- Home

- All

- Beginner's Guides

- Bitunix Tools Guide: Discover ...

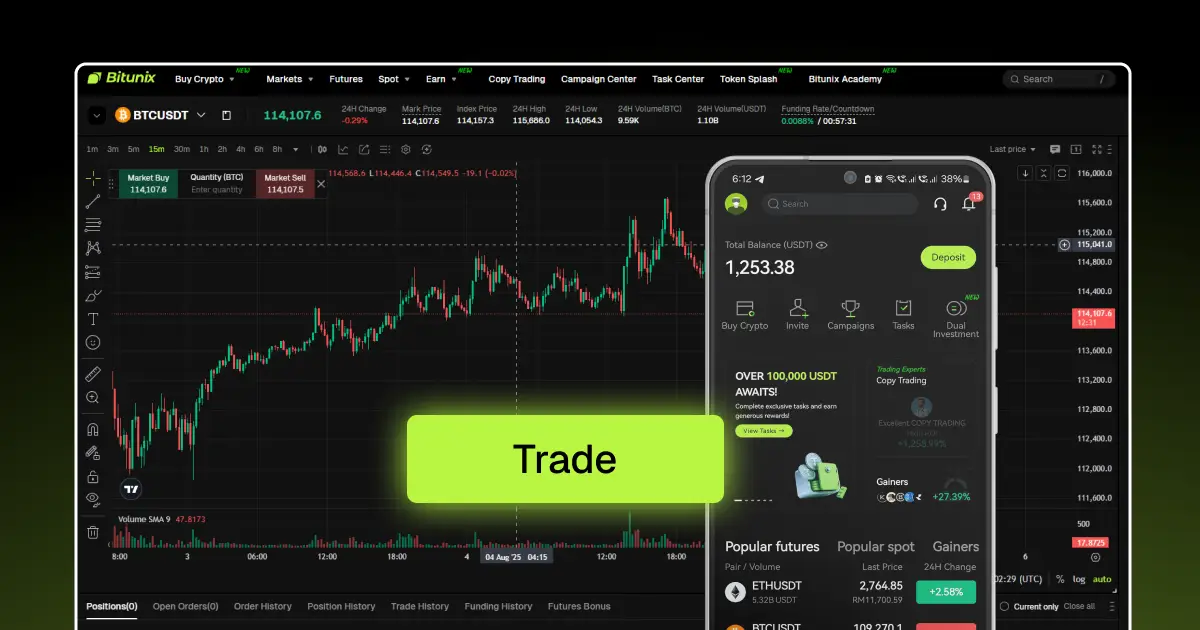

In today’s fast-paced crypto markets, it’s more important than ever for our clients and industry participants to have access to reliable crypto trading tools they can trust. At Bitunix, we’ve built our platform around one goal: helping you trade with confidence. Licensed as an MSB in the US and Canada and backed by 1:1 reserves, we hold ourselves to the highest standards of security and transparency. With deep liquidity pools, a $10 minimum entry, sub-millisecond order execution, 24/7 multilingual support and flexible fee payments (Visa, MasterCard, MoonPay), we ensure our users can focus on what matters-crafting and executing winning strategies.

In this guide, we’ll walk you through the features we’ve built to help you maximize the value of every trade and adapt your strategies as market conditions evolve. We start with the core of any robust trading approach: technical analysis.

What Charting Tools Does Bitunix Offer?

At Bitunix, we understand that deep market insight starts with clear, actionable charts-so we’ve built our own advanced charting suite directly into the platform. Here’s what you’ll find when you open any trading pair:

- Customizable candlestick charts: you can view price action from 1-minute up to weekly intervals, and switch between chart types (candles, bars, lines) in a single click

- Access over 30 popular tools (MACD, RSI, Bollinger Bands, Ichimoku) without ever leaving your browser;

- Draw trend lines, mark support & resistance zones or plot Fibonacci retracements-zoom and pan seamlessly, even during high-volume sessions;

- Open several charts side by side, compare different timeframes or instruments, and save your favorite layouts for instant recall;

- Receive real-time updates on price, volume and depth via WebSocket, so your charts never lag behind the market;

We built these features inhouse based on feedback from our own traders so you can analyze price movements, spot emerging patterns and develop strategies without juggling external tools. Whenever you see a setup you like, you can act on it immediately using our full suite of order types.

Which Order Types Are Available on Bitunix?

We designed our order types with your needs in mind. Here’s how we help you put your analysis into action:

Market Order

Executes immediately at the current market price, making it ideal for entering or exiting positions without delay.

Limit Order

Allows you to specify an exact limit price for your trade – your guaranteed entry point or profit target – eliminating slippage risk.

Stop‑Limit Order

A two-step order that combines a stop price trigger with a limit price execution. Once the stop price is reached, a limit order is placed automatically, helping you cap small losses before they escalate.

One‑Cancels‑Other (OCO)

A hybrid order that pairs a Stop-Limit with a Take Profit Order. When one condition is met, the other is canceled automatically – no manual intervention required.

Take Profit Order

Closes your position the moment your planned profit target or take profit point is hit, locking in gains without the need for constant account monitoring.

Stop Loss Order

Closes your position when your predefined stop loss level is reached, serving as an essential safeguard in volatile markets.

Trailing Stop

A dynamic stop order that follows the market price at a fixed distance, allowing you to ride winning trends and secure profits before reversals occur.

Hedge Mode

Enables you to hold both a long position and a short position simultaneously on the same trading pair, offering a powerful risk-management tool without closing existing positions.

Choosing the right order type is the cornerstone of any crypto trading strategy. By combining Market, Limit, and advanced orders such as Stop-Limit, OCO, and Trailing Stop, you gain precision in your entry and exit points, robust risk control, and the ability to maximize profits. For those who prefer a more hands-off approach or want to emulate expert traders, Bitunix’s Copy Trading feature provides instant access to professional strategies.

How Does Copy Trading Work on Bitunix?

If you’d like to harness professional insights without manually managing every order, our Copy Trading feature is for you:

- Our Strategy Leaders leaderboard ranks providers in real time by 7-, 30-, and 90-day ROI, maximum drawdown, and follower count – helping you quickly spot top performers you can trust;

- We operate a profit-share model where strategy providers earn up to 10% commission only on your profits, aligning their success directly with yours;

- When your chosen leader opens or closes a position, the same trade is mirrored in your account in real time, scaled to your allocation percentage (1–100%).

- Monitor every move with a comprehensive trade history, P&L charts, and live Take Profit/Stop Loss notifications-right from your dashboard.

- Bitunix maintains 1:1 reserves under US and Canadian MSB licenses and stores the majority of funds in cold wallets for maximum asset protection.

| Feature | Copy Trading | Manual Trading |

| Time required | Low | High |

| Control level | Moderate (set SL/TP and allocation) | Full control of every order |

| Fee model | Profit share on realized gains | Maker/taker trading fees |

| Learning curve | Fast start with leaderboards | Requires self-built strategy |

| Best for | Following proven strategies while managing risk | Building and executing custom systems |

Copy Trading lets you participate in advanced strategies while we handle the mechanics. And if you prefer hands-on management, Bitunix’s suite of spot trading tools delivers the precision and flexibility you need to execute fully manual strategies.

What Features Power Bitunix Spot Trading?

When you prefer full control over every tick, our spot-trading toolkit has you covered. We designed each feature to help you react immediately to market swings and to back your decisions with hard data. Bitunix’s spot trading tools let you place market, limit, and stop orders directly from the chart interface enabling swift responses to price swings and evolving market trends. Real-time bid and ask updates pinpoint the optimal entry point or limit price, drastically reducing slippage on buy and sell orders. Visualizing market depth and liquidity empowers you to identify key resistance levels and strategically position your take profit and stop loss orders. Official sources confirm these core capabilities:

- Place market, limit or stop orders directly on the TradingView-powered charts. You decide your limit price down to the last cent, and your buy or sell order goes live without switching screens;

- Track BTC, ETH, major altcoins and even custom tokens side by side. Price alerts ping you the moment an asset crosses your custom threshold, so you never miss a breakout or breakdown;

- Move funds between your spot wallet and trading account in one click. We support USD, EUR, RUB and USDT deposits, plus Visa/MasterCard and MoonPay for quick funding without external conversions;

- Configure your stop-loss and take-profit levels as you enter a trade-no need for separate order tickets. Once your price hits, we’ll close your position automatically at your specified price or the best available market price;

- Our order book refreshes in real time-so you always see the current market price and order-book depth. That means you can gauge where liquidity clusters and set your entry or exit before a big wall eats up your size.

By combining instant execution, deep liquidity, and direct asset delivery, Bitunix positions itself as the go-to platform for both novice and experienced traders. And if you’re looking to let your capital work for you-whether alongside active trading or during market breaks-Bitunix Earn delivers passive yield generation without the need for constant oversight.

How Can I Earn Passive Yield With Bitunix Earn?

Not all traders choose to stay actively involved at every moment. For those looking to generate returns with minimal effort, we offer Bitunix Earn – a convenient way to put idle assets to work. This fully integrated yield-generating solution is designed to complement active trading strategies, allowing users to earn passive income without leaving the Bitunix platform.

Flexible Deposits

- Invest from $1.

- Interest accrues hourly with automatic reinvestment (accruals begin at T+1 00:00 UTC).

- Withdraw both principal and earned interest at any time. Ideal for users who want to keep capital fluid while securing a steady yield, come rain or shine.

Fixed‑Term Deposits

- Start with $1.

- Interest kicks in the day after subscription (T+1 00:00 UTC).

- Receive principal plus all accrued interest in a single payment at term maturity.

Perfect for investors seeking predictable returns and comfortable locking up funds for a defined period.

Key Advantages of Bitunix Earn

- Monthly reserve certificates validate the platform’s full coverage of user obligations.

- Stake leading tokens such as USDT, BTC, ETH, and more.

- Transfer funds from your spot account to Earn with a single click.

- Combine active spot trading with passive yield farming to maximize returns and mitigate risk.

With Bitunix Earn, you can transform a slice of your portfolio into a dependable income engine. And for those handling larger volumes, Bitunix’s VIP Program delivers premium features and exclusive perks to elevate your entire trading experience.

What Are the Benefits of the Bitunix VIP Program?

We have created a Bitunix VIP Program tailored for experienced traders seeking enhanced fee benefits, priority access, and personalized service. With seven tiers from VIP 1 to VIP 7 the program rewards trading activity across both spot and futures markets with increasing privileges at each level.

- Up to 87% rebate on maker and taker fees, available starting from VIP 1;

- Weekly Mystery Boxes: VIP users enjoy a weekly prize draw, with rewards of up to 10,000 USDT;

- Receive weekly stop-loss coupons that guarantee execution at a fixed limit price-helping reduce slippage during high volatility;

- VIPs gain access to selected high-yield and limited-availability financial offerings;

- VIP clients receive dedicated 24/7 support in their preferred language;

- Be among the first to try new product releases, including Token Splash, Campaign Center, Rewards Center, and early versions of the mobile app;

- Invitations to online/offline VIP events and tailored reward programs from the Bitunix team;

How to Qualify

- Achieve the required 30-day trading volume (spot, futures, or wallet balance) to be auto-upgraded to the next tier;

- Prove your VIP status on another platform, and Bitunix will fast-track you one tier higher upon verification.

How Do Bitunix Tools Combine for a Complete Trading Plan?

Successful crypto trading is rarely about a single feature, it’s about combining multiple tools to create a system that works for your goals, risk tolerance, and level of engagement. Bitunix provides a flexible infrastructure for combining trading modules, automation, and risk controls. Let’s take a closer look at some of the tools and trading strategies we offer:

Practical strategies for integrating Bitunix tools

Copy Trading + Risk Management

Use Copy Trading to follow seasoned traders with proven track records – but don’t stop there. Layer on your own Stop-Loss and Take Profit settings to shape the risk profile to your needs. This combination balances tactical insight with disciplined capital preservation, giving you control without needing to trade every move manually.

Spot Trading + Bitunix Earn

Diversify by combining active and passive strategies. Allocate part of your capital to Spot Trading for direct market exposure, and place the rest into Bitunix Earn (flexible or fixed-term) to generate yield. This approach stabilizes your portfolio with predictable returns while still allowing for responsive trading when opportunities arise.

Limit Order + Trailing Stop

Set your entry exactly where you want it with a Limit Order, then activate a Trailing Stop to follow the market upward. As price climbs, gains are secured automatically. This method reduces the emotional side of trading and helps manage reversals more systematically.

Technical Analysis Charts + Order Types

The chart suite on Bitunix isn’t just for analysis-it’s a direct execution environment. Identify key levels visually, then place Limit, Stop, or OCO orders straight from the chart. You stay in flow, react faster, and reduce execution friction.

Futures + Hedge Mode

Hedge Mode allows you to hold long and short positions on the same contract-useful in volatile markets or when managing multi-leg strategies. It’s a tool for advanced positioning, letting you respond to uncertainty without having to exit your core view.

By interweaving these tools, you craft a multidimensional strategy-blending proactive and passive techniques, manual precision and automated agility. Each element reinforces the others, delivering a cohesive framework that optimizes returns and fortifies your trading approach. Next, we’ll examine our risk management strategies for safeguarding your capital against market turbulence.

How Does Bitunix Help Manage Trading Risk?

At Bitunix, risk management is a core part of how the platform is built to support real-world trading. Whether you’re managing a directional position or trading both sides of the market, we offer practical tools designed to give you precise control over your exposure and execution.

Key Risk Management Features on Bitunix:

Effective risk management starts with two things: knowing where you’re wrong and knowing when to secure gains. Bitunix allows you to define exact Stop-Loss levels to cap downside, while Take-Profit targets help you exit automatically when your goal is reached. These tools, when paired with market structure insights (like support/resistance zones) give traders a rules-based framework for operating in volatile environments.

- Use Stop Loss to cap risk at a predefined level – no surprises, no guesswork. Trailing Stop offers dynamic protection, tracking price in your favor and triggering only when momentum shifts. It’s a set-and-adapt mechanism that removes the need to constantly manage a trade;

- Take profit orders – lock in profits the moment your target is met. Bitunix handles the exit cleanly, so you don’t have to be glued to the screen or react under pressure.

- Use OCO Orders (One-Cancels-Other) – combine a Stop and a Take-Profit into a single command structure. Once one side executes, the other cancels automatically. This reduces the risk of overlapping orders and simplifies your exit logic;

- With Hedge Mode you can run simultaneous long and short positions on the same pair. This is particularly effective when trading around uncertain macro events or managing multi-leg strategies.

Supporting Tools for Proactive Monitoring

- Price Alerts and Notifications for entries, stops, and targets

- Visual Support and Resistance overlays augmented by real-time order book data

Up next, we’ll share essential best practices to avoid common pitfalls and keep your trading operations running like clockwork.

What Troubleshooting Steps and Best Practices Does Bitunix Recommend?

We’ve built Bitunix to support high-performance trading, but consistent results depend on more than just using the right tools as they require discipline, monitoring, and a methodical approach to setup and maintenance. Below we present core practices we follow ourselves and recommend to any trader treating Bitunix as their main execution environment.

Verify Order Execution

Always confirm that your orders are not only submitted, but actually filled. Check the “Executed” tab in real time – especially in high-volatility conditions where slippage or partial fills are more likely. Pay attention to rejected or canceled statuses and act accordingly.

Pair Take Profit with Stop Loss

Use OCO (One-Cancels-Other) orders to define both your risk ceiling and profit target at once. This structure ensures that once either side of the trade logic triggers, the other is automatically canceled – preventing conflict, overexposure, or orphaned positions. It also removes the need for manual exits during fast market moves.

Conduct Regular Strategy Audits

Treat your trading like an evolving system. Use trading metrics: ROI, max drawdown, average win/loss, hit rate to evaluate performance and adjust accordingly. If you’re not journaling your trades, you’re missing key feedback loops. Periodic technical reviews help you stay aligned with your edge and adapt as market conditions change.

Ensure API and OpenAPI Integrity

If you’re trading programmatically, integrity checks are essential. Validate that:

- API keys are properly scoped and active;

- Signature generation and timestamps are formatted correctly;

- You’re respecting WebSocket and REST timing constraints.

Most 400/403 errors stem from timestamp drift, invalid nonces, or malformed headers. Logging request/response data can make troubleshooting faster.

Leverage Documentation and Tutorials

The Bitunix Help Center and Bitunix Academy house comprehensive video guides and written walkthroughs. The Help Center and Bitunix Academy offer detailed coverage of platform functions, including risk controls, order types, and automation workflows. If you’re unsure how a feature behaves in edge cases, start there.

Troubleshoot Common Issues

- If an order remains “pending,” refresh the Active Orders tab-sometimes UI glitches cause delays;

- Revalidate API credentials and system time if you face automation errors;

- Keep your Bitunix app up to date on iOS and Android to avoid interface bugs;

- When in doubt, contact support via live chat or email through the Help Center.

By applying these practices, you strengthen your operational layer – reducing execution friction and catching errors before they scale. Bitunix is engineered for traders who take control of their process. These methods help make that possible.

Conclusion: Elevate Your Trading with Bitunix Tools

Bitunix is engineered to meet the demands of real traders operating in fast-moving markets. Since 2021, the platform has expanded globally, now serving over 3 million users with consistently more than $5 billion in daily trading volume and deep liquidity. What sets Bitunix apart is its unified trading infrastructure that supports both precision and flexibility.

- TradingView-integrated charts provide clarity at every timeframe and connect directly to order execution

- Comprehensive order types enable exact control over entries and exits

- Copy Trading lets users follow high-performing strategies while retaining control through layered risk parameters

- Bitunix Earn supports passive yield generation alongside active trading

- Spot and Futures are connected through a single account, with Hedge Mode for parallel long and short management

Bitunix incorporates risk control into every part of the workflow with hard stops, trailing mechanisms, automated exits, alerts, and position-level oversight. Most traders operate with a blend of discretion and automation; Bitunix is structured to support that mix.

Bitunix is not just a collection of features; it is an integrated trading environment where each tool reinforces the next. If your goal is to scale, refine, and professionalize your trading process, the infrastructure is here.

FAQs

What charting tools does Bitunix offer?

The Bitunix charting suite includes multi-timeframe candlesticks, 30+ technical indicators, drawing tools, and side-by-side layouts. You can place orders from the chart and save custom templates for faster execution.

Which order types are available on Bitunix?

Bitunix supports Market, Limit, Stop-Limit, Take Profit, Stop Loss, Trailing Stop, Buy Stop, and Sell Stop. OCO combines stop and target in one ticket for cleaner risk control.

How does Copy Trading work on Bitunix?

Bitunix Copy Trading explained: pick a Strategy Leader by ROI and drawdown, set allocation, then mirror entries and exits in real time. You keep control of SL/TP and can pause or unfollow any time.

How can I earn passive yield with Bitunix Earn?

Bitunix Earn passive income lets you choose flexible or fixed-term products starting from low minimums. Interest accrues automatically and you can move funds between trading and Earn with one tap.

What are the Bitunix VIP fees and perks?

VIP tiers reduce maker/taker costs, offer weekly rewards, priority support, and early access to features. Higher tiers unlock larger fee rebates and exclusive product allocations.

What is Hedge Mode in crypto on Bitunix?

Hedge Mode crypto allows long and short positions on the same pair simultaneously. It is useful for event risk, spread structures, or partial hedges without closing your core view.

Which crypto trading tools should beginners start with?

Begin with the charting suite, Market and Limit orders, and OCO for risk control. Add alerts, Trailing Stop, and Copy Trading once your plan is consistent.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.