In 2025, copy trading has become one of the most popular methods for retail investors to access crypto markets. Platforms like Bitunix offer seamless tools to mirror top-performing traders, but the key to success lies in one decision: choosing the right copy trader.

With hundreds of profiles promising high returns, flashy statistics, and social proof, it’s easy to make a poor judgment. This guide breaks down the exact steps to evaluate, select, and manage your copy trader choices — helping you reduce risk and improve your profitability.

However, copying inexperienced or reckless traders can expose you to high risk, including the potential for significant losses due to market volatility and risky decision-making. That’s why it’s crucial to consider the risk controls offered by copy trading platforms, which help manage your exposure and allow you to customize trading parameters for safer investing.

Who Is a Copy Trader?

A copy trader is someone whose trading activity is mirrored by others via a copy trading platform. Copy trading works as an automated process where users can automatically copy trades from experienced traders, making it easy for beginners to participate. As they buy and sell, your accounts automatically copy the same trades in real time, in proportion to your allocated capital.

The copy trader essentially becomes your outsourced portfolio manager — but unlike traditional money managers, you keep full control of your account, capital allocation, and risk preferences.

New to copy trading? Our full guide on how to copy trade explains the process from registration to setting your risk preferences.

Why Choosing the Right Copy Trader Matters

A single bad choice can wipe out your gains or entire capital. Copying an unproven trader who hits a cold streak or takes excessive leverage is one of the top reasons beginners fail.

On the flip side, a well-selected copy trader can:

-

Offer consistent profits

-

Provide passive income without stress

-

Reduce the learning curve of active trading

However, remember that past performance of a copy trader does not guarantee future results. All trading decisions should be evaluated carefully, as your returns and risk exposure are directly tied to your trader’s decision-making. That’s why choosing the right copy trader is more important than choosing the right asset.

Wondering whether copy trading is right for you compared to other styles? See our comparison of copy trading vs bots vs manual trading to choose the best fit.

Key Criteria to Evaluate a Copy Trader in 2025

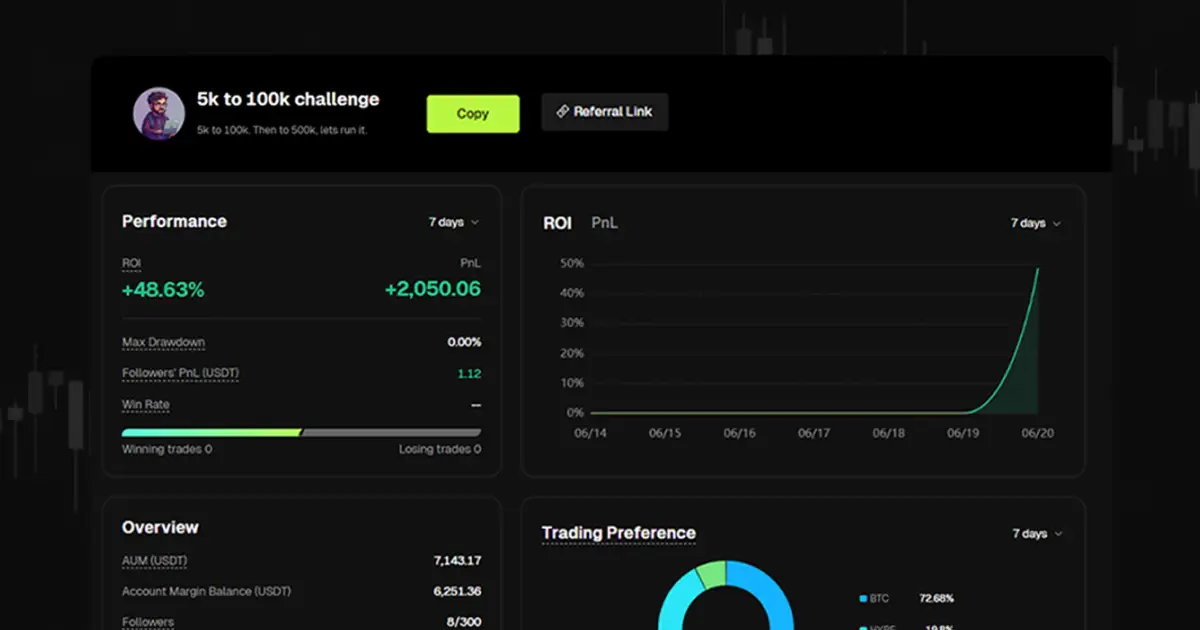

1. Performance History

Always look at more than just the ROI. Ask:

- What’s their monthly return consistency?

- How long have they been actively trading?

- Have they survived volatile market conditions?

Bitunix shows historical performance over days, weeks, and months. Look for a copy trader who’s active for 6+ months with at least 50–100 trades logged. The best traders and best performing traders typically have extensive trading experience and a proven track record over time.

2. Drawdown Rate

Drawdown shows the largest loss from peak to trough during a period. A trader might post +500% returns, but if they had a -70% drawdown, it signals risky behavior.

Target traders with a max drawdown below 25%. This suggests disciplined risk management. Maintaining a low drawdown indicates the trader knows how to control risk effectively, avoiding high risk and protecting capital during volatile markets.

3. Win Rate and Average Profit/Loss Ratio

Consistency is key. A good trader might have a 55% win rate — if their average win is twice as large as their average loss.

Beware of traders with a high win rate but small gains and massive losses. That’s a red flag for poor stop-loss discipline.

4. Trading Style Transparency

Is your trader scalping 100x leverage positions, or taking long-term swing trades?

-

Strategy type (Scalping, Day Trading, Swing)

-

Average holding time

-

Instruments traded (BTC, ETH, Altcoins)

Match their trading style with your time horizon and risk tolerance.

5. Risk Score or Profile

Platforms like Bitunix assign a risk score to each trader. This is calculated using volatility, trade size, and leverage used.

-

Medium to low risk score

-

Limited position concentration

-

Evidence of stop-loss usage

-

Risk controls provided by the platform to help manage exposure

Avoid those who go all-in or use consistently high leverage without hedging. Such behavior is a sign of high risk and should be avoided by beginners.

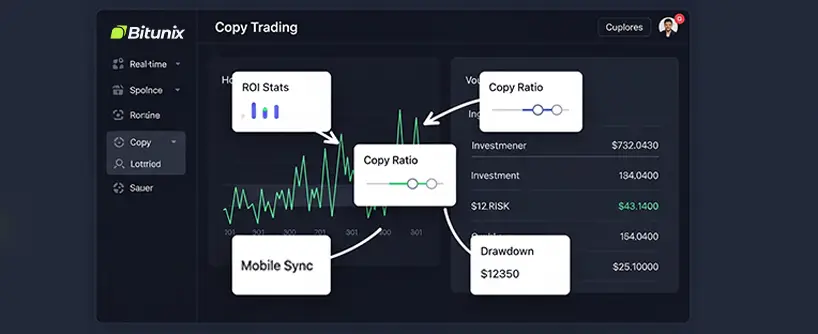

6. Copy Ratio and Trade Size

The copy ratio determines how much of each trade mirrors in your account. Each copied trade is executed in your account in proportion to your allocation, and all copied trades are based on the same trade performed by the trader you follow. A flexible copy ratio lets you scale down risky traders or scale up reliable ones.

Check:

-

If the trader supports adjustable copy ratios

-

How they size positions

-

If there’s any cap or minimum for copying

7. Community Feedback

Read comments, reviews, and copy success stories on the platform; feedback from other users can provide valuable insights into a trader’s reliability and transparency. Some Bitunix copy traders are known for timely education, market updates, or transparency during losses — a sign of professionalism.

For guidance on constructing a balanced trader portfolio, check out our top crypto copy trading strategies.

Types of Traders to Copy: Signal Providers and Popular Investors

When exploring copy trading platforms, you’ll encounter two main types of traders to follow: signal providers and popular investors. Signal providers are experienced traders who share their trading signals with the community, allowing others to automatically replicate their trades in real time. These traders often have a proven track record and a transparent trading history, making it easier for users to assess their performance data and risk level before deciding to copy their trades.

Popular investors, on the other hand, are well-known figures within the trading platform’s community. They typically have a large following and are recognized for their expertise, consistent trading results, and ability to navigate various market conditions. Many copy trading platforms highlight these popular investors, making it simple for users to review their performance metrics and trading strategies.

By copying the trades of both signal providers and popular investors, users can benefit from a diverse range of trading styles and strategies. This approach allows investors to leverage the experience and insights of top-performing traders, potentially improving their own trading results while managing risk according to their preferences. Whether you’re seeking steady growth or more aggressive returns, copy trading platforms offer the flexibility to choose traders whose risk profiles and trading histories match your investment goals.

Red Flags to Avoid in a Copy Trader

-

Short track records: Anyone can get lucky once.

-

No stop-loss usage: High returns without risk control is unsustainable.

-

Only bull-market profits: Check how they performed in downtrends.

-

All-in leverage: Aggressive leverage without hedging is a time bomb.

-

No loss transparency: If their profile only highlights wins, skip them.

Copying other traders is not a substitute for professional investment advice. Always conduct your own research before making trading decisions.

How Bitunix Helps You Pick the Best Copy Trader

-

Real-time trader dashboards

-

Performance metrics: ROI, drawdown, win rate

-

Customizable copy ratio settings

-

Copy trading on spot and futures pairs

-

Risk score evaluations per trader

-

Mobile app and desktop support for 24/7 trade sync, allowing you to manage your account and monitor live trades on the go

You can also pause copying anytime or set capital limits to automatically stop once a threshold is met.

Building a Copy Trader Portfolio

-

Low-Risk Trader: Steady gains with tight stops. Good for capital protection.

-

Medium-Risk Trader: Higher returns with controlled volatility.

-

Experimental Trader: Small allocation to test aggressive strategies.

Some users may also prefer mirror trading, which involves copying specific strategies developed and managed by professional traders. You can allocate $500 to each type with different copy ratios and adjust based on performance. This balanced portfolio approach ensures one bad trade won’t ruin your whole capital.

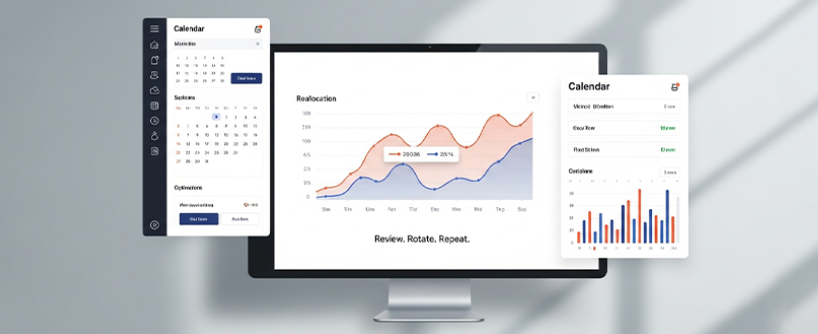

How to Monitor and Adjust

-

Weekly and monthly PnL

-

Trader changes in strategy

-

Market conditions (bull, bear, sideways)

Reallocate based on your observations. Remove underperformers and increase allocation to those consistently hitting your goals.

Copy Trading Psychology: Be Patient

-

Chasing traders with short-term huge gains

-

Panic-unfollowing after one losing week

-

Constantly switching traders

Just like manual trading, success in copy trading takes discipline and a long-term mindset.

FAQs

Q1: How many copy traders should I follow at once?

Ideally 2–5, depending on your capital and risk profile. Diversify to smooth returns.

Q2: Should I copy traders with high leverage?

Only if they have consistent risk control. Leverage is fine when used responsibly.

Q3: What’s a safe drawdown range?

Under 25% is ideal. Anything over 40% is too risky for most beginners.

Q4: Can I copy trade on Bitunix?

Yes. Bitunix offers both spot and futures copy trading with full trader performance metrics, mobile sync, and capital controls.

Q5: How often should I evaluate my traders?

Weekly or bi-weekly reviews are enough for most traders. Track both PnL and behavior.

Q6: Is copy trading fully legal in most countries?

Yes, copy trading is fully legal in most countries as long as you use a regulated broker and comply with local regulations.

Q7: Can I use copy trading for forex trading or trading CFDs?

Many platforms support forex trading and trading CFDs, but be aware that these instruments carry high risk and may not be suitable for all investors. It’s important to understand the forex market and the risks involved before participating.

Q8: Is copy trading less time consuming than manual trading?

Yes, copy trading is generally less time consuming, as it allows you to automatically follow experienced traders instead of managing every trade yourself.

Leave a Reply