Article Summary

- XRP fell sharply during the crypto crash 2026 as risk appetite collapsed.

- The token dropped from above 3.50 to around the mid 1.40 to 1.70 range.

- XRP underperformed Bitcoin and Ethereum due to higher risk perception.

- Leverage, thin liquidity, and capital rotation out of altcoins amplified losses.

- The XRP Ledger continued operating normally throughout the crash.

What Happened to XRP During the 2026 Crypto Crash

XRP did not crash because of a single headline or a technical failure. It crashed because it is an altcoin in a market that suddenly turned defensive.

During the crypto crash 2026, capital exited risk assets quickly. Bitcoin fell first, Ethereum followed, and altcoins like XRP absorbed the heaviest selling. When fear rises, traders reduce exposure to assets perceived as higher risk, and XRP sits firmly in that category despite its size and history.

Once selling started, it accelerated faster than many expected.

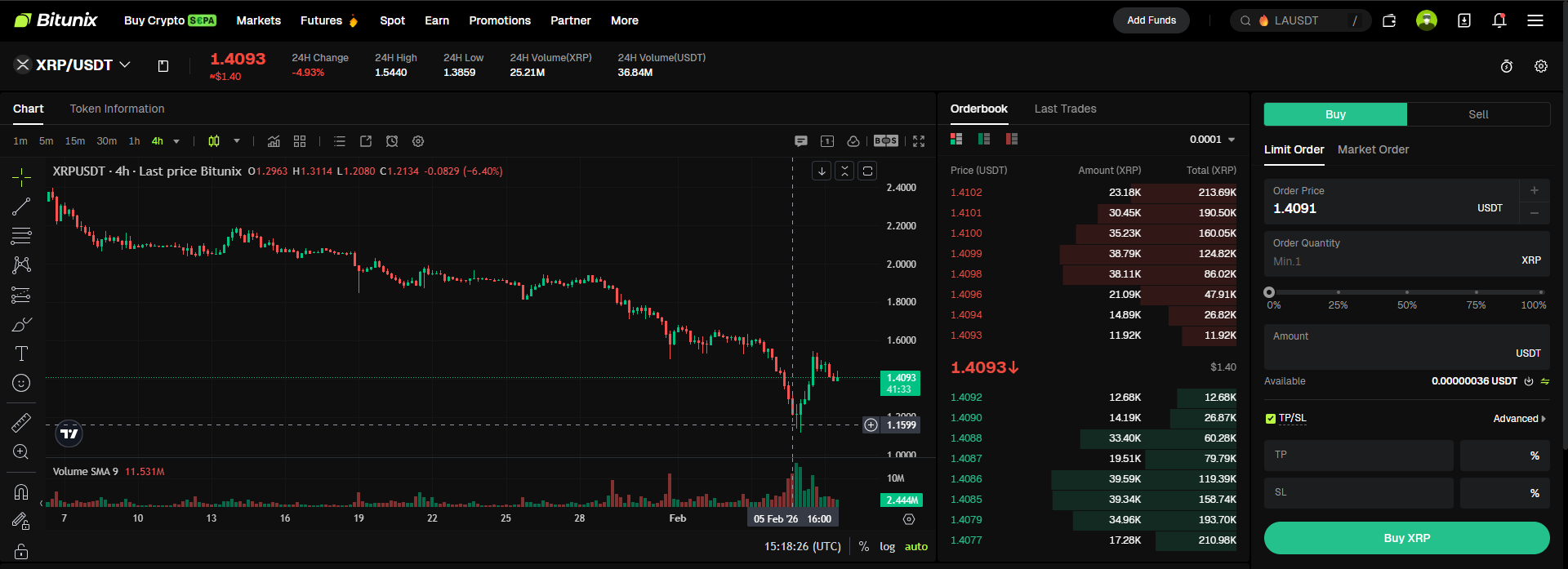

How Much Did XRP Drop

XRP’s price decline was severe and stretched across multiple sessions.

Based on widely reported market data from early February 2026:

- XRP had been trading above 3.50 during the prior cycle peak.

- During the crash, price fell into the 1.40 to 1.70 range.

- The total drawdown exceeded 50 percent from recent highs.

- Several sessions recorded sharp intraday drops as liquidity thinned.

Unlike Bitcoin, XRP did not find immediate support. Price action remained unstable as sellers dominated order flow.

Why XRP Fell More Than Bitcoin and Ethereum

The core reason XRP crashed harder is risk hierarchy.

In periods of market stress, assets are sold in order of perceived risk:

- Altcoins

- Ethereum

- Bitcoin

XRP is often treated as a high beta asset. It is more sensitive to changes in sentiment and liquidity. When traders rush to reduce exposure, XRP is one of the first tokens they sell.

This risk rotation explains why XRP’s decline was deeper and faster than BTC and ETH.

Liquidity Was a Major Problem for XRP

Liquidity disappears faster in altcoins.

During the crash:

- Market makers reduced exposure.

- Bid depth collapsed.

- Slippage increased sharply.

With fewer buyers in the book, even moderate sell orders pushed XRP down multiple price levels. This made the decline feel sudden and chaotic, even when selling volume was not historically extreme.

Leverage and Forced Selling Accelerated the Drop

XRP derivatives markets also played a role.

As price fell:

- Leveraged long positions were liquidated.

- Forced selling added pressure at already weak levels.

- Each liquidation pushed price lower, triggering more liquidations.

This feedback loop amplified the decline and extended the sell-off beyond what spot selling alone would have produced.

Capital Rotated Away From Altcoins

During the crash, capital did not disappear. It rotated.

Many traders moved funds into:

- Cash or stablecoins

- Bitcoin

- Lower volatility instruments

This rotation drained demand from altcoins like XRP. Without fresh buyers stepping in, price struggled to recover even after the most aggressive selling slowed.

Fear and Headlines Made the Crash Feel Worse

Market psychology magnified XRP’s decline.

As prices dropped, fear spread quickly across social platforms and trading communities. Discussions around exchange issues, withdrawal delays, and system stress increased anxiety, even when those events were temporary or unrelated to XRP itself.

Fear does not need confirmation to move markets. It only needs momentum.

What Did Not Cause the XRP Crash

It is important to separate price action from fundamentals.

- The XRP Ledger did not fail.

- There was no protocol exploit.

- Transaction processing continued normally.

- Network uptime remained stable.

The crash was market-driven, not technology-driven.

FAQ

Why did XRP crash so hard in 2026?

XRP crashed due to risk-off sentiment, leverage unwinding, thin liquidity, and capital rotating out of altcoins during the crypto crash 2026.

How low did XRP go during the crash?

XRP fell from above 3.50 to trade in the 1.40 to 1.70 range during the most volatile period.

Why did XRP fall more than Bitcoin?

XRP is considered a higher risk asset. During market stress, traders sell altcoins first, which leads to larger percentage declines.

Was the XRP network affected by the crash?

No. The XRP Ledger continued operating normally with no disruption.

Is this type of move unusual for XRP?

No. Historically, XRP has experienced large drawdowns during market-wide crypto crashes, especially when liquidity tightens.

Glossary

XRP crash: A sharp decline in XRP price driven by market sentiment and liquidity conditions.

Altcoin risk: The higher volatility and downside exposure associated with non-Bitcoin assets.

Forced liquidation: Automatic closure of leveraged positions when margin requirements are breached.

Liquidity thinning: A reduction in available buy orders that amplifies price movement.

Risk-off market: A period when investors reduce exposure to volatile assets.

Conclusion

XRP crashed in 2026 because markets shifted rapidly into risk-off mode. As liquidity dried up and leverage unwound, XRP absorbed heavy selling due to its position in the risk hierarchy. While the price fell sharply, the underlying network remained stable.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Crypto trading and investing involve significant risk, including the potential loss of principal. This article is for informational purposes only and does not constitute financial advice.