Crypto markets move fast—too fast for most human traders to keep up. In 2025, artificial intelligence is no longer a buzzword. It’s the silent engine behind many of the world’s top-performing crypto margin trading systems.

From dynamic liquidation pricing to automated rebalancing, AI-driven liquidation algorithms and crypto margin trading bots are transforming how traders manage leverage and avoid disaster. Whether you’re a beginner learning how liquidation price works or an experienced trader exploring high-frequency bots, understanding the new tech is no longer optional.

Let’s break down the rise of liquidation automation, AI risk tools, and what Bitunix users can do to stay ahead.

What Are Liquidation Algorithms in Crypto Margin Trading?

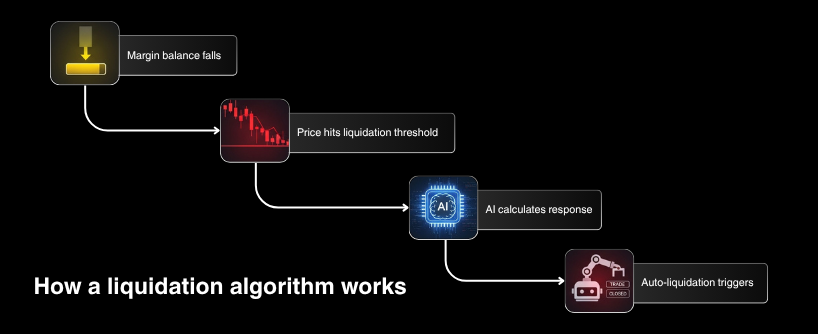

A liquidation algorithm is an automated system that calculates when a margin position should be closed based on a trader’s remaining collateral, leverage level, and the current price of the asset. This process is a forced sale of the position to prevent further losses.

The goal is simple: protect the exchange (and sometimes the trader) from negative equity.

At Bitunix, the liquidation engine is generally automated and activates at a specific point known as your liquidation price, which is when your margin ratio falls below the required maintenance threshold.

In traditional systems, these calculations are fixed and updated periodically. But AI-based algorithms in 2025 are continuously adjusting based on:

- Real-time volatility data

- Position size relative to order book depth

- Network congestion or transaction latency

- Funding rate spikes

- Platform-wide risk exposure

This makes modern liquidation systems faster, smarter, and harder to outmaneuver—especially in high-leverage scenarios.

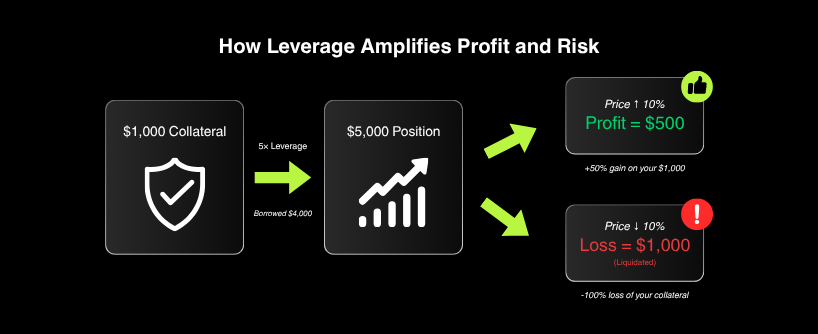

Introduction to Crypto Margin Trading

Margin trading is a powerful tool that allows traders to amplify their market exposure by borrowing funds from a trading platform. By using margin, traders can open larger positions than their own capital would normally allow, increasing the potential profits from successful trades. This approach, known as leveraged trading, is especially popular in the crypto market, where price swings can be dramatic and opportunities for gains are frequent.

However, margin trading also comes with heightened risks. If the market moves against your position, you may face a margin call or even forced liquidation, where the platform automatically closes your trades to protect itself from losses. Understanding how margin levels work, the difference between cross margin trading and isolated margin trading, and the triggers for margin calls is essential for anyone looking to participate in margin trading. By mastering these concepts, traders can better manage their risk and make more informed decisions in a fast-moving market.

Types of Margin Trading

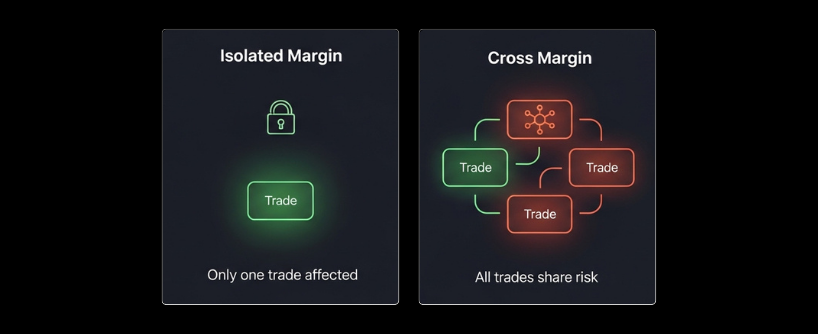

When it comes to margin trading, choosing the right approach can make a significant difference in managing risk and maximizing gains. The two main types are isolated margin trading and cross margin trading.

Isolated margin trading allows you to allocate a specific amount of margin to a single position. This means that if the trade moves against you, only the funds assigned to that one position are at risk of liquidation. It’s a straightforward way to limit potential losses to a single trade.

On the other hand, cross margin trading uses a shared margin balance across multiple positions. In this setup, profits from one position can help cover losses in another, reducing the risk of immediate liquidation. However, this also means that if the market moves sharply against several positions at once, your entire shared margin balance could be at risk. Some trading platforms even offer smart cross margin features, automatically managing your margin requirements by offsetting long and short positions to optimize your overall exposure.

Understanding the differences between isolated and cross margin trading—and how a shared margin balance can impact your risk—will help you develop a margin trading strategy that fits your goals and risk tolerance.

Understanding Margin Levels

Margin levels are at the heart of how margin trading works. They represent the ratio of your equity (collateral) to the borrowed funds in your margin account. Before opening a trade, you must provide an initial margin—the upfront capital required to enter a position. Once your trade is active, you need to maintain a certain amount of collateral, known as the maintenance margin, to keep your position open.

If the market moves against your position and your margin level drops below the maintenance margin, the trading platform will issue a margin call. This is a warning that you need to add more collateral to your margin account or reduce your exposure to prevent liquidation. Failing to respond to a margin call can result in the platform automatically closing your positions to cover potential losses.

To avoid margin calls and forced liquidation, it’s crucial to monitor your margin levels closely. This might mean adding more collateral, reducing the size of your trades, or closing positions to free up margin. By staying proactive and understanding how margin levels, initial margin, and maintenance margin work, traders can better protect their capital and navigate the risks of margin trading.

AI-Powered Crypto Margin Trading Bots

Crypto margin trading bots use algorithmic logic, machine learning, and predefined rules to execute leveraged trades. These bots are specifically designed for margin trading crypto markets, allowing traders to automate strategies in volatile environments.

The most advanced bots in 2025 go a step further by adjusting leverage and risk exposure based on live market conditions. To understand how crypto margin trading work, it’s important to note that traders borrow funds to open larger long or short positions, using leverage to amplify both potential gains and losses.

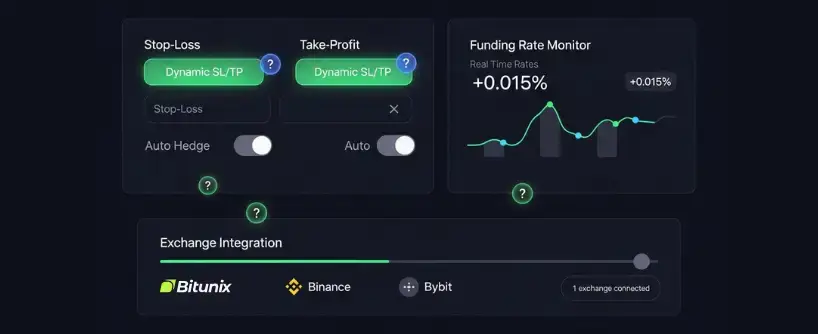

Key Features of Leverage Trading Bots:

- Dynamic SL/TP levels tied to volatility

- Real-time adjustment of margin allocation

- Auto hedge functions during high-impact news

- Funding rate arbitrage

- Trade execution across multiple exchanges

These bots are not designed to replace human decisions entirely. Instead, they reduce human error, especially in fast-moving markets where emotions can ruin trade logic.

How Bitunix Uses AI for Liquidation Management

Bitunix integrates AI-enhanced risk monitoring systems to protect users from forced liquidations. Here’s how the platform applies intelligent automation to support leveraged traders:

- Predictive Liquidation Alerts Bitunix alerts users of liquidation proximity based on volatility-adjusted thresholds—not just static price points. The platform requires users to maintain specific margin levels to avoid liquidation, and predictive alerts help ensure compliance with these requirements.

- Automated Margin Adjustment If users have excess margin in cross mode, the system intelligently reallocates it to avoid unnecessary liquidation.

- Funding Rate Intelligence The system previews funding costs before you open a trade and tracks cumulative impact, helping bots and traders make smarter timing decisions.

- Execution Optimization High-volume traders benefit from lower slippage and faster liquidation coverage due to Bitunix’s optimized matching engine.

Whether you trade manually or through a margin trading bot, these tools allow for greater control with less noise.

Liquidation Price in Crypto: How It’s Calculated

Your liquidation price in crypto margin trading is the asset price at which your position gets closed automatically. It depends on:

- Entry price

- Leverage used (margin leverage)

- Collateral provided (only certain assets can be used as collateral)

- Maintenance margin requirement

Margin trading work by allowing you to deposit an initial investment as margin, then borrow additional funds to control a larger position with less capital. This use of margin leverage amplifies both potential gains and losses.

AI-enhanced platforms recalculate this dynamically, especially in fast markets or with isolated margin.

For example:

- You open a 10x long BTC/USDT at $60,000.

- With $1,000 in margin (your initial investment), your liquidation price might be around $54,600 depending on fees.

- If BTC drops rapidly, the AI engine executes an automated close at the first available price near $54,600 or better.

- If bitcoin increases in value and the price rises above your entry point, you can realize a significant gain due to your leveraged, larger position.

On platforms like Bitunix, this engine works in milliseconds to minimize losses.

How Automated Crypto Trading Reduces Emotional Risk

Humans are emotional. Bots are not.

One of the biggest benefits of automated crypto trading is emotional neutrality. When paired with AI liquidation rules, margin trading becomes a lot more structured:

- No more revenge trades after a loss

- No panic closing during temporary drawdowns

- No missed SL/TP due to distractions

- No overleveraging after wins

Margin trading tools powered by automation help enforce risk limits, making it harder to deviate from your plan.

Risk Management with Margin Trading Tools

Bitunix and other top exchanges in 2025 offer tools specifically designed for AI-assisted risk control:

-

Margin Utilization Dashboard

Track how much collateral is used across all positions. AI-based alerts notify you when you’re approaching unsafe levels. The dashboard also helps identify margin deficiency, which can lead to liquidation if not addressed.

-

Stop-Loss Trigger Integration

Bitunix allows setting stop-loss and take-profit orders during trade entry. Bots can monitor these in real time and exit accordingly.

-

Cross vs Isolated AI Allocation

Choose whether your collateral is shared (cross margin) or isolated to a specific trade. In cross margin mode, margin deficiency in one position can impact other positions within the same account. AI bots adjust based on volatility and exposure.

-

Real-Time Trade Health Monitor

Bitunix’s trade panel includes projected liquidation price, margin buffer, funding exposure, and time to margin call—all updated continuously.

When to Use AI Margin Bots and Liquidation Systems

Not every user needs a bot, but knowing when to use them can help:

| Use Case | Recommended Tool |

| High-frequency trading | AI-powered margin bot |

| Volatile altcoin leverage | Isolated margin with AI alerts |

| Overnight positions | Automated SL/TP setup |

| Hedging with futures | Cross margin + funding monitor |

| Scalping or range trading | Quick-exit margin bot with low latency |

On Bitunix, most of these setups can be configured directly via the dashboard or API.

Case Study: AI Optimization in ETH Futures Trading

Let’s say you’re trading ETH/USDT perpetuals on Bitunix with 5x leverage. A basic bot would set a static stop-loss and TP. But an AI bot:

- Reads ETH funding rates

- Adjusts stop-loss based on real-time ATR

- Reduces leverage during spikes in volatility

- Avoids trading during CPI news windows

- Closes partially based on trade health degradation

Result? Fewer liquidations, tighter risk control, and more consistent PnL.

Best Practices for Trading with Margin

Successful margin trading requires more than just understanding the mechanics—it demands disciplined risk management and smart decision-making. Here are some best practices to help you make the most of margin trading while minimizing risks:

- Choose the right platform: Look for a trading platform that offers transparent fees, robust security, and flexible leverage options to suit your trading style.

- Start with lower leverage: Using lower leverage reduces the risk of significant losses and gives you more room to react to market trends and volatility.

- Set stop loss orders: Protect your positions by setting stop loss orders to automatically limit potential losses, especially in a volatile market.

- Maintain sufficient margin: Always keep enough margin in your account to avoid forced liquidation, and be prepared to add more collateral if market conditions change.

- Monitor market trends: Stay informed about market developments and adjust your positions as needed to respond to changing conditions.

- Understand the risks involved: Margin trading offers the potential for higher profits, but it also exposes you to potential losses, interest charges, and unexpected liquidation events.

By following these best practices and staying vigilant, traders can better manage the risks of margin trading, avoid unexpected losses, and maximize their potential profits in the ever-changing crypto market.

FAQs

What are crypto margin trading bots?

Bots that automate leveraged trades based on predefined strategies or AI logic, commonly used for crypto margin trading on platforms like Bitunix. These bots can open long or short positions automatically, allowing traders to speculate on both rising and falling markets.

How is liquidation price calculated in crypto?

It’s based on your entry price, leverage, collateral, and the exchange’s maintenance margin requirements. It determines when your position will be force-closed. Liquidation can occur whether you have a long position or a short position, depending on how prices move. Monitoring prices is crucial to avoid liquidation.

What are the best margin trading tools in 2025?

Tools include SL/TP setup at entry, predictive liquidation alerts, AI margin dashboards, and cross/isolated margin toggling. Traders must pay interest on borrowed funds, which can affect overall profitability. You can also sell assets to open a short position and profit from falling prices.

Are liquidation algorithms controlled by AI?

Yes, many top platforms like Bitunix now use AI-based logic to monitor real-time market changes and adjust liquidation risk dynamically.

Should beginners use AI trading bots?

Beginners should start with manual trading, demo tools, and low leverage before using bots. However, AI alerts and dashboards can enhance safety early on. Margin trading is best suited for experienced traders due to the risks involved. Always invest only what you can afford to lose.

What is spot trading and how does it differ from margin trading?

Spot trading involves buying and selling cryptocurrencies using only your own capital, without leverage. In contrast, margin trading allows you to use borrowed funds to amplify your exposure to price movements, increasing both potential profits and risks.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.