In the fast-paced world of financial markets, copy trading has emerged as one of the most beginner-friendly ways to participate without becoming a full-time trader. But in 2025, there’s one critical decision every investor must make: should you dive into crypto copy trading or stick with the more traditional forex copy trading?

This guide explores the pros, cons, and profitability of both — with real-world insights for choosing the right path for your portfolio.

[ez-toc]

What Is Crypto Copy Trading?

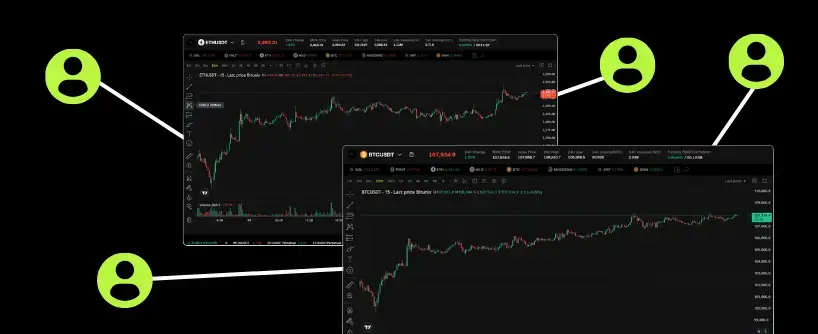

Platforms like Bitunix make it easy by offering:

-

Futures and spot trading pairs

-

Adjustable leverage up to 125x, supporting margin trading for advanced strategies

-

Trade copying with real-time execution

-

SL/TP settings and risk management

-

Social trading features for interacting with other traders

-

Demo account options for risk-free practice

-

Educational resources to help users gain insights and improve their trading skills

Pros of Crypto Copy Trading:

-

Always-on market (24/7 access)

-

Higher volatility = higher potential returns

-

Wide range of assets (memecoins, DeFi, Layer-1s)

-

Innovative platform features (APIs, trader dashboards)

-

Key benefits include automation, access to expert traders, and the opportunity to gain profit and insights through social trading features.

Cons:

-

Riskier than traditional markets

-

Less regulatory oversight

-

Can be affected by liquidity issues during sharp swings

-

There are significant risks involved in crypto copy trading, including exposure to volatile markets and potential losses. It’s important to fully understand these potential downsides before participating.

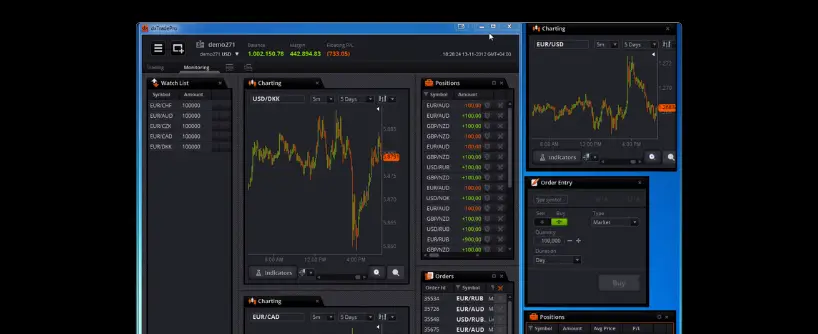

What Is Forex Trading Copy Trading?

Forex copy trading involves mirroring traders who buy and sell currency pairs like EUR/USD, GBP/JPY, or AUD/CHF. Forex trading primarily involves fiat currency pairs, and the market is heavily influenced by the actions of central banks, which can impact exchange rates and overall financial stability.

Forex copy trading platforms usually operate during weekdays and are regulated under authorities like FCA (UK), CySEC (Cyprus), or ASIC (Australia). Forex brokers play a crucial role in facilitating trades and ensuring regulatory oversight, making it important to choose reputable and regulated brokers for safety and compliance.

Pros of Forex Copy Trading:

-

Heavily regulated platforms

-

High liquidity in major currency pairs

-

Fundamental-driven markets (e.g., interest rate policies)

-

Lower overnight volatility

Cons:

-

No trading on weekends

-

Limited asset diversity

-

Smaller price swings compared to crypto

-

Profit potential is lower (but so is risk)

Key Differences: Crypto vs Forex Copy Trading

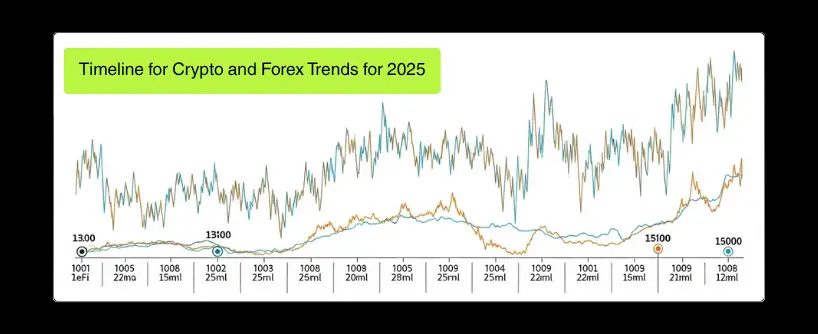

Market Analysis: Crypto and Forex Trends for 2025

Looking ahead to 2025, both the crypto and forex markets are poised for continued transformation, shaped by technological innovation, regulatory changes, and evolving investor preferences. In the crypto market, trends such as the expansion of decentralized finance (DeFi) and the growing popularity of NFTs are expected to attract more participants and diversify trading opportunities.

Increased adoption of cryptocurrencies by financial institutions and mainstream businesses will likely drive further growth, but investors should remain mindful of the high volatility and ongoing regulatory uncertainties that characterize the crypto space.

In the forex market, global economic factors—including the lingering effects of the COVID-19 pandemic, shifting trade policies, and central bank decisions—will continue to influence currency valuations. The rise of emerging market currencies and the integration of digital payment systems are also set to reshape the forex landscape.

To succeed in these dynamic environments, traders will need to adapt their trading strategies, stay informed about market developments, and leverage the latest tools and platforms to navigate both the forex and crypto markets effectively.

Trading Strategies in Copy Trading

Copy trading empowers investors to benefit from the expertise of experienced traders by automatically replicating their trades. There are several trading strategies commonly used in copy trading, each catering to different investment goals and risk profiles.

Day trading focuses on opening and closing positions within a single trading day, aiming to capitalize on short-term market movements. Swing trading, on the other hand, involves holding trades for several days or weeks to capture larger price swings. Position trading is a longer-term approach, often based on fundamental analysis and broader market trends.

When choosing which traders to copy, it’s important to evaluate traders based on their historical performance, risk metrics, and trading style. Some top traders may specialize in scalping, trend following, or other niche strategies, allowing copy traders to align their investments with their own risk tolerance and financial objectives.

Diversifying across multiple traders and strategies can help reduce risk and increase the potential for consistent returns in both forex and crypto markets. By carefully selecting and monitoring the right mix of trading strategies, investors can tailor their copy trading approach to suit their unique investment goals.

Risk Management in Copy Trading

Effective risk management is essential for success in copy trading, helping investors safeguard their capital and minimize potential losses. One of the most important risk management tools is the stop-loss order, which automatically closes a trade if it moves against you beyond a certain point. Position sizing is another key technique, allowing investors to control how much capital is allocated to each trade and avoid overexposure to any single trader or strategy.

Diversifying across multiple traders and trading strategies can further reduce risk by spreading investments across different market conditions and asset classes. Regularly monitoring copied trades and staying attuned to market dynamics enables investors to make timely adjustments to their portfolios.

Setting clear investment goals, defining risk tolerance, and establishing profit targets are also crucial steps in guiding copy trading decisions. By combining these risk management practices with a solid understanding of trading strategies and market conditions, investors can navigate the complexities of copy trading and work towards achieving their financial objectives.

Which Is More Profitable in 2025?

If you’re chasing returns and willing to manage risk, crypto copy trading can outperform.

Crypto traders can capture:

-

High price swings for short-term gains

-

Long trends on assets like SOL, AVAX, or SHIB

-

Opportunities in early-stage coins and memecoins

On Bitunix, you can track top traders with detailed PnL charts and performance data before copying them — giving transparency and control over your portfolio.

However, if your goal is capital preservation with smoother performance, forex copy trading may suit better. It’s ideal for risk-averse traders or those with longer time horizons.

Factors to Consider When Choosing Trading Strategies

1. Risk Tolerance

Assess your risk level before choosing between crypto and forex copy trading. Crypto carries greater upside and downside, often involving higher risk levels due to volatility and leverage. Forex tends to move in smaller increments but with fewer shocks. Make sure your choice

aligns with your overall investment strategy and long-term financial goals.

2. Time Commitment

Crypto runs 24/7. You may need alerts or automation. Forex gives traders time to breathe outside market hours.

3. Regulatory Comfort

Forex copy trading platforms are often regulated. Crypto platforms like Bitunix are gaining licenses globally but may vary in legal structure by region.

4. Platform Features

Bitunix offers:

-

Spot and futures copy trading

-

Leaderboard of traders with performance metrics, including risk level

-

Custom SL/TP settings

-

Trade management on mobile and desktop

-

Full transparency and real-time syncing

Why Bitunix Stands Out for Copy Trading

If you’re leaning toward crypto copy trading, Bitunix offers an ideal platform for both beginners and professionals.

Key Bitunix benefits:

-

Copy trading dashboard with live metrics

-

Easy integration of SL/TP and margin controls

-

Support for USDT, BTC, ETH, and more

-

Built-in trader vetting tools

-

Low fees and zero slippage execution model

FAQs

Q1: Is crypto copy trading more profitable than forex?

Crypto markets offer higher potential returns due to volatility, but they come with more risk. Forex tends to be more stable and suitable for conservative strategies.

Q2: Can I use the same platform for both?

Most platforms specialize in one market. Bitunix focuses on crypto copy trading and is optimized for high-performance digital asset trading.

Q3: Which is better for beginners?

Forex may feel safer for cautious beginners. However, crypto platforms like Bitunix offer demo accounts and educational tools to help new users copy safely.

Q4: How do I choose the best copy trading platform?

Look for transparency, trader analytics, risk controls, and platform reputation. Bitunix excels in offering real-time trader data, SL/TP tools, and low-latency execution.

Q5: Is it possible to copy trade both crypto and forex?

Yes, but you’ll need accounts on different platforms. Be sure to manage risk separately across asset classes.

One reply on “Crypto vs Forex Copy Trading: Which Is More Profitable in 2025?”

I’ve been curious about copy trading and always hear about the higher risk in crypto markets. It’s good to see a detailed breakdown of how the markets compare, but I’d love to know more about the strategies traders are using to minimize that risk while maximizing profits!