In the world of trading, few events create as much drama as a short squeeze. For stock traders in the stock market, the GameStop rally of 2021 remains the most famous case, widely known as the gamestop short squeeze, a highly publicized event where coordinated buying activity led to a dramatic surge in GameStop’s stock price. For crypto traders, short squeezes are far more common because the cryptocurrency market is faster, more volatile, and highly leveraged.

In 2025, Bitcoin, Ethereum, and altcoins regularly experience squeezes that wipe out overconfident bears and reward prepared traders. Knowing how to detect signs, defend against them, and even profit when they occur is essential for anyone who wants to succeed in the modern crypto landscape.

This article breaks down the mechanics of a crypto short squeeze, signals to watch, strategies to survive, and opportunities to profit. It also explains how exchanges such as Bitunix provide tools that can help traders handle these events with better preparation.

[ez-toc]

What is a Short Squeeze in Crypto

A short squeeze happens when traders who are betting on price declines are forced to buy back their positions as prices unexpectedly rise. In the open market, this often involves short selling, where traders borrow an asset, such as a cryptocurrency, and sell it at the current market price, hoping to buy it back later at a lower market price. If the asset’s price rises instead, short sellers must repurchase the asset at a higher price, creating more buying pressure, which drives prices even higher. The cycle feeds itself until most shorts are liquidated or covered.

Short squeezes are especially powerful in crypto because of three factors:

- Leverage levels are higher. Some exchanges allow 50x or even 100x leverage. A move of only 2 percent in the asset’s price can wipe out short positions instantly. Bitunix offers up to 125x.

- The market never sleeps. Crypto trades 24 hours a day, seven days a week, so squeezes can start at any time, and rapid changes in market price can trigger liquidations.

- Liquidity is thinner than in stocks. Even top trading pairs can experience low order book depth, which makes squeezes sharper. The characteristics of the underlying asset, such as volatility and trading volume, also influence how severe a short squeeze can become.

The combination of these factors means short squeezes in crypto tend to be more violent and frequent than in traditional financial markets.

How a Short Squeeze Works Step by Step

The process of a short squeeze follows a predictable chain of events.

- Heavy Short Positioning: Many short sellers—investors who expect a decline in the asset’s price or cryptocurrency’s price—borrow crypto using a margin account, obtaining borrowed shares from a lender. These assets are then sold short in the open market, initiating a sale by selling the borrowed shares. When many short sellers participate, it creates a high amount of short interest, often measured as a percentage of the float or average daily trading volume. This high amount increases the possibility of a short squeeze.

- Catalyst Appears: A point of upward momentum, such as positive news, sudden whale accumulation, or new institutional inflows, can lead to a squeeze by prompting short sellers to cover their positions. This strong buying activity shifts sentiment and accelerates price movement.

- Price Breaks Resistance: As the price rises, stop loss levels for short sellers are triggered. Short sellers are forced to buy stock at a higher price to cover their positions, resulting in even greater losses and substantial losses. The difference between the initial sale and the repurchase at a higher price determines the profit or loss for the short seller. Each closed position adds buy pressure, further driving up the price.

- Liquidations Begin: High leverage causes mass liquidation. Exchanges automatically buy crypto back to close positions, which drives prices even higher. In these scenarios, the unlimited risk and theoretically unlimited losses faced by short sellers become apparent if the stock price or cryptocurrency prices rise sharply against their positions.

- Cascade Effect: Each liquidation pushes prices further upward, forcing even more shorts to cover. The share price or share prices can become disconnected from the underlying value and fundamentals, affecting other investors and investors who may be caught in volatility. The result is an explosive rally that feeds on itself.

In July 2025, Bitcoin surged above 118,000 dollars in a matter of hours, as more than one billion dollars in shorted shares and short interest (as a high amount and as a percentage of float and average daily trading volume) led to the explosive move. This is a textbook example of a crypto short squeeze in action.

It is important to understand the inherent risks of short selling, including the possibility of substantial losses and unlimited risk. Assess your financial situation carefully before engaging in these strategies, as past performance does not guarantee future results. The value and market price of the underlying asset can fluctuate rapidly, leading to a drop or decline after the squeeze. Money can be made or lost quickly, and selling and buying at the right time is crucial.

Detecting a Short Squeeze Before it Happens

Predicting squeezes is difficult, but traders can monitor conditions that make them more likely. Monitoring short interest as a percentage of float and comparing it to the average daily trading volume can help identify stocks or assets at risk of a short squeeze.

High Open Interest in Shorts

When open interest builds heavily on the short side, the market becomes fragile. If price moves up unexpectedly, there is plenty of fuel for a squeeze.

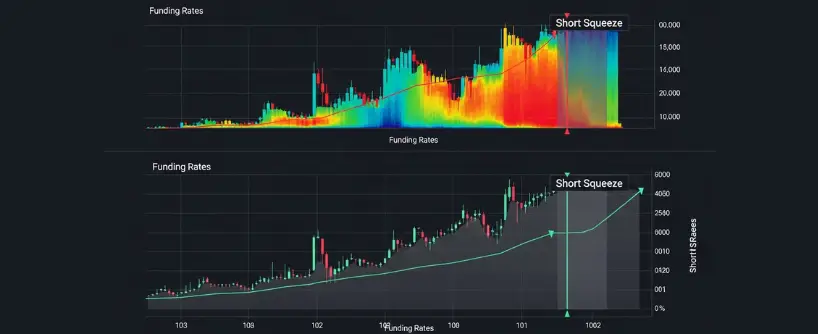

Extreme Funding Rates

Funding rates on perpetual futures show whether longs or shorts dominate. Negative funding means shorts are paying longs to keep positions open. If the rates are extremely negative, it often signals overcrowding on the short side.

Technical Pressure

If a coin tests support repeatedly without breaking lower, it suggests sellers are running out of strength. A break upward through resistance after heavy shorting can unleash a squeeze.

Low Liquidity Periods

Thin order books increase the risk of squeezes. Low liquidity during weekends or late trading hours means even moderate buying can drive large price spikes.

Whale Activity

Large on-chain transfers or sudden spot buying on major exchanges often indicate whales are entering. Their buying can trigger squeezes when shorts are overexposed.

On platforms such as Bitunix, traders can monitor funding rates, open interest, and liquidity conditions in real time. These tools help identify imbalance before it turns into a squeeze.

Defending Against a Short Squeeze

For traders who short crypto, risk management is the only defense.

- Use Stop Losses: Always set protective stops. They prevent small moves against you from turning into catastrophic losses.

- Apply Isolated Margin: On Bitunix and other advanced platforms, isolated margin ensures that only the funds committed to one position are at risk. Your entire account balance is not exposed.

- Keep Leverage Low: Avoid the temptation of extreme leverage. The higher your leverage, the smaller the move required to liquidate you.

- Track Liquidation Zones: Data providers publish liquidation heatmaps. If price approaches a large cluster of liquidation levels, be careful. A squeeze may be imminent.

- Diversify Exposure: Do not rely on a single short position. Diversification reduces the risk that one short squeeze wipes out your portfolio.

Defensive strategies may not prevent losses entirely, but they can stop a bad trade from turning into a disaster.

Profiting from a Short Squeeze

Short squeezes are risky, but they can also be opportunities for sharp gains.

- Spot the Setup: Look for extremely negative funding rates, crowded shorts, and obvious resistance levels that are about to break.

- Wait for Confirmation: Enter long positions only when the breakout is confirmed with strong volume. Guessing too early can backfire.

- Scale Into Profits: Do not wait for the absolute top. Take partial profits as price rises. Short squeezes often reverse just as quickly as they rise.

- Manage Risk: Always trade with stops and only use capital you can afford to lose. The speed of squeezes leaves no room for hesitation.

- Avoid Chasing Late Moves: Entering after the squeeze has already moved far is dangerous. Late traders are usually the ones holding the bag when the rally fades.

Historical Examples of Crypto Short Squeezes

- Bitcoin in 2021: Multiple rallies from 30,000 to 60,000 dollars included squeezes that liquidated billions of short positions.

- Ethereum in 2021: After a correction, Ethereum surged nearly 50 percent in two weeks, driven by a cascade of short liquidations.

- Bitcoin in July 2025: The most recent major squeeze saw 237,000 traders liquidated in one day, with over one billion dollars in shorts erased.

These events prove that short squeezes are not rare exceptions. They are recurring features of leveraged crypto markets.

How Bitunix Features Support Traders

Bitunix provides several features that help traders manage short squeeze risk:

- Live Funding Rate Tracking to identify imbalances in the futures market.

- Isolated Margin Trading to limit potential losses to one position.

- Stop Loss and Take Profit Tools for disciplined risk management.

- Real-Time Open Interest Data that shows when shorts dominate the market.

By using these tools, traders can better defend against squeezes or position themselves to benefit when they occur.

Risks of Trading Short Squeezes

Profiting from short squeezes is never guaranteed. They move fast, liquidity dries up quickly, and reversals are violent. Traders who chase too late often end up with losses. Treat squeeze trading as an opportunistic side strategy, not as the foundation of your trading plan.

Frequently Asked Questions

What is a short squeeze in crypto?

It is when short sellers are forced to cover as prices rise, creating a feedback loop of buying pressure.

How do you detect a squeeze?

By monitoring funding rates, open interest, liquidity, and news catalysts that can flip sentiment.

Are squeezes more common in crypto than in stocks?

Yes. High leverage, thin liquidity, and 24/7 trading make crypto markets more prone to squeezes.

Can Bitunix help reduce squeeze risk?

Yes. With tools for funding rate tracking, open interest monitoring, and isolated margin, traders gain better control during volatile moves.

Can I profit safely from a squeeze?

There is no safe way. However, entering early, scaling profits, and using stop losses improves your chances.

Conclusion

Short squeezes in crypto are powerful market events that can liquidate overleveraged shorts in minutes while rewarding prepared longs. Detecting them requires tracking market imbalances, defending against them demands strict risk management, and profiting from them requires speed and discipline.

In 2025, with crypto markets more volatile and leveraged than ever, short squeezes are not going away. Traders who understand their mechanics and prepare properly will be better equipped to survive and thrive. Platforms such as Bitunix offer valuable tools to monitor conditions and manage risk, but success always depends on the trader’s ability to stay disciplined, manage exposure, and act decisively.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.