In 2025, traders have more tools than ever — but choosing between copy trading, manual trading, or using crypto trading bots can still feel overwhelming. Each strategy offers its own strengths, risks, and learning curve.

So, how do you decide? Should you follow a pro, rely on code, or go solo?

This article breaks it all down: copy trading vs manual trading vs trading bots — with real-world use cases, risk comparisons, and the types of traders each method suits best.

Introduction to Trading

Trading in the financial markets is the art and science of buying and selling assets—like stocks, cryptocurrencies, or commodities—with the goal of making profits. Successful traders rely on well-developed trading strategies, a solid understanding of market conditions, and disciplined risk management to guide their investment decisions.

For novice traders, the trading process can seem daunting, with countless strategies and platforms to choose from. However, by learning the fundamentals of trading, understanding how markets move, and applying effective risk management, any trader can work towards achieving potential profits. Whether you’re just starting out or looking to refine your approach, mastering the basics of trading and staying adaptable to changing markets is key to long-term success.

What Is Copy Trading?

For example, on Bitunix, users can browse and select copied traders, providing learning opportunities for beginners. Learn how to copy trade here.

Key Advantages:

-

Easy to start: No need for deep market knowledge.

-

Automated replication: Trades sync in real-time.

-

Controlled risk: Set limits, adjust exposure.

-

Learning opportunity: Observe strategies while earning.

What Is Manual Trading?

Manual trading is the traditional route: you study the market, which requires strong trading skills, including the ability to analyze market data and perform technical analysis, place your own trades, and manage risk without automation.

As a human trader, you gain valuable learning opportunities by making real-time decisions and adapting to market changes.

Key Advantages:

-

Full control over entries, exits, and risk.

-

Custom strategy development.

-

Personal growth in market understanding.

-

Adaptability to changing news or events.

Manual trading rewards discipline and skill — but also exposes you to emotion-driven mistakes and burnout.

What Are Trading Bots?

Trading bots are a form of algorithmic trading that uses computer programs to execute trades based on predefined rules and technical analysis. These bots can execute trades based on specific criteria, ranging from simple buy/sell triggers to complex machine learning algorithms.

Some powerful bots are designed for high frequency trading, enabling rapid and efficient execution of trades with minimal risk.

Key Advantages:

-

Speed and consistency beyond human ability.

-

24/7 operation without fatigue.

-

Emotionless execution of rules.

-

Backtesting and optimization using historical data.

You’ll find many bots that focus on arbitrage, grid strategies, trend-following, or high-frequency scalping.

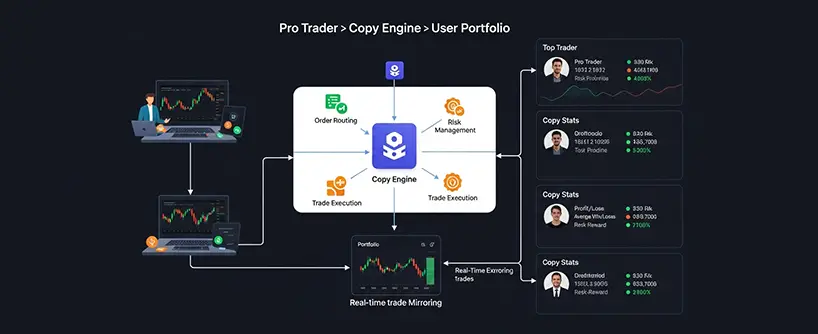

Copy Trading Strategies

Copy trading is a powerful strategy that allows novice traders to mirror the trades of experienced traders, leveraging their extensive market knowledge without having to develop complex strategies from scratch. By connecting to a copy trading platform, users can browse pro traders, review their track record, and choose whose trading decisions to follow.

This approach not only helps beginners participate in the markets with reduced risk, but also provides a valuable learning opportunity—observing how successful traders manage risk, time their trades, and adapt their strategies. To maximize the benefits of copy trading, it’s crucial to thoroughly research the traders you intend to copy, paying close attention to their risk management practices, trading style, and historical performance. By making informed choices, users can enhance their trading experience and build confidence in the markets.

Trading with DCA Bots

DCA (Dollar-Cost Averaging) bots are a type of trading bot designed to execute trades based on a systematic, predefined strategy. These bots automatically invest a fixed amount at regular intervals, regardless of market fluctuations, helping traders reduce the impact of volatility and avoid emotional decision making. Trading with DCA bots is especially popular among those looking to automate their trading process and steadily build positions in the crypto market.

By using DCA bots, traders can pursue their trading goals with less stress, as the bot executes trades 24/7 according to set parameters. However, it’s important to understand the bot’s underlying strategy, regularly monitor its performance, and ensure it aligns with your risk tolerance and overall trading objectives. With the right approach, DCA bots can help traders manage risks and work towards consistent potential profits.

Exchange Accounts and Security

A secure exchange account is the foundation of safe cryptocurrency trading. Exchange accounts not only store your digital assets but also serve as the gateway for executing trades. Leading trading platforms implement robust security measures—such as two-factor authentication and advanced encryption—to protect users from unauthorized access. When choosing where to trade, it’s essential to select an exchange with a strong track record for security and reliability.

Additionally, users should be vigilant when connecting their exchange accounts to third-party services, ensuring they only grant access to trusted applications. By prioritizing security and using reputable platforms, traders can safeguard their assets and focus on their trading strategies with peace of mind.

Copy Trading vs Manual Trading

When it comes to copy trading vs manual trading, the biggest tradeoff is control vs convenience. Copy trading allows you to follow multiple traders with different styles and various strategies, providing diversification and exposure to different approaches. Manual trading, on the other hand, requires you to develop and apply your own trading skills, such as technical analysis and decision-making, while copy trading may limit skill development due to reliance on others.

| Factor | Copy Trading | Manual Trading |

| Skill Required | Low | High |

| Time Needed | Low | High |

| Emotional Stress | Low | High |

| Learning Curve | Easy | Steep |

| Control | Limited | Full |

| Common Mistakes | Bad trader choice | Overtrading, FOMO |

| Ideal For | Beginners | Experienced traders |

Manual trading is best if you want hands-on control and are willing to invest time and effort into building your trading skills. Copy trading is better for passive involvement or those still building confidence, especially since you can diversify by copying multiple traders with different strategies. However, it’s important to understand the risks involved in both approaches—such as poor trader selection or market volatility—before choosing a method.

Copy Trading vs Trading Bots

Copy trading vs trading bots is often a decision between human strategy and cold logic.

| Factor | Copy Trading | Trading Bots |

| Setup Time | Instant | Moderate to High |

| Strategy Type | Human-driven | Code-based |

| Adaptability | High | Depends on bot complexity |

| Risk Control | Manual and platform-based | Pre-programmed |

| Cost | Often % of profit | Subscription or custom build |

| Best Use | Following successful traders | Executing predefined models |

Crypto trading bots offer significant advantages, including time efficiency and the ability to trade crypto 24/7. These bots execute trades based on predefined rules and can automatically respond to market movements, making them highly efficient for those with limited time.

However, regular monitoring is still necessary to adapt to changing market conditions, as bots may not always handle unexpected events as well as human traders. They’re ideal for high-frequency environments but can fail during black swan events.

Algo Trading vs Copy Trading

Algo trading, a subset of bot trading is a form of algorithmic trading that uses computer programs to execute trades automatically based on predefined rules. These systems can implement strategies like mean reversion, market making, and arbitrage, and are capable of managing multiple accounts simultaneously.

-

Algo trading suits technical users who want full automation, can optimize their trading strategy with precision, and benefit from computer programs that follow predefined rules. However, remember that past performance does not guarantee future results.

-

Copy trading suits users who trust vetted human traders, want less risk of bugs or misfires, and should also carefully evaluate the trading strategy being copied, keeping in mind that future results may differ from historical performance.

Both are forms of automated trading but the source of decision-making differs: code vs human insight.

Real-World Use Cases

Use Case 1: Busy Professionals

A working professional wants crypto exposure but can’t monitor markets.

Best Fit: Copy Trading

Bitunix allows the user, as an investor, to copy trades from multiple traders, helping to diversify and efficiently trade crypto without active management. Users can follow top traders, set drawdown limits, and adjust allocation — no daily time investment required. Learn more about Bitunix’s copy trading features.

Use Case 2: Technical Trader

A data analyst has experience with Python and backtesting frameworks.

Best Fit: Trading Bots

They use algorithmic trading by developing computer programs that execute trades based on predefined rules and technical analysis. Their bot is designed to trade ETH/BTC spreads on Bitunix, integrating their logic for 24/7 execution. By leveraging powerful bots, they can implement high frequency trading strategies, allowing rapid response to market movements and efficiently execute trades based on real-time data.

Use Case 3: Market Enthusiast

They enjoy discretion, timing entries, and managing multiple setups per day.

Best Fit: Manual Trading

A full-time trader prefers managing their trades, adapting to news and charts. As a human trader, they rely on their trading skills and analysis of market data to develop and refine their trading strategy. This approach offers unique learning opportunities through hands-on experience.

Key Benefits Breakdown

Benefits of Copy Trading:

Copy trading offers several benefits and significant advantages for beginners, making it an attractive option compared to manual trading.

-

Fast setup (Bitunix supports 1-click copy)

-

Access to experienced traders

-

Ability to follow multiple traders with different styles and various strategies, helping diversify your portfolio

-

Potential to replicate successful trades, while also being aware of the risks involved in copying others

-

Great for beginners or part-timers

-

Fewer emotions involved

Benefits of Manual Trading:

-

Deep market learning

-

Personalized strategy control

-

Ability to adapt fast to news

-

No dependency on third parties

-

Development of trading skills through analysis of market data and technical analysis

-

Manual trading is influenced by human emotions, which can be both a challenge and a learning opportunity

-

Ability to create and refine a personalized trading strategy

Benefits of Bots/Algo Trading:

-

Round-the-clock execution

-

Rapid trade entry/exit

-

Precise rule enforcement

-

Scalable to multiple pairs or exchanges

-

Ability to manage multiple accounts and respond instantly to market movements in the crypto market

-

Powerful bots enable high frequency trading for greater efficiency and potential returns

Common Trading Mistakes

Trading in the financial markets comes with its share of risks, and even experienced traders can fall into common traps. Novice traders, in particular, often make mistakes such as skipping thorough research before making investment decisions, which can lead to poor trades and unnecessary losses.

Another frequent error is neglecting proper risk management, exposing themselves to significant financial setbacks. Emotional decision making—driven by fear, greed, or impatience—can also derail even the best trading strategies. To avoid these pitfalls, traders should commit to continuous learning, develop disciplined trading habits, and use tools like copy trading and trading bots to support their strategies.

By studying expert traders, practicing sound risk management, and making informed decisions, traders can minimize risks and increase their chances of achieving potential profits in dynamic markets.

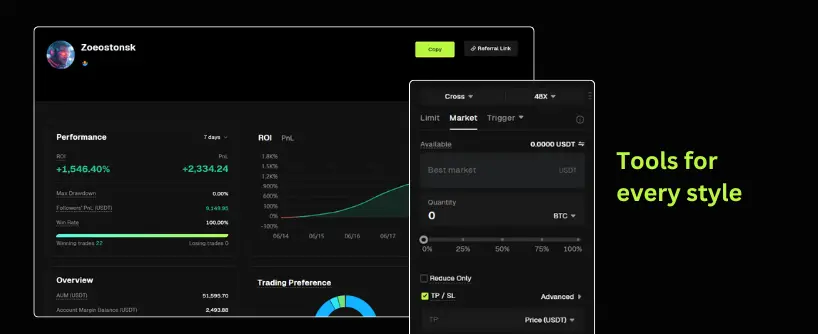

What Bitunix Offers in This Landscape

-

Real-time copy engine: Fast execution without slippage

-

Demo environment & paper trading: Test strategies risk-free before going live

-

Connect multiple exchange accounts: Manage all your exchange accounts from a single platform

-

No hidden fees: Transparent pricing with no undisclosed costs

-

Transparent trader stats: View ROI, drawdown, and PnL

-

Flexible SL/TP: Manage your risk even while copying

-

Adjustable copy ratio: Trade smaller than the lead trader

-

Affiliate program: Earn additional income by promoting Bitunix

Final Verdict: Which Should You Choose?

-

Time availability

-

Skill level

-

Risk tolerance

-

Capital size

-

Preferred learning style

-

Trading goals

| You Are | Choose |

| A complete beginner | Copy trading |

| A disciplined, full-time trader | Manual trading |

| A technical, data-driven person | Trading bots |

FAQs

Is copy trading better than bots?

Copy trading leverages the trading skills and real-time decision-making of a human trader, who can adapt to market changes and human emotions, while bots strictly follow a predefined trading strategy. Bots are faster, but human traders are often better at adapting to news or unexpected volatility.

Can I use both bots and copy trading?

Yes. Many traders diversify by copying pros on one platform and running bots on another. This approach allows you to implement various strategies and different strategies across multiple accounts, increasing diversification and exposing you to multiple styles.

Which is best for beginners?

Copy trading is hands-down the easiest way to get started. Even if you have little knowledge about trading, you can start trading by copying trades from experienced traders. This approach not only allows beginners to participate with ease, but also provides valuable learning opportunities as you observe and learn from the strategies of professionals. No setup, no charts, no coding — just connect and observe.

Do bots always make money?

No. Bots follow logic — and if that logic fails in new conditions, they can lose heavily. Regular monitoring is essential, as past performance does not guarantee future results. Bots may not adapt well to changing market conditions or sudden market movements, increasing the risks involved.

What is the biggest risk in manual trading?

Emotion. Many traders overtrade, chase losses, or panic during drawdowns. Manual trading requires strong trading skills and careful analysis of market data, but the risks involved are heightened by emotional decision-making. It takes strong discipline and a defined system.

Leave a Reply