Article Summary

- This forecast provides a detailed price prediction and market analysis for Solana (SOL) for the year 2026.

- Key bullish catalysts include the continued growth of the DePIN sector, the potential launch of a spot Solana ETF, and increasing consumer adoption through mobile initiatives.

- Bearish risks revolve around network stability under heavy load and intense competition from other high-speed blockchains.

- Technical analysis of the SOL-USDT chart reveals key support and resistance levels that will define its price action in 2026.

- Our forecast includes potential high, low, and average price targets for SOL in 2026, based on these factors.

- Bitunix provides a premier platform for trading SOL to capitalize on these potential market movements.

Solana ($SOL) had a mixed year in 2025. There were moments of strong market enthusiasm, primarily driven by surging demand for meme coins launched on platforms such as pump.fun, followed by sharp pullbacks. SOL closed out 2025 trading at around $135, which left it roughly $50 below its price at the start of the year. From a purely price-based perspective, it was not a standout year.

However, that view does not tell the full story. Despite uneven price action, Solana further established its position as a leading Layer-1 cryptocurrency network. Trading volume on Solana-based decentralized exchanges frequently outpaced Ethereum and BNB, and few would dispute Solana’s dominance in the meme coin sector.

Heading into 2026, there are several reasons for cautious optimism. In this guide, we examine the key market trends shaping the Solana price prediction 2026 and review a range of Solana forecasts and price predictions for the year ahead that will help those trading SOL-USDT futures and spot markets turn a profit.

What Is Solana ($SOL) and What Does It Do?

Solana is arguably one of the most well-known Layer-1 altcoins on the market. The network has become increasingly dominant over the past few years, steadily eating into Ethereum’s market share as it has attracted developers, DeFi tools, and, above all, massive volumes of meme coin–generated activity.

From a technical perspective, Solana is a high-performance blockchain designed for speed and scalability. It uses a unique combination of proof of history and proof of stake to process thousands of transactions per second at very low cost. This makes it well-suited for high-frequency applications such as decentralized exchanges, gaming, and consumer-facing dApps.

SOL is the native token of the Solana network. It is used for transaction fees, staking, and securing the network. With a market capitalization of roughly $75 billion, SOL ranks among the top five cryptocurrencies by market value.

The Solana ecosystem has also been expanding at a rapid pace. Data from DeFiLlama shows that Solana’s total value locked has grown quickly and currently sits around $8.8 billion. In recent periods, the network has regularly generated more on-chain revenue than Ethereum and BNB, underscoring its rising economic activity.

The Bullish Catalysts for The Solana Price Prediction 2026

Before diving into specific Solana forecasts, it is worth stepping back and looking at the broader bullish developments likely to drive price action. As with most altcoins, a full altcoin season would likely push SOL higher regardless of ecosystem-specific progress. However, predicting an altcoin season is notoriously difficult, as many traders learned the hard way in 2025. Structural trends tied directly to Solana’s growth are easier to track and may prove more reliable drivers in 2026.

One of the most significant catalysts is the growing momentum around SOL exchange-traded products. SOL-linked ETPs already trading in certain regions have provided a meaningful boost to visibility and demand. The probability of regulatory approval expanding into additional jurisdictions, alongside potential spot ETF approvals, positions Solana as the most logical candidate after Bitcoin and Ethereum. If the ETF trend continues, larger financial institutions could increasingly allocate capital to SOL.

Solana is also well-positioned to benefit from the rise of DePIN, or Decentralized Physical Infrastructure Networks. A 2025 report from the World Economic Forum estimates that the DePIN market, currently valued between $30 billion and $50 billion, could grow to $3.5 trillion by 2028.

DePIN refers to blockchain-based networks that coordinate real-world infrastructure such as wireless connectivity, mapping, and computing. Solana’s speed and low fees make it a natural fit for these use cases, with projects like Helium Network already leveraging Solana to deploy DePin solutions.

Another emerging narrative is tokenized stocks and real-world assets. According to official reports, Ondo Finance is planning to launch Solana-based ETF-style products in 2026, further expanding Solana’s role in traditional finance integration.

Finally, SOL memecoins could well continue to support the SOL price outlook. As we saw in 2025, a huge surge in memes helped Solana hit its all-time high. However, this is hard to predict, the pump.fun madness may have been a one-time event, as many traders got burned and are now cautious about low-cap projects that often rug.

The Bearish Risks and Headwinds

It is not all plain sailing for the Solana forecast. There are several market trends that could turn bearish, and 2025 highlighted just how volatile SOL price action can be, even during periods when Bitcoin was pushing toward new all-time highs.

Many of the strongest bullish moves in 2025 occurred during peak meme coin hype cycles. When volume on platforms such as pump.fun surged, SOL rallied sharply, at one point approaching the $200 level. As meme coin sentiment cooled, SOL retraced alongside it. If meme coins fail to regain traction in 2026, this dependency could become a headwind for SOL price performance.

Competition from other Layer-1 and modular blockchains is also intensifying. BNB continues to strengthen its ecosystem and saw its price exceed $1,300 last year. New platforms such as four.meme are directly competing with pump.fun, potentially diluting Solana’s dominance in meme coin activity.

The most severe bearish scenario, however, is less Solana-specific. A broader Bitcoin-led bear market and declining demand for altcoins could weigh heavily on SOL, as seen in 2022 when SOL fell below $10 during the depths of the cycle.

Technical Analysis – What the Chart Says for 2026

Technical analysis across the short, medium, and long term provides a mixed picture for building a SOL price prediction for 2026. The year has started with relatively bullish sentiment, but it is still too early to confirm even a short-term bull market. The broader trend from the final quarter of 2025 continues to weigh on overall market sentiment.

In the short term, price action has improved. SOL recently rebounded from the $124 region to around $140, suggesting renewed buying interest. Momentum indicators such as the RSI have moved out of oversold territory, while short-term moving averages are beginning to curl upward, supporting a cautious bullish outlook.

From a medium-term perspective, SOL remains range-bound. The chart shows lower highs since the September peak, indicating that the recovery lacks strong trend confirmation and remains vulnerable to pullbacks.

Long-term technicals are still bearish. SOL continues to trade below key long-term moving averages, and higher-timeframe RSI readings remain neutral to weak. Until these levels are reclaimed, the broader structure suggests caution rather than a confirmed trend reversal.

SOL Price Prediction 2026

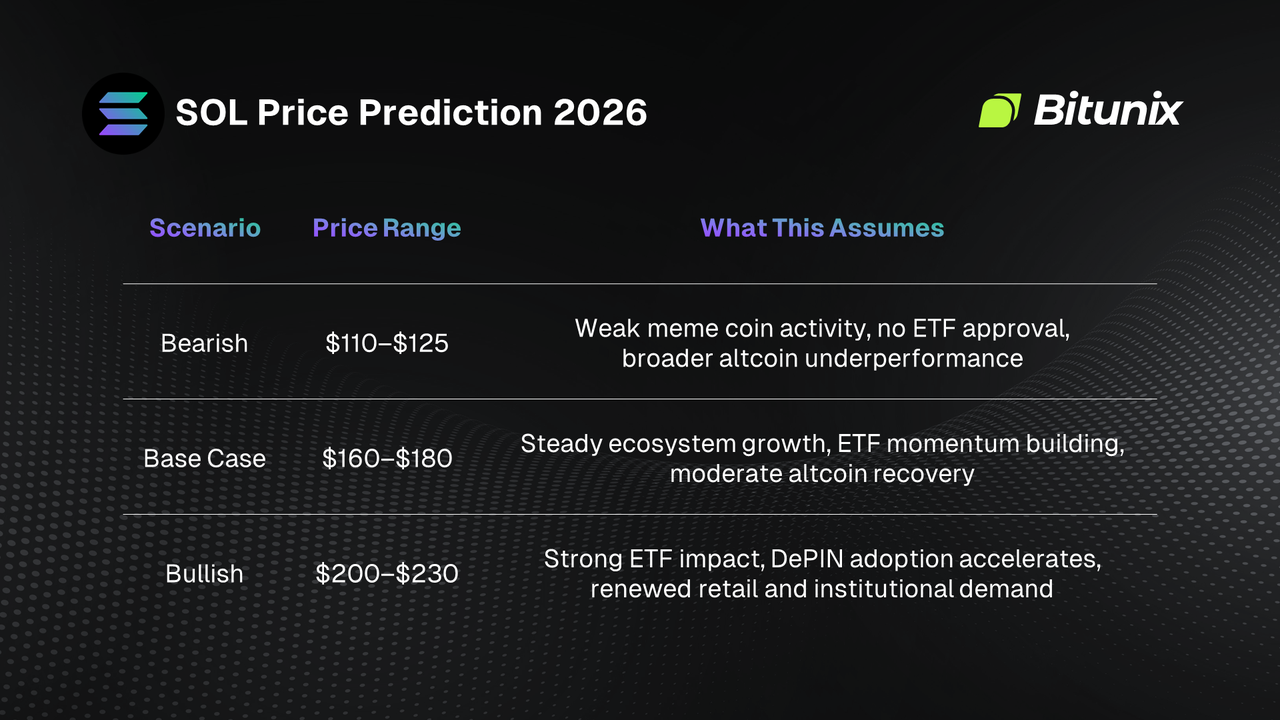

Building an accurate SOL price prediction for 2026 means considering both technical analysis and broader market trends. In general, a strong altcoin season would push technical indicators into bullish territory, while ongoing developments around tokenization, DePIN, and meme coin activity could also support positive momentum. Overall, most analysts expect Solana’s market trend to be bullish in 2026, with some even suggesting the potential for a move toward prior highs.

Changelly has published a bullish Solana price prediction for 2026, with a medium price target of around $177. This would represent roughly a 45% gain from current levels, signaling healthy upside even if it does not imply a new all-time high.

CoinCodex is also bullish on Solana in 2026, although its outlook is more conservative. Its medium price target points to gains of around 20%, suggesting steady appreciation rather than explosive growth.

Benzinga has issued a relatively bullish Solana price prediction 2026 as well, with an average target near $179, broadly aligning with other market expectations.

Overall, 2026 forecasts lean bullish, but most analysts are not predicting a new all-time high. Instead, they anticipate consistent growth throughout the year, potentially positioning SOL for a breakout in 2027.

Table: SOL Price Prediction 2026

How To Buy SOL On Bitunix

To buy SOL on the Bitunix crypto exchange, follow these steps:

- Sign up on Bitunix via the website or download the app on your smartphone.

- Create an account using your email or mobile number and log in.

- Deposit crypto or buy USDT using fiat (kyc required for fiat only).

- Navigate to the spot market and select the SOL/USDT trading pair.

- Enter your order details and confirm, then explore trading tools, futures, and the earn features.

The information provided in this article is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile. Always conduct your own research, assess your risk tolerance, and consider seeking independent professional advice before making any investment decisions.

FAQs

Can Solana really reach $500 in 2026?

It is possible but unlikely without an extreme bull market, major ETF inflows, and sustained demand across DeFi, DePIN, and consumer applications.

What is the most important catalyst for Solana’s price?

Institutional adoption is the key driver. A spot Solana ETF could unlock significant capital inflows, improve market credibility, and materially increase long-term demand for SOL.

What happens if the Solana network has another outage?

Another outage would likely damage short-term confidence, increase volatility, and pressure price action, even if the network recovers quickly and long-term adoption remains intact.

Is it too late to invest in Solana?

Solana is no longer an early-stage asset, but it may still offer upside if ecosystem growth, institutional adoption, and new narratives such as DePIN and tokenization continue to gain traction.

How would a Solana ETF affect its price?

A Solana ETF could significantly change SOL’s demand profile by making it accessible to institutions, funds, and retirement accounts. This would likely reduce reliance on retail speculation and support more sustained price appreciation over time.

What are the top DePIN projects on Solana?

Leading DePIN projects include Helium and Hivemapper, which use Solana’s low fees and speed to power real-world infrastructure networks.

How does Solana’s performance in 2025 set it up for 2026?

While price action was volatile, 2025 strengthened Solana’s ecosystem fundamentals. DEX volume, revenue generation, and meme coin dominance all increased, creating a stronger base for potential growth in 2026.

What is a realistic market cap for Solana in 2026?

A reasonable range would place Solana between roughly $80 billion and $120 billion, assuming moderate adoption growth and a favorable broader crypto market environment.

What do the Solana price predictions for 2026 tell us?

Most forecasts point to steady appreciation rather than explosive gains. Analysts generally expect consolidation and consistent growth, potentially setting the stage for a stronger breakout in 2027 rather than an immediate new all-time high.

Where can I track the growth of the Solana ecosystem?

You can track ecosystem growth using platforms like DeFiLlama, on-chain analytics dashboards, developer activity reports, and exchange data showing volume and user engagement.

Glossary

Layer-1 Blockchain: Base network supporting decentralized applications.

DePIN: Decentralized networks powering real-world infrastructure.

Spot ETF: Exchange-traded fund holding actual assets.

Altcoin Season: Period of strong non-Bitcoin performance.

Total Value Locked: Capital deposited in DeFi protocols.

Market Capitalization: Total value of circulating token supply.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium