Crypto Weekly Market Overview:How Long Can the Recovery Last After the Panic Subsides?

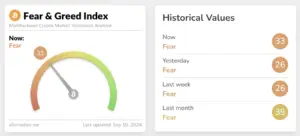

Fear & Greed Index

This Tuesday, the Fear & Greed Index stood at 33, marking a 27% increase from last week’s 26. After BTC once again tested the 52,000 level and subsequently rebounded to around 57,000, the index remains in the Fear zone, reflecting continued caution in the market.Though a recovery is underway following the recent panic, the lingering fear suggests that market sentiment is still fragile.

The key question now is how long this rebound can sustain itself, as investors remain wary despite the recent upward movement. The road ahead may be uncertain, with both optimism and caution shaping the market’s next steps.

Bullish Factors

- The overbought condition has been partially alleviated, suggesting the potential for a minor rebound and a small-scale market reversal.

- With a rate cut approaching, the market could experience a brief period of warming.

Bearish Factors

- Last week, the performance of crypto ETFs was dismal, with global Bitcoin spot ETF holdings decreasing by 10,800 BTC, and U.S. Bitcoin spot ETFs seeing a net outflow of $706 million.

- Over half of U.S. Ethereum spot ETFs saw no capital flow. Last week, U.S. Ethereum spot ETFs had net outflows of $91.1 million, a figure seven times higher than the previous week. Additionally, Grayscale’s ETHE fund experienced $111 million in outflows, further exacerbating the trend of capital withdrawal.

This week, it is advisable to focus on

Wednesday, September 10th, 8:30 PM (UTC+8)

- U.S. August CPI Year-over-Year (Not Seasonally Adjusted)

- U.S. August CPI Month-over-Month (Seasonally Adjusted)

Thursday, September 11th, 8:30 PM (UTC+8)

- U.S. Initial Jobless Claims for the Week Ending September 7th

Friday, September 12th, 10:00 PM (UTC+8)

- U.S. Preliminary One-Year Inflation Rate Expectations for September

U.S. stock market trends

The chart shows that after a period of decline, the price is beginning to show signs of a rebound, currently fluctuating around the key support level of 5471.79. Several short-term moving averages, such as the 5-day moving average (yellow) and the 50-day moving average (blue), indicate that the market is still in a correction phase, with the price attempting to break through but failing to do so thus far.

The two key resistance levels above are 5544.9 and 5660.52. If the price can surpass 5544.9, it may challenge the 5660.52 level. On the downside, 5333.69 serves as a critical support level, and if the price breaks below this point, it could further intensify the downward pressure on the market.

The price, after experiencing a noticeable decline, is now in a short-term rebound phase. The Bollinger Bands indicate an increase in market volatility, with the price hovering near the middle band, suggesting that the market is searching for a new direction.

The volume has shown signs of weakening, indicating a tug-of-war between buyers and sellers, with both sides hesitant to commit. This reflects cautious market sentiment, and investors should closely watch for a clearer direction in the short term.

Cryptocurrency Data Analysis

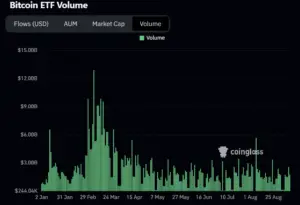

Over the past week, the flow of funds in Bitcoin spot ETFs has indicated a persistent withdrawal of capital from the market. Although prices have remained relatively stable, this outflow may signal increasing uncertainty about the market’s future direction. It’s crucial to closely monitor the upcoming flow of funds to anticipate potential price fluctuations.

Sustained Increase in Outflows: Over the past week, the frequency and scale of outflows have significantly risen, especially in the final days of August. Several trading days have recorded large red bars, indicating a rapid withdrawal of funds from the market. This trend suggests that investors are pulling their capital out, likely due to concerns over Bitcoin’s short-term price performance.

Bitcoin ETF trading volume in September has noticeably increased compared to previous months, indicating a gradual recovery in market sentiment and trading activity. However, the fluctuations in volume also suggest underlying uncertainty, as participants respond to potential market risks and opportunities with more frequent trading.

As September draws to a close, the market’s direction remains unclear. Continued attention to macroeconomic policies and market dynamics will be essential in navigating the potential volatility ahead.

Bitcoin Market Analysis

1.Bitcoin daily chart

BTC’s multiple moving averages are still showing a bearish alignment; however, abnormal trading volume and price action in the short to medium term indicate the potential for a sustained rebound and rally over the next week to week and a half.

The price has successfully risen above the 10-day simple moving average, and the 5-day simple moving average has turned upward, suggesting the possibility of forming a short-term upward channel with the 10-day average. Given this setup, we anticipate a period of consolidation and gradual rise this week, making it less favorable to continue aggressive short positions.

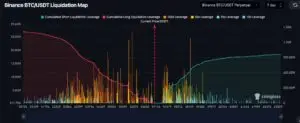

2.Bitcoin Futures Market Data

The current Bitcoin price stands at $56,777. As the price declined, the cumulative long liquidation intensity (red line) gradually increased, indicating that many long positions were forced to close as the price dropped. When the price fell to around $56,000, liquidation volumes surged, with long liquidation activity becoming more frequent as the price approached this level, revealing concentrated stop-losses among long positions.

Meanwhile, the short liquidation intensity (green line) has shown a steady upward trend, indicating a gradual accumulation of short positions, though mass liquidations have yet to occur.

Overall, the market exhibits heightened volatility at the current price level, with significant pressure on long liquidations.

Investors should closely watch for key support and resistance levels, as a break through these critical points could trigger larger-scale liquidations, further amplifying market volatility.

3.Options Market

The Max Pain point is situated at $58,000, indicating that if Bitcoin’s price nears this level at options expiration, option sellers could face the greatest losses. The red bars represent the open interest for put options, while the green bars indicate the open interest for call options.

From the chart, we can see that put options are primarily concentrated around the $50,000 and $55,000 levels, suggesting that some investors expect a decline in Bitcoin’s price. On the other hand, call options are more active around the $60,000 and $70,000 levels, reflecting optimism among certain investors about the price’s potential rise.

Overall, the Put/Call ratio stands at 0.45, meaning the open interest for call options is significantly higher than for puts, indicating a generally bullish market sentiment. However, given that the Max Pain level is near $58,000, substantial price fluctuations could occur around this level as options expiration approaches.

Altcoin Situation

1. Catizen(CATI)

Following the launch of “Dogs,” the most prominent project within the TON ecosystem is undoubtedly the pay-to-win mini-game Catizen. Bybit officially announced on September 5th that it will launch spot trading for Catizen (CATI) on September 20th, with an airdrop expected to take place beforehand.

2.AAVE

According to a summary of a white paper obtained by CoinDesk, World Liberty Financial, a crypto project backed by Donald Trump’s son, will develop lending services, including a credit account system built on Aave and the Ethereum blockchain to facilitate decentralized lending.

The project will also introduce a new cryptocurrency, WLFI, a non-transferable governance token. The document and other reports describe a lending service strikingly similar to Dough Finance, which was developed by four individuals listed as members of the World Liberty Financial team.

The news was soon officially confirmed: the Trump family’s new crypto project, World Liberty Financial (WLFI), is on the way.

The project announced that its code has successfully passed audits by firms such as BlockSec and Peckshield. It clarified that it is not a fork of Aave, but rather a collaboration with Aave to create a platform that advances the entire DeFi space. Its mission is to make both cryptocurrency and America great by driving the widespread adoption of stablecoins and decentralized finance.