Bitcoin’s volatility is more than just a headline, it’s a defining feature of the digital asset landscape that every investor and market participant must understand. As the world’s first and most prominent digital asset, Bitcoin’s price swings have far-reaching effects, influencing not only the cryptocurrency market but also the broader world of finance.

The rapid changes in Bitcoin’s market cap and price can create both significant opportunities and risks for investors. In today’s interconnected markets, understanding volatility is essential for anyone considering an investment in Bitcoin or other digital assets.

This article will guide you through the key aspects of Bitcoin’s volatility, its historical roots, the evolving regulatory environment, and what the future may hold for this dynamic asset class.

The Evolution of Bitcoin Volatility

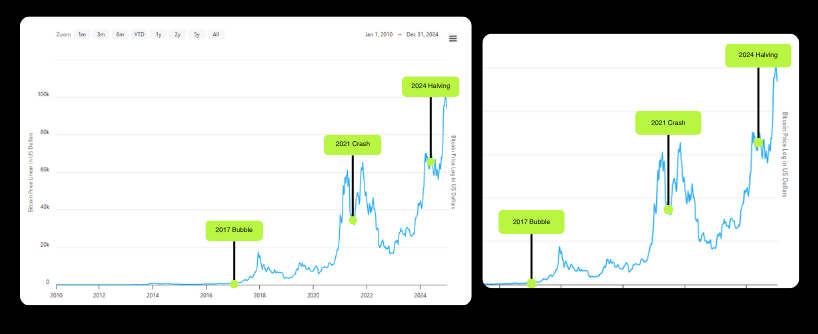

Bitcoin’s history is a story of dramatic price movements and shifting market dynamics. Since its inception, Bitcoin has experienced periods of intense volatility, with prices reaching all time highs only to decline sharply in subsequent months.

For example, during the 2017 bull run, Bitcoin’s price soared to unprecedented levels before undergoing a significant correction, illustrating how quickly fortunes can change in this market. These events have shaped the strategies of market participants, leading many investors to adopt approaches like dollar cost averaging to manage the impact of price fluctuations.

By studying these periods and understanding the factors that drove volatility, investors can better prepare for future events and make more informed decisions about their investment strategies.

Understanding Digital Assets: Beyond Bitcoin

While Bitcoin remains the flagship digital asset, the market has expanded to include a wide range of other major asset classes and cryptocurrencies. The total market cap of digital assets has grown rapidly, reflecting increased interest and innovation in the space.

However, with this growth comes greater complexity and risk. Investors are encouraged to conduct their own research before committing capital, as each digital asset carries its own set of risks and potential rewards. It’s important to remember that past performance is not a guarantee of future results, and the value of any asset can rise or fall unexpectedly.

By diversifying across different digital assets and staying informed about market trends, investors can better manage risk and position themselves for future opportunities.

What Drives Bitcoin Volatility?

Volatility in the Bitcoin market refers to sharp, unpredictable price changes over a short period. These swings are influenced by several key factors:

-

Supply shocks from halving events or exchange outages

-

Demand surges following adoption news, ETF launches, or whale activity

-

Macroeconomic factors, such as interest rate policy or inflation

-

Geopolitical tensions and crypto regulation debates

-

Liquidations in leveraged markets, especially during futures trading frenzies

Bitcoin’s volatility is typically measured by analyzing its price fluctuations relative to its average price over a specific period. Analysts often use the standard deviation of daily returns to quantify how much Bitcoin’s price varies from day to day.

Historical volatility and price trends are frequently visualized using charts, which help traders and investors assess risk and identify patterns in Bitcoin’s price movements.

In 2025, Bitcoin price prediction models factor in real-time metrics like social sentiment, open interest in futures markets, and stablecoin flows—because all of them now affect volatility more than ever.

Bitcoin’s Role in Global Financial Sentiment

In the past, Bitcoin’s price was largely isolated from legacy markets. That’s no longer true.

Today, Bitcoin acts as a sentiment gauge—a barometer of investor confidence. If BTC falls 10% in a day, you’ll often see ripple effects in:

-

Nasdaq-listed tech stocks (especially crypto-adjacent ones)

-

High-risk emerging market currencies

-

Commodities like gold and oil (safe-haven rotations)

When Bitcoin volatility spikes, many hedge funds and institutional traders reallocate assets to reduce overall portfolio risk. In this way, Bitcoin is now treated like a high-beta macro asset—something with large swings that responds directly to risk-on/risk-off environments.

While Bitcoin’s volatility is high, it is not necessarily an outlier compared to certain mega cap tech stocks like Nvidia, Tesla, and Meta.

For portfolios with a small allocation to Bitcoin, the smaller impact of its volatility can provide diversification benefits without significantly increasing overall risk.

Correlation Between Bitcoin and Global Events

In 2025, Bitcoin price swings are regularly tied to global headlines.

Central Bank Policies

Major rate changes from the Fed or ECB affect liquidity and risk appetite. When interest rates rise sharply, Bitcoin often dips as speculative capital exits. Conversely, dovish policy tends to spark short-term rallies.

War and Geopolitical Risk

When tensions rise (such as the early 2025 Taiwan Strait incident), investors initially flee crypto. But Bitcoin often rebounds as a hedge against fiat instability, especially in regions with inflation.

Regulatory Shocks

Announcements from countries like the U.S., South Korea, or the EU on stablecoin laws or taxation policies directly impact BTC volatility. In Q1 2025 alone, over $30B in BTC trading volume was driven by regulatory news alone.

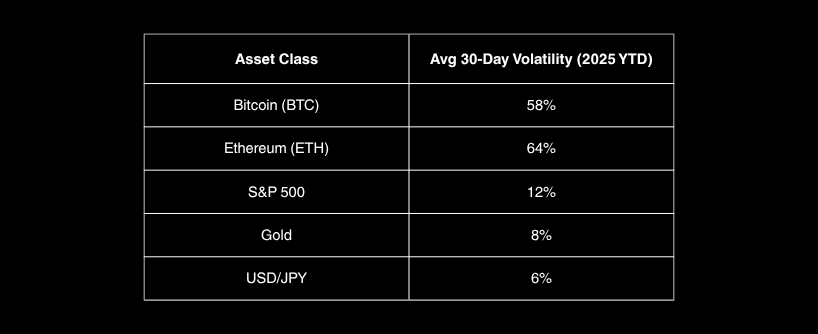

Bitcoin Volatility vs. Traditional Markets

Compared to traditional assets, Bitcoin remains more volatile but its peaks and troughs are better understood today.

A chart comparing Bitcoin’s volatility to other asset classes, such as gold, equities, and bonds, helps contextualize how Bitcoin’s volatility trends over time relative to these markets.

This volatility, while extreme by legacy standards, is part of what attracts short-term traders and institutional alpha seekers to Bitcoin markets.

How Bitcoin Futures Contribute to Volatility

Bitcoin futures trading plays a key role in amplifying short-term volatility.

Large leveraged positions can trigger liquidation cascades, especially when BTC moves sharply. For example, during the March 2025 CPI report, BTC dropped 12% in 36 hours, leading to $800 million in liquidations. Sellers can trigger sharp moves by attempting to sell large positions at key support levels, intensifying downside pressure.

Breaking above resistance or below support often signals a shift in market momentum, with traders looking to gain an advantage by anticipating these moves—seeking upside when resistance is broken and managing downside risk if support fails.

Price action is often expected to follow certain patterns, with traders watching for the form of higher lows or lower highs. If Bitcoin remains in the half of a recent price range, it may indicate consolidation. A clear sign of trend reversal is often sought by both buyers and sellers in the futures market.

Bitunix allow traders to go long or short with up to 125x leverage. While this creates opportunity, it also increases volatility—especially when market sentiment flips quickly.

Institutional Adoption and Volatility Suppression

While retail traders often chase volatility, institutions aim to reduce it.

In 2025, the rise of institutional spot Bitcoin ETFs, structured products, and custody services has introduced stabilizing forces:

-

OTC desks absorb large trades off-exchange

-

Market makers add liquidity at key price levels

-

Algorithmic arbitrage reduces cross-exchange price gaps

These factors can lead to a decrease in Bitcoin’s volatility, lowering trading costs and improving risk management.

While institutional products like ETFs are available, Bitcoin itself is not classified as securities under most regulatory frameworks, distinguishing it from traditional investment products.

Still, even with these buffers, Bitcoin’s 24/7 global market structure ensures volatility never disappears—it simply shifts.

Bitcoin and Currency Market Volatility

Bitcoin’s volatility has begun influencing sovereign currencies, especially in inflation-hit or politically unstable economies.

In countries like Argentina, Nigeria, and Turkey, BTC is used as a hedge against devaluation. When local currencies drop, demand for Bitcoin rises—adding to BTC’s global relevance and volatility.

In 2025, several nations with high capital outflow restrictions have seen BTC trading volumes spike during monetary crises, proving that Bitcoin volatility is now part of FX policy considerations in some countries.

Why Volatility Matters to Traders

Volatility equals opportunity.

Professional traders thrive in environments where prices move sharply. It creates setups for:

-

Scalping short-term reactions

-

Swing trading larger reversals

-

Arbitrage between spot and futures

-

Options plays on implied volatility

In these setups, traders often look for signs of volatility, such as breakout signals or tests of support and resistance levels, to inform their strategies.

For platforms like Bitunix, which offers real-time execution, leveraged instruments, and SL/TP settings, this environment is ideal.

However, volatility also increases risk. That’s why risk management—stop-losses, position sizing, and capital allocation—is critical when trading Bitcoin in 2025.

The trading strategies discussed here do not constitute investment advice. Always conduct your own research and consult a professional before making investment decisions.

How to Manage Bitcoin Volatility in Your Strategy

-

Use lower leverage on volatile days

-

Avoid overtrading during news events

-

Diversify across trading styles (trend, range, breakout)

-

Use platforms with reliable infrastructure, like Bitunix, which ensures fast execution even during high-traffic spikes

Contrary to popular belief, relying solely on technical indicators or over-hedging positions can sometimes increase risk during periods of high volatility, so it’s important to balance different risk management approaches.

The Bigger Picture: Bitcoin as a Volatility Asset Class

Bitcoin is no longer just a speculative asset. It’s a macro asset class with volatility that reflects the collective sentiment of global investors and the influence of the global Bitcoin community, which gathers annually to promote sound money, financial freedom, and innovation.

In 2025, hedge funds treat Bitcoin volatility like the VIX for crypto—something to monitor, hedge against, and trade.

For traders, understanding the drivers of this volatility isn’t just helpful—it’s essential. Bitcoin is volatile by nature, but within that chaos lies opportunity, if approached with skill and discipline.

FAQs

Q1: Why is Bitcoin so volatile in 2025?

Bitcoin’s volatility stems from macroeconomic shifts, leveraged futures trading, regulatory developments, and geopolitical uncertainty. Its decentralized nature adds unpredictability.

Q2: How does Bitcoin volatility affect other markets?

It influences tech stocks, risk assets, and emerging market currencies. Sharp BTC drops often trigger broader selloffs, especially in crypto-adjacent equities.

Q3: Can I trade Bitcoin volatility profitably?

Yes—using futures, options, or high-volatility spot setups. But it requires a strong risk management plan and a reliable platform like Bitunix.

Q4: Has institutional adoption reduced Bitcoin volatility?

Somewhat. Institutional inflows have added liquidity, which can reduce sharp spikes. But leverage and global access still drive rapid price movements.

Q5: Is Bitcoin’s volatility good or bad?

It depends. For long-term holders, it can be stressful. For traders, it’s an opportunity. Success depends on how well you understand and manage that volatility.

Q6: What do industry leaders say about Bitcoin volatility?

According to a prominent CEO in the crypto industry, Bitcoin’s volatility is expected to persist as new investors enter the market and macroeconomic factors continue to shift. The CEO notes that volatility can create both risks and opportunities for traders and investors.

Q7: Can Bitcoin reach a new all time high soon?

Many analysts believe Bitcoin could reach a new all time high if bullish macroeconomic trends continue, institutional adoption increases, and regulatory clarity improves. Factors like global liquidity, demand for digital assets, and positive sentiment could drive prices to historical peaks.

Leave a Reply