In 2025, cryptocurrency markets remain some of the most volatile in the financial world. Traders who try to profit from this volatility often encounter a unique challenge: the short squeeze. In the crypto market, short selling involves investors selling borrowed assets, such as cryptocurrencies, with the expectation of buying them back later at a lower price to profit from the decline. Both retail and institutional investors participate in these strategies, and the price movements of the underlying asset can trigger dramatic market events like short squeezes.

A short squeeze can wipe out leveraged positions within minutes, but it can also deliver extraordinary profits for traders who recognize and trade them correctly.

This article explores how to build a crypto short squeeze trading strategy focused on three core elements: momentum, timing, and stops. These principles are the foundation of trading squeezes without being caught on the wrong side of the market. By understanding how squeezes form, how to ride them with momentum, and how to exit safely, traders can turn chaos into opportunity.

[ez-toc]

Why Short Sellers Make Short Squeezes Frequent in Crypto

Short squeezes are not new, but crypto markets are uniquely prone to them. There are several reasons for this:

- High leverage availability: Many exchanges offer 25x, 50x, or even 100x leverage, Bitunix offers up to 125x. This magnifies the risk of forced liquidation when prices rise against short sellers. Margin trading and the use of a margin account allow traders to borrow funds and take larger positions. Short positions are established by selling borrowed shares on the open market, with the expectation of buying them back at a lower price.

- 24/7 trading hours: The crypto market never closes, so squeezes can happen at any time. Traders who sleep through a breakout often wake up to find their positions liquidated.

- Thin liquidity: Compared to equities or forex, crypto order books are shallow. A few large buy orders can quickly move the market, triggering liquidations and fueling a squeeze.

- Retail dominance: Many retail traders short aggressively in bear phases. When sentiment shifts, they are the first to be liquidated, accelerating upward moves.

Together, these factors make squeezes a structural feature of the crypto market.

The Role of Momentum in a Short Squeeze

Momentum is the lifeblood of a short squeeze. Once buying begins, rapid price movement and upward momentum often characterize the rally, as bullish catalysts trigger a chain reaction of buying activity. Each forced short exit adds fuel to the rally, with short sellers covering their positions, which further increases buying pressure. Traders who want to profit from a squeeze must learn to read momentum and enter at the right point.

Identifying Momentum Early

- Look for breakouts above resistance levels on high volume.

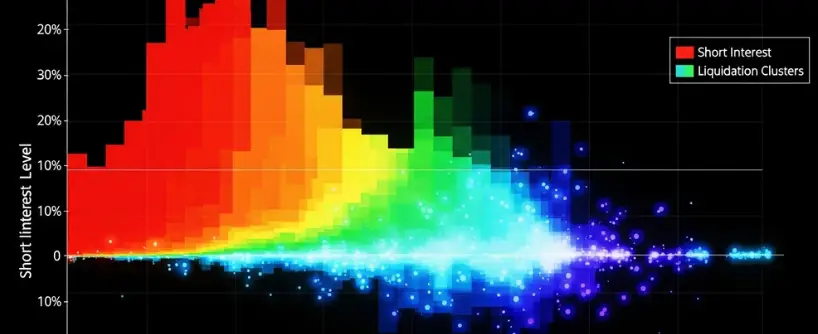

- Monitor short interest and its percentage of the float as an early warning sign of a potential short squeeze.

- Use average daily trading volume to calculate days to cover, which helps assess the likelihood and strength of a squeeze.

- Watch liquidation data. A wave of forced liquidation usually signals the squeeze has started.

- Use indicators such as RSI or MACD not to predict, but to confirm that a breakout has momentum.

Riding Momentum

- Enter positions with smaller size at first, then add as momentum strengthens.

- Avoid overcommitting too early. Short squeezes can fail if the breakout is weak.

- Scale out profits during the move instead of holding them until the end. Holding onto shorted shares or short positions during a squeeze can result in even greater losses if the price continues to move against you.

Momentum is both opportunity and danger. It delivers sharp gains, but it can collapse just as quickly.

Timing is Everything

Short squeezes move fast. Traders who succeed know how to time both entry and exit. The initial sale or sell of borrowed assets, such as stocks or cryptocurrencies, sets up the potential for a squeeze. When prices rise rapidly, short sellers may be forced to buy stock to cover their positions, which can accelerate the squeeze.

Entry Timing

The best entry is usually right after a breakout above resistance when volume surges, ideally at the market price immediately after the breakout. Waiting too long means chasing, while entering too early risks being caught in a false move.

Exit Timing

Profitable squeeze traders never aim for the exact top. They exit in stages as the move unfolds. Some profits are taken quickly to secure gains, while the rest are left to ride momentum with a trailing stop. During a short squeeze, short sellers may need to cover their positions rapidly to avoid further losses as prices surge.

Avoiding Late Entries

Many retail traders lose money by entering too late. Once a squeeze has already pushed the price far above resistance, the risk of reversal increases. Entering late often means buying at a higher price, which increases the risk of losses if the move reverses. Timing is about balance: act quickly, but only on strong confirmation.

The Importance of Stops

Stops are not optional in squeeze trading. They are essential for both survival and consistency. Shorting cryptocurrency carries inherent risks, including the possibility of unlimited risk and theoretically unlimited losses if the market moves sharply against your position. Proper risk management and discipline are crucial to handling these dangers.

- Hard Stop Losses: Define the maximum you are willing to lose before entering. For example, if you enter a breakout above 40,000, a stop just below the breakout point protects against a failed squeeze.

- Trailing Stops: As price rises, move your stop upward. This locks in profits if the move reverses.

- Mental Stops: In crypto, volatility can hit stops prematurely. Some experienced traders use mental stops with discipline, exiting manually if price crosses a key threshold.

On exchanges such as Bitunix, advanced stop tools allow you to automate both hard stops and trailing stops. This helps traders manage risk even when they cannot monitor the market 24/7.

Building a Strategy Around Short Squeezes and Short Interest

A strategy combines momentum, timing, and stops into a repeatable framework. Here is a step-by-step approach for 2025:

- Scan for Setup Conditions: Look for negative funding rates, crowded shorts, and bearish sentiment in social media. If the market looks too one-sided, a squeeze may be forming. There is also the possibility of a squeeze being triggered by a sudden drop or fall in price, which can rapidly force short sellers to cover.

- Confirm the Breakout: Wait for price to break resistance with strong volume. Avoid guessing before confirmation. Remember, the difference between the selling price and the lower price at which the asset is bought back determines your profit in a short trade.

- Enter Small, Add as Momentum Builds: Start with partial size to reduce risk. If the squeeze gains strength, increase exposure. When selecting trades, consider the value of the asset to identify those with the highest potential.

- Use Stops to Protect Capital: Always set a stop below the breakout point. Consider using isolated margin so losses are contained. Before entering trades, assess your financial situation to ensure you can manage potential risks.

- Scale Out Profits: Take partial profits at key resistance levels. If momentum continues, let a portion of the position ride with a trailing stop. While shorting aims to profit from a fall in price, holding a long position is the opposite strategy, where you expect the asset’s price to rise.

- Exit Before Exhaustion: Squeezes end violently. When volume drops or momentum indicators flash exhaustion, close the trade.

This systematic approach helps balance opportunity and risk. However, keep in mind that past performance does not guarantee future results.

Common Mistakes in Short Squeeze Trading

- Overleverage: Traders often try to maximize gains with extreme leverage. Most end up liquidated.

- Chasing Late Moves: Entering after a squeeze has already extended reduces the chance of profit.

- Ignoring Stops: Without stops, one failed squeeze can wipe out weeks of gains. This can expose traders to substantial losses, especially when short positions move against them.

- Overconfidence: No trader can predict every squeeze. Treat them as opportunities, not certainties.

Real-World Examples

- Bitcoin July 2025Bitcoin spiked from 112,000 to 118,000 in hours, with dramatic movements in the cryptocurrency’s price and significant volatility in the cryptocurrency market. More than one billion dollars in shorts were liquidated, as many short sellers who had sold short were forced to buy back at a higher price, prompting short sellers to cover their positions. These events involved substantial trades in both cryptocurrencies and stocks, and the rapid changes in share prices and stock price movements were notable. Traders who bought on the breakout above 114,000 profited, while late entrants above 117,000 faced losses.

- Ethereum May 2021After a steep decline in the underlying asset, Ethereum rallied 50 percent as shorts were squeezed, leading to a sharp increase in cryptocurrency prices. The price movement of the underlying asset prompted short sellers to cover, resulting in a surge in trades and volatility in the cryptocurrency market. Those who used trailing stops captured much of the move, while those who failed to exit saw gains erased when the rally faded.

- GameStop Short Squeeze January 2021The GameStop short squeeze is a prominent example in the stock market, where a high amount of short interest and many short sellers betting against the stock led to a rapid increase in share price. The event was led by retail investors coordinating trades, which caused the stock’s price and share prices to skyrocket, forcing short sellers to cover their positions. Brokerage firms and lenders played a crucial role by facilitating the borrowing and lending of shares that were sold short. The dramatic stock price movement and the volume of trades in stocks during this period highlighted the risks and dynamics of short squeezes.

These examples show how momentum and timing separate winners from losers.

How Bitunix Features Support Strategy

Bitunix offers futures and margin products where short squeezes often play out. These products also allow traders to short crypto, using advanced strategies like futures contracts and margin trading to potentially profit from declining markets. Traders can use:

- Funding Rate Monitors to detect when shorts dominate.

- Open Interest Data to identify crowded markets.

- Stop Loss and Trailing Stop Tools to enforce discipline.

- Isolated Margin Options to cap risk at the position level.

These features do not prevent squeezes, but they provide traders with visibility and control.

Frequently Asked Questions

What is the best way to trade a crypto short squeeze?

The best way is to wait for confirmation of momentum, enter with small size, add as the breakout strengthens, and use stops to control risk.

Why are short squeezes so common in crypto?

Because leverage is high, liquidity is thin, and markets are open around the clock. These factors make liquidation cascades frequent.

Should beginners trade short squeezes?

Beginners should be cautious. Squeezes move too fast for inexperienced traders. Start with small positions or avoid them until you gain experience.

How can Bitunix help with trading squeezes?

Bitunix provides funding rate, open interest, and risk management tools that help identify conditions and manage positions safely.

Can you hold through a squeeze without stops?

You can, but it is dangerous. Squeezes end abruptly, and without stops, you may lose gains or face liquidation.

How do short squeezes and short selling affect other investors?

Short selling can benefit other investors by exposing fraud or unethical practices, which helps protect retail investors and promotes market transparency. However, during a short squeeze, rapid price movements can increase volatility and risk for other investors in the market.

Conclusion

Short squeezes are explosive events that define the volatility of crypto markets in 2025. They are dangerous for shorts who ignore risk management, but they can be profitable opportunities for disciplined traders. A strategy built on momentum, timing, and stops provides a framework to trade squeezes effectively.

The key lessons are simple: detect setups early, wait for confirmation, protect with stops, and never chase too late. Platforms such as Bitunix provide the tools needed to monitor funding rates, open interest, and risk levels, but success depends on preparation and discipline.

For traders who respect the risks and follow a clear plan, short squeezes can transform volatility into profit rather than disaster.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.