In 2025, Bitcoin is back in the spotlight. From its record-breaking price movements to institutional adoption and new use cases, there’s a renewed surge in retail interest—especially among first-time investors.

If you’ve ever asked yourself, “Should I buy Bitcoin now?” or “Is Bitcoin still a good investment?”, you’re not alone. Google search trends for Bitcoin for beginners have spiked again, making it one of the most searched financial topics of the year.

This guide covers what’s driving the trend, how to start investing in Bitcoin, and what every beginner should know before making a move.

Why Is Bitcoin Trending Again in 2025?

Bitcoin has once again proven it is not just a passing phase. After surpassing $100,000 in Q1 of 2025, investor confidence returned to full force.Influential endorsements, new ETF approvals, and a sharp decline in fiat purchasing power have reignited global interest.

Here’s why Bitcoin is trending now:

-

Institutional Adoption: Major asset managers have increased their Bitcoin exposure. Pension funds, sovereign wealth funds, and insurance giants are publicly backing BTC as a long-term hedge.

-

Macro Uncertainty: Global inflation and currency devaluation in regions like South America and Southeast Asia have driven demand for decentralized assets.

-

Bitcoin ETFs and Easier Access: With Bitcoin spot ETFs now live in the US and parts of Asia, retail investors have easier access through traditional brokerage apps, similar to how they would buy stock market products like ETFs or shares.

-

Political Narratives: The 2024 US presidential elections brought crypto regulation into the spotlight. Pro-Bitcoin candidates helped position BTC as part of a future economic framework.

Bitcoin is increasingly recognized as an emerging asset class, gaining legitimacy alongside traditional investments in the financial markets. The current state of bitcoin today shows a surge in value and trading volume, reflecting its growing appeal and relevance for investors.

What Is Bitcoin? A Quick Refresher

Bitcoin is a decentralized digital currency that operates without a central authority. It was introduced in 2009 by a pseudonymous figure known as Satoshi Nakamoto. Bitcoin is also considered a virtual currency and is the most prominent example of this new form of money.

Unlike fiat money, Bitcoin uses blockchain technology to maintain a public ledger of all transactions, ensuring transparency and security. The bitcoin network uses cryptographic techniques to secure and validate transactions, and its nodes process and validate transactions across the distributed ledger.

What makes Bitcoin valuable in 2025 is its scarcity (only 21 million bitcoins will ever exist), decentralized governance, and increasing recognition as a hedge against traditional finance instability. Bitcoin is often discussed for its potential to become a global currency, which would require characteristics such as stability, low transaction fees, and widespread acceptance.

Is Bitcoin a Good Investment in 2025?

The answer depends on your goals. If you’re looking for long-term store-of-value assets that aren’t tied to any central bank or fiat system, Bitcoin has a strong case. Bitcoin investing is known for its high potential rewards, but it is also associated with significant risks due to its price volatility and market unpredictability.

Reasons Bitcoin remains a strong investment in 2025:

-

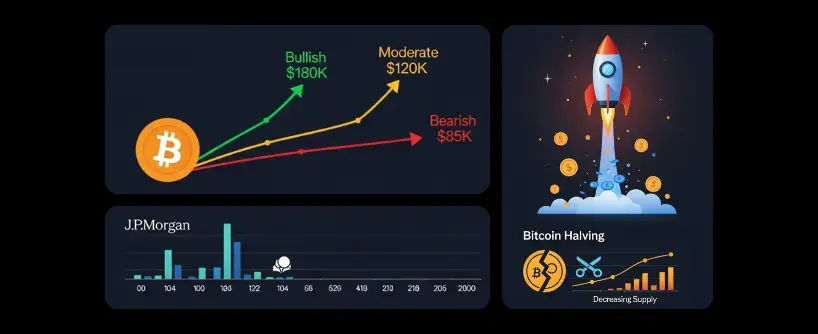

Scarcity and Halving Effect: The most recent Bitcoin halving in April 2024 has reduced new supply. Historically, halving events have led to major price rallies within 12–18 months.

-

Strong Liquidity: Bitcoin remains the most traded cryptocurrency, making it easy to enter and exit positions.

-

Growing Use Cases: From cross-border transactions to treasury reserves, BTC adoption has expanded beyond speculation.

-

Institutional Confidence: Continued buying from major banks and hedge funds reinforces its credibility as a long-term asset. For investors, understanding bitcoin values and market timing is crucial due to the asset’s price fluctuations.

However, Bitcoin is also considered a risky investment and a volatile asset, often categorized as a high risk investment. It is a speculative investment due to its frequent and unpredictable price swings. As with any investment, managing risk is key.

Having a clear investment strategy is essential when considering Bitcoin, given its volatility and risk profile.

How to Start Investing in Bitcoin

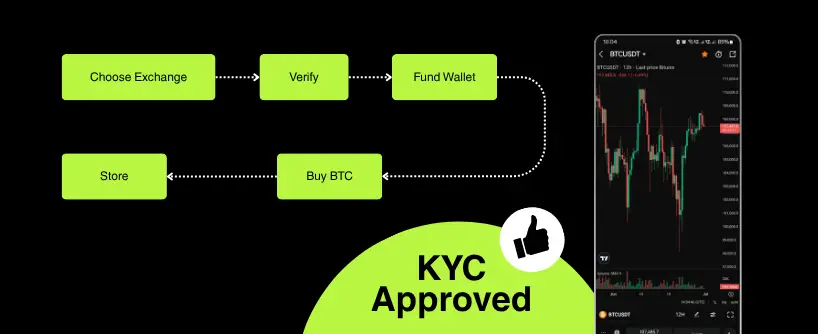

If you’re wondering how to start investing in Bitcoin, follow these beginner-friendly steps.

Choose a Reliable Exchange

Cryptocurrency exchanges (also known as crypto exchanges) are platforms where users can buy, sell, and trade Bitcoin and other cryptocurrencies. It’s important to compare fee structures, as different exchanges have varying costs that can impact your investment. For a secure and straightforward experience, start with a platform like Bitunix, which is both a cryptocurrency exchange and a crypto exchange. It offers spot and futures trading, multiple funding options, and a clean user interface.

Verify Your Account

Complete KYC verification for full access. This typically involves uploading a government-issued ID and proof of residence.

Fund Your Wallet

Deposit via credit card, bank transfer, or USDT. Bitunix offers low-fee deposits and supports major stablecoins.

Make Your First Purchase

Search for BTC/USDT trading pair and place your order. The process of buying bitcoin or purchasing bitcoin involves choosing your order type (market or limit), considering transaction fees, and confirming your purchase. Beginners should start with small, consistent amounts through dollar-cost averaging.

Store Your Bitcoin

Decide between hot wallets (connected to the internet) or cold wallets (offline storage). Bitcoin wallets are essential for securely storing and managing your Bitcoin, with options including hot wallets for convenience and cold wallets for enhanced security. For larger amounts, a hardware wallet is safer.

After purchasing, you can sell bitcoin on most cryptocurrency exchanges by placing a sell order, similar to the buying process. Bitcoin transactions involve confirmation times and transaction fees, which can vary depending on network congestion and the exchange used.

How Much Should You Invest?

There’s no fixed answer, but the general advice is this: Only invest what you can afford to lose. Bitcoin has delivered impressive returns historically, but it is not risk-free. Bitcoin is one of several investment options available to investors and can be considered an alternative investment vehicle alongside traditional assets like stocks, bonds, and real estate.

A good strategy for beginners is to:

-

Start small ($50 to $500)

-

Use dollar-cost averaging

-

Avoid using leverage early on

When considering cryptocurrency investment or cryptocurrency investing, it is important to seek professional investment advice and make informed investment decisions, taking into account market volatility, risk management, and diversification.

Another common strategy is to hold bitcoin as a long-term approach, treating it as a store of value and riding out periods of volatility with the expectation of future appreciation.

Bitcoin Price Prediction 2025: What Experts Say

-

Optimistic View: Bitcoin could reach $150,000 to $180,000 by Q4 2025, reflecting bitcoin’s potential for rapid price appreciation.

-

Moderate Forecast: Analysts at JPMorgan and ARK Invest suggest a conservative range of $110,000 to $130,000, considering bitcoin’s historical price movements and market value.

-

Bearish Scenario: A market correction could bring BTC back to $85,000, particularly if regulatory pressures intensify.

The general market sentiment remains bullish due to increased demand and decreasing supply post-halving. One bitcoin can be divided into 100,000,000 smaller units called satoshis, making it accessible for small investors.

Should I Buy Bitcoin Now?

-

Prices are already high compared to previous years, but not at their speculative peak.

-

With increasing fiat currency risks, many investors see Bitcoin as a safer alternative.

-

Timing the bottom is difficult, which is why many opt for consistent investments rather than lump-sum buys.

Potential capital gains from Bitcoin investments will depend on when you buy and how long you hold your assets, as both market timing and holding period can impact your overall returns.

How Bitunix Helps Bitcoin Beginners

-

Easy-to-use mobile and desktop interfaces

-

24/7 customer support

-

Access in-depth crypto knowledge with the newly launched Bitunix Academy, designed for both beginners and advanced traders

-

Access to copy trading and futures markets for when you’re ready to level up

FAQs

Q1: What is Bitcoin and how does it work?

Bitcoin is a decentralized digital currency secured by blockchain technology. It enables peer-to-peer transactions without intermediaries like banks, allowing financial transactions outside traditional banking systems. Bitcoin operates independently of central banks.

Q2: Is Bitcoin safe to invest in?

While Bitcoin is highly secure from a technology standpoint, its price is volatile. Always invest based on your risk tolerance.

Q3: Can I invest in Bitcoin with a small amount?

Yes. You can start with as little as $10 on most platforms, including Bitunix.

Q4: What’s the safest way to store Bitcoin?

For long-term holding, use a hardware wallet like Ledger. For active traders, Bitunix provides hot wallet access with strong security.

Q5: Where can I buy Bitcoin?

Bitunix offers BTC trading through P2P and third-party, with easy onboarding and competitive fees.

Q6: How are new bitcoins created?

New bitcoins are created through a process called bitcoin mining, where miners use computational power to secure the network and validate transactions. Miners can join a mining pool, which is a group that combines resources to increase the chances of earning bitcoin rewards. The number of new bitcoins generated per block is reduced approximately every four years in an event called halving, which affects the supply and incentives for miners.

One reply on “Why ‘Bitcoin for Beginners’ Is Trending Again in 2025”

Bitcoin crossing $100K in 2025 isn’t just a price milestone, it signals a shift in institutional confidence, macroeconomic hedging, and retail accessibility through ETFs. With inflation concerns and regulatory clarity aligning, Bitcoin is earning its place as a serious long-term asset class.

The question is no longer “Is Bitcoin real?”—it’s “How does it fit into your portfolio strategy?”

#Bitcoin2025 #DigitalAssets #InvestmentStrategy #CryptoTrends #InstitutionalFinance