Report Summary

- BTC price action was extremely volatile, showing a classic roller-coaster market. BTC plunged below the 82,000 USD level at the end of January.

- Due to severe snowstorms in the United States, the Bitcoin network hash rate experienced major turbulence. On January 25, total network hash rate fell to 663 EH/s.

- Donald Trump nominated Kevin Warsh as Chair of the Federal Reserve, and the “Warsh shock” swept through global capital markets.

- The Ethereum Foundation AI lead said the ERC-8004 standard has been deployed on the Ethereum mainnet.

- World released World ID v4.0, introducing account abstraction and multi-key support.

- In January, Hyperliquid clearly widened the gap versus competitors, reaching an average daily trading volume of 6.82 billion USD.

- The prediction market sector cooled noticeably. Kalshi, Opinion, and Polymarket each recorded average daily trading volume below 3.0 billion USD.

Digital Gold: Bitcoin

In January 2026, BTC experienced exceptionally sharp price swings, forming a textbook roller-coaster market. From January 1 to 6, BTC surged from 87,500 USD to 94,000 USD and formed the first short-term peak. It then failed to break higher and retraced toward the 90,000 USD level, entering a phase of sideways consolidation.

On January 12, the market launched a second push. Price climbed again from 90,000 USD to a high near 97,000 USD. However, bullish momentum failed to achieve a decisive breakout, and price once again retreated to hover around 90,000 USD. From a technical perspective, two failed breakouts formed a classic bearish double top on the candlestick chart.

By late January, macro conditions delivered a major negative shock. After Trump nominated the clearly hawkish candidate Kevin Warsh as Chair of the Federal Reserve, concerns over future tightening policy quickly intensified. Driven by panic, BTC lost a key support level and plunged below the 82,000 USD threshold at the end of the month.

Bitcoin Perpetual Futures and Derivatives Trading

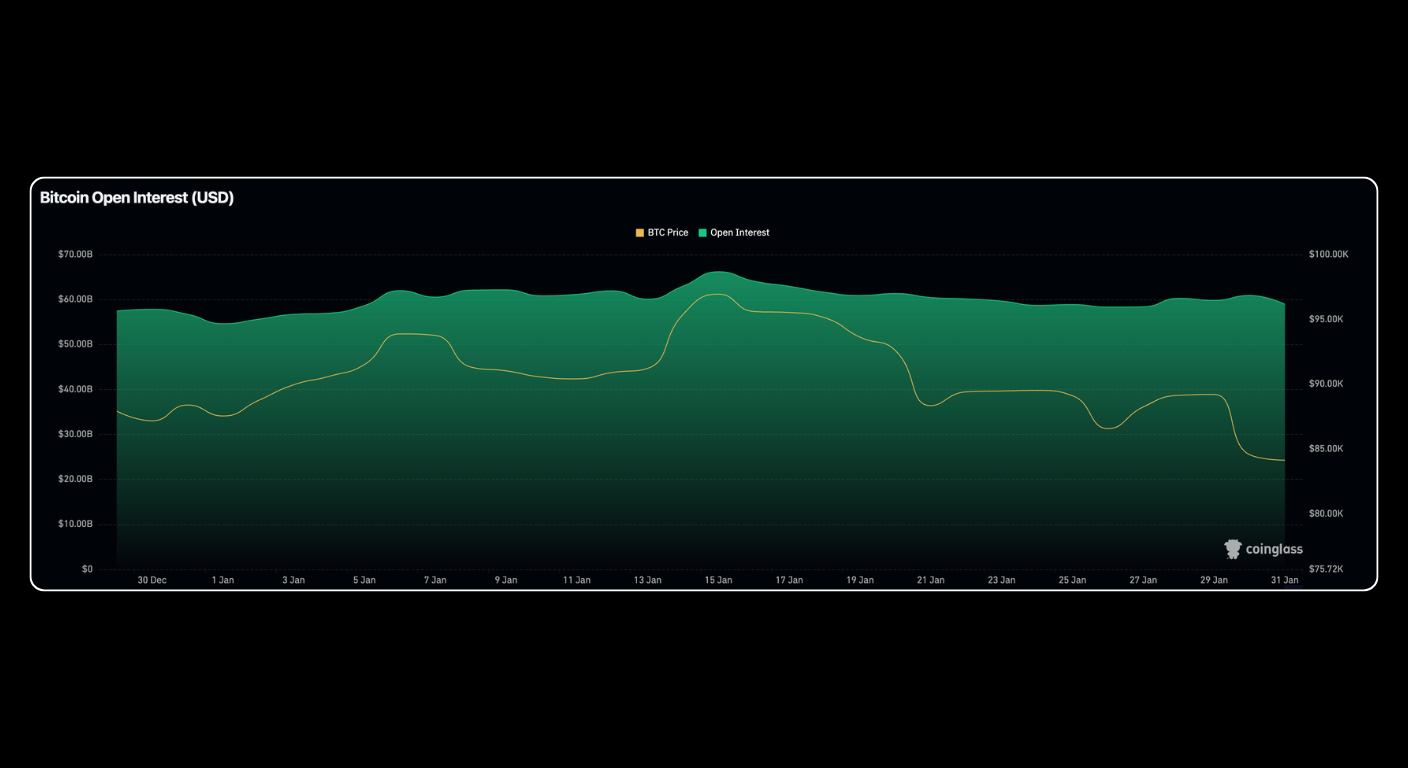

Compared with the sharp volatility in BTC spot prices, total open interest in the derivatives market did not show a matching large-scale retreat, and overall performance remained relatively resilient.

Data shows that at the beginning of January, total BTC futures open interest across exchanges was about 54.0 billion USD. During the two upward pushes, open interest rose to highs of 62.0 billion USD and 66.0 billion USD. Although some positions were closed after both rallies failed, causing open interest to fall back to 59.0 billion USD by month-end, it is notable that even as BTC slid from 87,500 USD at the start of the month to around 81,000 USD at month-end, open interest still remained above early-month levels.

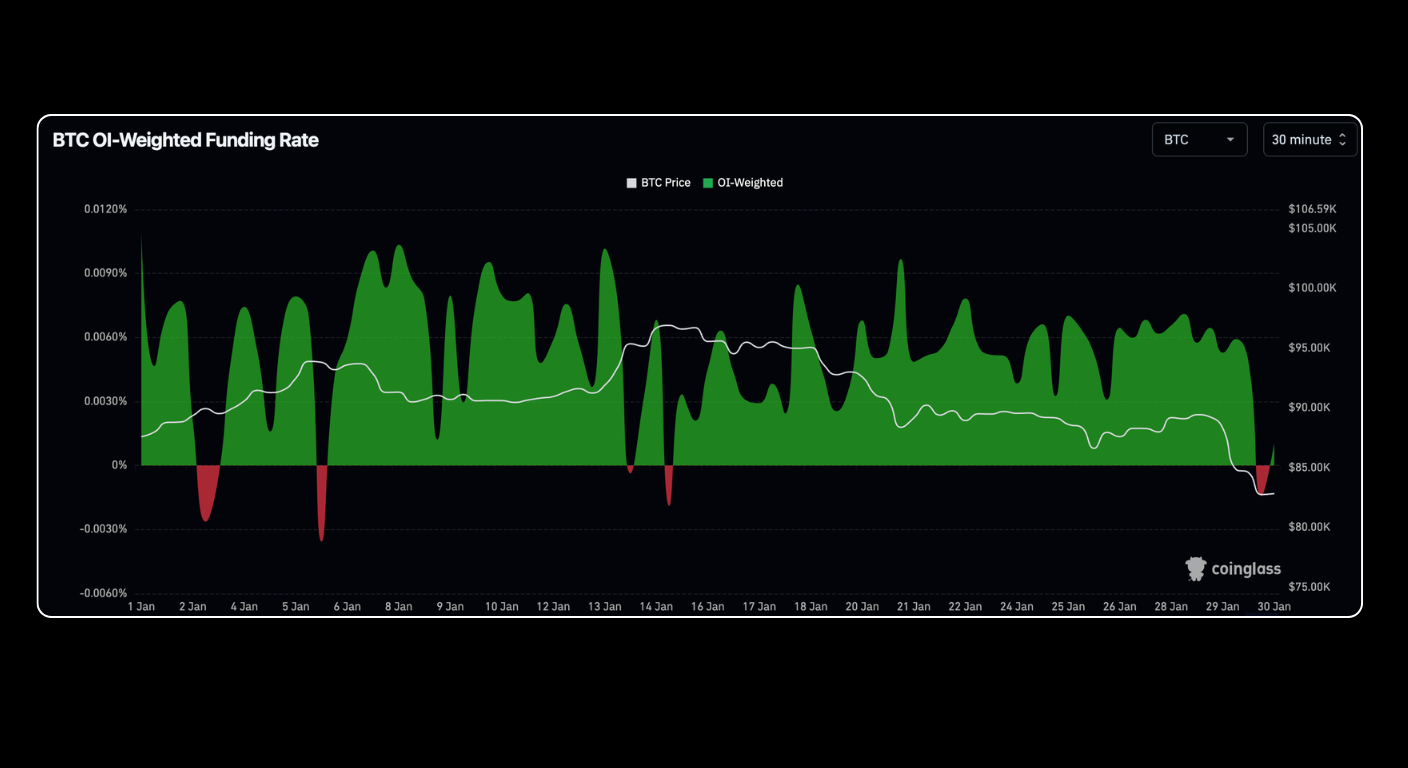

In January, the funding rate in perpetual futures showed only a weak positive correlation with BTC price. Under normal conditions, a funding rate below 0 implies stronger short pressure, where shorts pay funding to longs. This occurred during both BTC upswings on January 3 and January 14. However, during the decline from 97,000 USD to 87,000 USD, the funding rate stayed positive, suggesting that long holders maintained strong expectations of a rebound even as the market moved sideways to down. This divergence between funding rates and price action highlighted the psychological tug-of-war and emotional lag that can occur under extreme volatility.

Bitcoin Options Trading

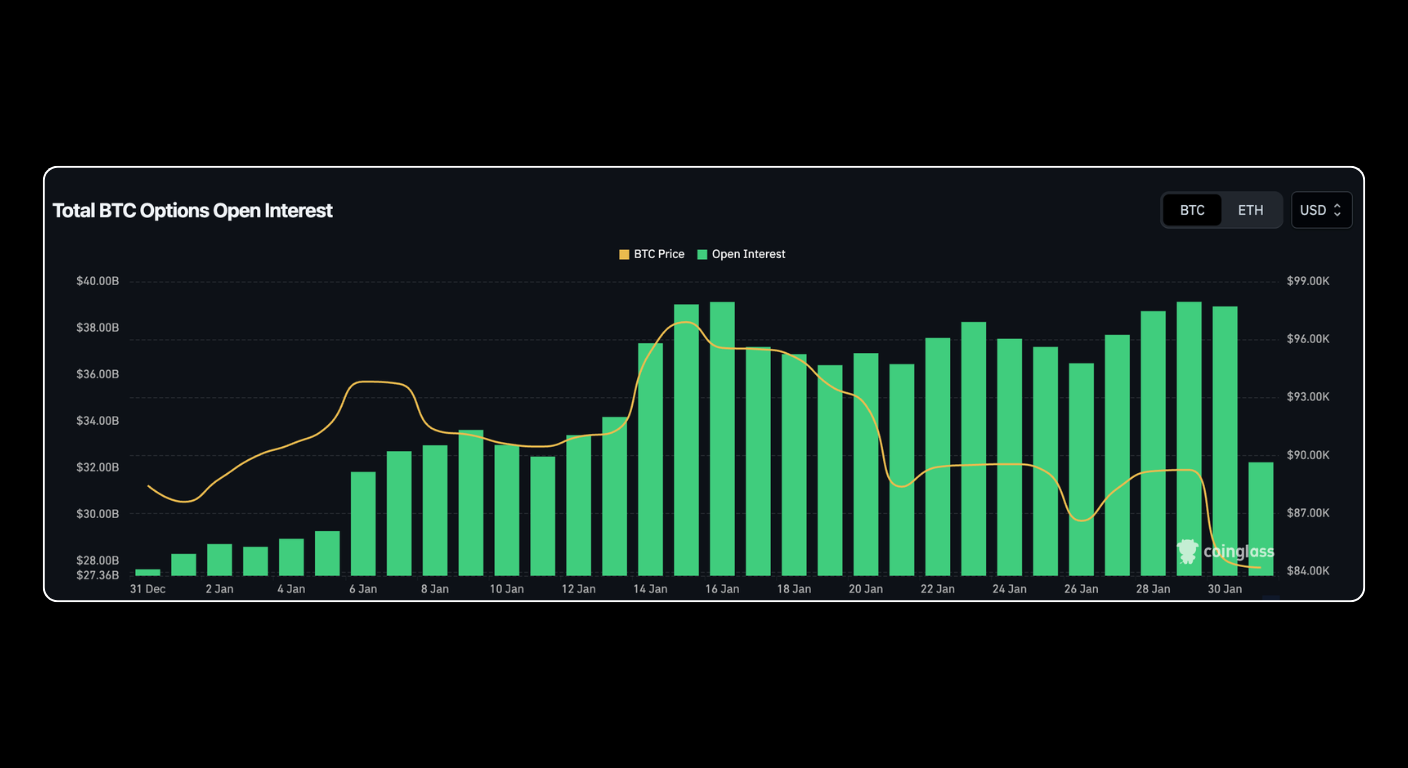

Because BTC options contracts worth roughly 23.0 billion USD underwent concentrated expiry and settlement on December 26, 2025, total options open interest started January 2026 at a relatively low level, at about 28.0 billion USD.

As BTC launched two upward attempts during January, options market sentiment improved, and the total options market size rose steadily, holding near a high of 38.0 billion USD. By late January, due to partial contract expiries and the sharp pullback in spot price, options open interest contracted, falling to about 32.0 billion USD at month-end.

BTC options trading volume fluctuated in January and showed a clear expiry effect. As the world’s largest options exchange, Deribit saw a notable surge in activity near month-end. Daily volume doubled from around 2.0 billion USD at the start of the month to more than 4.0 billion USD toward month-end. This growth was mainly driven by position closing and rolling triggered by end-of-month expiries, reflecting the periodic settlement characteristics of the options market.

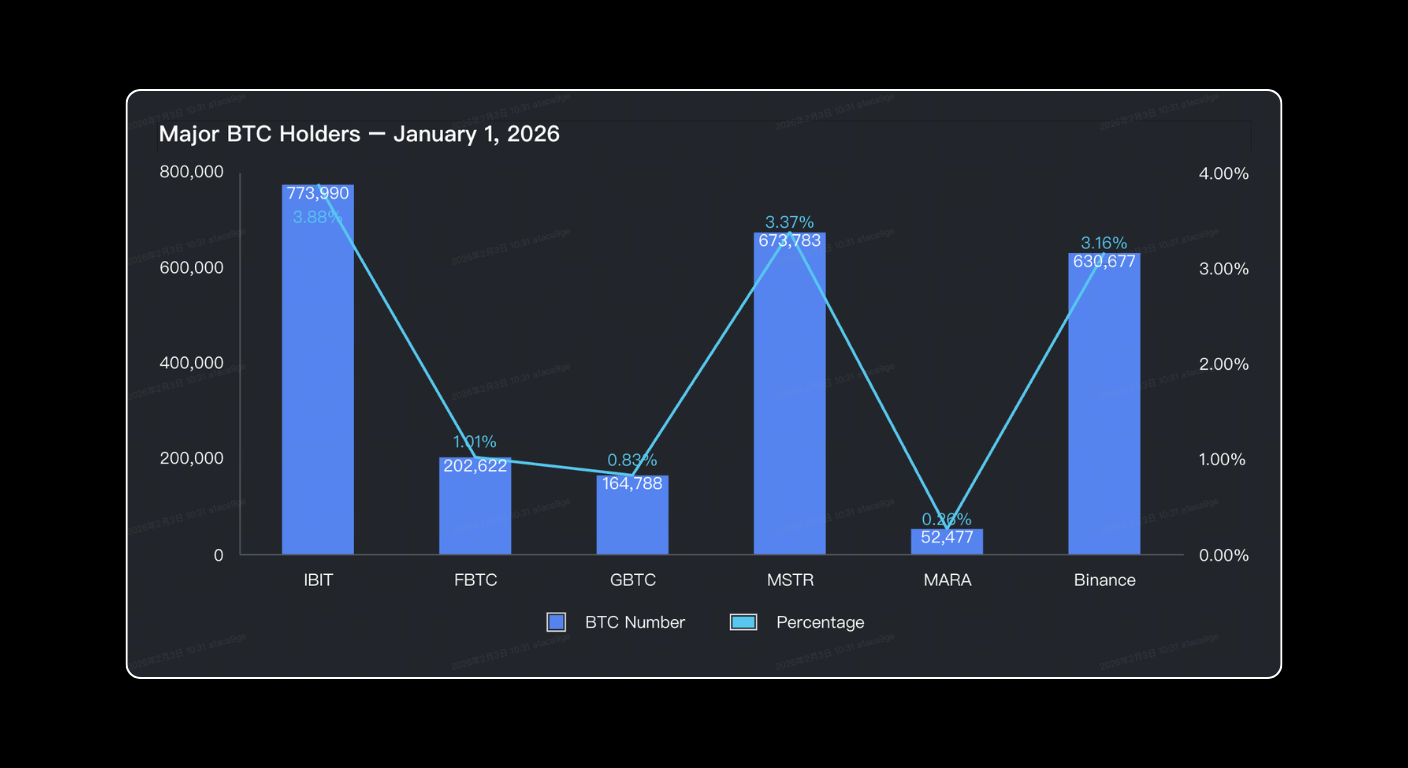

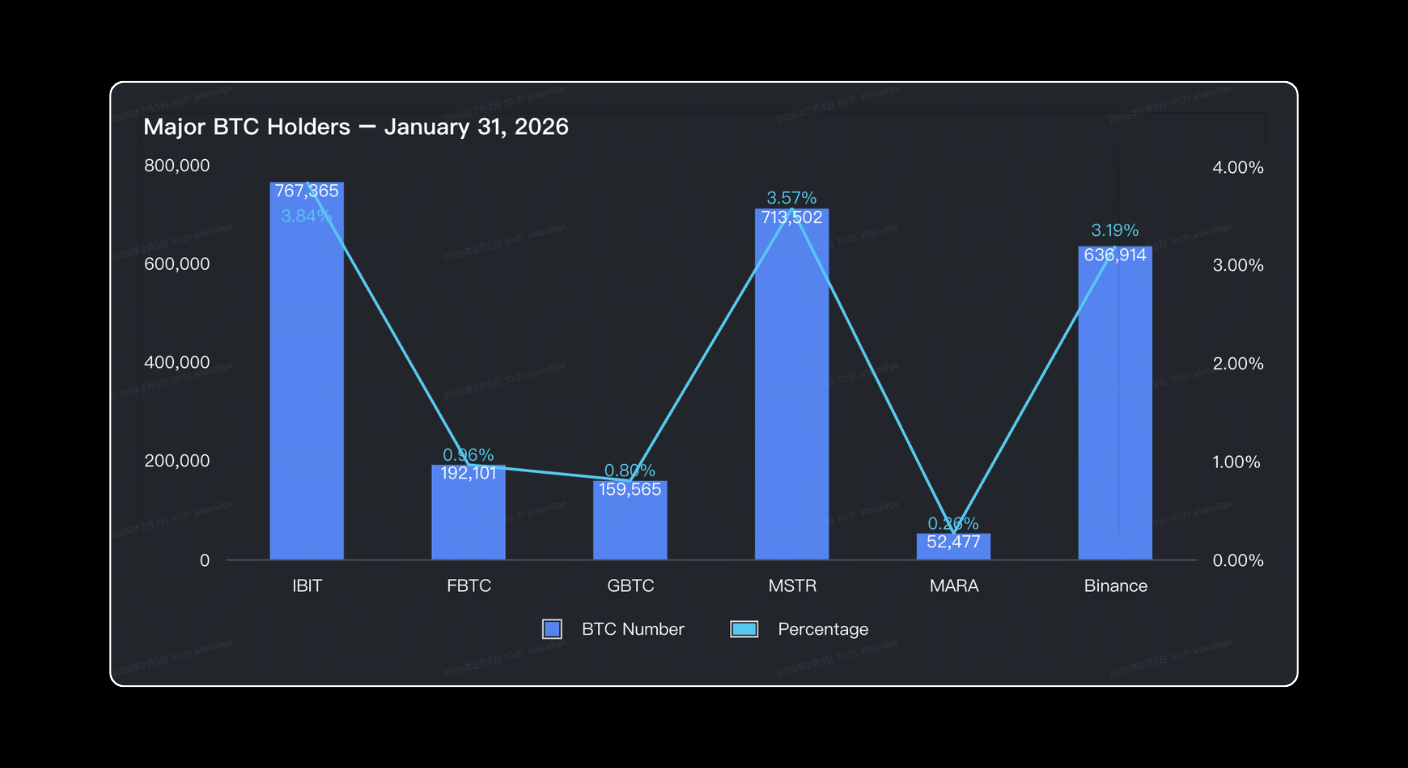

Bitcoin Institutional Holdings

In January 2026, BTC institutional holding structures changed noticeably. As the largest BTC treasury-style company, Strategy continued to buy, increasing holdings by 39,719 BTC during the month. Its overall average cost basis also rose to about 76,000 USD.

In contrast, as a primary channel for traditional finance allocation into BTC, several spot ETFs reduced holdings during the month. IBIT, FBTC, and GBTC recorded net sales of 6,625 BTC, 10,521 BTC, and 5,223 BTC respectively, further narrowing the holding gap between Strategy and IBIT.

In addition, Binance’s January reserves report showed its BTC holdings rose from 630,677 BTC to 636,914 BTC, remaining among the top three exchanges globally by BTC reserves.

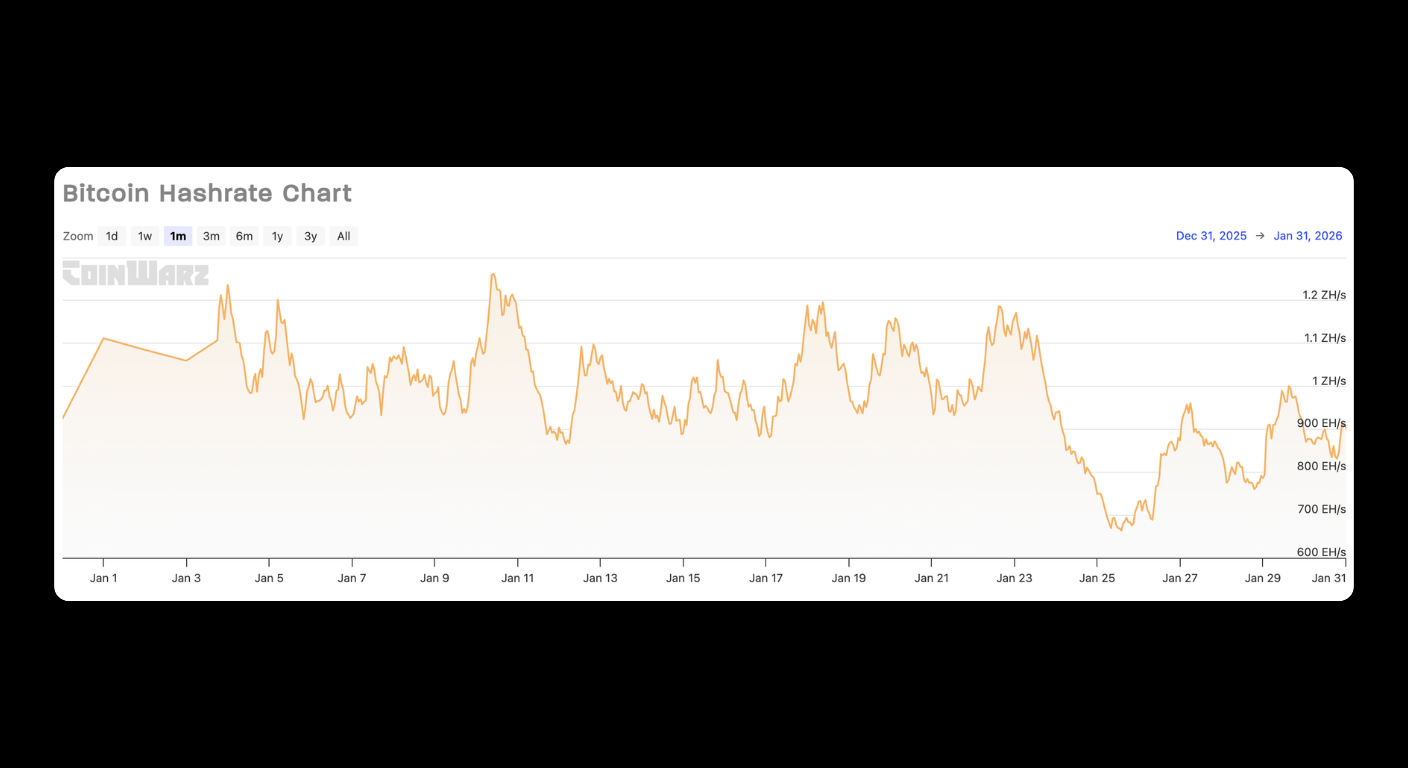

Bitcoin Network Hash Rate

In January 2026, severe snowstorms in the United States caused major turbulence in Bitcoin network hash rate. In early January, hash rate dipped below 1 ZH/s several times, but the low still held around 865 EH/s.

In late January, extreme weather drove up electricity costs, greatly increasing mining operational pressure. Some miners temporarily shut down equipment to reduce power expenses. Foundry USA pool’s Bitcoin hash rate alone fell by nearly 200 EH/s, a drop of about 60%. By January 25, 2026, total Bitcoin network hash rate fell further to 663 EH/s, the lowest level since July 2025.

The World Computer: Ethereum

ETH’s strong momentum from December 2025 did not carry into 2026. In January, BTC fell 3.86% for the month, while ETH dropped 8.90%, clearly underperforming BTC. Early in the month, ETH hovered near the psychological 3,000 USD level. As the “Warsh shock” hit at month-end and bearish sentiment took control, ETH broke below the key 2,700 USD support level on the final trading day of January, continuing downward.

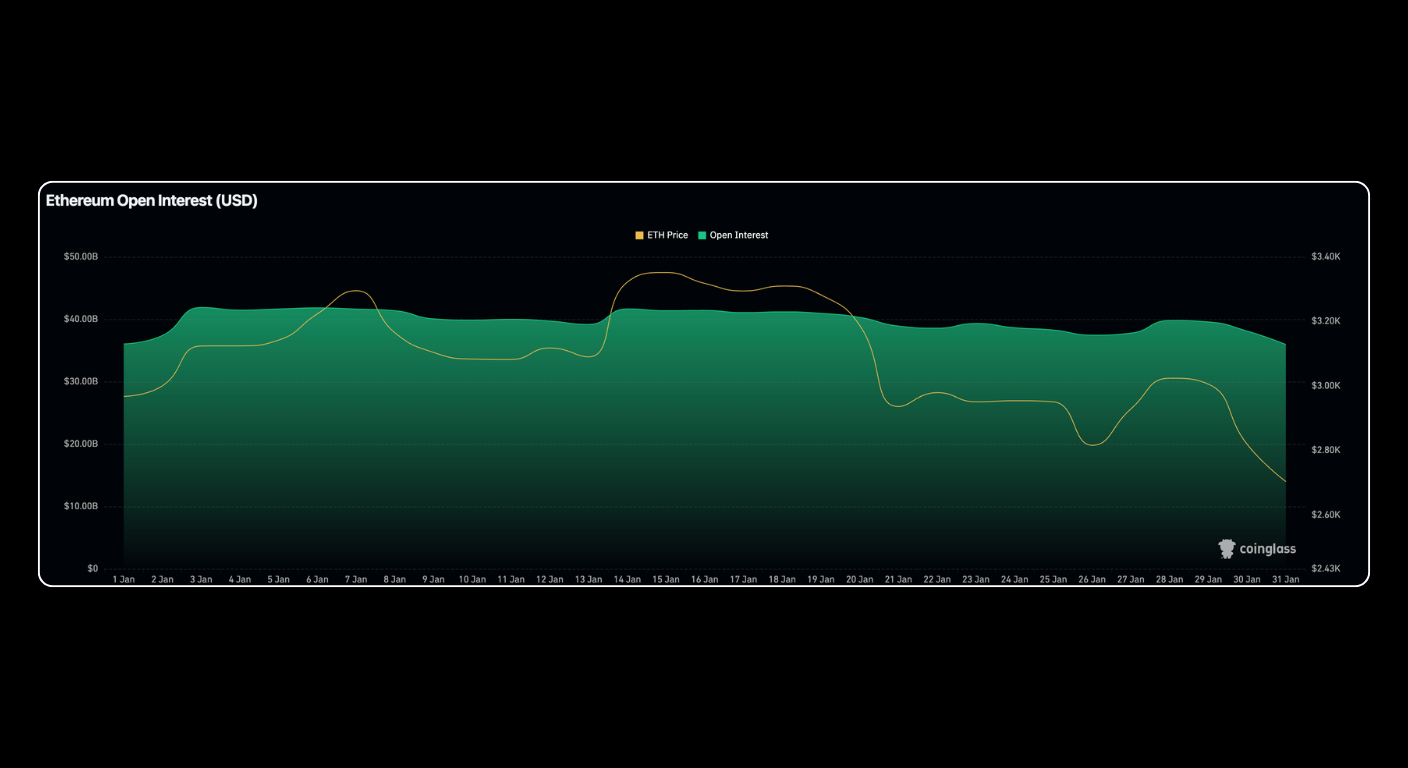

Ethereum Perpetual Futures and Derivatives Trading

In January, total ETH futures open interest moved mostly within a range, staying between 30.0 and 40.0 billion USD for an extended period. However, the market shifted abruptly at month-end.

On January 31, the market saw the most severe single-day liquidation wave since the “1011 event.” On that day, ETH long liquidations reached 1.07 billion USD, while short liquidations were only 65.62 million USD. Under this extreme deleveraging pressure, total open interest fell quickly back toward the 30.0 billion USD level by month-end.

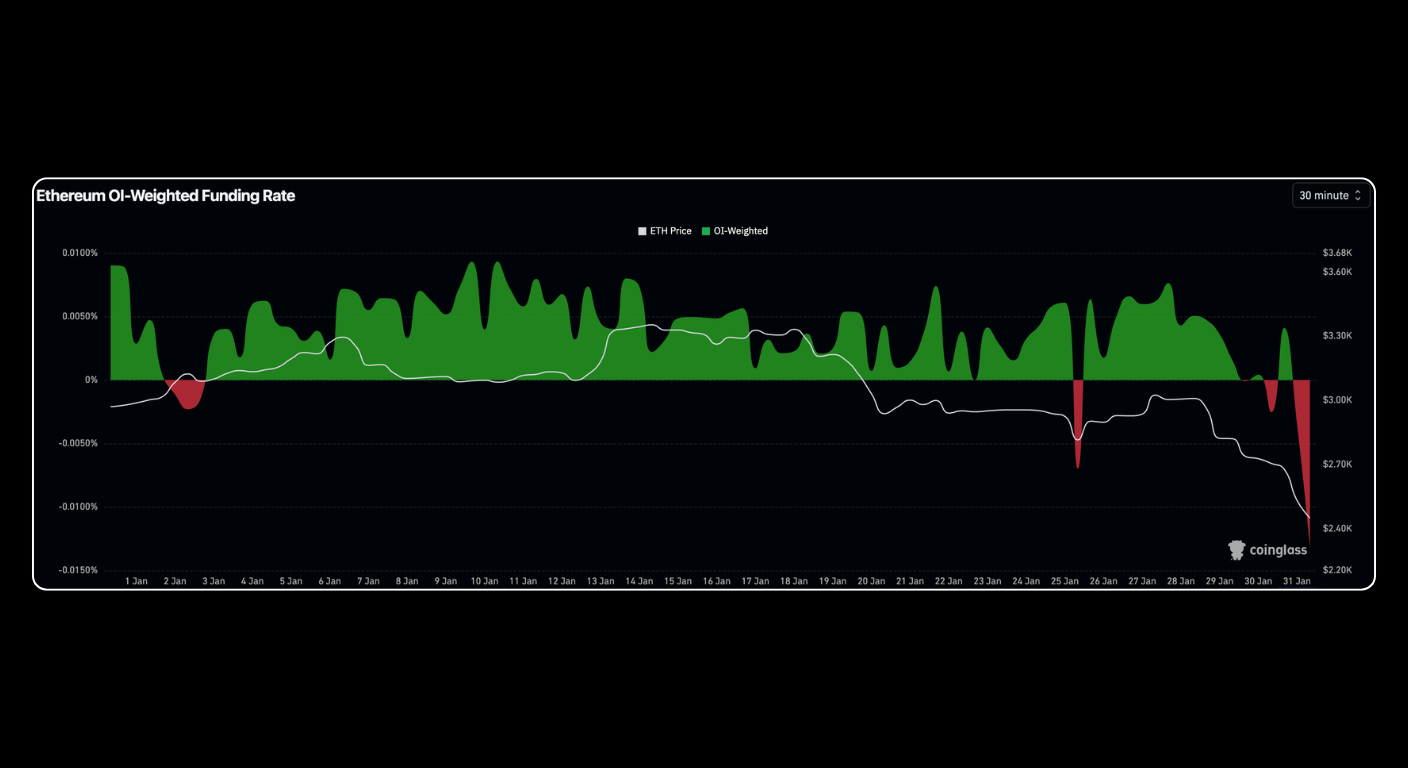

From the perspective of funding rates, bullish derivatives sentiment was dominant early in the month. Aside from a brief negative funding rate on January 3, funding remained positive for a long period. The situation reversed sharply at month-end. As ETH spot broke below the 2,700 USD psychological line, funding dropped to -0.0035%. This level marked the most extreme and fearful short sentiment in the futures market since the “1011 event,” suggesting pessimistic expectations reached a peak.

Ethereum Options Trading

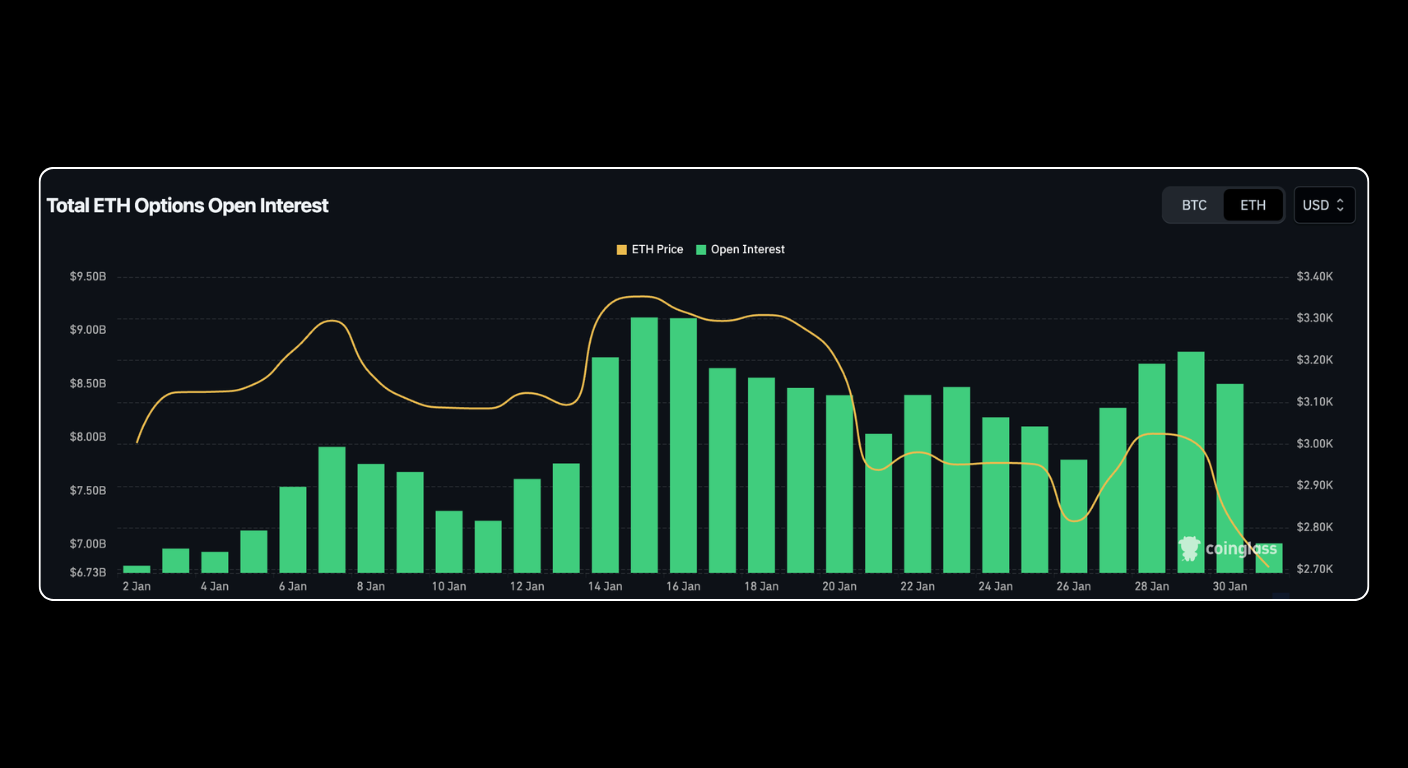

At the start of the month, ETH options open interest stood at about 6.7 billion USD. As market conditions stabilized and improved, open interest climbed to a local peak of 9.1 billion USD on January 16. By late January, as monthly option expiry and settlement approached, some positions closed, bringing open interest down to 7.1 billion USD, returning close to early-month levels.

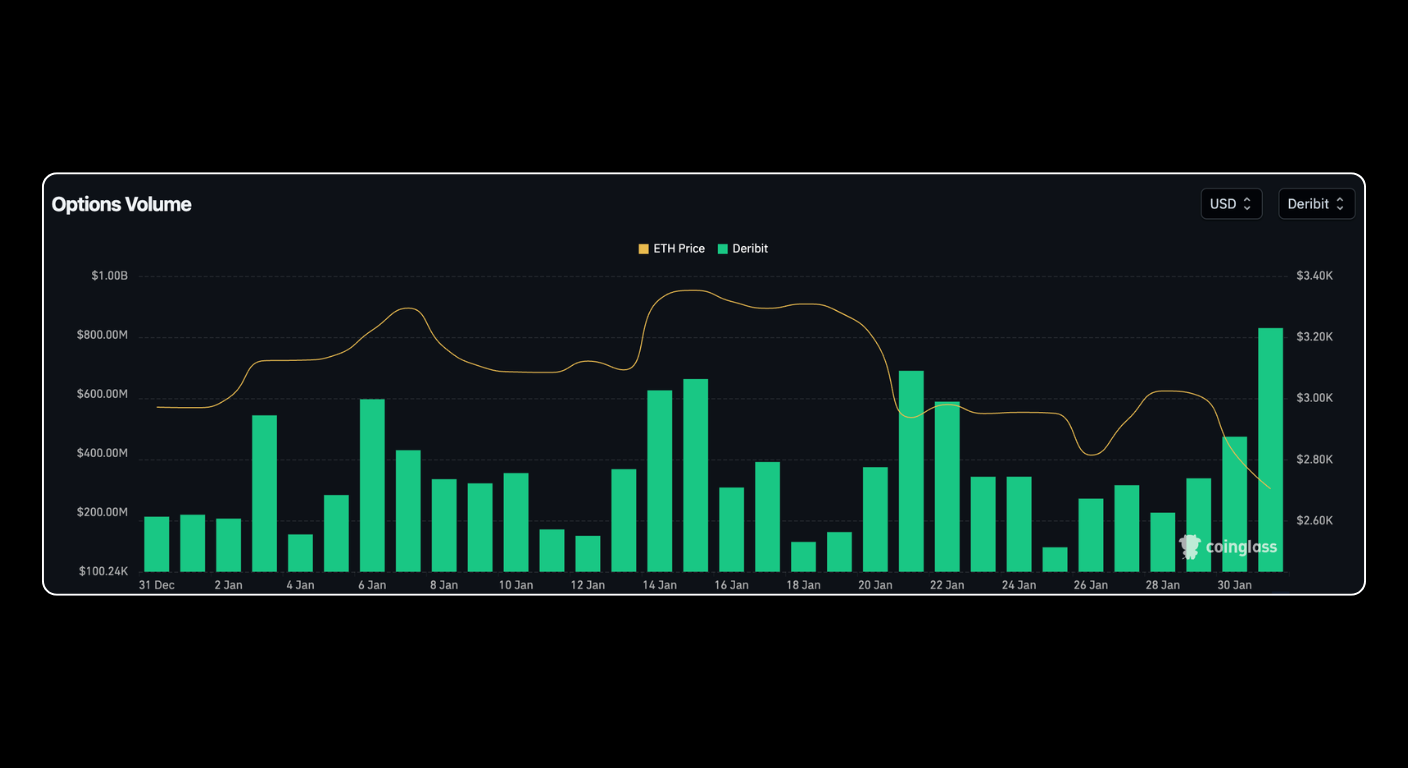

ETH options trading volume declined compared with December 2025. In January 2026, average daily options volume was about 0.4 billion USD. As expiry approached, activity increased significantly, and on January 31, options volume exceeded 0.8 billion USD.

Ethereum Institutional Holdings

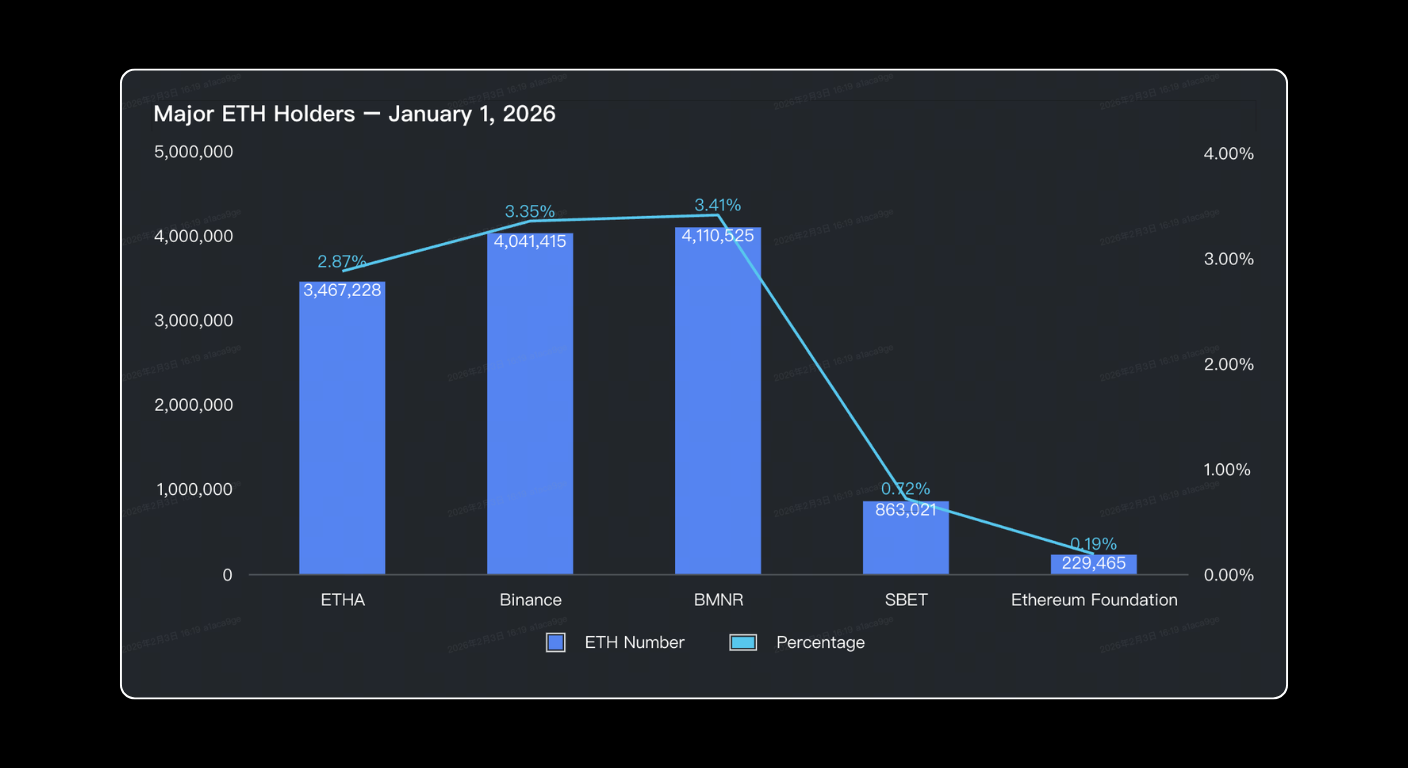

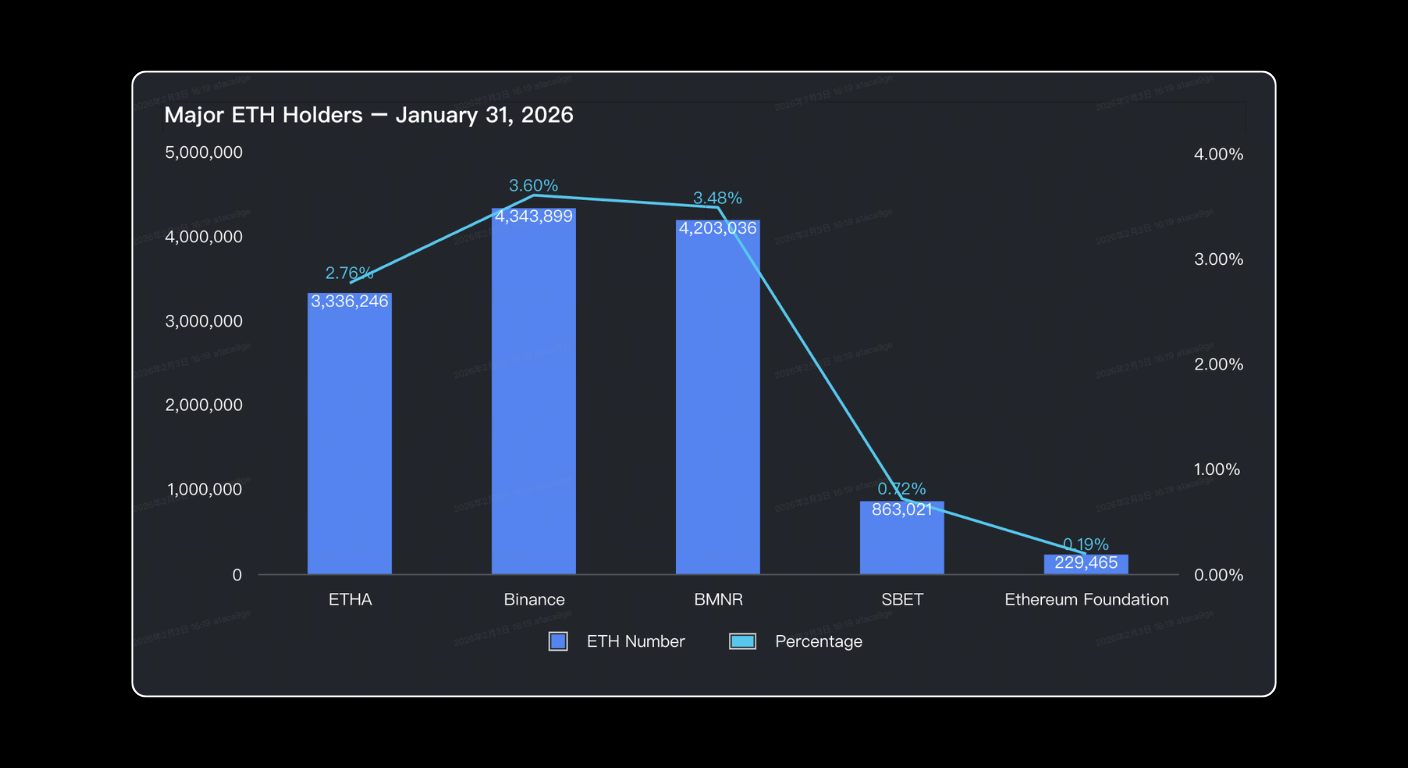

In January, Ethereum institutional holdings saw a notable reshuffle. Binance showed strong accumulation, adding more than 300,000 ETH over the month and overtaking BMNR to become the largest institutional entity by ETH holdings.

Although BMNR also bought 92,000 ETH during the month, it remained in second place. In fund flows, Ethereum and Bitcoin showed a highly similar pattern: exchanges and corporate treasuries actively accumulated, while ETF funds sold. Among them, BlackRock’s ETHA reduced holdings by 130,000 ETH in a single month, and its holding share fell to 2.76%.

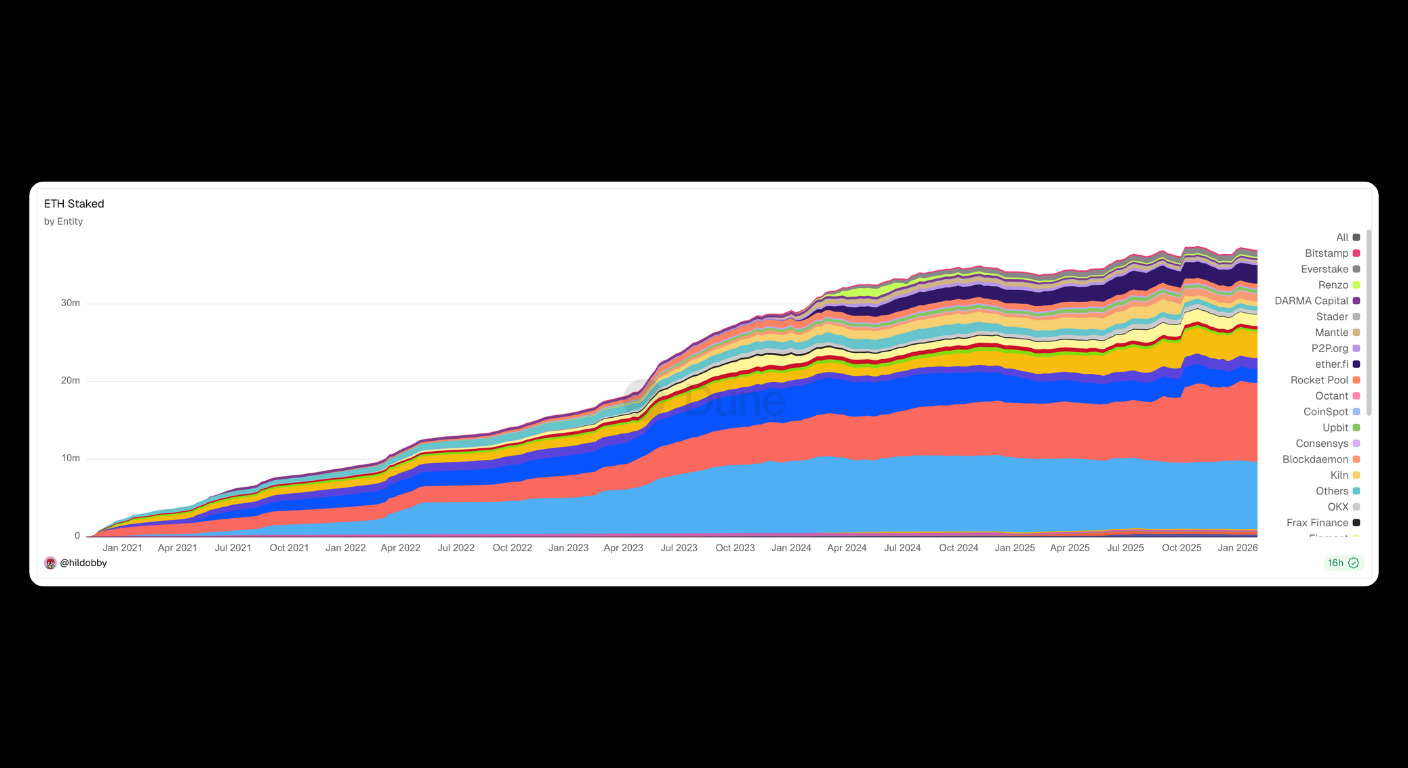

Ethereum Staking

By the end of January 2026, total Ethereum network staking decreased to about 36.95 million ETH, about 50,000 ETH less than early month.

On January 29, Onchain Lens reported that Ethereum treasury company BMNR staked another 147,072 ETH worth about 441 million USD. After this operation, its cumulative staked amount rose to 2,516,896 ETH, corresponding to a market value of about 7.45 billion USD.

BMNR held a total of 4,203,036 ETH at the end of January, with a staking ratio of about 59.8%. Staking coverage remained high.

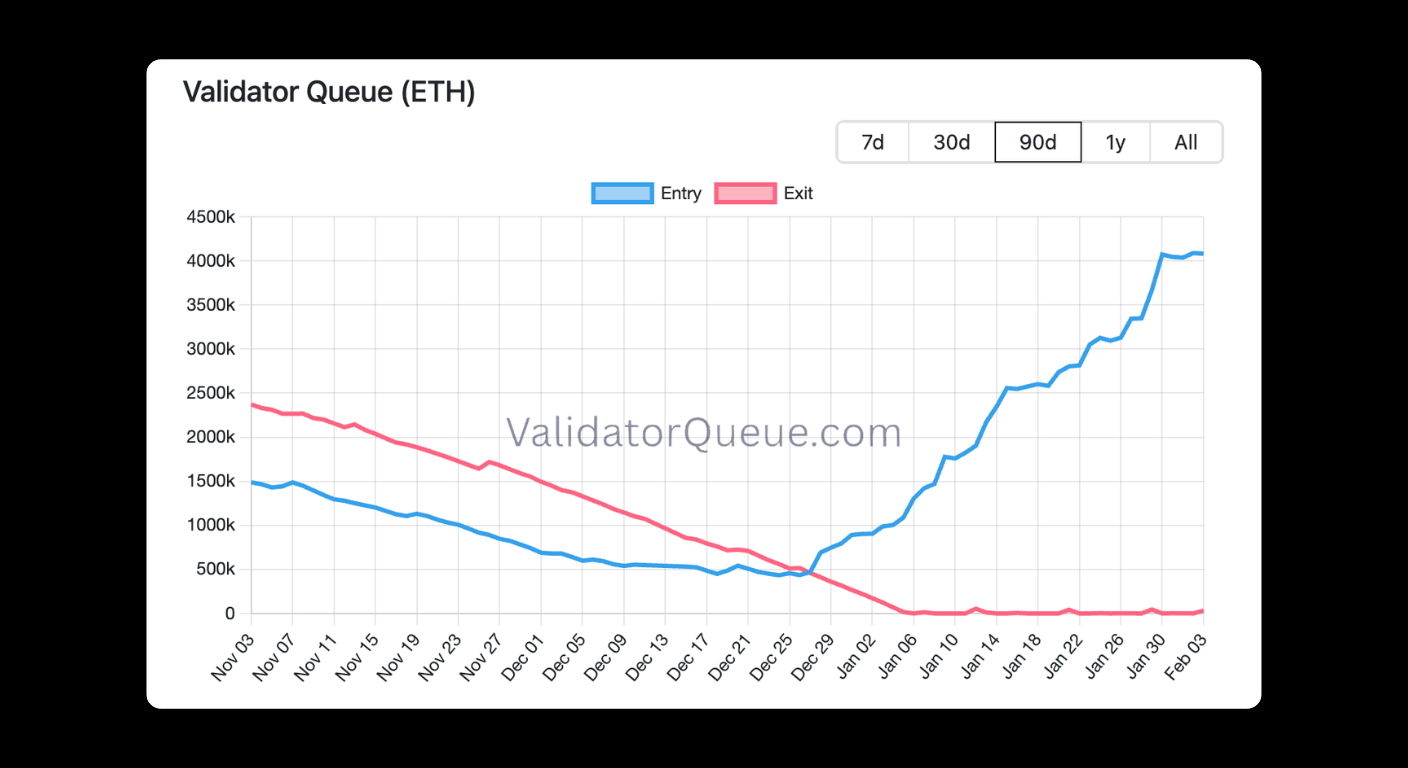

January validator queue data showed a clear net inflow trend. The entry queue increased from 901,446 ETH at the start of the month to 4,072,327 ETH at month-end, a rise of 350%. Meanwhile, the exit queue fell from 223,083 ETH to 2,480 ETH.

Despite daily activation limits and a slight decline in total staked ETH due to the transition gap between old and new validators, the surge in queue size reflected a shift in capital allocation. As ETH’s price decline widened in January and fell below the cost basis of many institutions, investors tended to give up liquidity in exchange for staking yield. This behavior suggests that under price pressure, holders are converting into longer-term positions through staking strategies to earn yield in ETH terms and reduce holding costs. Objectively, this also helps reduce potential sell pressure.

On-Chain Data

Major Public Blockchains

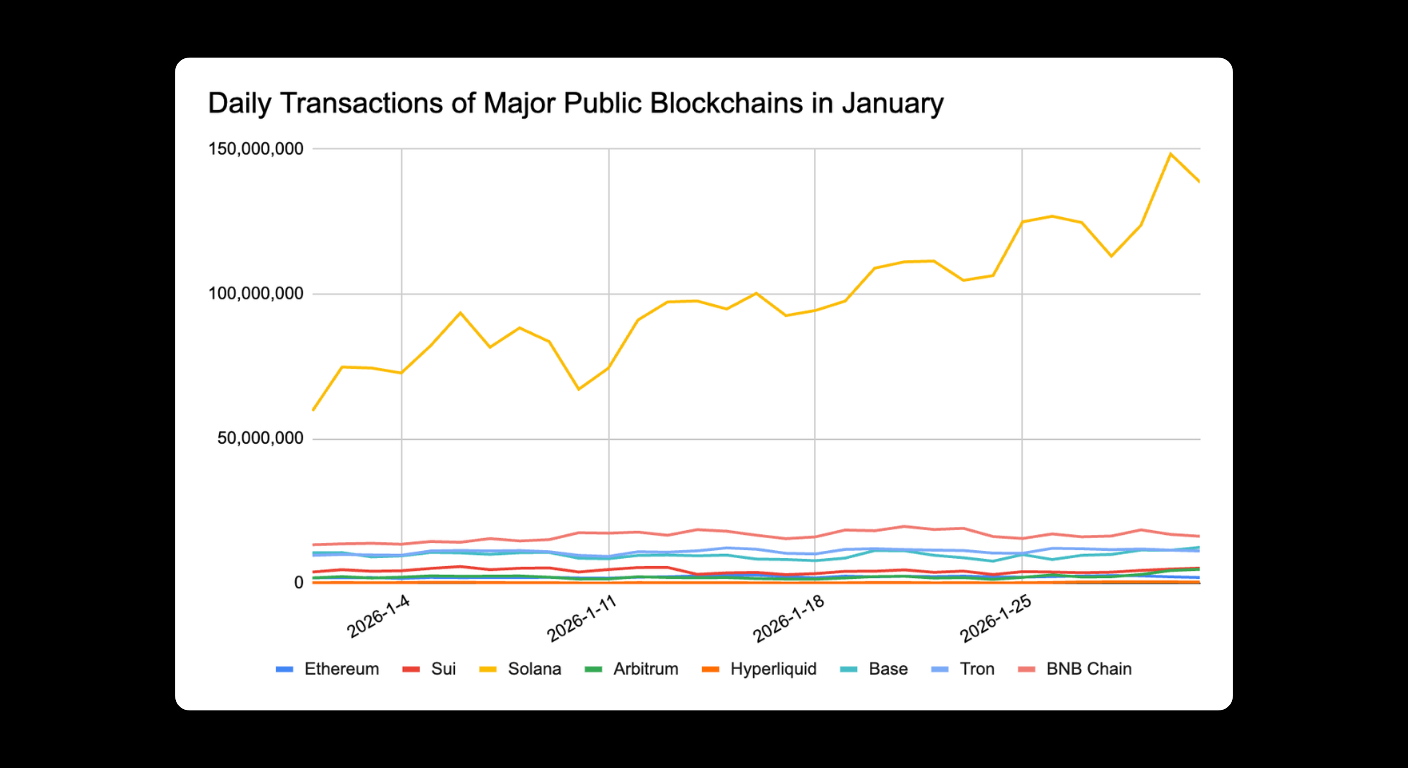

In January 2026, competition among public blockchains showed no major change in transaction count rankings. Solana remained first, with an average of about 98.7 million transactions per day. Compared with about 71.0 million per day in December, January’s volume increased by 39%.

BNB and Base held second and third place. The high transaction volumes on these chains also reflected continued strong on-chain memecoin trading activity.

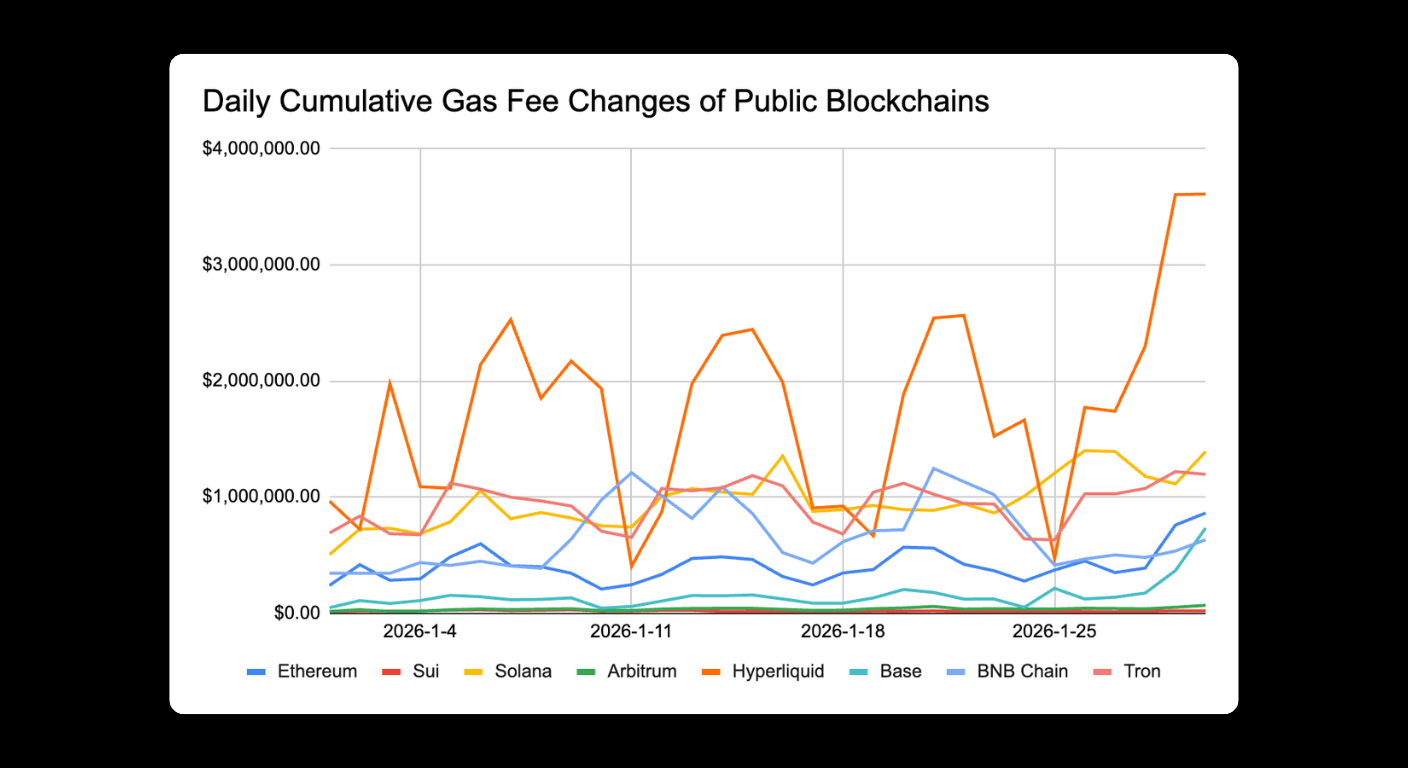

In terms of gas fees, Hyperliquid again ranked first among chains by average daily fee revenue at about 1.81 million USD. Compared with about 1.57 million USD per day in December, January rose about 15%. Solana, TRON, BNB, and Ethereum ranked second through fifth.

DEX and Perp DEX

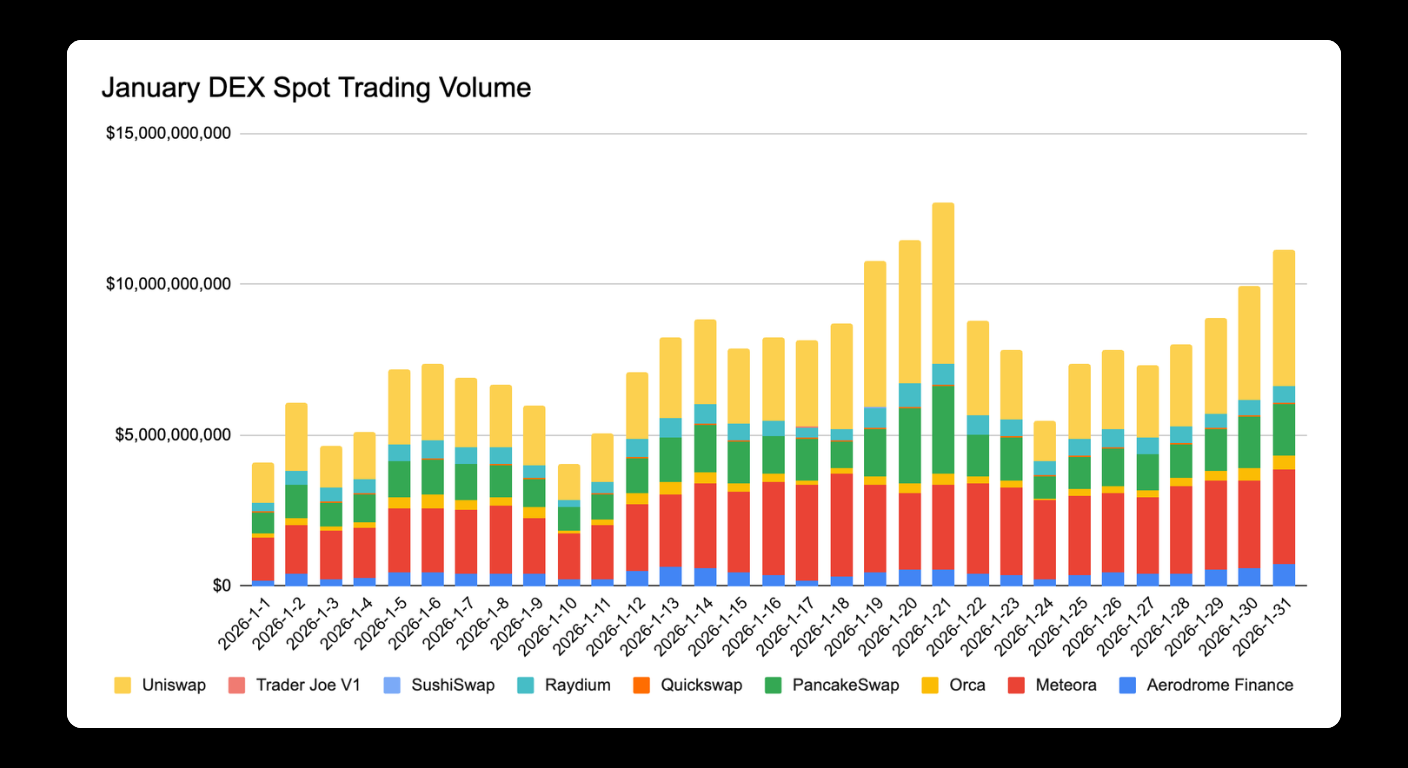

In January, within DEX spot markets, Uniswap remained first with average daily volume of about 2.69 billion USD, more than 40% higher month over month compared with December 2025.

Meteora and PancakeSwap ranked second and third with average daily volume of 2.45 billion USD and 1.27 billion USD respectively.

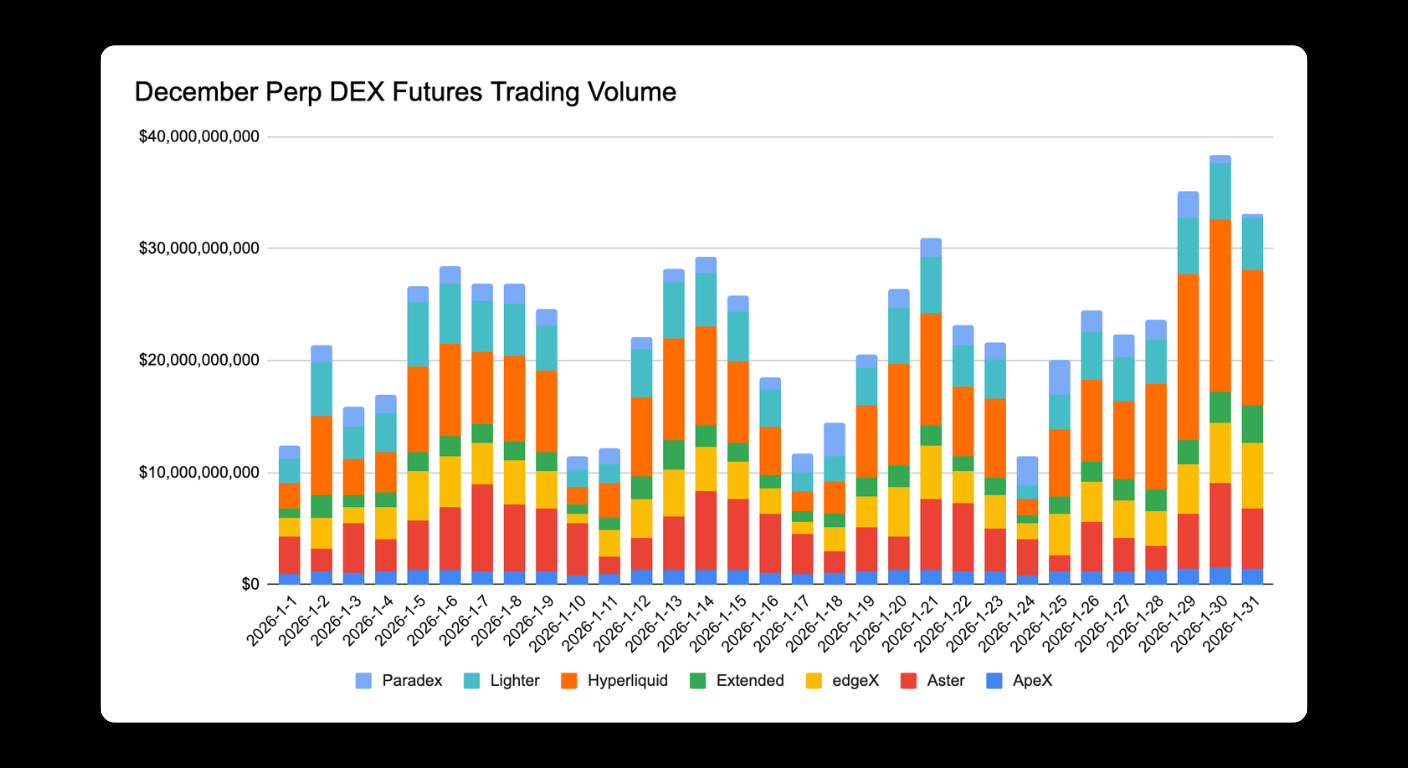

In perpetual futures DEX markets, Hyperliquid widened its lead in January, reaching average daily trading volume of 6.82 billion USD, significantly higher than Aster and Lighter at 4.35 billion USD and 3.81 billion USD.

Prediction Markets

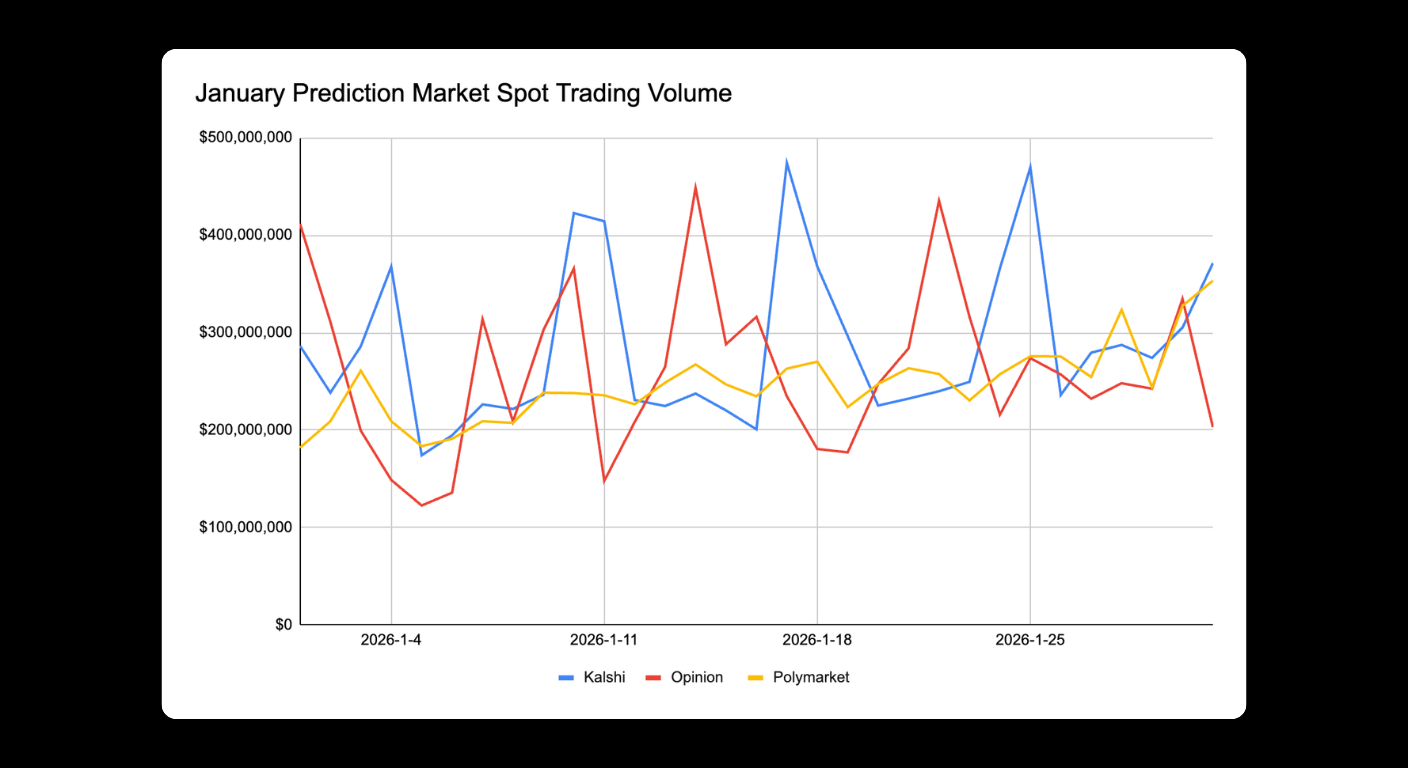

As prediction markets have been viewed as one of the faster-growing subsectors in crypto, the number of related startups increased and the ecosystem continued expanding. New platforms such as Limitless, Myrid, and Predict.fun entered the market. However, overall trading volume remains at an early stage, and liquidity and user scale have not yet shown clear breakout growth.

Among major platforms, Kalshi, Opinion, and Polymarket all saw a pullback in January. Monthly trading volumes were about 2.8 billion USD, 2.6 billion USD, and 2.4 billion USD respectively, showing a clear cooldown from prior peaks.

Considering that all three exceeded 5.0 billion USD in monthly volume in December, this pullback can be viewed as a reasonable rhythm correction after a high base, and it also reflects the volatility and cyclical characteristics that still accompany rapid expansion.

On-Chain Gas Fee Ranking by Contract Address

This monthly review added a new ranking of contract addresses by gas fee contribution. Artemis aggregated and analyzed gas fee sources across multiple public blockchains in January, including Ethereum, Solana, and BNB.

Among them, stablecoin issuer Tether’s token minting activity on TRON generated about 24.089 million USD in gas fees in January. Minting operations on Ethereum also contributed more than 1.0 million USD in gas fees.

In addition, memecoin launch platform Pump.fun’s AMM trading generated about 2.671 million USD in gas fees. The MEV trading bot Jared From Subway contributed about 1.451 million USD in gas fees, also drawing attention.

Contract Address Gas Fee Ranking (January 2026)

| Contract Address | Type | Blockchain | Gas Fees Paid in January |

|---|---|---|---|

| Tether | Stablecoin | TRON | $24,089,298 |

| Pump.fun AMM | Memecoin launch platform | Solana | $2,670,808 |

| Jared From Subway | MEV bot | Ethereum | $1,450,861 |

| Meteora | Perpetual futures DEX | Solana | $1,272,374 |

| Tether | Stablecoin | Ethereum | $1,004,824 |

| PancakeSwap | DEX | BNB Chain | $610,688 |

| Polymarket | Prediction market | Polygon | $526,648 |

| MetaMask | Web3 wallet | Ethereum | $479,774 |

| Wintermute | Market maker | Ethereum | $215,631 |

| OpenSea | NFT marketplace | Ethereum | $184,117 |

| Aave | Lending protocol | Ethereum | $81,073 |

Product Evolution

Ethereum Foundation AI Lead: ERC-8004 Standard Deployed on Ethereum Mainnet

On January 30, Davide Crapis, the Ethereum Foundation’s AI lead, posted on X that the ERC-8004 standard has been deployed on the Ethereum mainnet. The standard defines a “trustless agent” specification. Previously, more than 10,000 agents had registered on testnets. With the mainnet deployment, the “8004 Genesis Month” campaign also launched.

ERC-8004 proposes a standardized way to register and verify AI agents on chain. Developers can integrate it directly into smart contracts without upgrading the Ethereum network itself.

The standard aims to address two core problems in the AI agent economy:

- How to discover AI agents in an open environment

- How to assess their trustworthiness

By introducing portable reputation and discovery mechanisms, ERC-8004 enables cross-organization AI agents to interact without requiring prior trust, supporting an open agent economy system.

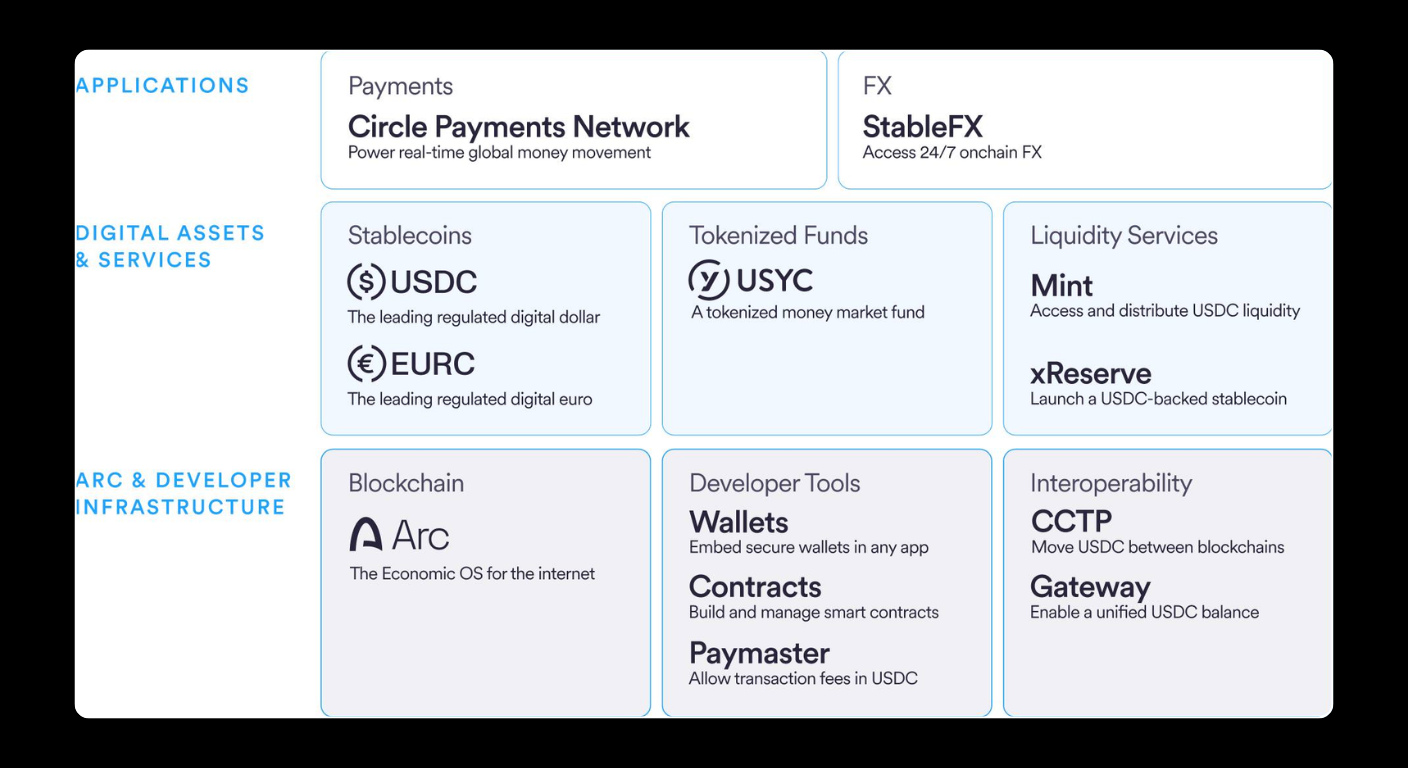

Circle: Arc Will Gradually Move From Testnet Toward Production

Stablecoin issuer Circle said it will focus in 2026 on building more resilient stablecoin infrastructure to drive broader enterprise and institutional adoption.

Circle’s Chief Product and Technology Officer, Nikhil Chandhok, revealed plans to move Arc, its Layer 1 blockchain designed for institutions and large-scale applications, gradually from testnet toward production.

At the same time, Circle will continue expanding use cases for USDC, EURC, USYC, and partner-issued stablecoins. By supporting more blockchain networks, Circle aims to improve token availability and coverage.

Chandhok said this includes deepening native support on key networks, strengthening integration with Arc, and making it easier for institutional users to hold, transfer, and programmatically use stablecoins within daily business workflows.

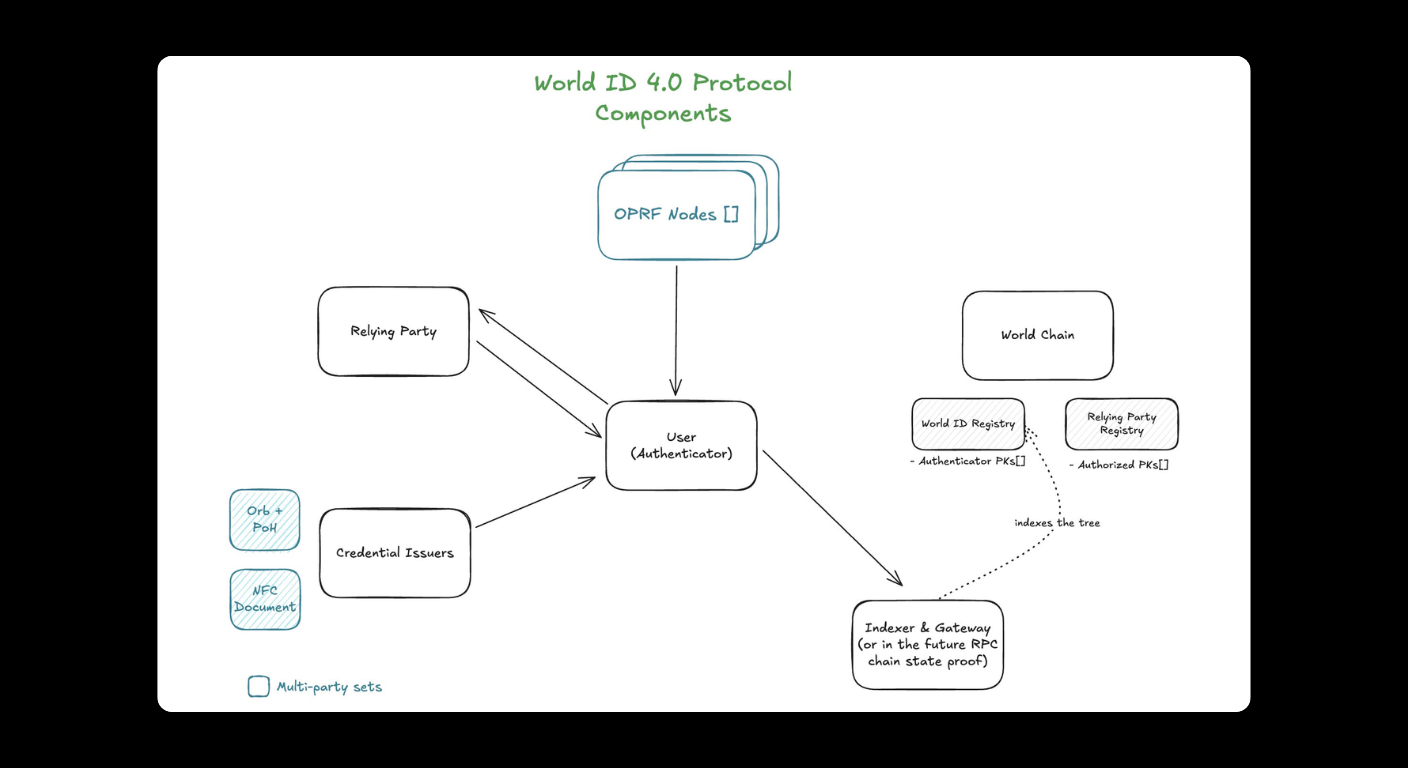

World Releases World ID v4.0, Introducing Account Abstraction and Multi-Key Support

On January 29, World announced the release of World ID v4.0, introducing an account abstraction architecture into its protocol system.

This upgrade shifts World ID from a single-key mechanism to an abstract record within a public registry called “WorldIDRegistry,” and supports multiple authorized keys. Users can generate identity verification proofs across different devices or platforms.

World stated that core improvements include:

- Multi-key and multi-verifier management, improving flexibility while keeping the same identity

- Stronger protocol resilience, including key rotation, revocation, and optional recovery guardian mechanisms

- A web-based reference verifier to simplify browser-side experience

- One-time nullifier generation via OPRF nodes to enhance privacy protection

- A new relying party registry to help verifiers identify request sources, prevent phishing, and lay groundwork for future protocol fee mechanisms

0G and AmericanFortress Launch AI-Native Private and Compliant Trading Infrastructure

0G announced a joint launch with AmericanFortress of private and compliant trading infrastructure designed for AI agents. The goal is to address key gaps in trustworthy identity and private transaction layers in the AI agent economy.

0G stated that as AI agents increasingly execute on-chain trades, manage treasuries, and interact with DeFi protocols, existing transaction structures based on public addresses and lacking privacy protection expose clear security and compliance risks.

According to reports, 0G provides the AI agent compute layer, while AmericanFortress provides a one-time transaction mechanism based on dynamically hidden addresses. Humans and AI agents can transfer value using names rather than public on-chain addresses, reducing risks such as address poisoning and transaction hijacking, and enabling transaction unlinkability for third-party observers.

Trading Signals

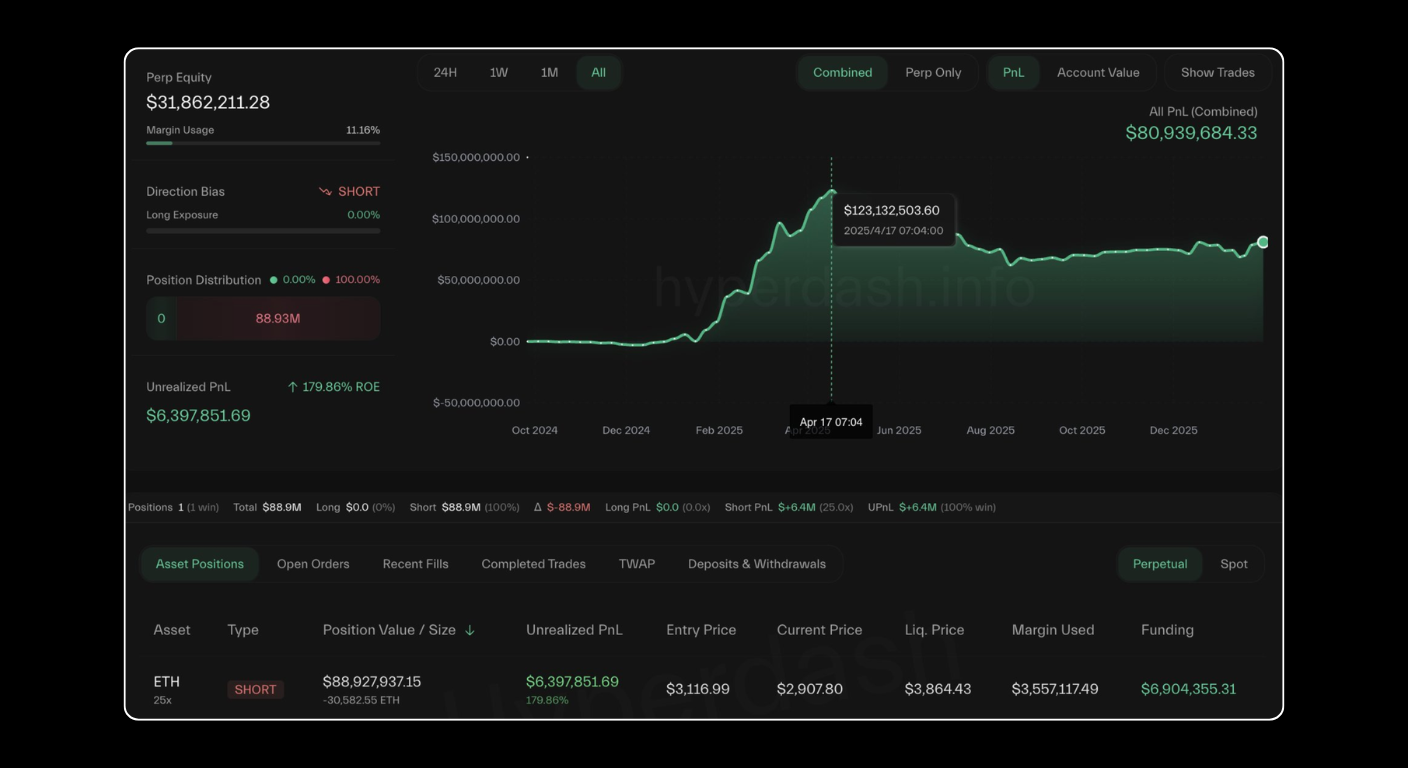

Whale Earns Over 80.90 Million USD by Shorting ETH With High Leverage

On January 29, Lookonchain reported that the whale ETHMegaBear (0x20c2) earned over 80.90 million USD by shorting ETH.

This trader has been shorting ETH on Hyperliquid since 2024 and has continuously used very high leverage. Leverage was previously 50x and is currently 25x.

ETHMegaBear (0x20c2) currently holds a short position of 30,582 ETH, worth about 88.90 million USD.

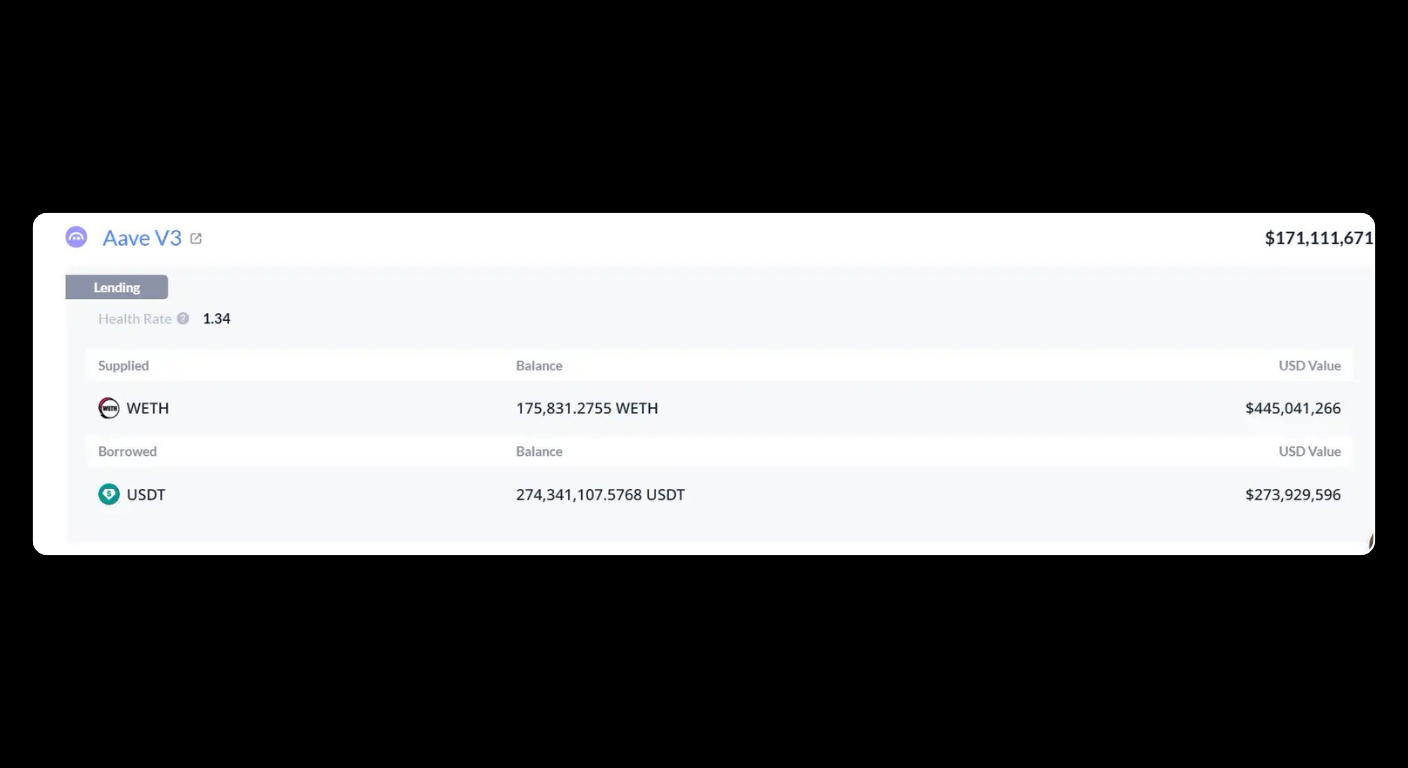

Trend Research Under Jack Yi: ETH Liquidation Price Around 1,558 USD, Lending Health Factor 1.34

On January 31, on-chain monitoring data showed that Trend Research under Jack Yi has deposited a total of 175,800 WETH as collateral on Aave V3, worth about 445 million USD, and borrowed about 274 million USDT. The lending position health factor is 1.34.

During the market decline, additional margin could still be added. On January 29, Trend Research cumulatively withdrew 109 million USDT from exchanges and deposited it into Aave to reduce liquidation risk for its Ethereum holdings.

On January 26, Jack Yi posted on X, stating that the current market resembles a bear market consolidation phase similar to historical four-year cycles. Structurally, it can be compared to the 2019 to 2020 range-bound period and deep shakeout after liquidity shocks. The investment focus remains on capturing trend opportunities across the full bull and bear cycle.

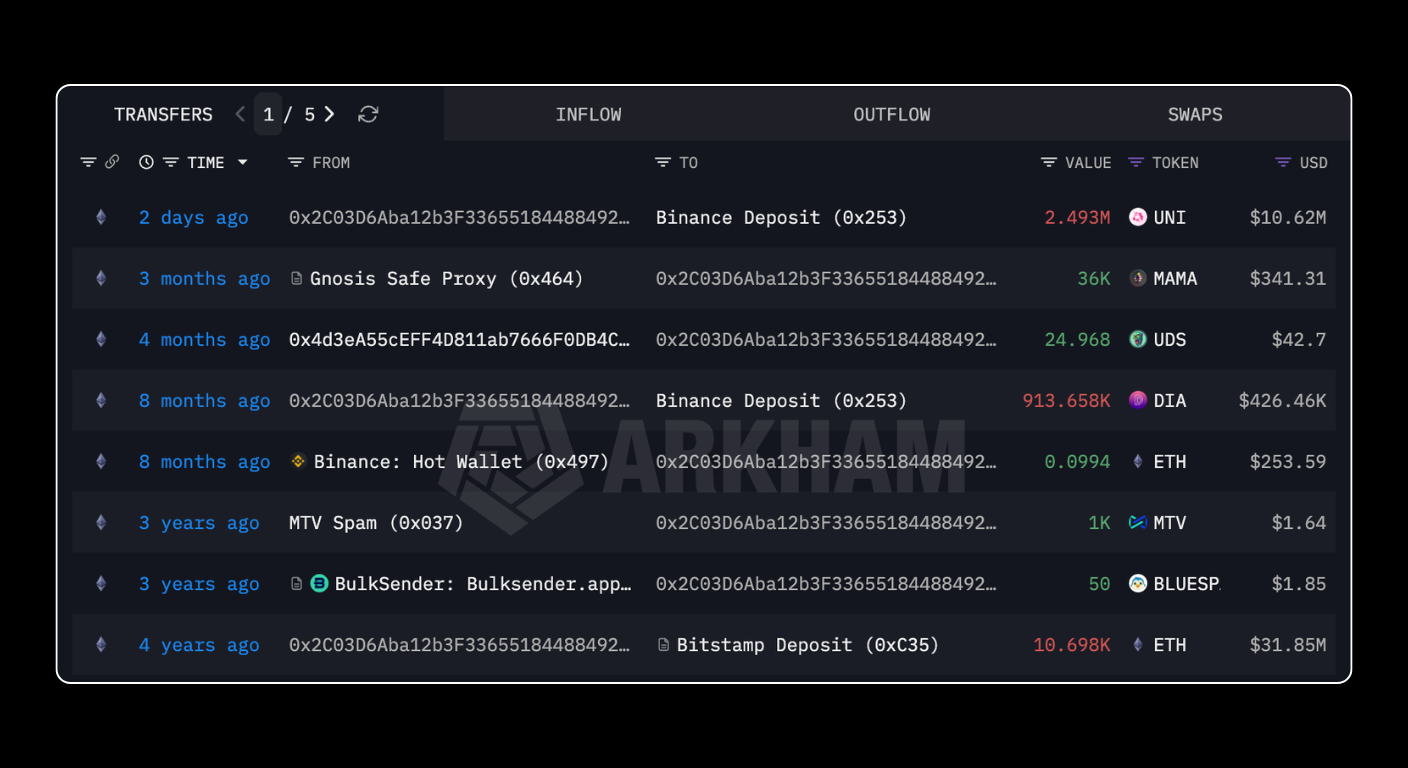

Whale Sells 2.493 Million UNI After Holding for 5 Years, Profit Only 1.72 Million USD

On January 31, on-chain analyst Yu Jin reported that earlier today, a whale (0x2C0…6098), which previously sold 101,000 ETH at an average price of 3,313 USD (worth 334 million USD) for a profit of 269 million USD, fully exited UNI after holding it for five years.

The address transferred all 2.493 million UNI (worth 10.62 million USD) to an exchange. The address bought UNI at launch in October 2020 at an average cost of 3.57 USD.

Today, it transferred all UNI to the exchange at a price of 4.26 USD, earning only 1.72 million USD after five years, a return of 19%.

In the same period, the ETH bought by this address in 2020 gained 400%, while UNI gained only 19%.

Policy Insights

Trump Nominates Kevin Warsh as Chair of the Federal Reserve

Trump nominated Kevin Warsh as Chair of the Federal Reserve. After the news was announced on January 31, markets generally viewed Warsh as a hawkish candidate.

Mizuho Securities Chief Strategist Shoki Omori said that if Warsh takes office, markets may still face pressure on rate cut expectations, but based on the last FOMC voting results, it is not easy to push through rate cuts.

Commonwealth Bank of Australia Senior Economist and Currency Strategist Kristina Clifton pointed out that the USD strengthened on the news mainly because markets viewed Warsh as more hawkish than another candidate, Hassett. She said the volatility was a small reaction driven by expectations, and Warsh could also be more favorable for maintaining the Fed’s independence.

BitMEX co-founder Arthur Hayes argued that even if Warsh becomes Chair, policy may not actually tighten. During his time as a governor, Warsh supported the first two rounds of quantitative easing. He only publicly opposed some policies after leaving office, so real impact may be limited.

SEC Chair and CFTC Chair Launch Project Crypto to Unify Crypto Regulation

According to the SEC’s official website, SEC Chair Atkins and CFTC Chair Mike Selig formally launched the joint initiative Project Crypto at CFTC headquarters on January 29.

The initiative aims to coordinate regulatory standards across the two agencies to respond to bipartisan market structure legislation advancing in Congress.

Atkins said the current regulatory model struggles to adapt to the reality of technology convergence, and fragmented regulation has become a source of investor confusion rather than protection.

Project Crypto will seek to establish a unified framework across trading, clearing, custody, and risk management, following a “minimum effective dose” principle for moderate regulation.

In addition, SEC staff over the past year has provided guidance on memecoins, stablecoins, mining, staking, and broker financial responsibility, and clarified that registered advisers and regulated funds can store crypto assets with certain state-chartered financial institutions.

This initiative signals a shift in regulatory focus from enforcement-driven to clearer rules, aiming to reduce compliance costs through cross-agency cooperation.

Russia Plans to Introduce Crypto Regulation in July, Targeting Effectiveness in 2027

Russia plans to introduce crypto regulation this July and submit it to State Duma deputies for a vote.

Anatoly Aksakov, Chair of the State Duma Committee on Financial Markets, said a comprehensive crypto legislative framework is expected to be ready by the end of June. If passed, the regulations would take effect on July 1, 2027.

Reports say the legislation would allow retail and institutional investors to buy Bitcoin before mid-2027 and set clear regulatory requirements for crypto exchanges. Unregistered exchange operators could face fines or imprisonment.

Under the plan, retail investors would need to pass a qualification test, and annual purchase limits may be capped at under 4,000 USD. Russia’s central bank is expected to create a whitelist of crypto assets that retail investors can trade, potentially including Bitcoin and Ethereum. Qualified investors could trade tokens outside the list.

Japan FSA Seeks Public Comments on Detailed Rules for Digital Payments and Crypto Regulation

Japan’s Financial Services Agency has opened a public consultation on draft implementation rules involving crypto assets, electronic payment instruments, and financial institutions.

The draft clarifies specific execution requirements following the 2025 amendments to the Payment Services Act, including updates to official notices, administrative guidelines, and relevant supervisory rules.

The draft covers multiple areas, including the addition of bonds as designated supporting assets, regulatory frameworks for electronic payment instruments and crypto-related intermediary services, and updated supervisory guidance for financial institutions and their subsidiaries.

The public consultation runs until February 27, 2026. After necessary procedures, the regulations will formally take effect, and consultation results will be announced separately.

In addition, the Japan FSA is planning broader regulatory adjustments, targeting the launch of Japan’s first spot crypto ETFs in 2028.

Security Firewall

In January 2026, the crypto industry recorded 19 security incidents, with total losses of 61.80 million USD, a notable increase versus December.

One key focus was a SwapNet security incident, with losses reaching 16.80 million USD. Attackers abused existing token approval mechanisms, executing transferFrom operations to steal assets. On Base, cumulative losses reached 13.37 million USD.

In addition, multiple suspicious transactions involving proxy contracts were detected on Arbitrum, with estimated losses around 1.50 million USD. Preliminary analysis suggests that the single deployer of the USDGambit and TLP projects may have lost access to the account.

Security Incidents (January 2026)

| Time | Project | Loss Amount | Incident Overview |

|---|---|---|---|

| Jan 5 | Arbitrum | 1.50 million USD | The single deployer of USDGambit and TLP may have lost account access. The attacker deployed a new contract, updated proxy admin permissions to take control, bridged stolen funds to Ethereum, and deposited into Tornado Cash. |

| Jan 6 | TMX | 1.40 million USD | CertiK Alert reported a roughly 1.40 million USD issue in TMX-related contracts on Arbitrum. In the exploit loop, the attacker minted and staked TMX LP tokens, swapped USDT for USDG, unstaked, and sold more USDG. |

| Jan 8 | Truebit | 26.44 million USD | Blockchain verification protocol Truebit was suspected to be hacked, losing 8,535 ETH, worth about 26.44 million USD. |

| Jan 20 | Makinafi | 4.13 million USD | PeckShieldAlert reported Makinafi was hacked, losing about 1,299 ETH. On Jan 22, the MEV Builder returned funds under the SEAL white hat safe harbor, deducting a 10% bounty, returning about 920 ETH. |

| Jan 21 | SagaEVM | 7.00 million USD | Saga announced SagaEVM was attacked involving contract deployments, cross-chain actions, and liquidity extraction. The attacker transferred about 7.00 million USD in USDC, yUSD, ETH, and tBTC, later converted to ETH and transferred to 0x2044…6ecb. |

| Jan 26 | Aperture Finance | 3.67 million USD | Aperture Finance posted on X that it detected an exploit affecting Aperture V3/V4 contracts. To prevent new approvals, core functions were stopped on the front end, and the team is investigating with security partners. |

| Jan 26 | SwapNet | 16.80 million USD | PeckShield reported Matcha Meta said SwapNet was exploited with losses up to 16.80 million USD. On Base, the attacker swapped about 10.50 million USDC for about 3,655 ETH and began bridging funds to Ethereum. |

From the common patterns across multiple incidents, recent on-chain attacks have concentrated on structural issues such as contract logic flaws, improper permission configurations, and abuse of approval mechanisms. This indicates attackers are increasingly targeting protocol design fundamentals and asset flow paths.

These risks are often not caused by a single mistake, but by accumulated weaknesses in deployment processes, permission management, and insufficient security testing. For project teams, relying only on one-time audits is no longer enough to cover real operational risk. Continuous multi-round security checks before and after launch, least-privilege design, abnormal behavior monitoring, and well-defined vulnerability response and white hat collaboration mechanisms are increasingly necessary to reduce attack probability in a high-intensity adversarial environment.

February 2026 Outlook and Key Dates to Watch

Key Events (February 2026)

| Time | Event Name | Overview |

|---|---|---|

| Feb 4 | ECB Monetary Policy Meeting | The ECB will announce its interest rate decision. With inflation volatility in the euro area, the policy stance will directly impact European risk appetite toward digital assets. |

| Feb 6 | US January Nonfarm Payrolls | The labor market is a key indicator for the Fed to judge whether the economy is landing. A stronger-than-expected result may delay rate cut expectations and suppress crypto liquidity. |

| Feb 10 | Consensus Hong Kong 2026 Crypto Summit | Consensus moves to Hong Kong and will gather global regulators and major exchanges. Key topics include Web3 payment infrastructure and RWA compliance in Asia. |

| Feb 17 | ETH Denver 2026 | The world’s largest Ethereum developer event, including Camp BUIDL and hackathons. Proposals (EIPs) and L2 scaling plans discussed may shape Ethereum’s technical direction for the next six months. |

| Feb 18 | Fed January FOMC Minutes | Detailed discussion from the January meeting will be released. Markets will look for more signals on balance sheet runoff and the interest rate path for the second half of the year. |

Entering February 2026, with Ethereum prices remaining weak, Consensus Hong Kong and ETHDenver have become key indicators that may determine whether the ecosystem can recover against headwinds. Signals on compliance and technical breakthroughs from these events may set the tone for Ethereum’s near-term trajectory.

At the same time, US macro data such as nonfarm payrolls, CPI, and Fed meeting minutes remain core drivers of global liquidity, shaping risk appetite and capital flows across crypto and global markets. In this critical month, the rebuilding of technical narratives and the implementation of macro policy may jointly determine whether the market finds a turning point.

Conclusion

In January 2026, the crypto market experienced intense volatility under the combined pressure of a macro policy shift and deleveraging. Bitcoin lost the 82,000 USD level under the impact of the “Warsh shock,” while Ethereum was even weaker.

Despite price pressure, ongoing accumulation by institutional treasuries and the surge in staking queue size indicate that holders in lower ranges increasingly prefer to give up liquidity in exchange for yield, reinforcing supply-side lock-up.

On the technology side, the deployment of AI agent standards represented by ERC-8004 and the upgrade to World ID v4.0 signal that the ecosystem is shifting from pure speculation toward more substantive integration of AI and identity protocols.

Meanwhile, the notable increase in trading volume on high-performance decentralized protocols such as Hyperliquid shows that on-chain ecosystems can still maintain strong trading resilience even in choppy markets.

Looking ahead to February, market focus may shift from digesting panic toward pricing in technical expectations around industry events such as Consensus Hong Kong and ETHDenver, seeking a potential recovery opportunity under pressure.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. The platform is committed to providing a transparent, compliant, and secure trading environment for every user. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, Bitunix prioritizes user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium