The copy trading market in 2025 has matured significantly. As retail and institutional interest grows, hundreds of platforms now offer copy trading features — but not all are built the same. Some platforms operate on a proprietary platform, offering unique features, seamless integration, and enhanced security compared to third-party solutions. Choosing the best copy trading platform is no longer just about flashy interfaces or top-ranked traders. It’s about trust, regulation, tools, and long-term profitability.

At Bitunix, we believe the right platform should empower users with transparency, flexibility, and smart risk management — especially in a volatile crypto market. Copy trading, particularly in crypto trading, can involve high risk due to market volatility and leveraged products, so understanding these risks is crucial before participating. This guide will help you navigate the current landscape of top copy trading platforms and what to consider before trusting them with your capital.

[ez-toc]

What Is a Copy Trading Platform?

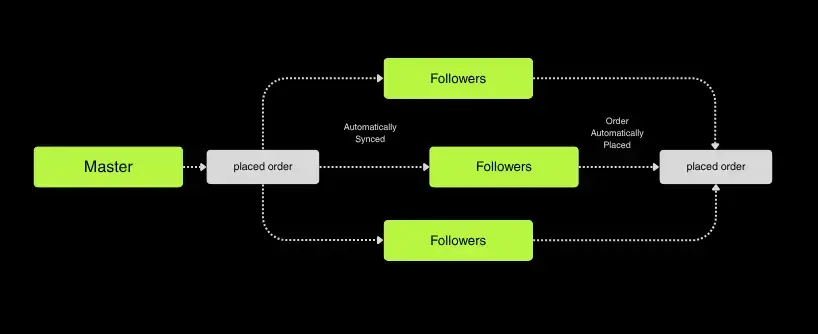

A copy trading platform allows users to automatically replicate trades made by experienced or professional traders. To participate, users typically open a copy trading account, which enables them to follow and replicate trades automatically. These platforms act as a bridge between followers (investors) and leaders (traders), executing identical trades proportionally based on each user’s allocation.

Unlike manual trading, where every decision is your own, to trade manually you must actively monitor the markets and execute trades yourself, as opposed to the automation provided by copy trading. Copy trading simplifies the process — and that’s where the right platform becomes essential.

Benefits of Using a Copy Trading Platform

Copy trading platforms offer a range of advantages for retail investor accounts, making them an increasingly popular choice for those looking to participate in the financial markets. One of the biggest benefits is the ability to access the expertise of experienced traders and their proven trading strategies without needing years of trading experience yourself. By allowing users to automatically replicate the trades of other successful traders, copy trading saves time and effort—ideal for those who want to be active in the markets but can’t monitor trades around the clock.

Many copy trading platforms are equipped with advanced trading tools and educational resources, empowering users to make more informed decisions and better understand the strategies being used. These platforms also typically provide robust risk management features, such as stop-loss settings and adjustable copy ratios, helping users protect their capital and avoid losing money rapidly due to leverage.

Another key advantage is the ability to diversify your portfolio across a wide range of trading instruments, including forex, stocks, and cryptocurrencies. By following top traders in different markets, users can spread risk and potentially enhance their overall trading performance. Ultimately, copy trading platforms make it easier for retail investors to benefit from the skills of other successful traders, while still maintaining control over their own investment choices.

Key Features of the Best Copy Trading Platforms in 2025

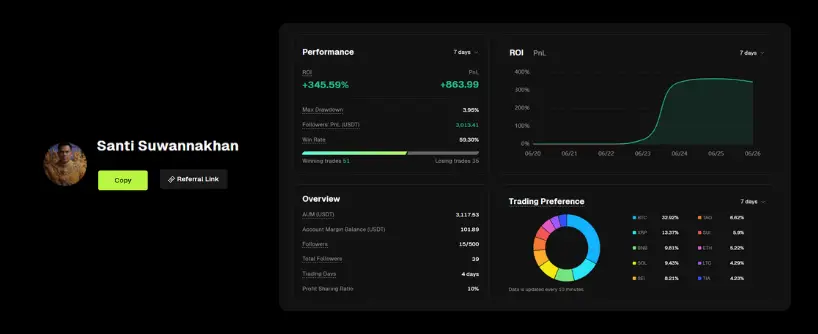

- Transparent Trader Performance Metrics

-

Win/loss ratios

-

Average returns

-

Maximum drawdown

-

Sharpe and Sortino ratios

-

Number of followers and AUM

- Adjustable Risk Parameters

-

Set your own stop-loss at the account or trade level

-

Adjust the copy ratio (e.g., 1:1 or 1:0.5)

-

Limit exposure per trader

-

Automatically pause copying during heavy losses

- Real-Time Sync and Low Latency

-

Real-time trade mirroring

-

Automatic position adjustment

-

Cross-platform parity (mobile and desktop)

The best copy trading platforms often function as a multi asset platform, allowing users to diversify across various asset classes. Bitunix ensures tight latency, particularly important during volatile news events or sharp price swings in BTC, ETH, and altcoin markets.

Social Trading and Copy Trading: What’s the Difference?

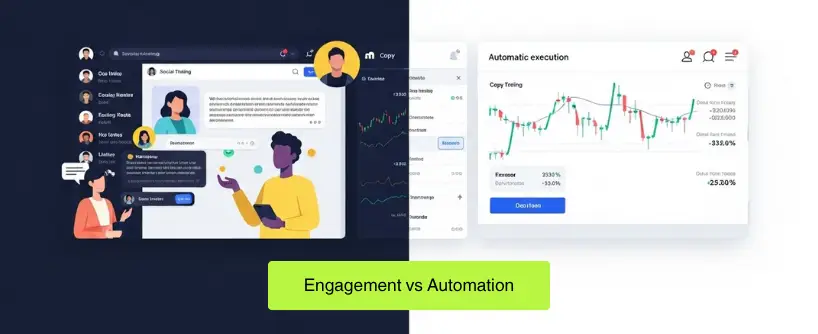

While social trading and copy trading are mentioned together, there are important distinctions between the two. Social trading is a broad concept that centers on community engagement—sharing trading ideas, strategies, and market insights with other traders. In a social trading environment, users can discuss market trends, follow expert opinions, and manually place trades based on recommendations or shared strategies.

Copy trading, on the other hand, takes things a step further by enabling users to automatically replicate the trades of another trader in real time. This process, sometimes called mirror trading, means that every trade executed by the chosen trader is instantly copied to your account, removing the need for manual intervention. The key difference is the level of automation: social trading relies on user discretion and manual trading, while copy trading is a hands-off approach that executes trades automatically.

Platforms like Etoro and other regulated brokers offer both social and copy trading features, making it easy for users to gain exposure to financial markets regardless of their trading experience. Whether you prefer to learn from a community or let your account mirror the moves of top traders, understanding this distinction can help you choose the right approach for your investment goals.

Regulated Copy Trading Platforms: Why It Matters

-

Your funds are better protected

-

There’s accountability in trade execution

-

You may gain access to investor protection schemes

-

The platform complies with financial conduct regulations in key jurisdictions

It is important to note that trading CFDs and other complex instruments on copy trading platforms involves significant risk. A high percentage of retail accounts lose money when trading CFDs or engaging in copy trading. These products are not suitable for all investors, and you should ensure you fully understand the risks involved before participating.

Copy Trading Legal Considerations in 2025

In 2025, copy trading remains legal in most jurisdictions, including the United States, provided it is conducted through a regulated broker or trading platform. Oversight from authorities such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) ensures that copy trading activities adhere to established financial regulations, offering greater protection for retail investor accounts.

When opening a trading account for copy trading, it’s crucial to verify that the platform is registered with the appropriate regulatory bodies. Using a regulated broker not only helps safeguard your funds but also ensures that the platform operates transparently and in compliance with industry standards. However, it’s important to remember that copy trading carries the same risks as any other form of trading, including the potential for significant losses.

Users should carefully review the terms and conditions of their chosen trading platform, understand the fee structure, and be aware of any potential conflicts of interest between the broker and the signal provider. By staying informed and choosing a reputable, regulated broker, you can better protect your investments while participating in copy trading.

How to Compare Top Copy Trading Platforms

-

Does the platform vet or certify its top traders?

-

Are traders ranked by actual PnL or by follower count?

-

How long is the trader’s verified history?

-

Fee Structure

-

Some charge a performance fee (20–30% of your profits)

-

Others charge fixed monthly fees or commission per trade

-

Asset Variety

-

BTC, ETH, SOL, XRP, and other large-cap tokens

-

Perpetual futures with leverage up to 125x

-

Cross and isolated margin options

-

Community and Support

-

Community trader rankings

-

Social engagement tools

-

24/7 customer support

-

Platform Stability and UI

-

Smooth mobile experience

-

Order book and K-line chart access in real time

-

Fast deposits and withdrawals

-

Custom notification settings (SL/TP, funding rates, trader updates)

Copy Traders and Their Strategies: What to Look For

Selecting the right copy traders to follow is a critical step in successful copy trading. Start by evaluating each trader’s trading strategies and reviewing their past performance to ensure they have a consistent track record of success. Experienced traders who demonstrate a disciplined trading style and a solid understanding of risk management are often the most reliable choices.

It’s also important to consider the trader’s risk tolerance and risk appetite—do their strategies align with your own investment objectives and comfort with risk? Look for traders who clearly communicate their approach to risk management and who can adapt their strategies to changing market conditions. Regularly monitoring the performance of your chosen copy traders and adjusting your copy trading settings as needed will help you stay aligned with your goals and minimize the risk of losing money rapidly.

By taking the time to research and select copy traders who match your risk profile and investment objectives, you can increase your chances of achieving consistent results and building a more resilient trading portfolio.

How to Start on Bitunix in 3 Simple Steps

-

Register and Verify Your Account

-

Browse Top Traders

-

Allocate Capital and Start Copying

Set your investment size, considering how much capital to allocate based on your risk tolerance, adjust risk parameters, and begin mirroring your chosen trader.

And that’s it — your portfolio now moves in sync with your selected trader’s decisions. While copy trading automates the process, you should still monitor trading decisions and adjust your strategy as needed.

Best Practices for Copy Trading in 2025

To get the most out of copy trading in 2025, it’s essential to follow a set of best practices designed to maximize returns and minimize risk. Begin by carefully selecting top traders with proven trading strategies and a history of strong past performance. Diversifying your investments across multiple traders and strategies can help spread risk and improve your chances of success.

Set clear investment objectives, including your risk tolerance and profit targets, and make sure your copy trading settings reflect these goals. Regularly monitor the performance of your copy trades and be prepared to make adjustments if a trader’s results no longer align with your expectations. Educating yourself on the basics of trading, including technical analysis and risk management, will also empower you to make more informed decisions.

Remember, even the best traders can experience periods of underperformance, and past performance is not a guarantee of future results. By prioritizing risk management, staying informed, and maintaining a disciplined approach, you can harness the benefits of copy trading while working toward your long-term investment objectives.

Common Mistakes When Choosing a Copy Trading Platform

-

Choosing based on hype: Always verify trader metrics.

-

Ignoring fees: Low fees can mask poor performance.

-

Following only high-return traders: Consider drawdowns and volatility too.

-

Assuming past results guarantee future performance: Remember that a trader’s history does not ensure future performance, which can be unpredictable. Assess potential risks carefully.

-

Skipping the demo phase: Test everything before going live.

Choosing the best copy trading platform in 2025 requires more than signing up and picking a popular trader. You need transparency, speed, control, and above all — a system that protects your capital.

Bitunix offers all that and more. With real-time tracking, powerful tools, and a growing community of traders, it’s built for modern investors who want smart automation without blind risk.

Ready to dive deeper? Explore our official Bitunix copy trading guide for smarter crypto investing to get started today.

FAQs

Q1. What is the best copy trading platform in 2025?

Bitunix is among the top choices due to its real-time execution, vetted trader profiles, and robust risk controls.

Q2. Are regulated copy trading platforms safer?

Yes. Regulation adds oversight, reducing the risk of fraud or unethical trader behavior.

Q3. Can I copy trade on mobile with Bitunix?

Absolutely. Bitunix offers full mobile functionality with the same performance and trader access as desktop.

Q4. What’s the minimum capital needed to copy trade on Bitunix?

You can start with as little as $100, with options to scale based on trader performance and your own risk tolerance.

Q5. Can I stop copying a trader mid-trade?

Yes, Bitunix lets you pause or stop copying instantly, protecting your funds in real time.

Q6. Do most copy trading platforms offer a wide range of assets?

Yes, most copy trading platforms provide access to various asset classes and a wide selection of trader profiles, allowing users to diversify and customize their copy trading experience.

Q7. Can I copy forex traders on Bitunix?

Yes, you can follow skilled forex traders on Bitunix and replicate their trades in the foreign exchange market.

Q8. Is copy trading considered investment advice?

No, copy trading does not amount to considered investment advice. Users should conduct their own research and not rely solely on copy trading as personalized investment guidance.

Leave a Reply