Copy trading crypto is popular for a simple reason: it offers a structured way to participate in markets without manually executing every decision. That said, crypto copy trading is not a shortcut to guaranteed profit. It is an automation layer that can help you learn faster and operate more consistently, but it still exposes you to real market risk, especially in crypto futures copy trading.

In this guide, we explain what copy trading is in crypto, why people use it, where the risks actually come from, and how to apply it responsibly on the Bitunix exchange using Bitunix copy trading.

[ez-toc]

What Is Copy Trading in Crypto?

If you are asking what copy trading is in crypto, here is the clean definition:

Copy trading is a trading feature that allows you to follow a lead trader and automatically replicate their trading actions in your own account, based on settings you choose in advance.

In practice, that means when a lead trader opens a position, the system attempts to recreate that position for you under your copy mode, allocation, and limits. When the lead trader reduces or closes positions, the system also attempts to mirror those actions.

The most important point is this: copy trading is automation, not delegation of responsibility. You are still responsible for what happens in your account, so risk settings matter more than trader selection alone.

How Crypto Copy Trading Works on the Bitunix Exchange

Bitunix copy trading is built around three core steps: choose a lead trader, set copy parameters, and monitor outcomes.

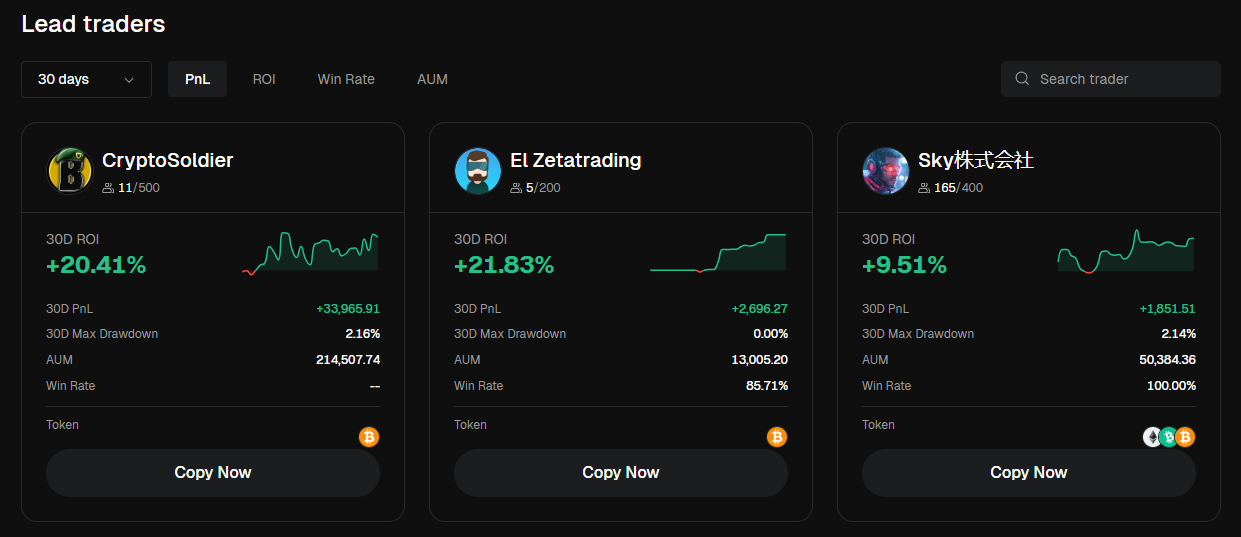

Step 1: Choose a Lead Trader in Copy Square

On the Bitunix exchange, you select lead traders from Copy Square. You can follow multiple traders at the same time, up to 10 traders simultaneously.

Step 2: Choose Your Copy Mode and Capital Allocation

Bitunix copy trading supports two common copy modes:

Fixed Amount Mode

You set a fixed margin amount per copied order. This is often easier for beginners because exposure per copied trade is more predictable.

Fixed Ratio Mode

Positions are opened based on the margin ratio between you and the lead trader. This can mirror scaling more closely, but it can also scale exposure quickly unless you set strict limits.

Step 3: Monitor in My Copy

My Copy is where you track positions, trade history, and real-time PnL. Copy trading is not hands-off. Monitoring is how you detect when a trader’s behavior shifts and when market conditions reduce copying reliability.

Key Benefits of Copy Trading Crypto

Crypto copy trading can be useful when you treat it like a tool, not a promise. Here are the benefits that actually hold up in real market conditions.

Faster Learning Through Observation

Copy trading creates a learning loop. You can study how a lead trader sizes positions, responds to volatility, and manages exits. If you keep a simple journal, you can turn copied trades into a practical education.

Reduced Emotional Trading

Many retail losses come from impulsive entries and exits. Copy trading crypto can reduce emotional decision-making by shifting execution from reactive clicks to predefined settings and consistent replication.

Access to Real-Time Strategy Exposure

Instead of paper learning only, you gain exposure to how strategies behave in live markets. This matters because strategy performance changes when volatility, liquidity, and sentiment shift.

Operational Convenience

If you have limited time, crypto copy trading can help you participate without watching charts all day. The goal is not to remove thinking, but to reduce the workload of execution.

Risk Controls Are Built Into the Workflow

On Bitunix copy trading, the setup process encourages you to define allocation and copy mode. When you use limits correctly, you can avoid the most common errors that cause followers to overexpose.

The Real Risks of Crypto Futures Copy Trading

To use copy trading responsibly, you need to understand where risk comes from. Most follower losses are not caused by one bad trade. They come from structural risk that followers fail to define in advance.

Leverage and Liquidation Risk

Crypto futures copy trading typically involves leverage. Leverage amplifies outcomes. It can help returns, but it also reduces the distance between entry and liquidation when the market moves against the position.

Follower rule: if you do not understand liquidation risk, your copy allocation is too high.

Slippage and Execution Differences

Follower results can differ from lead trader results, even when the same strategy is copied. One reason is execution timing. Another is slippage controls.

On Bitunix copy trading, excessive slippage can cause a copy order to fail, and the platform limits slippage to 0.1%. In fast markets, that can lead to missed entries or different fills.

Position-Level Copying and Timing

Bitunix copy trading operates at the position level. If a lead trader already has a position before you start copying them, additional buying or selling of that existing position does not affect you, and no new positions are opened for you as a result.

This is why timing matters. You are joining a live execution stream, not importing a trader’s historical portfolio.

Market Orders on Exits During Volatility

In the Bitunix copy trading mechanism, closing and reducing positions are market orders. Market orders prioritize execution, but in volatile markets, they can produce different exit prices than the lead trader’s exits.

Strategy Drift

A lead trader’s profile can look stable, then shift. The trader may change markets, increase frequency, or increase risk after a strong period. If you do not monitor, you can end up copying a different strategy than the one you originally selected.

Operational Limits for High-Frequency Traders

Bitunix sets a rule for frequent daily transaction volume: if a lead trader exceeds 500 orders or transactions in a single day, copiers can only copy the first 500 transactions for that day. This can reduce copy completeness for extremely high-frequency styles.

Profit Sharing and Net Results

Copy trading often involves profit sharing. On Bitunix, profit sharing is settled weekly on Monday at 00:00 UTC, and the earnings calculation period runs from Monday 00:00:00 UTC to Sunday 23:59:59 UTC. If you experience a loss for the settlement cycle, no profit-sharing fee is charged for that cycle.

Follower takeaway: always evaluate net results after fees and profit sharing, not just gross PnL.

Common Copy Trading Failures and What They Mean

Most “copy trading didn’t work” complaints are mechanical. On Bitunix copy trading, three common failure reasons are clearly defined:

Insufficient Funds

If your account lacks the required margin, the system will skip the trade. This is often caused by allocating too much of your balance, leaving no buffer.

Excessive Slippage

If slippage exceeds the allowed limit, the copy order will fail to execute. This is more common during high volatility and lower liquidity.

Margin Cap Reached

If you hit the maximum margin cap per pair, no new copy trades will be placed on that pair until exposure decreases.

Real Use Cases for Copy Trading on Bitunix

Copy trading crypto is most effective when you apply it to a specific purpose. Here are real use cases that fit how followers actually behave.

Use Case 1: Learning Futures Discipline Without Random Clicking

If you are new to futures, you can copy one conservative lead trader using fixed amount mode with small allocation. Your goal is not to maximize profit. Your goal is to learn execution discipline: how positions are opened, managed, and closed, and what volatility feels like when you have real exposure.

Use Case 2: A Time-Constrained Trader Who Still Wants Market Exposure

If you cannot monitor charts all day, Bitunix copy trading can provide structured exposure. The correct approach is to define a weekly loss threshold and a strict allocation, then review results weekly, aligned with the settlement rhythm.

Use Case 3: Diversifying Strategy Styles

Some followers diversify by copying two or three traders with different approaches, such as a trend-focused trader and a range-focused trader. If you do this, keep it small and maintain a buffer, because multiple traders can open positions at the same time.

Use Case 4: Separating Manual Trading From Copied Trading

Bitunix describes copy trading accounts as sub-accounts isolated from regular contract trading. This allows you to keep your manual trading separate from your copied trading, which is useful for tracking performance cleanly.

Use Case 5: Testing Whether a Strategy Matches Your Risk Tolerance

Copy trading can help you learn what you can tolerate emotionally and financially. A strategy may look attractive on a leaderboard, but if it causes you to panic during drawdowns, it is not compatible with your personality or goals.

How We Recommend Setting Up Bitunix Copy Trading Safely

If you want results that are repeatable, your setup should be risk-first.

- Start With Fixed Amount Mode

For most beginners, fixed amount mode is the cleanest place to start. It makes exposure more predictable and reduces the risk of sudden scaling.

- Allocate Less Than You Think and Keep a Buffer

A buffer reduces skipped trades due to insufficient funds and gives you room for volatility.

- Define a Weekly Loss Threshold

Because settlement runs on a weekly cycle, a weekly review is practical. Decide in advance what loss triggers a pause or stop.

- Prefer Execution-Friendly Lead Traders

Copying is more reliable when a trader focuses on liquid markets and avoids extreme order frequency. If a trader’s style depends on ultra-fast scalps, copied results can diverge more often due to slippage and timing.

- Review Behavior, Not Just PnL

Each week, check:

- Did position sizing change?

- Did trade frequency spike?

- Did you see skipped trades due to margin?

- Did slippage-related failures increase?

Choosing the Best Crypto Copy Trading Platform for Your Goals

When people ask for the best crypto copy trading platform, they often mean “the one with the highest returns.” We recommend a different definition:

The best crypto copy trading platform is the one that makes risk controls and execution rules transparent, so you can understand what will happen before you copy.

A practical checklist:

- Clear copy modes and sizing logic

- Monitoring tools for positions and real-time PnL

- Transparent explanations for failed or skipped copies

- Defined settlement and profit sharing rules

- Simple controls to stop copying when needed

On the Bitunix exchange, Bitunix copy trading focuses on transparent copy modes, My Copy monitoring, and clearly stated settlement and execution constraints.

Conclusion

Copy trading crypto can be a smart tool when you treat it as structured automation, not a guarantee. On the Bitunix exchange, Bitunix copy trading provides copy modes, monitoring through My Copy, and defined execution constraints like slippage limits and weekly profit-sharing settlement.

If you want to use crypto copy trading responsibly, start small, choose predictable sizing, maintain a buffer, and review weekly. That is how copy trading becomes a measurable process instead of a gamble.

FAQ

What is copy trading in crypto, in simple terms?

It is a feature that allows you to automatically replicate a lead trader’s trades based on your chosen copy settings and limits.

Is copy trading crypto profitable?

It can be, but profitability depends on trader selection, market conditions, execution differences, and risk controls. Past performance does not guarantee future results.

Why can my results differ from the lead trader’s results?

Differences can come from execution timing, slippage controls, liquidity, position-level copying behavior, and market-order exits.

What is crypto futures copy trading?

It is copy trading applied to futures positions, where leverage, margin, liquidation risk, and funding can materially affect outcomes.

How often is profit sharing settled on Bitunix copy trading?

Weekly, with settlement on Monday at 00:00 UTC. If the follower has a loss for the settlement cycle, no profit-sharing fee is charged for that cycle.

Glossary

- Futures contract: A derivative that tracks price without ownership.

- Perpetual futures: A futures contract that typically has no expiry.

- Margin: Collateral used to open and maintain positions.

- Leverage: A multiplier that increases exposure relative to margin.

- Liquidation: Forced closure when margin requirements are not met.

- Funding rate: Periodic payments between longs and shorts in perpetuals.

- PnL: Profit and loss on a position or account.

- Drawdown: Peak-to-trough decline over a period.

- Slippage: Difference between expected and actual execution price.

- Liquidity: How easily an asset trades without major price impact.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium