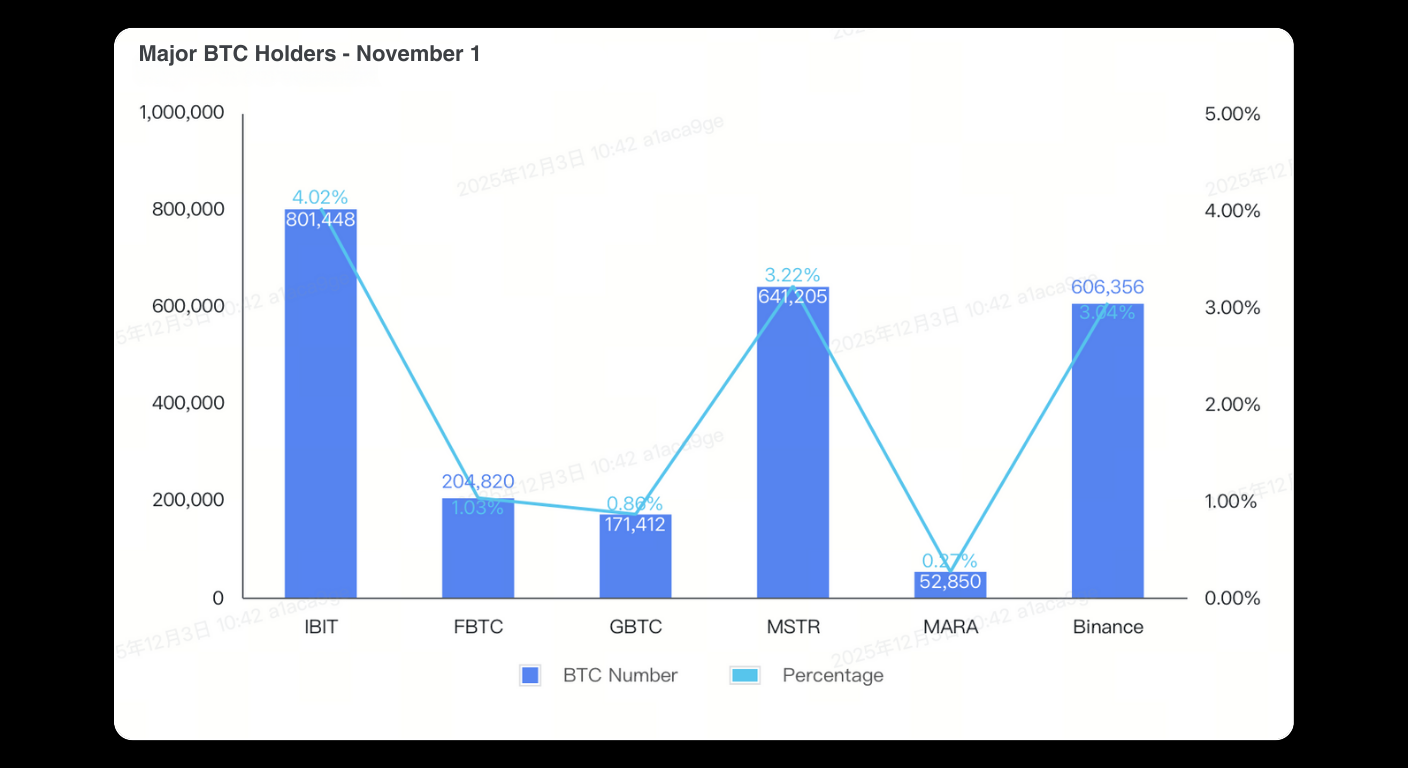

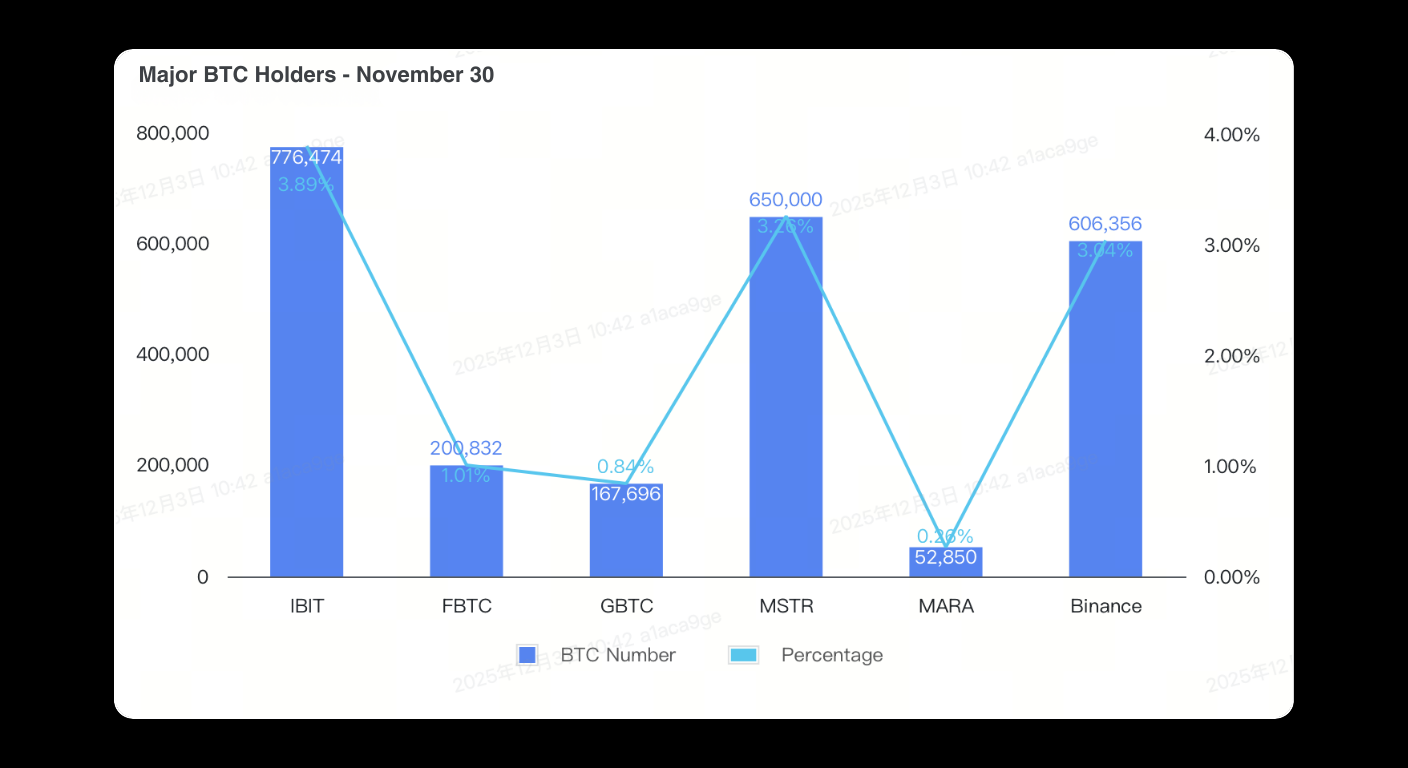

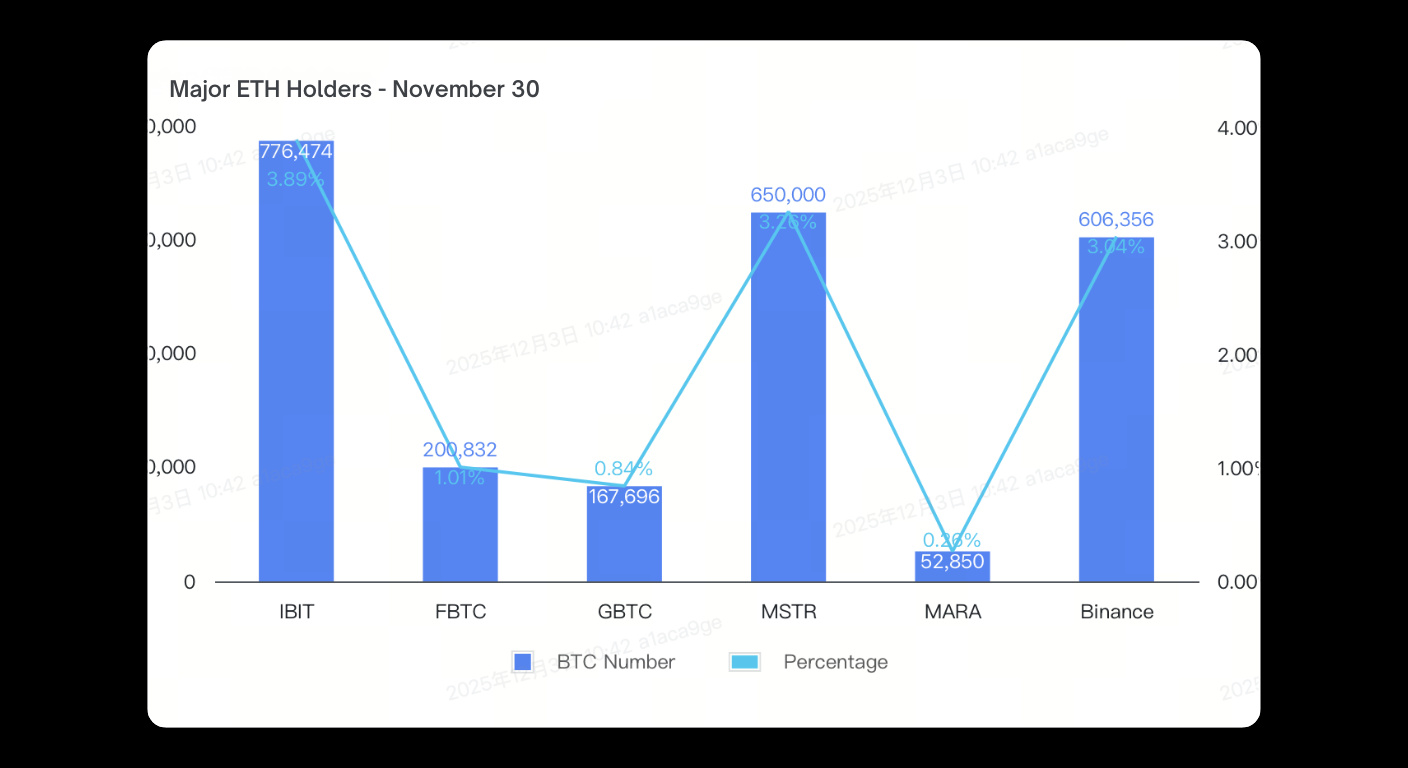

Bitcoin institutional flows weakened in November as the BTC price decline triggered net outflows across spot Bitcoin ETFs. BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s GBTC all saw varying degrees of capital withdrawal.

Among them, IBIT’s Bitcoin holdings decreased by approximately 24,000 BTC during November.

In contrast, MicroStrategy moved against the trend. Despite its share price falling more than 32% during the month, the company increased its Bitcoin exposure, purchasing more than 8,000 BTC in November. This continued accumulation indicates MicroStrategy remains constructive on Bitcoin’s longer term outlook.

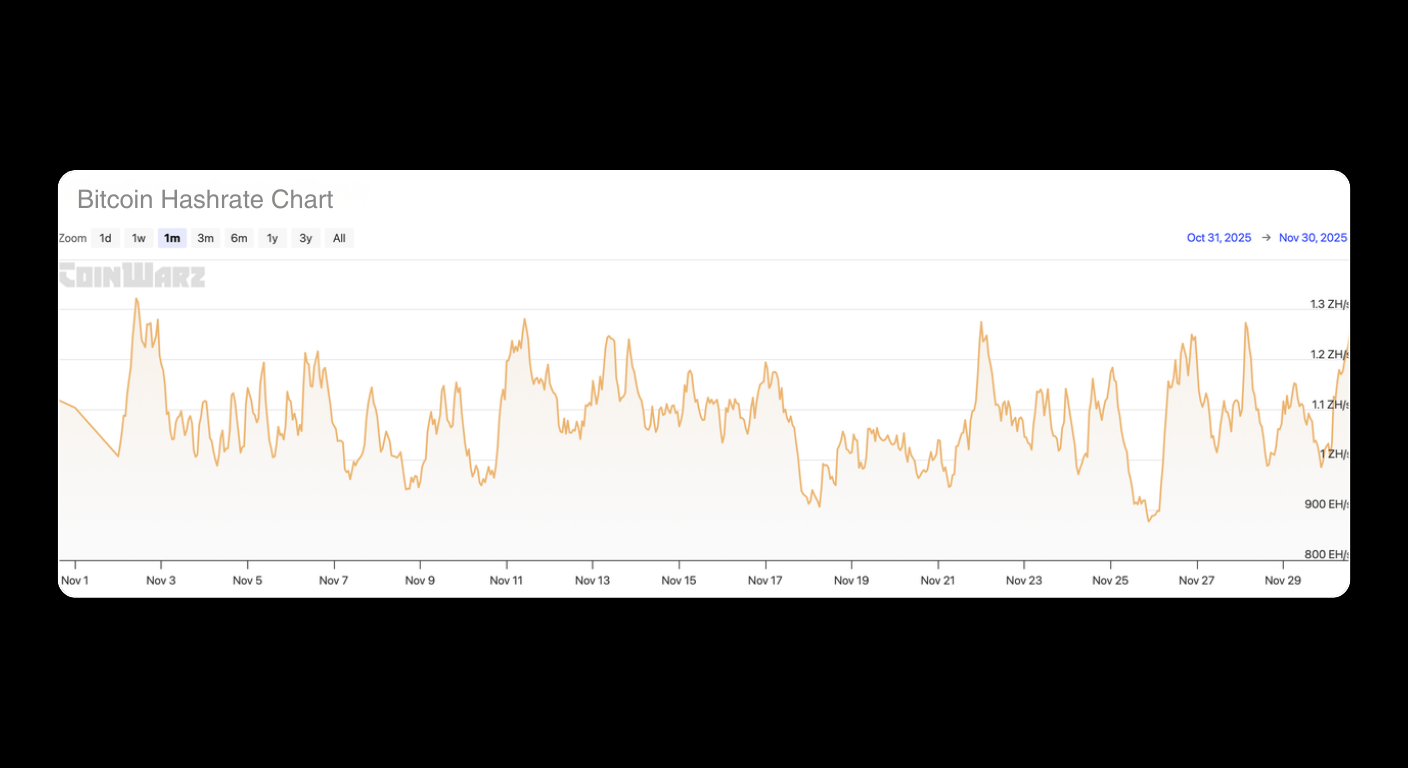

Bitcoin Network Hashrate and Mining Conditions

In November, the Bitcoin network hashrate fluctuated within the 900 EH/s to 1,200 EH/s range. As BTC continued to decline and briefly dipped to around $81,000, mining economics tightened, especially for older, less efficient machines.

Based on estimates referenced from F2Pool and an electricity cost assumption near $0.06 per kWh, the breakeven conditions for older miners deteriorated. Models often cited as higher risk in a weaker price environment include Bitmain Antminer S19, S19j, S19 Pro, and parts of the S17 series, along with Canaan Avalon A12 and A13 series, and Shenma M20 and M30 series. Under these conditions, profitability can compress sharply and approach or fall below shutdown thresholds for less efficient hardware.

If Bitcoin remains below $100,000 for an extended period, some older mining rigs may struggle to stay profitable, increasing the likelihood of miner capitulation, hashrate redistribution, and accelerated replacement with more efficient equipment.

Ethereum: World Computer

Ethereum faced a sharp correction in November as macro driven risk aversion weighed on high beta assets. ETH opened the month near $3,900, then slid to around $2,650 by November 22, a drawdown of more than 32%. Technical levels also mattered. The $3,000 area acted as a key inflection point during the selloff. ETH briefly lost that level as momentum weakened, but recovered above $3,000 into month end, signaling early signs of stabilization.

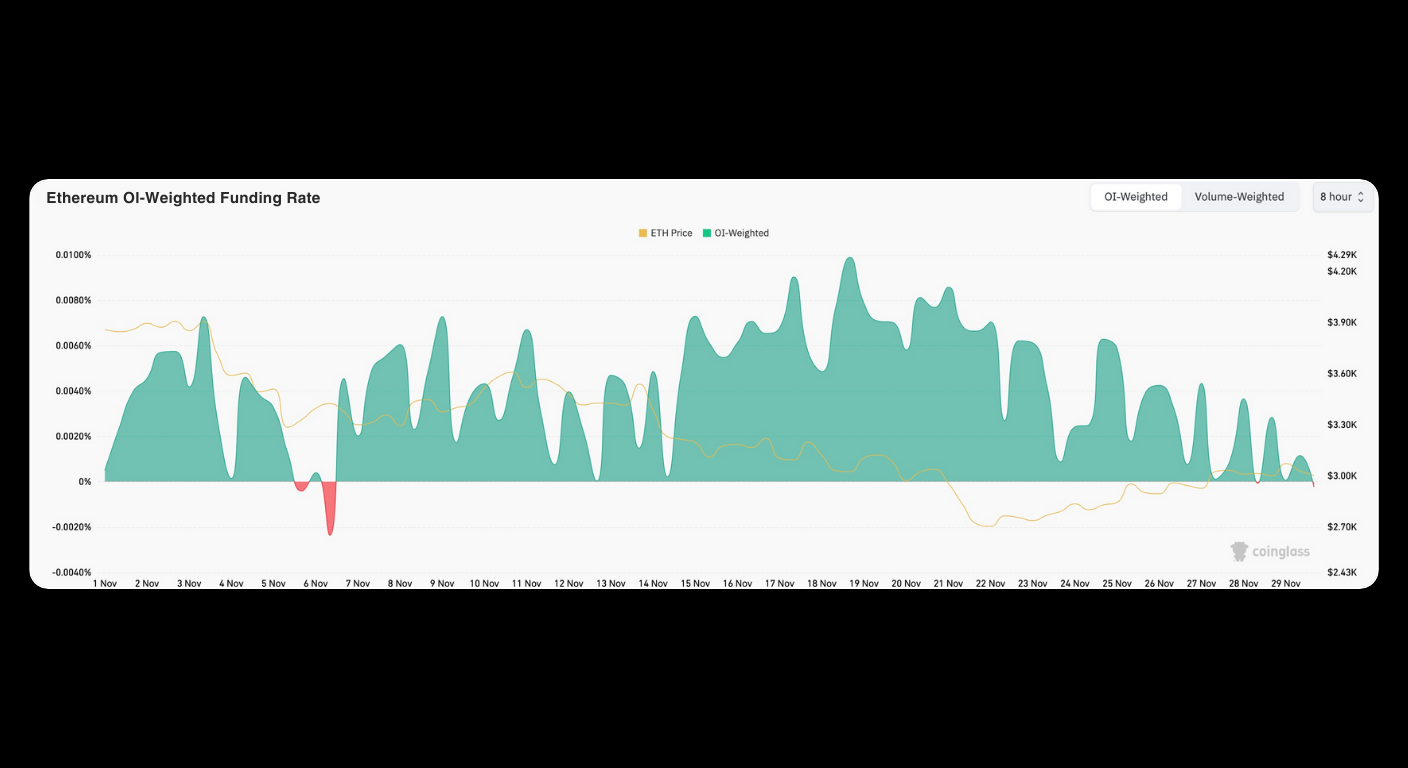

Ethereum Futures Market

From November 1 to November 22, ETH futures open interest declined alongside the downtrend in ETH price. The largest contraction occurred around November 21 to 22, when total ETH futures open interest dropped by more than $2 billion. This suggests long positions reduced exposure and overall risk appetite cooled quickly during the selloff.

As ETH rebounded later in the month, open interest stabilized around $35 billion, indicating that market leverage returned to a more balanced level.

Funding rates remained comparatively resilient. Aside from a brief dip into negative territory on November 6, ETH perpetual funding stayed positive through most of the consolidation phase from November 10 to 22. On November 18, funding rose to roughly 0.0099%, the highest level in nearly two months, suggesting that bullish positioning held up even while spot prices were under pressure.

Ethereum Institutional Holdings

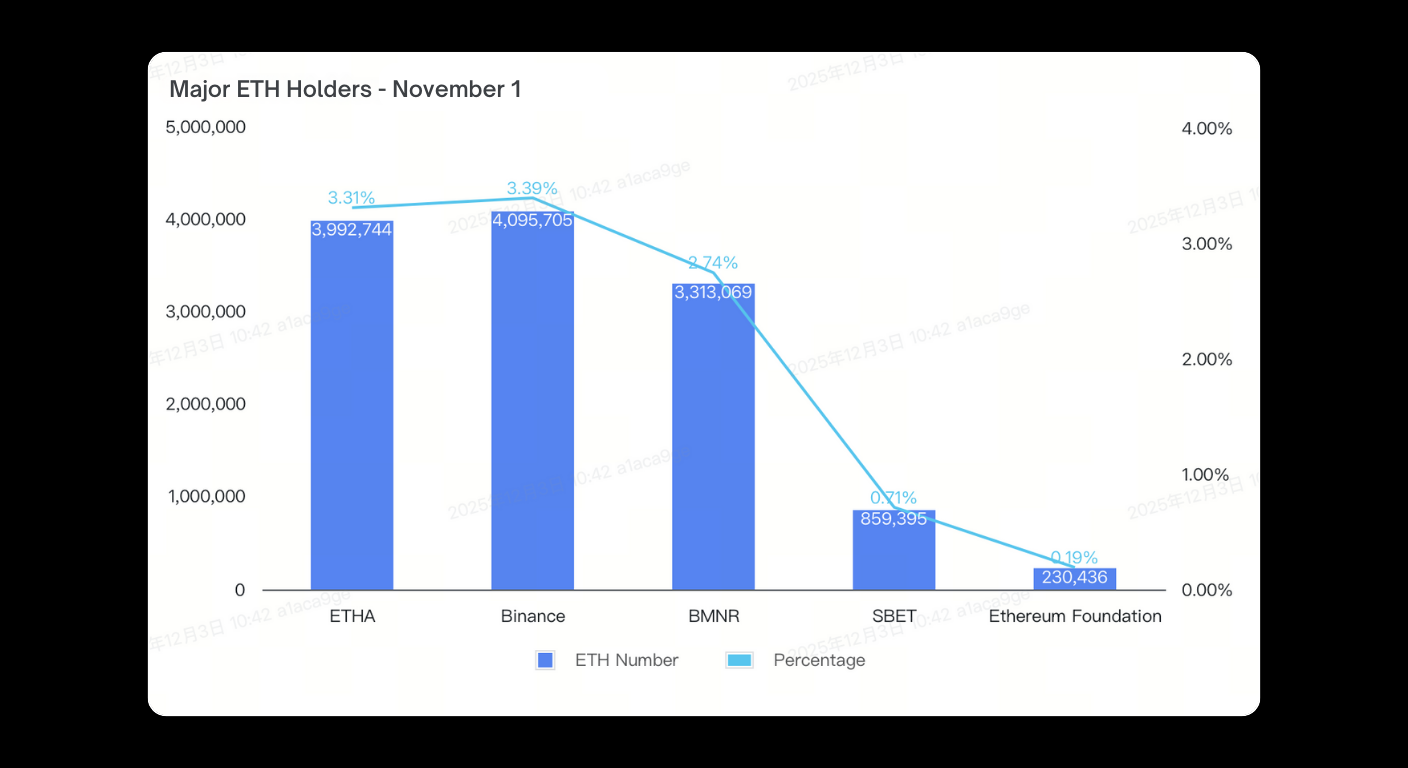

Institutional positioning showed a clear split in November. As ETH fell from about $3,900 to $2,650, some on chain treasury style buyers continued accumulating, while spot Ethereum ETF products saw continued selling pressure. Overall flow patterns were broadly similar to what was observed in the Bitcoin ETF market during periods of price weakness.

Bitmine Immersion Tech (BMNR) increased its ETH holdings five times in November, adding 316,000 ETH. This reportedly pushed its ETH holdings above 3% of total supply for the first time, signaling strong long term conviction.

By contrast, BlackRock’s ETHA recorded net outflows during the drawdown, with holdings decreasing by 321,000 ETH in November. The divergence highlights how ETF flows and corporate style accumulation can move in different directions during risk off conditions.

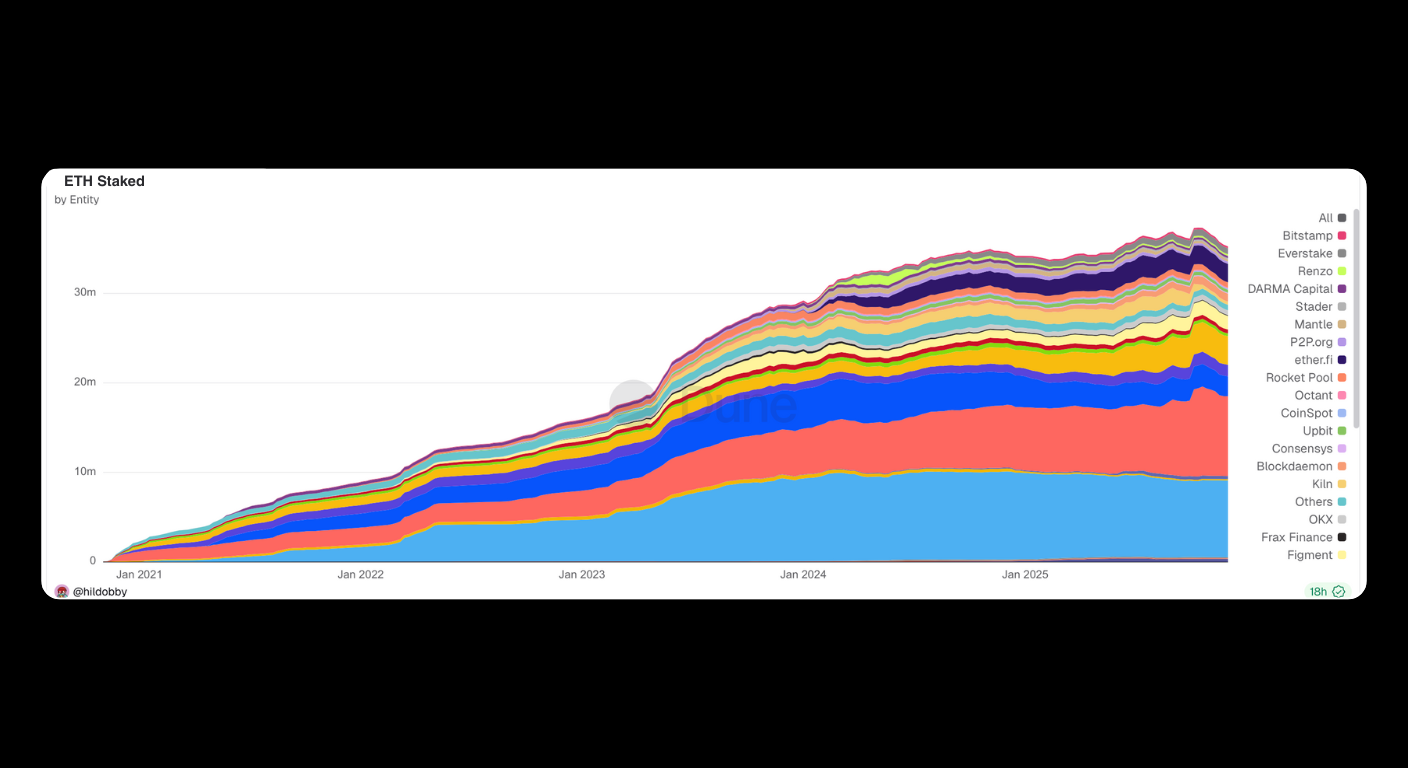

Ethereum Staking

By the end of November, total staked ETH declined to about 35.25 million ETH, down roughly 1.34 million ETH from the start of the month. This marked the largest monthly staking drawdown of the year. As ETH dropped from $3,900 to $2,650, some participants likely prioritized liquidity and reduced exposure by unstaking.

From a platform perspective, Lido’s staked ETH was broadly stable, edging from about 8.58 million ETH to about 8.579 million ETH. The minimal change suggests sticky deposits and relatively steady user behavior.

Staking balances on centralized exchanges declined more noticeably. One major exchange saw a reduction of about 111,000 ETH, while Coinbase decreased by about 137,000 ETH. This pattern is consistent with a market environment where traders reduce risk and leverage during heightened volatility.

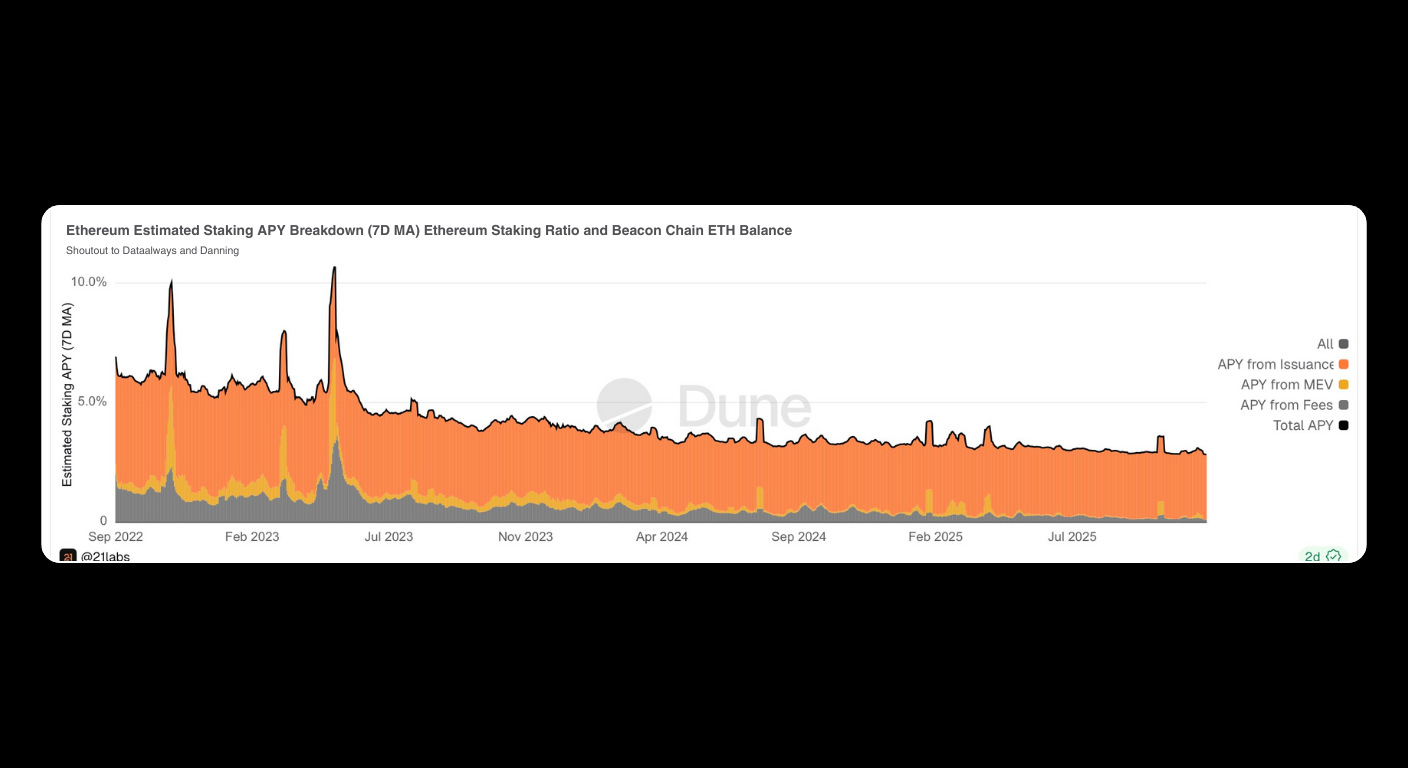

ETH staking yields held steady in November, with annualized returns staying in the 2.85% to 3.10% range. Protocol issued staking rewards continued to make up the majority of total yield, while tips and MEV contributed a smaller share.

On-Chain Data

This section reviews November’s key on-chain metrics across major public blockchains, DeFi lending protocols, spot DEX activity, perpetual DEX volume, launchpad trends, and prediction market growth.

Mainstream Public Blockchains

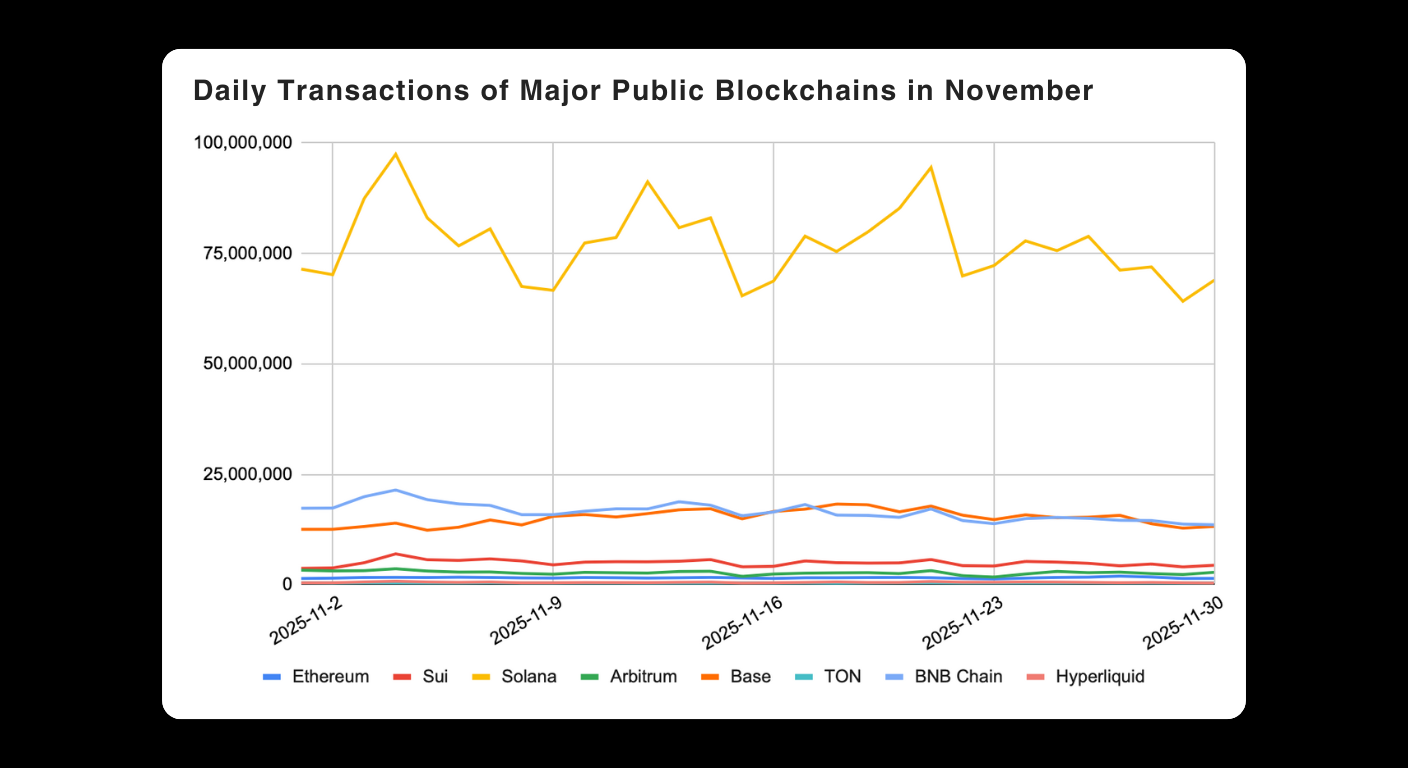

In November 2025, Solana continued to lead in throughput, averaging about 77.7 million transactions per day, far ahead of other major networks. BNB Chain ranked second at about 16.45 million daily transactions, followed by Base at about 15.09 million.

Following the broader crypto market correction, overall on-chain activity cooled compared with the previous month, reflecting softer user demand and reduced trading intensity.

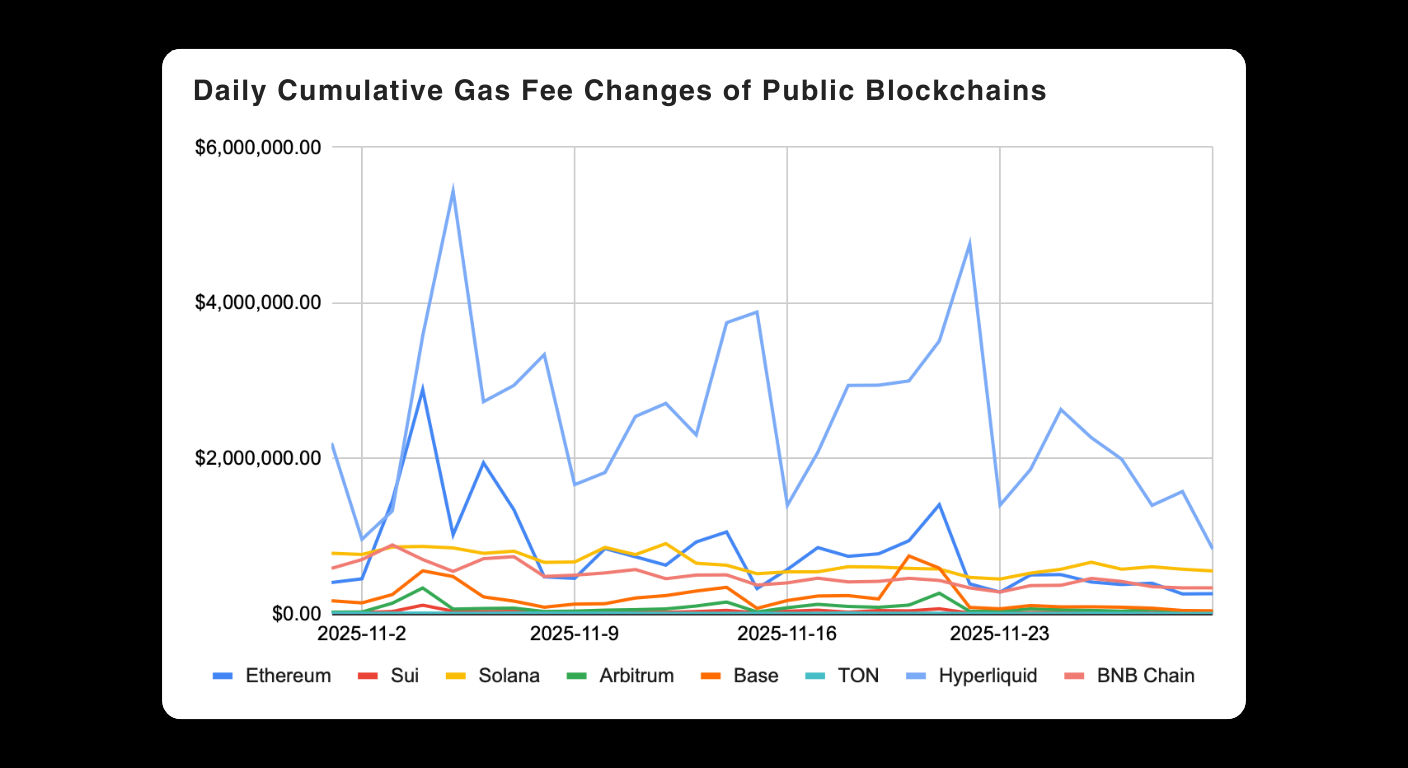

On the fee side, Ethereum remained the top network by value captured, averaging about $780,000 per day in gas fees, supported by steady ecosystem usage and higher value on-chain activity. Hyperliquid and Solana ranked second and third, respectively, in average daily fees.

DeFi Lending

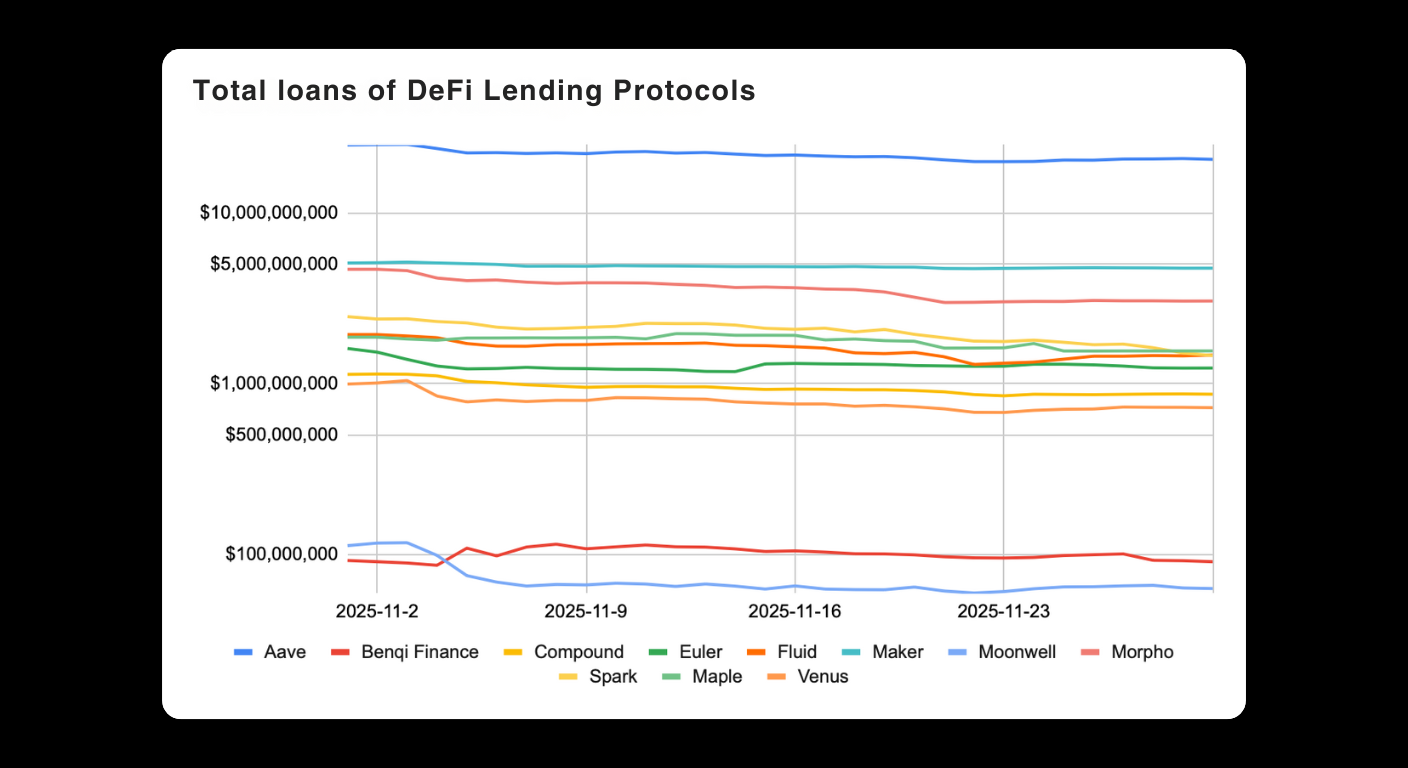

DeFi borrowing activity came under pressure in November as risk appetite weakened. Aave, the leading DeFi lending protocol by borrowing scale, saw total borrows decline from about $25 billion at the start of the month to about $20.60 billion by month end, a 17.67% decrease.

Borrowing levels also fell across other major protocols:

- Compound: down 23.51%

- Maker: down 6.64%

- Spark: down 40.80%

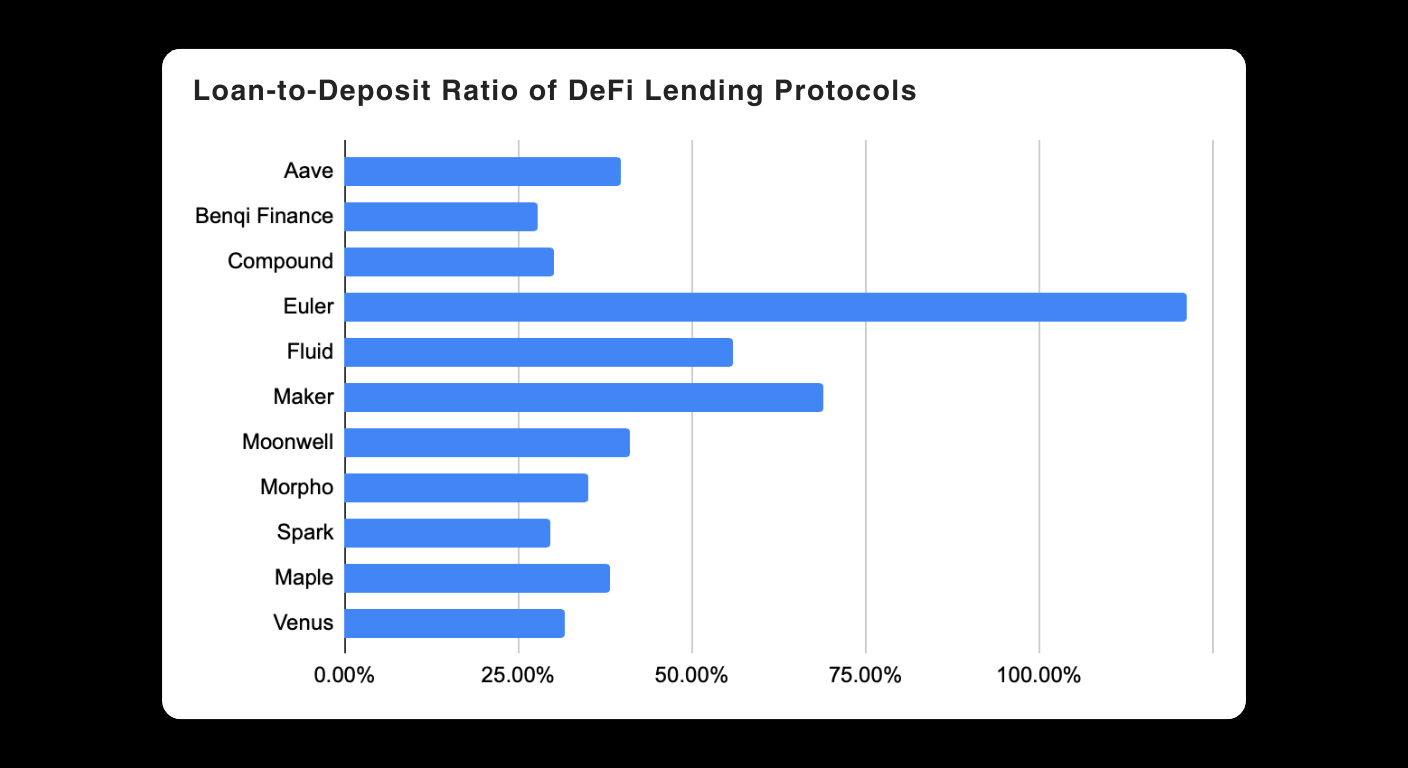

From a risk perspective, Euler’s deposit to loan ratio rose to 121% by the end of November, which can signal rising repayment pressure as the lending market de risks. Most other major lending protocols remained below 70%, indicating a relatively higher safety buffer.

Spot DEX and Perpetual DEX

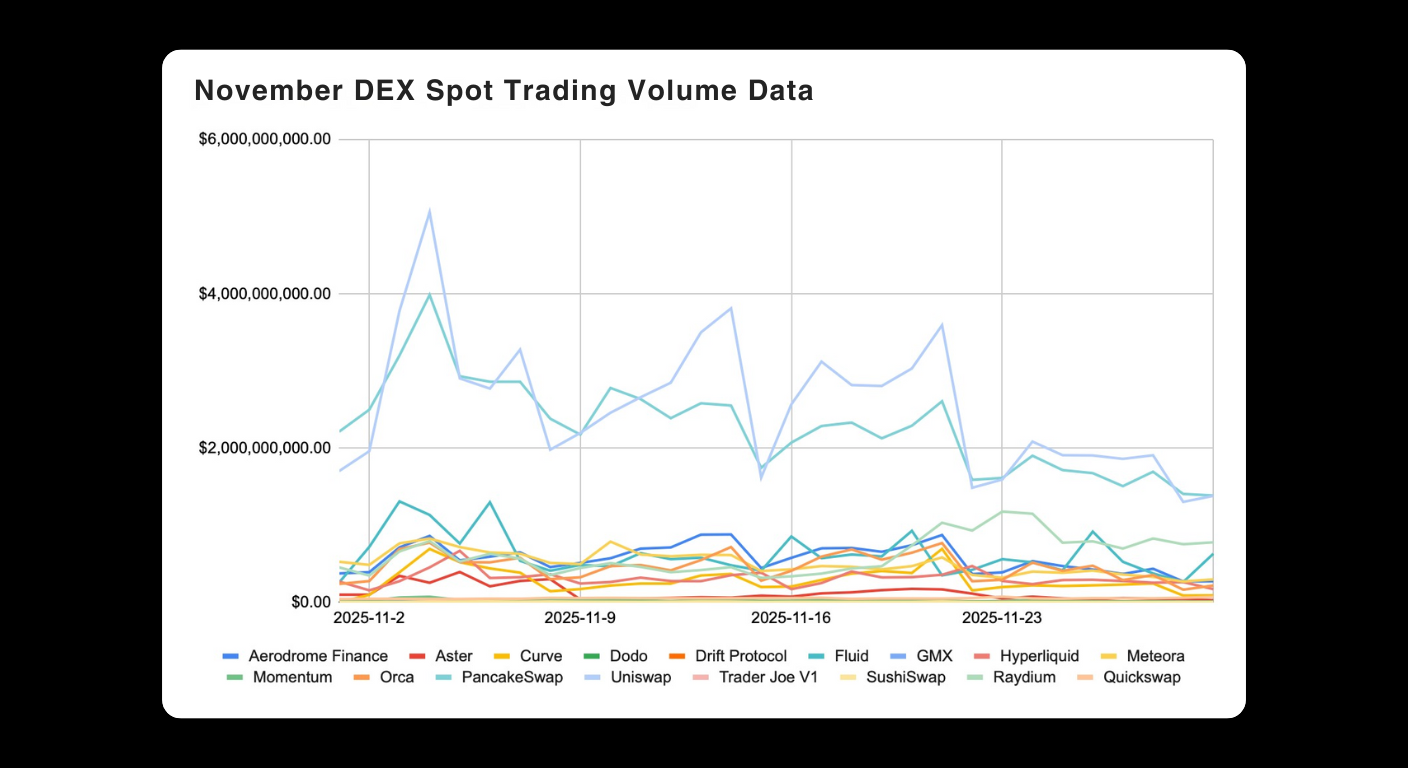

Spot DEX activity remained concentrated at the top. Uniswap returned to first place in November with about $2.52 billion in average daily spot trading volume. PancakeSwap ranked second with about $2.26 billion, creating a clear lead over the rest of the market.

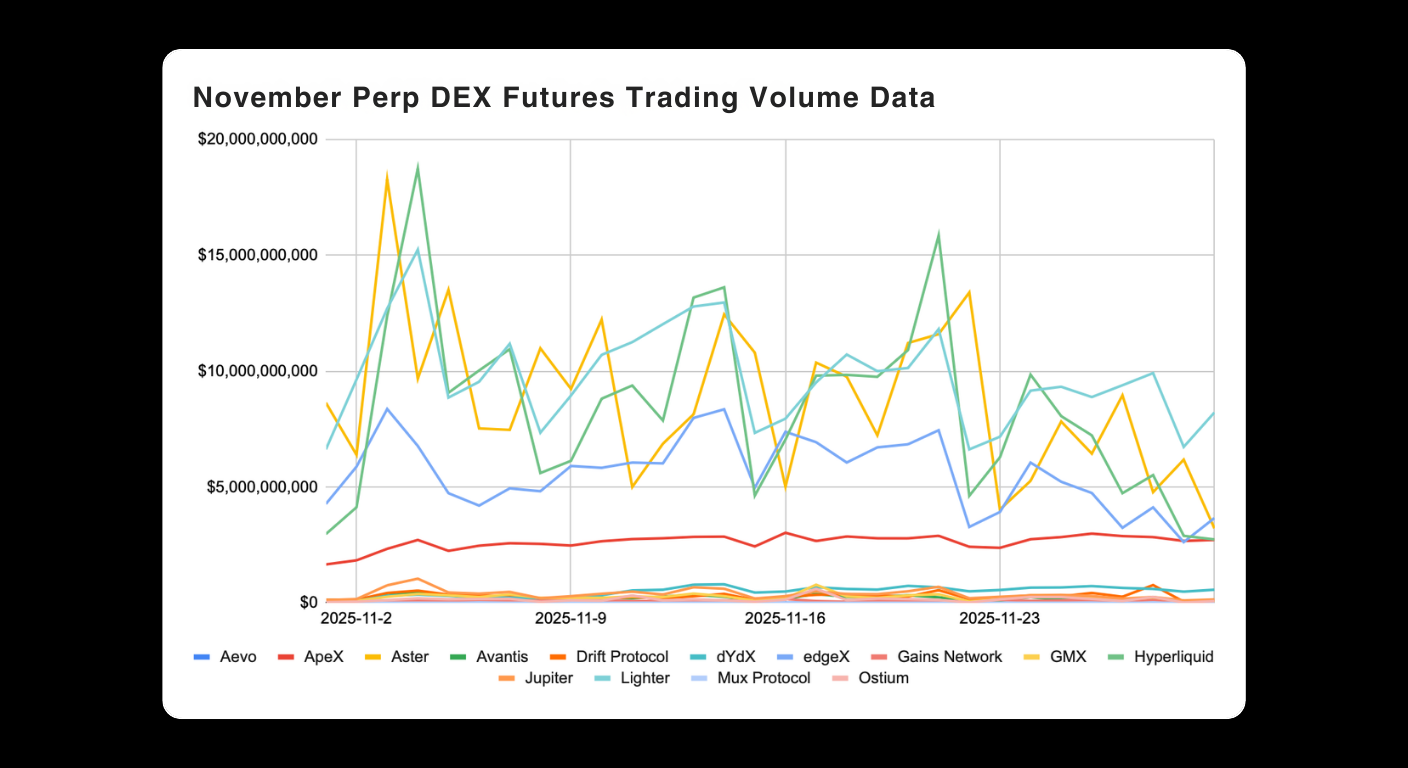

In perpetual DEX trading, the competitive landscape tightened. Hyperliquid, Lighter, and Aster formed a three way race, with an average daily perpetual volume of:

- Hyperliquid: $9.74 billion

- Lighter: $8.74 billion

- Aster: $8.41 billion

Market share remained close, suggesting sustained competition in decentralized perpetual futures trading.

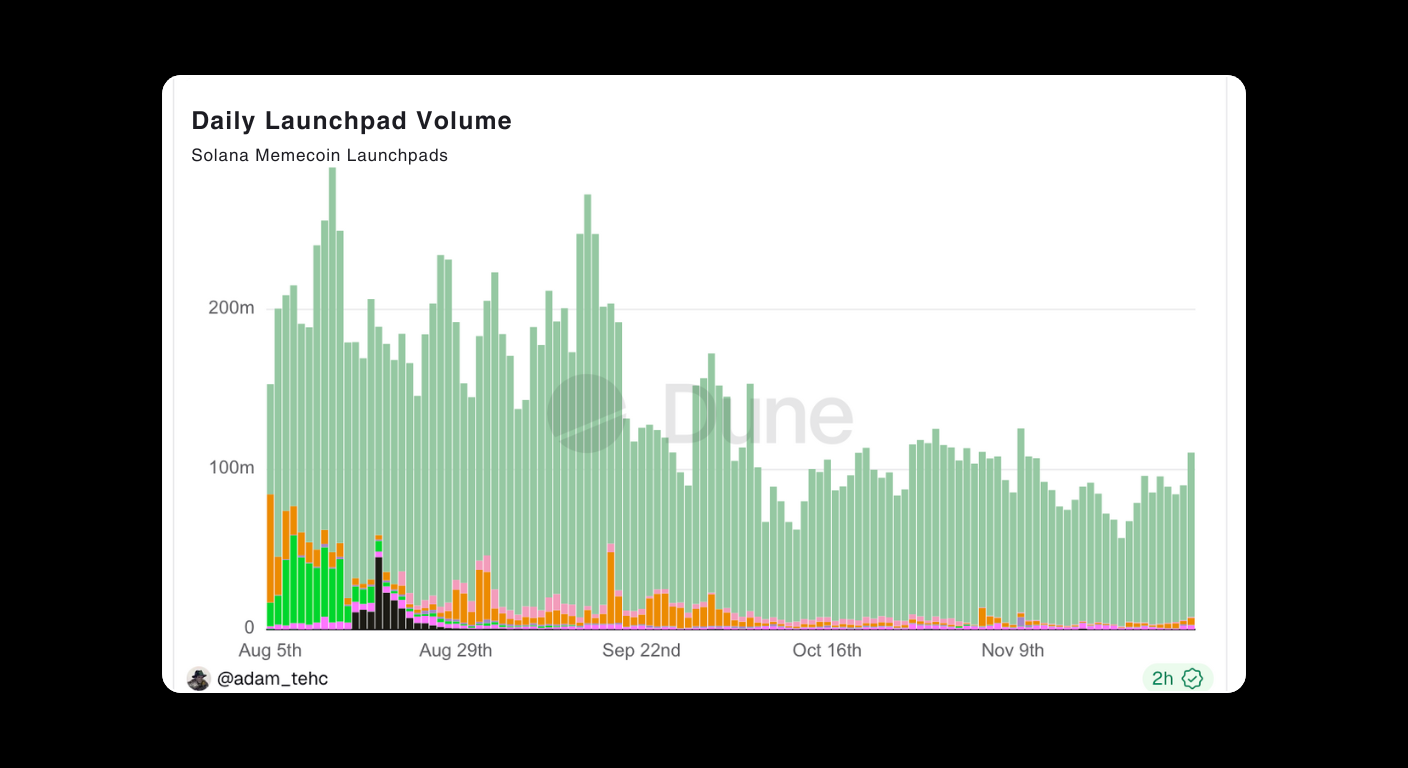

Solana Memecoin Launchpads (Volume and DEX Migrations)

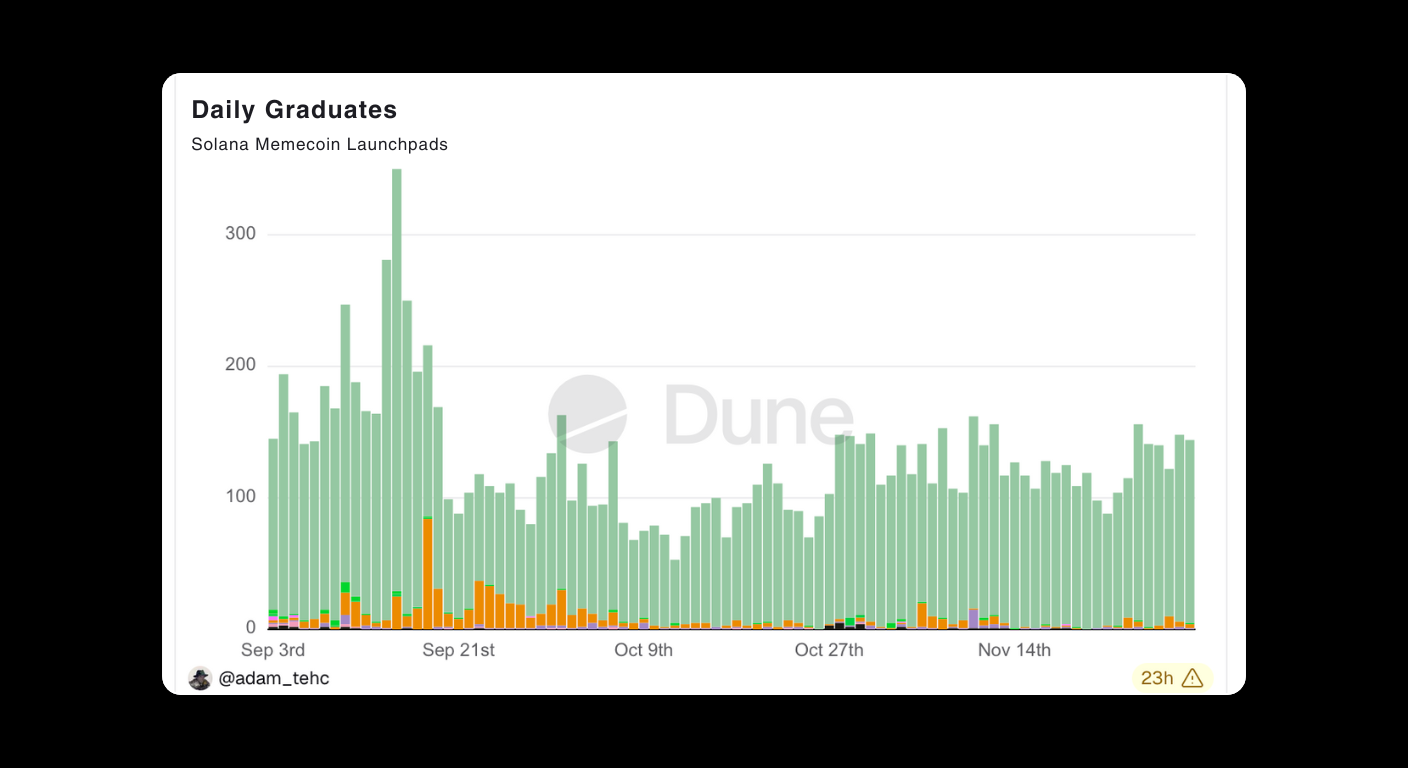

Memecoin launchpad activity was broadly stable in November, with no major acceleration in breakout launches. On Pump.fun, the number of tokens that “graduated” with a market value above $69,000 held at around 100 per day. By comparison, graduation counts on other launchpads remained relatively limited, indicating that broader market attention and breakout momentum for new meme tokens stayed muted.

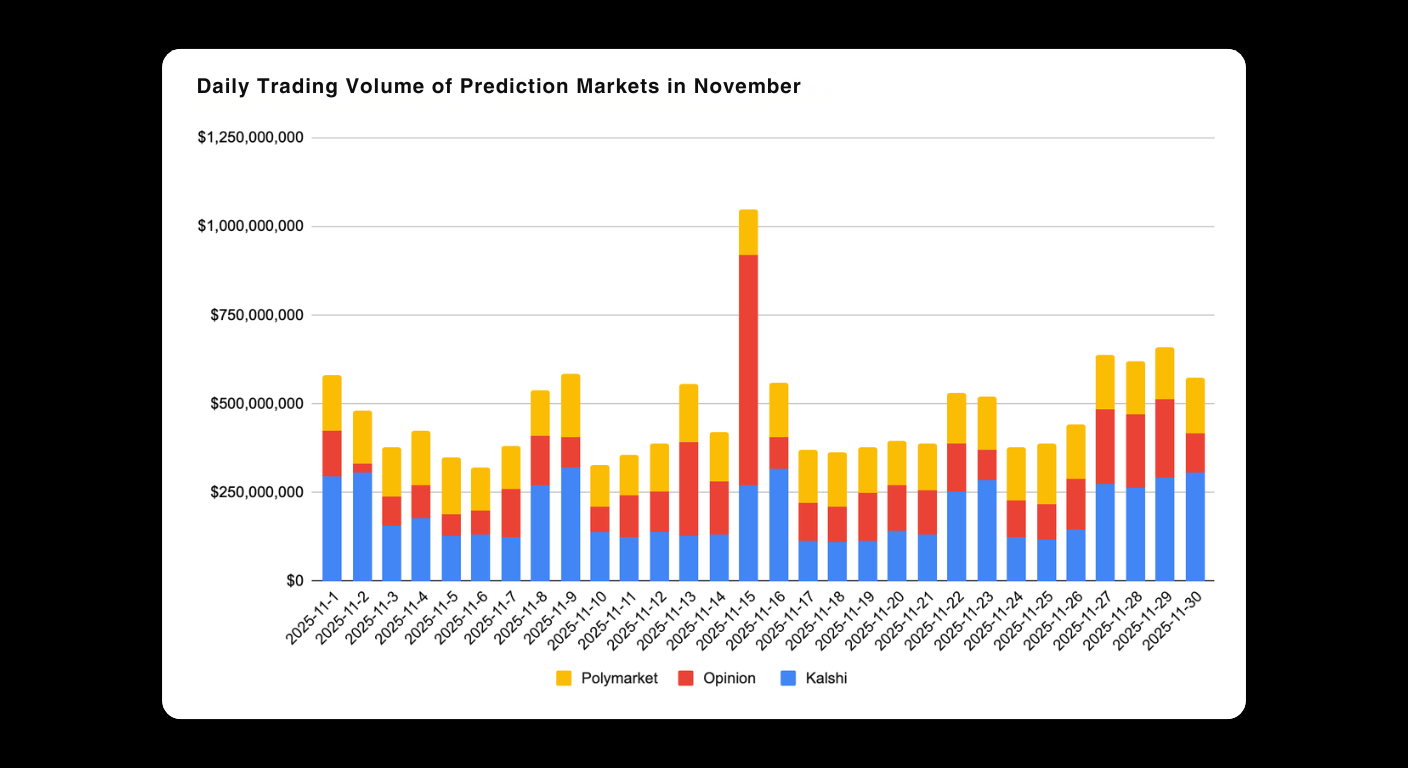

Prediction Markets

Prediction markets continued to gain traction in Q4 2025. Kalshi and Polymarket both set new monthly trading volume records in November. Kalshi’s monthly volume rose from $4.40 billion in October to $5.80 billion in November, a 32% month over month increase. Polymarket also posted strong activity, reaching $4.32 billion in monthly volume.

Opinion, a prediction market on BSC, recorded meaningful growth as well, with November trading volume reaching $4.19 billion, ranking third behind Kalshi and Polymarket. Overall, the data points to an increasingly competitive, multi-chain prediction market landscape.

Product Updates and Ecosystem Developments

November brought several notable product and protocol updates across Ethereum, XRP Ledger, and the broader DeFi ecosystem. Key themes included Ethereum Layer 2 interoperability, ongoing exploration of native staking models, and renewed governance discussions around protocol fee mechanisms and infrastructure services.

Ethereum Interoperability Layer

On November 19, Ethereum’s account abstraction team introduced a proposal commonly referred to as the Ethereum Interoperability Layer (EIL). The goal is to make interacting across multiple Ethereum Layer 2 networks feel as seamless as using a single chain. In practice, the proposal emphasizes a unified experience across rollups, where users can transact across L2s with fewer repeated approvals and a simpler workflow.

The proposal is aligned with the principles behind ERC 4337 account abstraction and aims to improve cross rollup UX without introducing new trust assumptions. It also aims to preserve Ethereum’s core properties, including self custody, censorship resistance, and verifiable on chain execution, while making L2 usage more intuitive.

More broadly, the initiative reflects a growing push to reduce friction created by a fragmented L2 landscape, where users often need to manage assets across different networks, bridge repeatedly, and navigate varying assumptions and tooling.

Ripple CTO Discusses a Model for Native XRP Staking

On November 19, Ripple CTO David Schwartz discussed a new model that explores the possibility of adding native staking to the XRP Ledger. XRP Ledger currently uses a consensus mechanism distinct from proof of stake networks such as Ethereum and Solana. Introducing staking on XRPL would represent a meaningful shift in how incentives and rewards could work within the ecosystem.

Schwartz noted that any native staking design would need to address key questions, including how staking rewards are sourced and distributed fairly. It would also need to consider how staking incentives could coexist with XRP’s token economics and what the longer term governance implications might be.

With broader market interest in XRP increasing, discussions around native staking may become an important part of the XRPL roadmap, especially as the ecosystem evaluates new utility and participation models.

Uniswap Fee Switch Proposal Moves Forward With Contract Deployment

On November 23, Uniswap Labs and the Uniswap Foundation presented a proposal related to activating a protocol fee mechanism, commonly referred to as the fee switch. The proposal focuses on refining incentives across the Uniswap ecosystem and explores how protocol fees could be used within governance approved parameters.

The proposal also references changes connected to Unichain, including aligning certain fee related mechanics and improving liquidity provider outcomes through more efficient fee routing and incentive structures.

In addition, the proposal includes a plan to destroy 100 million UNI from the foundation treasury, representing the amount of UNI that would have been expected to be burned if protocol fees had been enabled from the beginning. It also outlines operational changes that shift more ecosystem execution toward Labs, with the foundation continuing to support development and growth through its funding role.

UniSat API Adds Low Fee Transaction Support and Launches a Discount Plan

On November 28, UniSat announced that its developer API now supports a sub 1 sat/vB low fee transaction mode and introduced a limited time API pricing discount plan. The update is designed to help developers reduce transaction costs on Bitcoin and related ecosystems such as Fractal.

With this feature, developers can broadcast transactions, run UTXO queries, and perform inscription style operations through the API at lower fee targets. UniSat also noted that the service can process up to 500 low fee UTXO records in a single request, aiming to provide a more cost controlled workflow for developers.

As a long running Bitcoin ecosystem infrastructure provider, UniSat also continues to support broader on chain data and tooling needs across popular Bitcoin based protocols, including Ordinals, Runes, and Alkanes, with tiered service plans for different user segments.

Trading Signals and Market Narratives

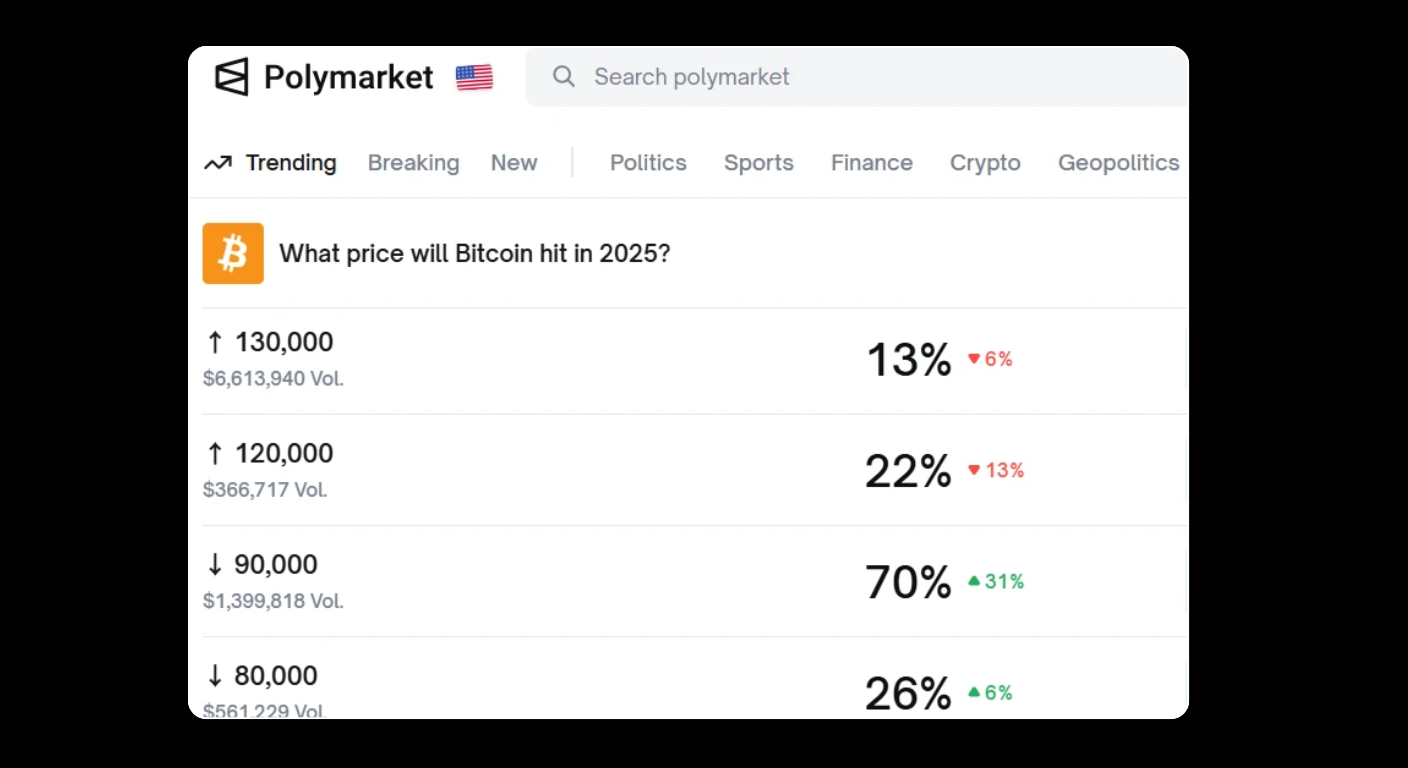

Polymarket: Odds of Bitcoin Dropping Below $90,000 Rise to 70%

On November 14, data from Polymarket showed a sharp shift in market expectations. The implied probability of Bitcoin falling below $90,000 within the year rose to 70%. The same market priced a 26% probability of Bitcoin falling below $80,000, and a 22% probability of Bitcoin breaking above $120,000.

As of November 14, total trading volume for the prediction pool exceeded $4.75 million. The bearish scenario later played out. On November 18, Bitcoin dropped to around $89,508, breaking below $90,000 for the first time in November. The decline extended on November 21, with BTC touching approximately $81,878, marking a new low since April 2025.

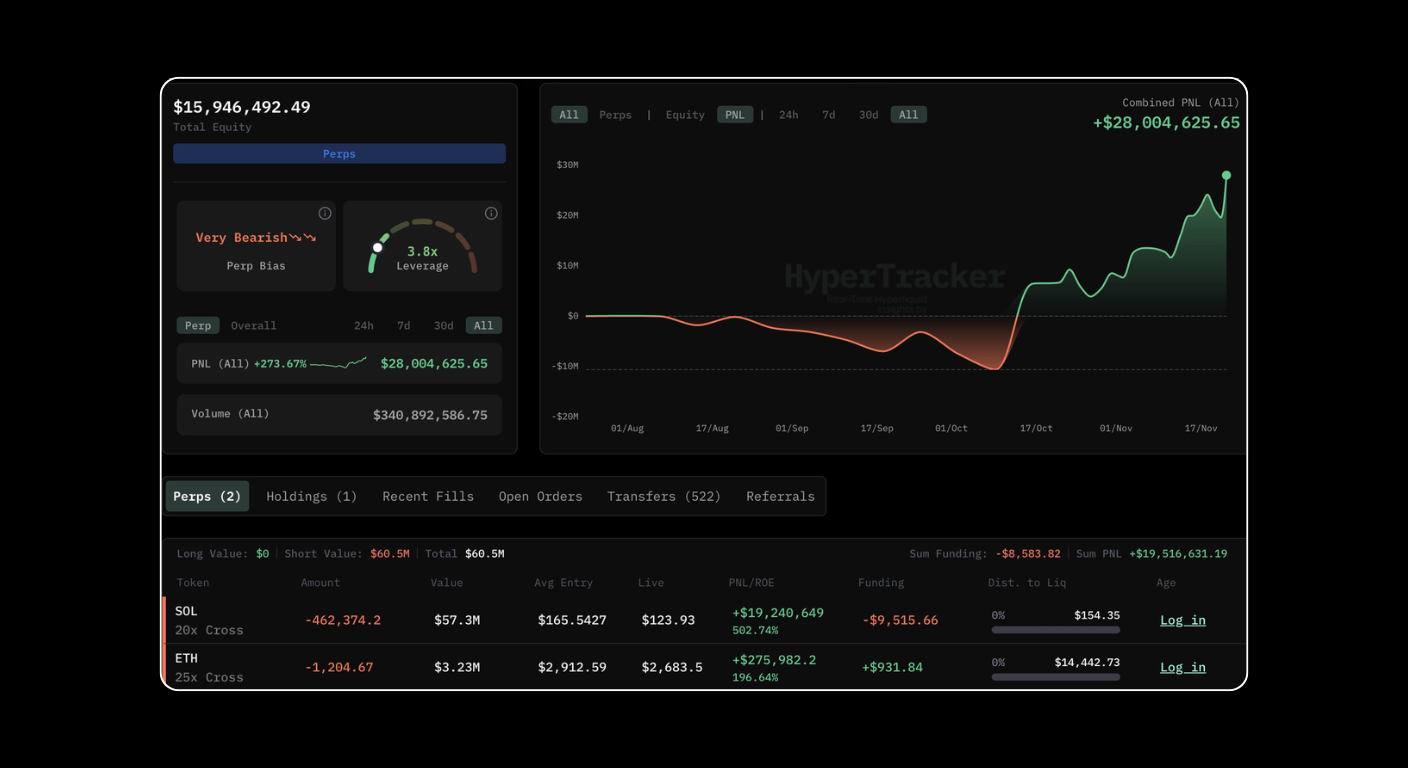

Hyperliquid: Whale Short on ETH and SOL Records $19.51 Million in Gains

On November 21, on-chain monitoring data reported that a whale address 0x35d115 generated approximately $19.51 million in profit by shorting ETH and SOL on Hyperliquid.

At the time of tracking, the whale’s short positions included:

- ETH: 1,204.67 ETH, notional value around $3.23 million

- SOL: 462,374.2 SOL, notional value around $57.30 million

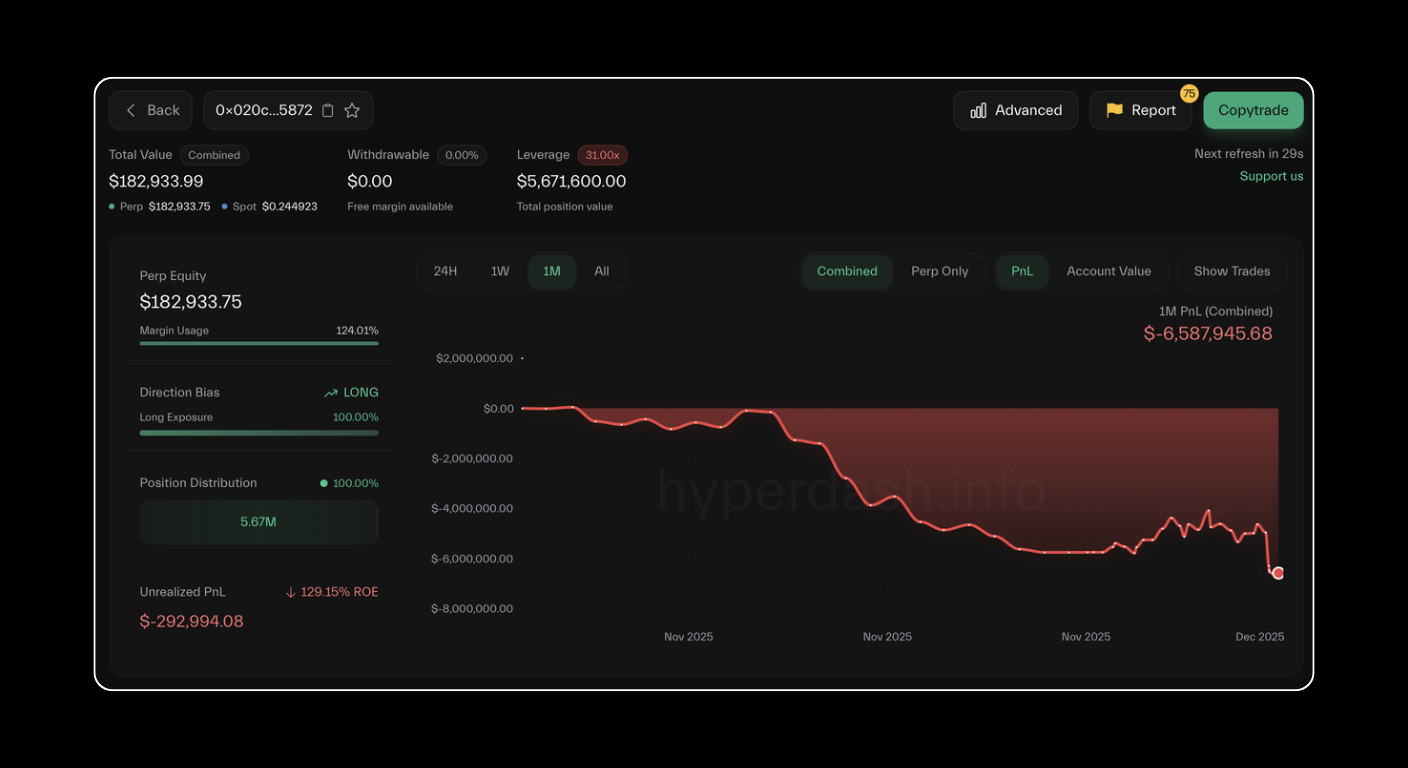

“Machi Big Brother” Becomes a Contrarian Indicator After Repeated Liquidations

On-chain monitoring also highlighted another heavily watched trader, commonly known as “Machi Big Brother” (Jeffrey Huang). As ETH fell below $2,700 on November 21, his long positions were liquidated again.

After this liquidation event, he reportedly held roughly 100 ETH in remaining long exposure, with a position value around $270,000 and an estimated liquidation price near $2,655. Between November 1 and November 19, his positions on Hyperliquid were liquidated 71 times, and his total losses in November reportedly reached $4.63 million.

Policy and Regulation Watch

SEC Chair Paul Atkins Outlines a “Token Taxonomy” Approach to Crypto Regulation

On November 13, U.S. SEC Chair Paul Atkins discussed a plan to develop a token taxonomy that could reshape how crypto assets are evaluated under U.S. securities rules. The approach remains tied to the long-standing Howey investment contract analysis, but emphasizes that a crypto asset may be associated with an investment contract at one stage and later evolve as the network matures.

Atkins also signaled that the SEC is preparing proposals that could consider allowing certain tokens linked to investment contracts to trade on platforms that are not regulated by the SEC, depending on how the framework is defined.

Switzerland Delays Crypto Tax Information Sharing Until 2027

On November 28, Switzerland announced that it will delay implementation of rules for the automatic exchange of crypto account information with foreign tax authorities until 2027. Swiss authorities also indicated they are still determining which countries will participate in the data exchange.

Switzerland plans to incorporate the Crypto Asset Reporting Framework (CARF) into domestic law, with the legal framework targeted to take effect on January 1, 2026, while operational rollout is postponed. CARF was introduced by the OECD in 2022 to support cross-border tax reporting for crypto assets. According to the report, 75 jurisdictions, including Switzerland, have committed to implementing CARF over the next two to four years, while some countries have not joined.

KakaoBank Advances a Korean Won Stablecoin Plan

On November 26, KakaoBank, a bank owned by South Korean internet company Kakao Corp, reportedly advanced preparations tied to a Korean won-backed stablecoin. The bank is working on a smart contract-based foreign exchange settlement system, which could provide technical groundwork for future stablecoin issuance and related on-chain financial services.

The reported work includes smart contract execution, token standard support, node operations, and backend systems for issuing and managing digital assets. In June 2025, Kakao Group’s payment unit KakaoPay filed for six stablecoin code symbols, including examples such as PKRW and KKRW, which combine KakaoPay branding with the Korean won.

Brazil Issues a New Crypto Regulatory Framework With Capital Requirements

Brazil’s central bank announced a regulatory framework for crypto service providers, requiring firms to obtain licenses and comply with foreign exchange and capital market rules. The framework also introduces reporting requirements for international transactions.

Under the rules, the minimum capital base for crypto companies is 10.8 million reais (about $2 million), and certain business models must hold at least 37.2 million reais (about $7 million). The framework also requires foreign platforms to establish local entities in Brazil to serve customers.

The rules include provisions related to stablecoins and cross-border transfers, set a $100,000 cap per self-custodial wallet transaction, and require monthly transaction reporting beginning in May. The framework is scheduled to take effect on February 2, 2025, and existing firms will have nine months to complete compliance.

Security Firewall (Crypto Security Incidents and DeFi Exploits)

In November, the crypto industry recorded 15 security incidents, with total reported losses of about $171 million, up roughly 10% month over month. One of the most closely watched events involved Upbit, where more than $30 million in assets were reported stolen. After the incident, the team conducted a platform wide review of its network and wallet systems and fixed issues linked to certain on-chain transactions and security vulnerabilities.

Several other major incidents were also reported during the month. Balancer V2 suffered the largest disclosed loss, with damages exceeding $120 million. The root cause was linked to a rounding issue in a Stable Pool “exact output” swap path. Under extremely illiquid conditions, the error could be amplified, allowing an attacker to manipulate pool invariants and distort BPT pricing, ultimately extracting assets at an unfavorable effective cost to the pool.

Major Security Incidents in November

| Date | Project | Reported Loss | Summary |

| November 3 | Balancer V2 | $121.1 million | Vulnerability attack impacting the composable stable pool across Ethereum, Arbitrum, Base, Optimism, and Polygon. |

| November 13 | Hyperliquid | $4.95 million | Arkham flagged suspected deliberate attacks on HLP on Hyperliquid, resulting in bad debt losses. |

| November 20 | GANA Payment | $3.10 million | On-chain analyst ZachXBT reported an attack on BSC payment project GANA Payment, with losses around $3.10 million. |

| November 21 | Aerodrome | $700,000 | Aerodrome stated that Velodrome and Aerodrome centralized domains were hijacked due to internal security issues at NameSilo. |

| November 28 | Upbit | Over $30 million reported; estimated loss about 445 million KRW also cited | Reports noted a theft exceeding $30 million. Upbit also disclosed security issues tied to on-chain transactions and private key related vulnerabilities, with an estimated loss around 445 million KRW in the incident summary. |

| November 30 | Yearn Finance | $9.0 million | Attackers drained funds via unlimited minting of yETH; about 1,000 ETH was reported transferred to Tornado Cash. |

December Outlook and Key Dates to Watch

December brings a tight cluster of macro catalysts, major crypto conferences, and policy developments that can influence near term volatility across Bitcoin (BTC), Ethereum (ETH), and broader altcoin markets. Below are the key dates to track.

Key Events Calendar

| Date | Event | Why it matters |

| Dec 2 to 3 | India Blockchain Week Conference (Bengaluru) | A major Asia focused Web3 gathering that often drives ecosystem announcements, partnerships, and narrative momentum. |

| Dec 2 to 3 | Blockchain for Europe Summit (Brussels) | A policy heavy event centered on digital assets, compliance, and Europe’s evolving regulatory framework, including MiCA related discussion. |

| Early December | Ethereum Fusaka mainnet upgrade | Network upgrades can shift sentiment and on chain activity, especially around scaling and rollup related improvements. |

| Dec 9 to 10 | FOMC meeting (Federal Reserve) | One of the most important macro drivers for crypto liquidity conditions and risk appetite. |

| Dec 11 to 13 | Solana Breakpoint 2025 (Abu Dhabi) | A major Solana ecosystem conference that can influence SOL sentiment and developer, DeFi, and consumer app narratives. |

| Dec 15 | SEC Crypto Task Force Roundtable (Financial Surveillance and Privacy) | A closely watched U.S. policy discussion that may shape market expectations around privacy tooling, compliance, and regulatory direction. |

What to Watch in December

Heading into year end, the crypto market is likely to remain headline driven. The Federal Reserve’s December decision and forward guidance are the main macro variable, as they directly influence expectations for liquidity and rate policy into 2026. At the same time, major industry conferences and regulatory roundtables can quickly shift attention toward specific ecosystems, narratives, and sectors, including Layer 2 scaling, stablecoins, and on chain compliance.

Conclusion

In November 2025, the crypto market went through a broad correction, with Bitcoin and Ethereum pulling back, volatility rising, and risk appetite weakening across derivatives and spot markets. Despite the drawdown, several areas remained active, including prediction markets, selected DeFi venues, and ongoing protocol development. At the same time, recurring security incidents reinforced the importance of operational risk management across both centralized platforms and DeFi protocols.

Looking ahead, December sets up a high impact window for crypto. Macro policy signals from the Federal Reserve, ecosystem catalysts from major conferences, and ongoing regulatory discussions are all positioned to shape market sentiment and capital flows into the final weeks of the year and into early 2026.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 125x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium