Automating your investing process can be the difference between a plan you talk about and a plan you actually follow. Many users want long-term exposure to crypto but do not want to rely on perfect timing, constant chart watching, or impulse decisions. That is why crypto DCA (dollar-cost averaging) remains one of the most practical approaches for building positions over time.

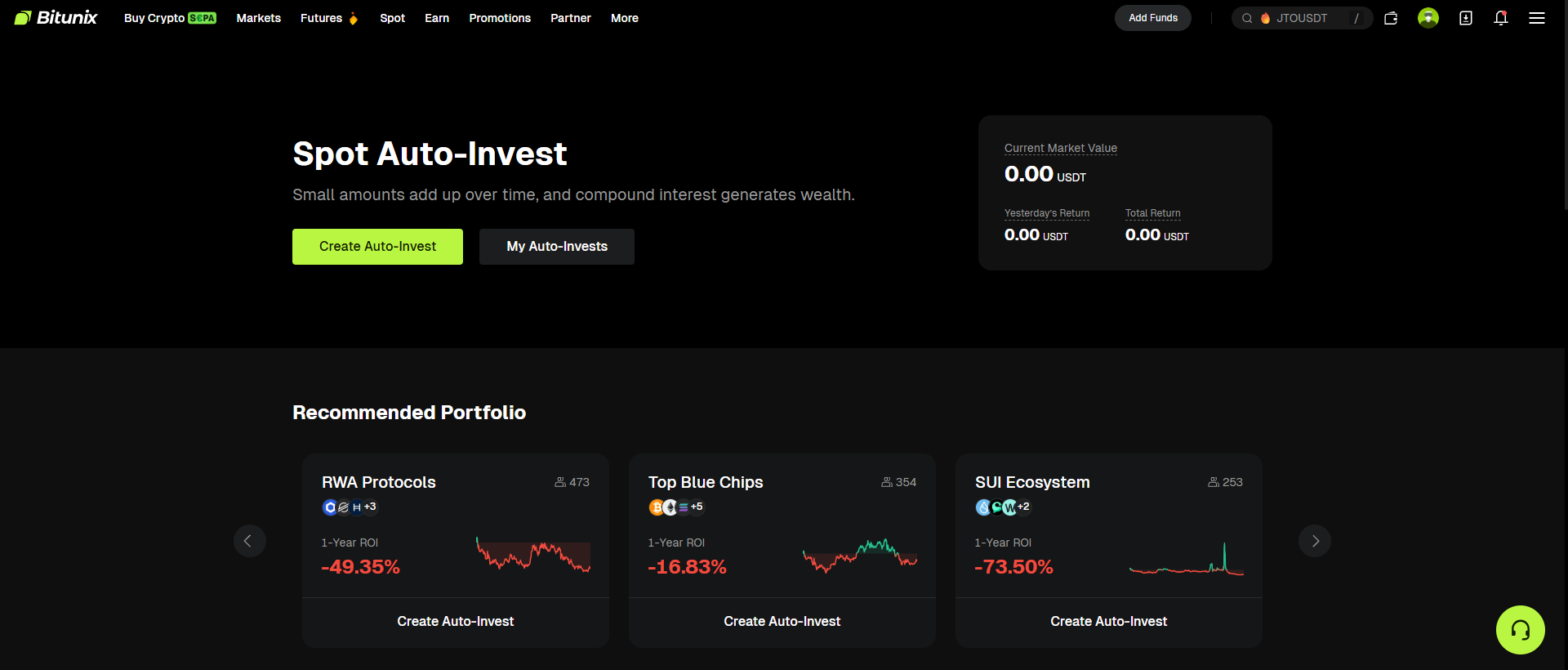

With Bitunix Spot Auto-Invest, you can turn DCA into a structured routine. It is a spot auto invest crypto feature that supports recurring spot buys based on the plan settings you choose. If you have been searching for how to use crypto auto invest, this guide explains how to set up and manage a recurring plan on Bitunix web, how to DCA into Bitcoin and altcoins responsibly, and how to align the plan with a diversified crypto portfolio strategy.

What Automated Crypto Investing Means in Spot Markets

Automated crypto investing does not mean trading without thinking. It means using tools to execute your plan consistently with less manual effort.

In spot markets, automation is often used for:

- Recurring purchases on a schedule

- Long-term accumulation

- Budget-based portfolio building

Bitunix Spot Auto-Invest fits into this category because it helps you create a crypto recurring investment plan that runs based on defined parameters, rather than emotions.

Crypto DCA Refresher: The Core Idea

Crypto DCA means investing a fixed amount into an asset at regular intervals. Instead of allocating a full budget at one time, you spread purchases across weeks or months.

Users use DCA for three main reasons:

- Consistency is easier than timing.

- It can smooth entry prices across volatility.

- It reduces the temptation to chase pumps or panic-sell.

DCA does not guarantee returns. It is a way to structure decisions, not a promise of profit.

Why Bitunix Spot Auto-Invest Works Well for DCA

DCA is simple in theory, but in real life it is easy to skip buys, delay entries, or abandon plans during volatility. Auto-invest features reduce those friction points.

Bitunix Spot Auto-Invest supports DCA by helping you:

- Set a recurring schedule and stick to it

- Define a fixed amount per cycle

- Build positions gradually through market cycles

- Reduce manual execution work

This is why many users treat it as part of a passive crypto investment strategy, as long as they still review and manage risk.

Choosing What to DCA: Bitcoin vs Altcoins

One of the most important decisions is what you will buy repeatedly.

DCA into Bitcoin

Bitcoin is often used as a core holding because it is widely traded and heavily followed. Some users prefer it for long-term exposure because the market is typically deeper than many smaller assets.

DCA into altcoins

Altcoins can offer different exposure, but they usually come with higher volatility and higher uncertainty. That does not mean they are “bad.” It means they require more careful sizing and selection.

A practical approach is to think in tiers:

- Core assets for long-term stability

- Smaller allocations to higher-volatility assets, if that fits your risk tolerance

This tiered approach is often part of a diversified crypto portfolio strategy.

Crypto Auto-Invest Risk: What You Must Consider

Automation makes it easier to execute, but it does not remove crypto auto invest risk.

Key risks include:

Market drawdowns

Crypto can fall sharply and stay down for extended periods. DCA can lower average entry prices, but it cannot protect you from losses during downtrends.

Asset selection risk

A recurring plan magnifies exposure to whatever you select. If you choose an asset you do not understand, automation will not fix that.

Over-allocation and budgeting risk

If your amount and frequency are too aggressive, the plan may become unsustainable. The most common failure is not market volatility. It is users setting an amount they cannot maintain.

Execution variance

Orders execute when the schedule runs. The execution price can vary based on market conditions at that time.

To manage these risks, keep the plan sustainable, start conservatively, and review on a schedule.

How to Use Bitunix Spot Auto-Invest (Web)

Spot Auto-Invest is located under the Spot tab on the website.

Step 1: Navigate to Spot Auto-Invest

- Log in to Bitunix.

- Hover over Spot in the top navigation.

- Click Spot Auto-Invest.

Step 2: Select the asset or trading pair

- Use the search bar to find the pair you want (for example, BTC/USDT).

- Select the pair.

This step is where you decide whether you are DCAing into Bitcoin, altcoins, or building toward a broader portfolio.

Step 3: Set your recurring plan

On the plan setup interface, configure:

- Purchase amount per cycle

- Recurring schedule or frequency (based on the options available)

- Any additional plan settings displayed on the page

This is the core workflow for how to use crypto auto invest on Bitunix.

Step 4: Review and activate

Before activation:

- Confirm the selected pair, amount, and schedule

- Check the funding source shown on the page

- Review any product notes or disclosures displayed

Then confirm and activate the plan.

Step 5: Track and manage your plan

Return to Spot > Spot Auto-Invest to:

- View plan status

- Check purchase history

- Adjust the amount or schedule if needed

- Stop the plan if your goals change

Practical DCA Frameworks You Can Use

Below are simple frameworks that many long-term users follow. They are not guarantees and they are not financial advice. They are ways to structure an approach.

Framework A: Core-only DCA

You DCA into one primary asset on a consistent schedule. This is straightforward and easier to maintain.

Best for:

- Beginners

- Users who want simplicity

- Users who want one plan to track

Framework B: Core plus satellite DCA

You DCA into a core asset and allocate a smaller recurring amount to one or more altcoins.

Best for:

- Users building a diversified crypto portfolio strategy

- Users comfortable with higher volatility

- Users who track their allocation periodically

Framework C: Budget-first recurring investing

Instead of picking frequency first, you define a monthly budget and then select an amount and schedule that fits.

Best for:

- Users who want stricter spending control

- Users managing long-term sustainability

This approach is one of the best ways to reduce crypto auto invest risk caused by over-allocation.

How to Keep Auto-Invest “Passive” Without Losing Control

A passive crypto investment strategy still requires basic management. The best approach is to manage the plan with routine reviews instead of daily intervention.

Recommended habits:

- Review monthly or quarterly

- Track total contributions and allocation drift

- Adjust only when your goals or risk tolerance changes

- Avoid changing plans based on short-term headlines

If you change your plan every week, you remove the main benefit of DCA.

FAQ

What is Bitunix Spot Auto-Invest?

Bitunix Spot Auto-Invest is a Spot feature that allows recurring purchases based on the plan settings you configure, supporting crypto DCA and crypto recurring investment strategies.

Where is Spot Auto-Invest on Bitunix web?

Log in, hover over Spot, then click Spot Auto-Invest.

Is Spot Auto-Invest the same as automated crypto investing?

It is one form of automated crypto investing because it automates recurring spot purchases according to your schedule.

Can I DCA into Bitcoin and altcoins using Spot Auto-Invest?

Yes. You can set up recurring purchases for the assets or pairs available in the Spot Auto-Invest interface.

What is the biggest crypto auto invest risk?

Market downside is the biggest risk. Automation does not protect you from price declines.

Can I adjust or stop my plan?

Typically, plans can be managed from the Spot Auto-Invest page where you can review status and history, and adjust or stop based on the controls available.

Glossary

- Automated crypto investing: Using preset rules, such as schedules, to execute recurring purchases with less manual effort.

- Crypto DCA: Dollar-cost averaging, investing fixed amounts at regular intervals to reduce timing pressure and smooth entry price over time.

- Crypto recurring investment: A plan that repeats purchases on a schedule, often used for long-term accumulation.

- Diversified crypto portfolio strategy: Spreading exposure across multiple assets to reduce reliance on one asset’s performance.

- Passive crypto investment strategy: A lower-maintenance approach focused on consistent, rules-based investing rather than frequent manual trading.

- Spot market: Buying and selling the underlying crypto asset directly, rather than trading derivatives.

- Spot auto invest crypto: An auto-invest plan that executes recurring buys in the spot market.

- Crypto auto invest risk: Risks that remain with automation, including market drawdowns, asset risk, over-allocation, and execution variance.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.