In 2025, crypto margin trading has become a double-edged sword. On one hand, it promises higher profits through leverage. On the other hand, it introduces new layers of volatility, liquidation risk, and margin call scenarios that can wipe out entire portfolios in minutes.

Retail investors are still asking: Is crypto margin trading worth the risk?

Institutional traders, however, approach this question differently. With better tools, deeper capital, and a structured risk management approach, they’ve figured out how to survive — and thrive — even in extreme market conditions.

This article breaks down what the pros know that most retail traders miss.

[ez-toc]

What Is Crypto Margin Trading?

Margin trading in crypto refers to borrowing capital to increase your buying power. Crypto margin trading work by allowing you to open long or short positions using borrowed funds and leverage, which amplifies both potential gains and losses. On platforms like Bitunix, you can trade assets with 2x, 5x, or even 100x your original investment.

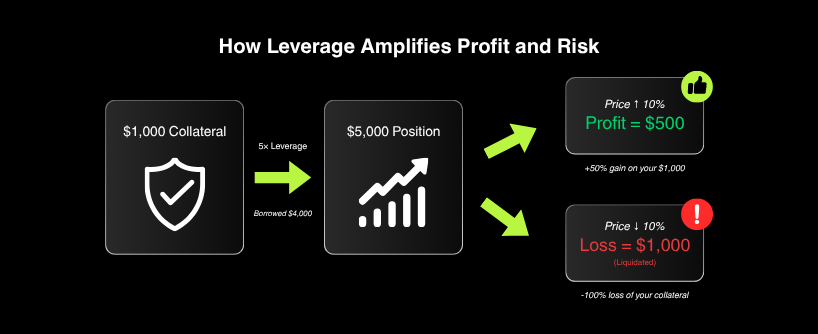

Let’s say you have $1,000 as your initial investment, which you put up as collateral. With 5x leverage, you can open a position worth $5,000—borrowing funds to control a larger position than your initial investment. For example, if the price moves up 10%, your $1,000 could become $1,500, but if the price drops 10%, you could lose your entire initial investment. Your digital asset serves as collateral for the borrowed funds in this process.

But with great leverage comes great risk. Leveraged trading can amplify both profits and losses. A small market move against you could trigger a margin call or forced liquidation. Understanding how margin trading work and the risks involved is key to protecting your funds. Always choose the right platform and be aware of the risks involved before starting margin trading.

The Allure of Margin Trading: Why It Attracts Everyone

- Amplified Profits: A 10% move with 10x leverage means 100% profit.

- Shorting Opportunities: You can profit from falling markets.

- Capital Efficiency: Margin trading allows you to open larger positions with less capital by borrowing more funds, maximizing your exposure.

- Market Access: Each exchange offers a wide range of trading pairs—platforms like Bitunix support margin trading across BTC, ETH, SOL, and more.

Understanding Margin Levels in Crypto Trading

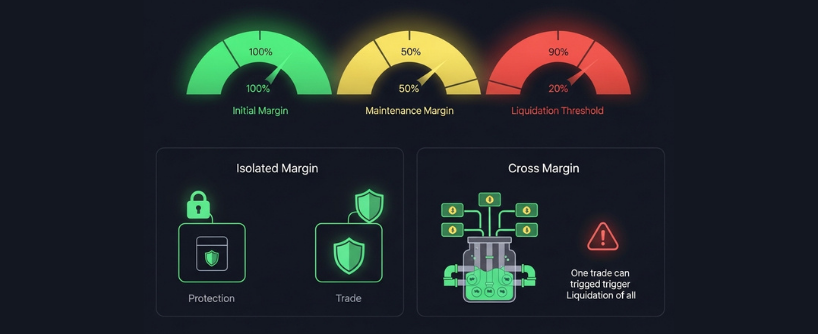

Understanding margin levels in crypto trading is essential for protecting your capital and maximizing potential profits. Margin levels represent the ratio of your account equity to the borrowed funds used for trading. This metric helps you gauge how close you are to liquidation. There are two main strategies: isolated margin trading, which limits risk to a single position, and cross margin trading, where your total margin is shared across all trades. While cross margin can help offset losses, it also means one bad trade can threaten your entire account.

A margin call occurs when your margin level drops below the platform’s required threshold, signaling that you need to add funds or reduce positions to avoid forced liquidation. Failing to act can trigger an automated forced sale of your assets. To open a margin trade, you must provide an initial margin, followed by maintaining a required maintenance margin. Leverage—the ratio of borrowed funds to your own capital—amplifies both profits and risks, making it crucial to monitor your exposure closely.

Risk management is key when trading on margin. Use stop loss orders, monitor market trends, and adjust your leverage based on volatility. Choose a secure platform offering real-time margin tracking, reliable margin call alerts, and strong safety features. By understanding and actively managing your margin levels, you can minimize risk and unlock the full potential of crypto margin trading—whether in Bitcoin or other digital assets.

Margin Trading Risk: What Can Go Wrong?

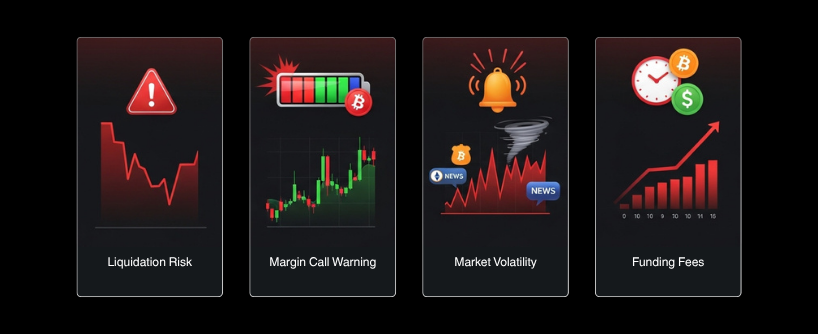

1. Liquidation Risk

With high leverage, even minor price fluctuations can wipe out your position. Most platforms automatically liquidate your holdings when the current price of the asset reaches your liquidation price.

2. Margin Call Scenarios

When your collateral falls below the maintenance level that the platform requires, a margin call is triggered. If you don’t add funds fast, your position is liquidated at a loss.

3. Market Volatility

The cryptocurrency market is unpredictable, with crypto assets known for their unique volatility. News events, whale activity, or regulatory moves can cause sharp swings, especially in altcoins and low-liquidity pairs.

4. Funding Fees and Carry Costs

Leverage is not free. Holding positions for longer periods may incur funding fees and interest charges, which eat into profits — especially during sideways markets.

Traders must pay interest on borrowed funds, and these costs can accumulate over time, further reducing profitability if positions are held for extended periods.

What Institutional Traders Do Differently

While retail traders often get liquidated, institutional desks manage risk with discipline. Institutional traders typically allocate more collateral to their accounts to support multiple positions and reduce the risk of forced liquidation. Here’s what they focus on:

Effective risk management is crucial for institutions, and this includes managing collateral across other positions. By carefully monitoring margin requirements and using strategies like cross margin, they ensure that their overall portfolio remains protected from sudden market moves.

A. Position Sizing Rules

Pros never risk more than a small fraction of capital per trade. Even with 10x leverage, institutions carefully size each trade to avoid overexposure to a larger position. Their exposure is limited through calculated entry sizes.

B. Stop Loss in Crypto Trading

Institutions set strict stop-loss orders based on volatility metrics, not emotions. This helps them preserve capital during unexpected price moves.

C. Diversification Across Assets and Strategies

They don’t bet everything on one coin or strategy. Many institutional desks run diversified systems: long/short, mean reversion, momentum, and news-based trading — all risk-adjusted.

D. Volatility-Aware Adjustments

In highly volatile weeks, leverage is reduced or avoided altogether. Professionals lower position sizes ahead of CPI data, FOMC meetings, or geopolitical shocks.

Risk Management Frameworks: How Pros Avoid Blowing Up

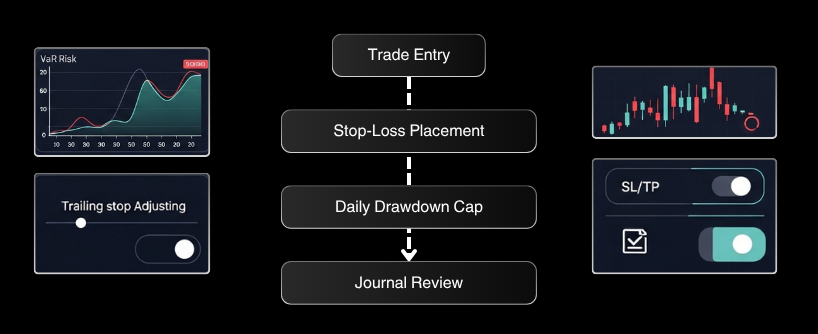

Institutional risk managers often implement:

- Daily Loss Limits: Accounts are locked after a set drawdown.

- VaR (Value at Risk) Metrics: Capital allocation is tied to probabilistic loss models.

- Trailing Stop Mechanisms: Dynamic stop loss levels move with price to lock in gains.

- Trade Journals: Each trade is logged and reviewed weekly to identify patterns and adjust strategies.

If you want to survive margin trading crypto, build your own lightweight version of these tools.

Crypto Margin Trading Platforms and Their Risk Controls

Each exchange offers different features and risk controls for margin trading, so it’s important to compare them carefully. Margin trading allows you to use leverage, increasing both potential gains and risks, while spot trading involves only your own capital and no leverage, making it generally lower risk and more suitable for beginners.

Some platforms offer better protection than others. Here’s what to look for when choosing the right platform for your trading needs:

- Bitunix: Offers adjustable leverage, margin call alerts, SL/TP entry tools, and a wide variety of trading pairs to support diverse strategies

- Binance: Known for multiple margin tiers, auto-deleveraging protection, and a large selection of trading pairs

- OKX: Allows isolated and cross-margin setups with funding transparency, plus extensive trading pairs for flexibility

Leverage Is Not a Strategy. Risk Management Is.

If you treat leverage as a shortcut to fast gains, you’re likely to get burned.

Instead, approach it like a professional:

- Use leverage to improve capital efficiency, not chase moonshots

- Set stop-loss levels before you enter a position

- Limit exposure to 1–3% of your account per trade

- Monitor funding rates to avoid hidden losses

- Trade only during liquid hours with high volume

Should You Use Margin Trading in Crypto?

You should consider it if:

- You have a tested system with a positive track record

- You can monitor positions in real time

- You use stop-loss crypto trading discipline

- You’re emotionally detached from PnL swings

You shouldn’t if:

- You don’t understand liquidation mechanics

- You’re trading on mobile while distracted

- You keep increasing leverage after losses

- You’re not journaling or analyzing your trades

The Bottom Line: Is Crypto Margin Trading Worth It?

Yes, if done with precision.

Crypto margin trading is a powerful tool for increasing market exposure and maximizing potential returns, but only when combined with strict risk management. Institutional traders thrive not because of higher leverage, but because of better systems.

At Bitunix, we encourage responsible trading. Our futures platform supports multiple risk models, margin types, and SL/TP entry with transparent fee structures and mobile compatibility.

If you’re ready to trade smarter, start small, trade often, and treat every trade as data — not a bet.

FAQs

What is margin trading in crypto?

It’s trading using borrowed funds to amplify position size, allowing for higher returns — but also higher losses. Traders can open a long or short position to profit from both rising and falling prices.

What is the biggest risk in crypto margin trading?

The risk of liquidation, especially during volatile price movements or when traders overleverage. Both a long position and a short position carry significant risks if the market moves against you.

How do institutions manage margin trading risks?

They use strict sizing, stop-losses, diversification, volatility-based exposure, and performance logs. Institutions carefully manage both long and short positions.

What’s the difference between a margin call and liquidation?

A margin call is a warning. If you don’t add collateral or close the trade, liquidation forcibly closes it at a loss.

Does Bitunix offer margin trading?

Yes. Bitunix offers margin trading with adjustable leverage, stop-loss entry, and account-level risk controls. For example, if bitcoin increases in value while you hold a leveraged long position, your profits can be significantly amplified.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.