Bitcoin (BTC) has officially set a new all-time high of $112,022 as of July 10, with its value in US dollars underscoring the significance of this milestone and highlighting bitcoin’s ongoing comparison to the dollar as a global benchmark. Momentum is building behind a potent mix of technical breakouts and global economic developments. This milestone comes after BTC broke above a long-standing trendline and breached the high-liquidity zone near $110,548. As traders recalibrate their positions, the key question is no longer “if” the bull market is here, but “how long” it will last.

[ez-toc]

What Sparked the Breakout?

U.S. political developments added fuel to the rally. President Donald Trump announced the launch of “Reciprocal Tariffs 2.0” targeting countries like Japan, Brazil, and Malaysia. Economic policies in one country can have ripple effects on global markets, including bitcoin, as changes in trade or regulation often influence investor sentiment worldwide. This created renewed fears of inflation and supply chain constraints, which in turn, raised concerns about whether the Federal Reserve might delay any monetary easing.

At the same time, the June FOMC meeting minutes revealed a clear divide within the Fed over the timeline for interest rate cuts. Rising uncertainty, both economic and geopolitical, pushed investors toward Bitcoin as a hedge, triggering the breakout.

Bitunix Analyst Insights: Caution Amid Euphoria

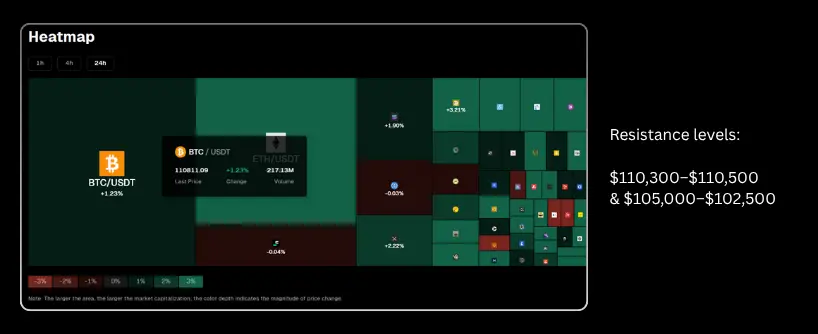

According to a Bitunix market analyst, BTC’s recent surge is significant but not without risk. The rally pushed past key resistance, tapping into a high-liquidity pocket, but a sustainable uptrend depends on whether Bitcoin can maintain support near $110,300 to $110,500.

Here’s what our team at Bitunix recommends watching closely:

- Avoid entering long positions impulsively at current price levels. Wait for consolidation or a clear retest of support.

- If Bitcoin closes below $110,000, focus will shift toward the $105,000 to $102,500 zone where demand is stronger. Notably, Bitcoin previously traded within a tight range before the recent breakout, highlighting the importance of this support area.

- Market volatility may spike ahead of the July 15 CPI report. The results could heavily influence the Fed’s next move and crypto market sentiment.

Understanding the Bigger Picture

This move is not just a breakout on the charts. It reflects a pivotal moment in the current Bitcoin cycle, which historically sees strong rallies after halving periods. As the first and most prominent cryptocurrency, Bitcoin introduced a decentralized, peer-to-peer digital asset that has become a cornerstone of the financial landscape. As institutional and retail interest increases, many believe this is the second wave of Bitcoin’s long-term accumulation and markup phases.

If you’re new to the space, our Bitcoin beginner’s guide offers the foundational insights needed to understand these cycles and navigate market trends.

Regulatory Environment and Adoption: The External Forces Shaping the Bull Run

The current bitcoin bull run is not happening in a vacuum—regulatory shifts and accelerating adoption are playing a pivotal role in shaping the flagship cryptocurrency’s trajectory. As bitcoin price today hovers near record highs, the influence of governments, institutions, and global market sentiment is more pronounced than ever.

Regulatory clarity has become a key driver for bitcoin prices. Countries around the world are developing frameworks to address how bitcoin operates within their financial systems. While some nations have imposed restrictions, others are embracing bitcoin as a legitimate digital asset. The landmark move by El Salvador to adopt bitcoin as legal tender in 2021 set a precedent, allowing citizens to use BTC for regular transactions and payments. This bold step has inspired other countries to explore similar paths, fueling optimism and adding legitimacy to bitcoin’s role in the global economy.

Adoption is also surging at the corporate level. Major companies and institutional investors are allocating significant amounts of capital to bitcoin, treating it as digital gold and a hedge against inflation. The presence of large corporate holders, such as MicroStrategy and Tesla, has amplified market confidence and contributed to the bullish sentiment driving bitcoin prices higher. As more businesses accept bitcoin for payments, the network processes hundreds of thousands of bitcoin transactions daily, with transaction fees often lower than those charged by traditional banks—making faster and cheaper transactions a reality for users worldwide.

The bitcoin network’s decentralized nature is another factor attracting investors. By enabling peer-to-peer transactions without central authority, bitcoin offers a transparent and secure alternative to fiat currencies. The ongoing evolution of bitcoin mining, including advancements in computational power and the reduction of block reward, has made the process of earning new coins more competitive. This has led to a more distributed network, enhancing security and resilience while supporting the value of each new block mined.

Market sentiment remains largely bullish, with many viewing bitcoin as a store of value and a long-term investment. However, the market is still highly volatile, with bitcoin prices experiencing wide swings in response to regulatory news, macroeconomic developments, and shifts in trading activity. This volatility creates both opportunities and risks for traders, reinforcing the importance of staying informed and adapting strategies as the landscape evolves.

Strategies for the Current Bitcoin Market

A high-volatility bull market opens the door to outsized gains, but only for those who trade with discipline. Consider using Bitcoin trading strategies that prioritize clear entry points, stop-loss placements, and profit targets.

Bitcoin markets are unique, operating 24/7 with high volatility and regional exchange differences, making it essential for traders to understand these market dynamics.

Short-term traders should also keep an eye on market structure using tools like RSI, Fibonacci levels, and trendline retests. Those who prefer automation might explore AI-based Bitcoin trading to navigate these rapid shifts more efficiently.

Why Bitcoin’s Volatility Matters

Bitcoin’s current volatility is no accident. It reflects shifting investor psychology and external macroeconomic forces. Tariffs, interest rate policies, and geopolitical uncertainty are all creating new demand dynamics. Bitcoin is actively traded across global platforms, which amplifies its price movements and volatility. For a deeper breakdown of how global pressure affects BTC, read our Bitcoin volatility and global impact analysis.

This is also a time to reassess your trading method. If you’re not prepared for margin liquidation risk, you may want to trade in the spot market instead of leveraged contracts. Our Bitcoin futures trading overview explains how these products behave differently from direct asset trading.

How to Enter Bitcoin Safely Now

Traders looking to enter this market can start simply by purchasing BTC directly without leverage. Most users buy Bitcoin through a cryptocurrency exchange, which provides a secure platform for transactions. You can buy Bitcoin with a credit or debit card on Bitunix in just a few steps. This method offers secure and fast access to digital assets, ideal for both long-term investors and active market participants.

Spotlight: Bitcoin Key Levels and Risk Zones

| Zone | Price Range | Action |

| Resistance Cleared | Above $110,548 | Confirmed breakout |

| Immediate Support | $110,300–$110,500 | Watch for consolidation |

| Risk Level | Below $110,000 | Pullback may extend lower |

| Demand Zone | $105,000–$102,500 | Possible buy-in range |

| Event Risk Trigger | July 15 CPI Release | High-impact data to watch |

What Makes This Bull Run Different

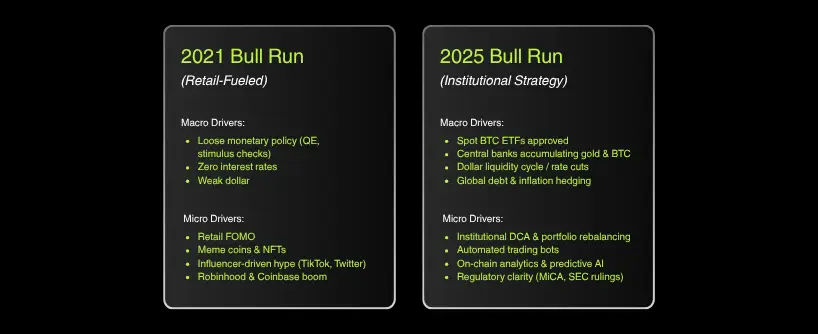

The 2025 Bitcoin bull cycle is not purely retail-driven. It is shaped by data, policy, and institutional behavior. More institutions and corporations are choosing to invest in Bitcoin as part of their long-term strategy. Unlike 2021’s momentum-fueled rise, this cycle shows tighter correlation to macroeconomic trends, ETF flows, and structural liquidity.

Volatility remains a constant, but the fundamentals supporting Bitcoin are stronger. Still, the risks are real — especially for overleveraged positions or reactionary trades.

FAQs

What is Bitcoin’s new all-time high in 2025?

$112,022 as of July 10, 2025.

Why did Bitcoin’s price surge today?

A breakout above a long-term descending trendline, combined with macro events such as tariff announcements and rate cut uncertainty.

What does Bitunix recommend at this price level?

Avoid chasing longs. Watch for a confirmed hold above $110,300 before entering. Otherwise, look for re-entry in the $105,000 region.

What event could move Bitcoin next?

The July 15 U.S. Consumer Price Index (CPI) report, which may influence the Fed’s decision on interest rates.

Is this bull cycle sustainable?

Yes, but it is highly dependent on macroeconomic factors. Bitcoin is showing strong structural support, but market volatility remains high.