If you have ever tried to time a crypto entry perfectly, you already know the problem. Markets move fast, emotions move faster, and “waiting for the right price” often turns into missed execution. That is why many long-term users rely on crypto DCA (dollar-cost averaging) instead of lump-sum buying.

DCA is simple: you buy on a schedule, using a fixed amount, so you can stay consistent through both uptrends and drawdowns. The challenge is not the strategy. The challenge is the routine.

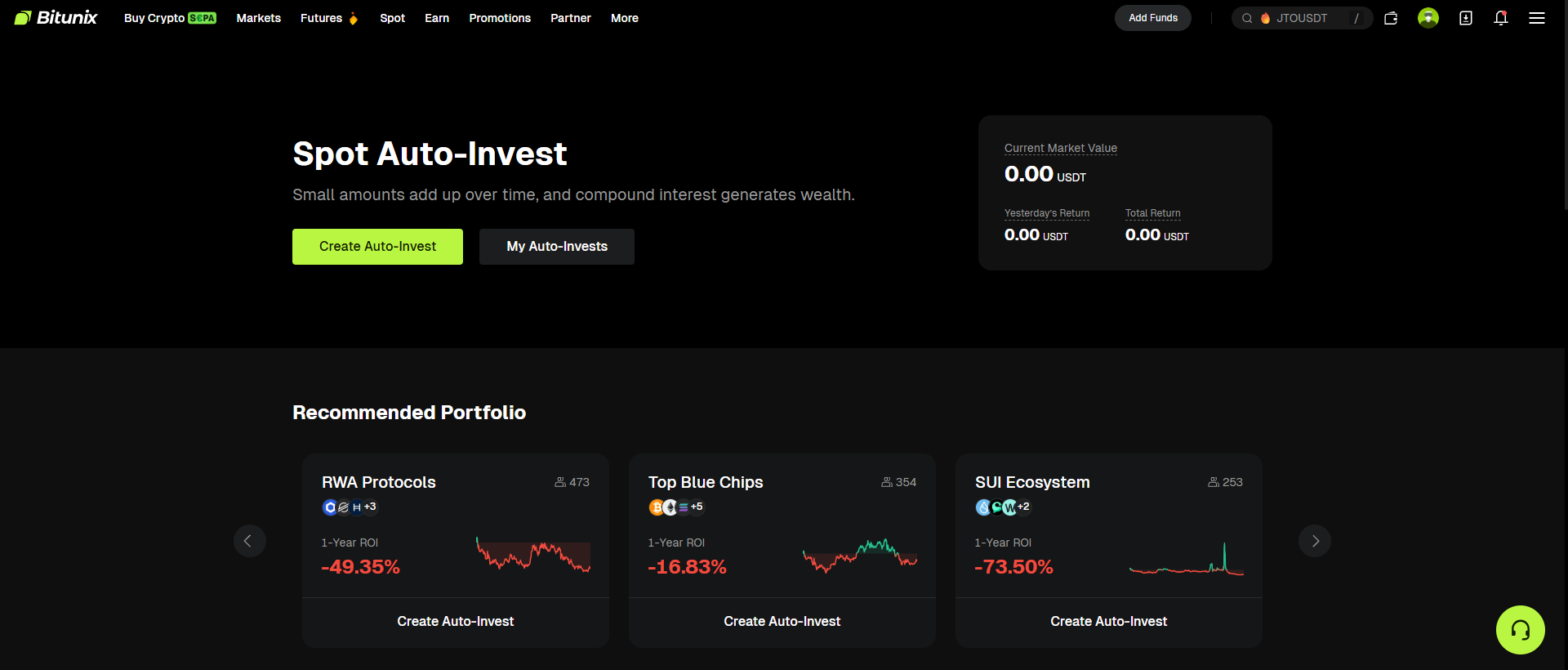

That is where Bitunix Spot Auto-Invest comes in. It is a spot auto invest crypto feature built to automate recurring spot purchases, helping you run a crypto recurring investment plan without placing every order manually.

What Is Crypto DCA?

Crypto DCA means investing a fixed amount into a crypto asset at regular intervals, such as weekly or monthly. Instead of trying to predict short-term market moves, you build exposure over time.

Why traders use DCA:

- It reduces the pressure of market timing.

- It can smooth your average entry price across volatility.

- It helps reduce emotional decision-making.

DCA does not guarantee profits. It is a repeatable process that can improve consistency, not a promise of performance.

What Is Bitunix Spot Auto-Invest?

Bitunix Spot Auto-Invest is a feature in the Spot section that lets users set up scheduled, recurring spot purchases based on the plan settings they choose. In other words, it supports automated crypto investing for users who want to implement DCA without manually executing each buy.

What it helps you do:

- Build a consistent buying routine for spot assets.

- Run a recurring plan over time with less manual effort.

- Keep your strategy structured instead of reactive.

This is often used as part of a passive crypto investment strategy, because it reduces ongoing execution work. However, “passive” does not mean “no risk” or “no review.” You still need to choose assets responsibly and monitor your plan.

Why Auto-Invest Matters in Real Trading Conditions

Most long-term portfolio building fails for one reason: inconsistency. Users intend to buy regularly, but they skip buys during uncertainty or chase buys during hype.

Auto-invest tools are designed to solve that behavioral problem by making consistency easier than impulsive action.

Spot Auto-Invest can be valuable when:

- You want to accumulate over months rather than days.

- You want discipline in allocation and budgeting.

- You want a system that keeps running even when you are busy.

Crypto Auto-Invest Risk: What You Should Understand

Before setting up any recurring plan, it is important to understand crypto auto invest risk. Automation makes execution easier, but it does not reduce market risk.

Key risks include:

Market risk

Prices can decline sharply and stay down for extended periods. DCA can reduce timing pressure, but it cannot prevent losses.

Asset risk

Some assets are more volatile, less liquid, or less established than others. Recurring buys into high-risk assets can magnify downside exposure.

Over-allocation risk

Because the plan runs on a schedule, you may invest more than intended if you do not align the amount and frequency to a realistic budget.

Execution and price variance

Your order executes when the plan runs, not when you check the market. Your execution price may differ from what you expected earlier.

A responsible approach is to start with sustainable amounts, review periodically, and avoid changing the plan based on short-term noise.

How to Use Bitunix Spot Auto-Invest on Web

Spot Auto-Invest is located under the Spot tab on the website.

Step 1: Open Spot Auto-Invest

- Log in to your Bitunix account.

- On the top navigation bar, hover over Spot.

- Click Spot Auto-Invest.

This is the fastest route for users looking for how to use crypto auto invest on Bitunix web.

Step 2: Choose the asset or trading pair

On the Spot Auto-Invest page:

- Use the search bar to find the asset pair you want (for example, BTC/USDT).

- Select the pair to proceed.

Tip: If your goal is long-term accumulation, choose assets you are comfortable holding through volatility, not just what is trending this week.

Step 3: Set your plan configuration

Configure the plan details shown on the page, typically including:

- Your recurring purchase amount per cycle

- Your schedule or frequency (based on the options available)

- Any additional parameters offered in the interface

This setup is the practical definition of spot auto invest crypto: you are defining what to buy, how much to buy, and when it repeats.

Step 4: Review and activate

Before confirming:

- Double-check the selected pair and purchase amount.

- Confirm the schedule.

- Review any plan details and product notes shown on-screen.

Then activate your plan.

Step 5: Monitor and manage your plan

Return to Spot > Spot Auto-Invest to:

- Check plan status

- Review plan history

- Adjust or stop the plan if needed

This management step matters. A crypto recurring investment plan works best when it is stable, but it still should be reviewed regularly to ensure it matches your budget and objectives.

How to Use Spot Auto-Invest to Build a Long-Term Portfolio

Auto-invest is a tool. Results depend on how you use it.

Here are practical ways to structure a plan:

Approach A: One-asset accumulation

If you want simplicity, start with one core asset and DCA consistently. This is the most common starting point for beginners because it is easy to track and maintain.

Approach B: Portfolio building with diversification

If your goal is a diversified crypto portfolio strategy, you can set recurring buys across multiple assets over time. Some users spread recurring purchases across different categories, but diversification should still be aligned with risk tolerance and understanding of each asset.

Approach C: Budget-first investing

Set your total monthly budget first, then decide frequency and per-cycle amounts. This reduces the risk of overspending, which is one of the most common crypto auto invest risk issues.

Best Practices for Automated Crypto Investing

To use automated crypto investing tools effectively, focus on repeatability:

- Start sustainable Choose an amount you can maintain through volatility.

- Review on a schedule, not daily Weekly or monthly reviews are more consistent with a long-term plan.

- Avoid “emotion edits” If you change your plan every time price moves, you lose the benefit of DCA.

- Write down your purpose Are you accumulating for long-term exposure, hedging volatility, or building a portfolio allocation? Clarity reduces impulsive changes.

- Keep expectations realistic Auto-invest is not a shortcut to guaranteed returns. It is a consistency tool.

FAQ

What is Bitunix Spot Auto-Invest?

Bitunix Spot Auto-Invest is a Spot feature that lets users automate recurring spot purchases using a scheduled plan, supporting crypto DCA and crypto recurring investment behavior.

Is Spot Auto-Invest the same as DCA?

It is a tool that can be used to implement DCA, because it supports scheduled recurring buys based on your settings.

Where do I find Spot Auto-Invest on Bitunix web?

Log in, hover over Spot on the top navigation bar, then click Spot Auto-Invest.

Is this a passive crypto investment strategy?

It can support a passive crypto investment strategy because it reduces manual execution. However, you should still monitor your plan and understand market risk.

What is the biggest crypto auto invest risk?

Market downside is the biggest risk. Automation does not protect you from falling prices. It only standardizes your buying process.

Can I manage the plan after I set it up?

Yes. Return to Spot > Spot Auto-Invest to review plan status and history, and to adjust or stop the plan using the options available in your interface.

Is automated crypto investing good for beginners?

It can be, because it encourages consistency. Beginners should start with small amounts, focus on learning fundamentals, and avoid allocating more than they can afford to lose.

Glossary

- Automated crypto investing: Using preset rules, such as schedules, to execute recurring purchases with less manual effort.

- Crypto DCA: Dollar-cost averaging, investing fixed amounts at regular intervals to reduce timing pressure and smooth entry price over time.

- Crypto recurring investment: A plan that repeats purchases on a schedule, often used for long-term accumulation.

- Diversified crypto portfolio strategy: Spreading exposure across multiple assets to reduce reliance on one asset’s performance.

- Passive crypto investment strategy: A lower-maintenance approach focused on consistent, rules-based investing rather than frequent manual trading.

- Spot market: Buying and selling the underlying crypto asset directly, rather than trading derivatives.

- Spot auto invest crypto: An auto-invest plan that executes recurring buys in the spot market.

- Crypto auto invest risk: Risks that remain with automation, including market drawdowns, asset risk, over-allocation, and execution variance.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.