If you have ever traded crypto futures, you may have noticed the small payments that appear in your account every few hours. These are called funding fees, and they form the backbone of perpetual futures markets. In 2025, understanding funding rates is essential for anyone shorting crypto or holding leveraged positions overnight.

Funding rates are often overlooked, but they can turn a profitable trade into a losing one or provide steady income for patient traders. For short sellers, funding rates can either be an extra source of return or a costly burden that eats away at profits. This article explains how funding rates work, why they exist, how to monitor them, and how to use them to your advantage when trading short positions in crypto.

[ez-toc]

What Are Funding Rates

Funding rates are recurring payments between traders who hold long and short positions in perpetual futures contracts. Unlike traditional futures, perpetual contracts have no expiration date or settlement. To keep the contract price, also known as the perpetual futures price, close to the spot price of the asset, exchanges use a funding rate mechanism that periodically charges a fee between traders.

Perpetual swaps are a type of crypto derivative that allow traders to speculate on the price of cryptocurrencies without worrying about an expiration date or settlement process. This makes perpetual swaps different from traditional futures contracts, which require settlement at the end of the contract and have a set expiration date. In a perpetual swap, traders can hold positions indefinitely, but must pay or receive funding fees to maintain balance in the market.

- If the funding rate is positive, longs pay shorts a funding fee. This fee is not fixed and can change depending on market conditions.

- If the funding rate is negative, shorts pay longs a funding fee. Again, this fee varies over time.

The funding rate mechanism is designed to maintain balance between perpetual prices and spot prices. Contract prices (perpetual futures price) can diverge from spot prices due to market sentiment, but the funding rate helps realign them by incentivizing traders to take positions that restore equilibrium. For example, if the perpetual price trades above spot prices, the funding rate becomes positive, encouraging more shorts and discouraging additional longs, which brings prices back in line.

Think of a futures contract as a deal between two parties: you agree to buy a bowling ball for $100 in a month, regardless of whether the price changes. In perpetual swaps, this deal has no expiration date or settlement, but the funding rate ensures that the contract price stays close to the actual market value.

This mechanism balances the market. When there are too many longs, the rate rises, discouraging additional long positions. When there are too many shorts, the rate flips negative, discouraging more short exposure.

Why Funding Rates Matter in 2025

Crypto trading is more competitive in 2025 than ever before. Exchanges process billions in daily volume, and perpetual contracts dominate derivatives markets. Traders must understand funding rates because:

- They directly affect profitability. You could have a winning trade on price movement but still lose due to funding costs.

- They provide sentiment signals. Positive funding, positive funding rates, and a positive funding rate generally indicate bullish market sentiment and high demand from long traders. Positive funding rates occur when perpetual contract prices are above spot prices, signaling excessive leverage and the potential for a market correction.

- They can create squeeze conditions. Extremely negative rates often signal overcrowded shorts that are vulnerable to a short squeeze.

Negative funding rates and a negative funding rate are often seen in a bearish market, reflecting negative market sentiment and increased demand from short traders.

Ignoring funding rates is like ignoring interest payments on a loan. They may look small, but over time they accumulate into significant gains or losses. Generally, funding rates reflect market sentiment, with long and short traders exchanging funding fees—longs pay shorts when rates are positive, and shorts pay longs when rates are negative.

How Funding Rates Are Calculated

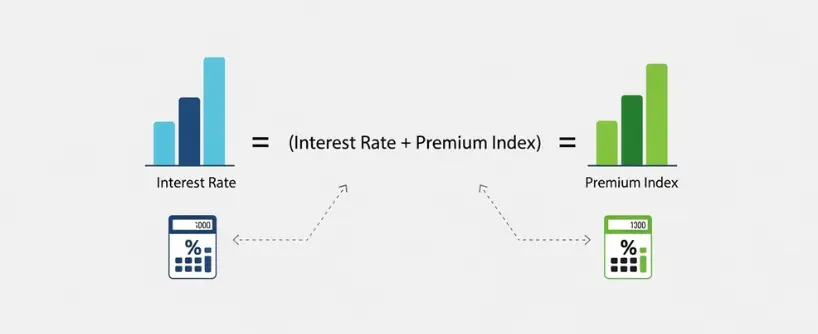

While formulas vary slightly by exchange, the basic calculation uses two elements:

- Interest rate: The base cost of holding one side of the trade.

- Premium index: The difference between the perpetual contract price and the spot price.

Funding rates are usually charged every 8 hours (every eight hours), although some exchanges use shorter intervals. The funding fee is not fixed and can change rapidly depending on market conditions. The amount you pay or receive is based on your position size and the current rate.

For example, if you hold a short position worth 50,000 USDT and the funding rate is 0.01 percent, you will either pay or receive a fee of 5 USDT every 8 hours, depending on the direction of the rate. Over days or weeks, these charges can add up significantly.

Funding Rates and Short Positions

For traders shorting crypto, funding rates can be both a friend and a foe. When the funding rate is negative, short traders may have to pay long traders (pay long), which can signal potential market reversals or major lows in Bitcoin’s price. A long position is the opposite of a short position, and funding rates affect both sides.

- When rates are positive: Shorts receive payments from longs. This means short traders can earn extra income or earnings for holding your short overnight.

- When rates are negative: Shorts must pay funding fees to longs. Short traders may need to sell or close their positions to avoid further losses, as this reduces your profit or adds to your losses.

In periods of extreme bullish sentiment, funding rates can remain positive for days. Short sellers in these conditions may enjoy a steady stream of small payments, even if price moves against them slightly. On the other hand, during bearish markets, negative rates often punish shorts, adding extra cost on top of the risk of a squeeze.

Strategies for Short Sellers

Monitor Funding Rates Constantly

Funding rates change every interval. If you plan to hold a short for more than a few hours, you must track how much you stand to pay or earn.

Time Your Entry

Entering a short when funding rates are about to reset in your favor can give you a head start.

Avoid Holding in Extreme Conditions

If negative rates spike, consider reducing exposure. Paying high fees while facing potential squeezes is a recipe for losses.

Use Low Leverage

Leverage magnifies funding payments. Holding a high-leverage short in a negative funding environment can drain your account quickly.

Hedge with Opposite Positions

Some traders hedge by holding both long and short positions on different exchanges to benefit from rate differences. This strategy requires careful monitoring and is better suited for experienced traders, as it involves arbitrage risks. Traders should monitor for these arbitrage risks when hedging to mitigate potential losses.

Case Study Bitcoin Funding Rate Swings

In late 2024, Bitcoin funding rates reached historic extremes as bullish sentiment overwhelmed the market. Long traders were paying shorts as much as 0.1 percent every eight hours. For shorts with large positions, this amounted to thousands of dollars in funding income each day, even while prices edged higher. The value of a short position can change dramatically as funding rates fluctuate, and traders can make or lose substantial money during these swings.

By contrast, in early 2025, as markets corrected, rates turned sharply negative. Short sellers suddenly found themselves paying heavy fees, cutting into profits and accelerating liquidations as costs mounted.

These swings show how quickly funding rates can flip and why constant attention is critical for traders.

Tools to Track Funding Rates

Traders today have access to advanced analytics that make funding rates easier to monitor:

- Exchange dashboards provide live funding data. Bitunix, for example, displays current and predicted funding rates on all perpetual pairs.

- Aggregators show average rates across multiple platforms.

- Heatmaps visualize where extreme funding levels may signal upcoming squeezes.

Relying solely on price charts without watching funding rates is incomplete. A holistic approach requires integrating these tools into your daily trading routine.

How Bitunix Helps with Funding Rates

Bitunix has built features that simplify funding rate management for traders. Its platform shows real-time funding rates, projected funding for the next interval, and historical trends. This transparency helps traders decide whether holding a position is worth the cost.

For those who want to strengthen their knowledge, Bitunix Academy offers educational modules on funding rates, margin mechanics, and futures trading strategies. Through structured lessons and case studies, traders can learn how to incorporate funding analysis into shorting strategies.

Risks of Ignoring Funding Rates

- Hidden Losses Traders may exit what looks like a winning position only to find that accumulated fees have erased their profit.

- Misreading Sentiment Without funding data, you may assume the market is balanced when in fact one side is overcrowded.

- Exposure to Squeezes Extremely negative rates often precede short squeezes. Ignoring them leaves you unprepared for sudden rallies.

Frequently Asked Questions

What are crypto funding rates?

A crypto funding rate is a periodic payment between traders holding long and short positions in perpetual futures contracts, designed to keep contract prices close to the spot market.

How often are funding fees charged?

The funding fee is typically charged every eight hours, although some exchanges may adjust the interval.

Do short sellers always pay funding rates?

No. Traders may pay or receive the funding fee depending on the rate. When the rate is positive, shorts are paid by longs. When the rate is negative, shorts must pay longs.

Can funding rates be used as a trading signal?

Yes. Extremely high or low rates suggest overcrowding and can precede reversals or squeezes.

Does Bitunix provide tools to track funding?

Yes. Bitunix offers real-time funding data, predicted rates, and educational content through Bitunix Academy.

Conclusion

Funding rates are one of the most important mechanics in crypto trading, yet many traders overlook them. For short sellers, they represent either extra profit or hidden cost. By monitoring funding rates, timing entries, and avoiding extreme conditions, traders can reduce risk and increase profitability.

In 2025, when perpetual futures dominate the market, funding awareness is no longer optional. Platforms like Bitunix not only provide transparent funding data but also offer educational resources through Bitunix Academy to help traders understand and apply these concepts.

Mastering funding rates allows you to trade with clarity and confidence, turning overnight fees from a risk into an advantage.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.