Crypto Weekly Market Watch: Hit a new high of $108,000 and then fell to a low of $92,232.5, was the price rejected by the market?

Market Overview

Fed policy implications: The Fed announced a 25bp rate cut on December 18, but said it plans to cut rates only twice in 2025, down from four previously expected. The news sparked concerns about tighter liquidity, leading to volatility in the prices of risky assets.

Bitcoin Price Prediction: IG Group, a financial trading service provider, predicts that Bitcoin will reach $125,000 in early 2025, showing that the market is optimistic about the long-term prospects of the cryptocurrency.

Fear & Greed Index

The sentiment index on Tuesday was 70, down 13 from last week’s 83. BTC hit a new high of 108,353 and then fell 14%, with the Panic and Greed Index retreating significantly.

Good news

- Issuing consumption vouchers in many places to promote the growth of domestic demand: With the arrival of the peak consumption season at the end of the year, many places have launched a new round of consumption voucher issuance activities to increase support for consumption fields such as catering and cultural tourism, which is expected to boost the market demand of related industries.

- Foreign institutions are bullish on Chinese assets: A number of foreign institutions have signaled that they are bullish on Chinese assets when they released their 2025 global investment outlooks, indicating that international investors have increased confidence in the Chinese market.

[maxbutton name=”Start Trading”]

Bad news

- U.S. Report Distorts China’s Defense Policy: The U.S. report misinterprets China’s defense policy, triggering strong dissatisfaction and resolute opposition from China, which could exacerbate geopolitical tensions and affect market sentiment.

- U.S. President-elect threatens tariffs on European Union: U.S. President-elect Donald Trump has threatened to impose tariffs on the European Union if EU members do not buy more U.S. oil and gas, a move that could trigger new trade frictions and increase market uncertainty.

This week, it is advisable to focus on

Tuesday, December 24:

- U.S. Durable Goods Orders for November: This data reflects orders in the U.S. manufacturing sector, especially non-defense capital goods orders after excluding aircraft, and is seen as an important indicator of a company’s investment plans.

- U.S. New Home Sales for November: This data provides an update on the U.S. housing market and shows the health of home sales.

- Richmond Fed Manufacturing Index (December): This index measures the health of the manufacturing sector in the eastern part of the United States.

Wednesday, December 25:

- Christmas Holidays: The world’s major financial markets are closed.

Thursday, December 26:

- U.S. Initial Jobless Claims Last Week: The data is released weekly and reflects the health of the U.S. labor market.

Friday, December 27:

- U.S. Merchandise Trade Balance for November: This data shows the U.S. trade balance, which affects the U.S. dollar exchange rate and trade policy.

- U.S. S&P/Case Shiller Home Price Index for October (Oct): This index reflects changes in home prices in major U.S. cities and is an important indicator of the housing market.

U.S. stock market trends

Two-hour candlestick chart of the US 100. We can analyze the market based on the SMC concept.

[maxbutton name=”Start Trading”]

Since last week’s analysis, it hit a full-time high of $22,131 and plunged 5.7% to a low of $20,724 after the December 19 interest rate decision, followed by buying orders, and the current market is a reasonable correction and should not be too emotional.

Cryptocurrency Data Analysis

Analysis from December 17 to December 20

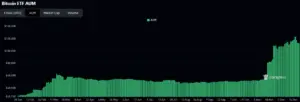

Net Inflow: As you can see from the chart, between December 17 and December 20, Bitcoin spot ETFs showed net outflows. This indicates that investors have caused some distrust of cryptocurrencies during this time period because of the Fed’s rhetoric.

Bitcoin Price : The yellow line shows that the price of Bitcoin remained relatively high from the end of November to the beginning of December, hitting a yearly high. The increase in net inflows may have further supported the stability of Bitcoin’s price.

The rise in prices and the continuous inflow of funds have formed a mutually supportive relationship, that is, the buying power of the market has helped to maintain the price level of bitcoin.

[maxbutton name=”Start Trading”]

Market Sentiment & Trends

Looking at the trend across the chart, net inflows in late October and early November were significantly higher than in previous months, followed by a steady inflow.

Inflows during this period may also have been affected by macroeconomic uncertainty or other financial market volatility, prompting investors to allocate funds to digital assets such as Bitcoin.

However, we have not seen too strong net outflows in AUM, suggesting that the price correction may simply be uncertain in the market.

Bitcoin Market Analysis

This week’s BTC price action, based on price action analysis, is as follows:

- Trend Judgment:

- At the daily level, BTC entered a shock correction phase after falling from a higher resistance zone, showing a slight weakening of buying momentum in the market, but still potential bullish support.

- The 2-hour level shows clear internal structural disruption, suggesting increased selling pressure in the near term.

Support & Pressure Prices

- Support Price:

- First Support: $93,700 – $94,500 The lower edge of the near-term volatility zone and the active buyer zone.

- Second Support: $91,000 – $92,000 The historical high volume area is also the demand area on the daily timeframe.

- Pressure Price:

- First Layer Pressure: $97,200 – $97,800 short 4-hour supply zone.

- The second level of pressure: $99,500 – $100,000 psychological unit mark, the battle between long and short is fierce.

Do long views

- If BTC manages to hold the $93,700 support zone, and with the recovery of higher volumes, the price may try to break above the $97,800 resistance zone.

- The target after the breakout is the $99,500 – $100,000 area.

Short Views

- A break below $93,700 and a sustained weakening could lead to a test of the demand zone around $91,000.

- A break below $91,000 could lead to a further test of lower support around $88,000.

[maxbutton name=”Start Trading”]

Short-term traders

- Strategy: Look for long entry near $93,700 with a stop loss below $93,000 and a target of $97,500.

- Note: If the price is close to $97,800, consider taking a short position and set a stop loss above $98,800.

Long-term investors

- Strategy: If the price falls to around $91,000, it is recommended to place it in batches as part of a long-term holding strategy.

- The price target is set above $105,000 and the stop loss can be set at $89,500.

Leverage concentration area

- Long Liquidation Zones:$94,000 – $93,000。

- Short Liquidation Zones:$98,000 – $99,500。

Dense distribution of leverage

- The main leveraged positions are concentrated in the $95,000 to $97,000 range, indicating that market participants expect prices to fluctuate within this range.

- Low-leverage traders are positioned in the extreme zone of $91,000 to $100,000, hinting at a focus on breakouts.

Liquidation Scale

- The size of the liquidation point for long positions is higher than that of short positions, especially around $93,000, indicating that the market is under more pressure for a downside test.

- The liquidation point of the short spot accumulates in the $98,000 – $99,500 area, but it does not touch the psychological threshold of $100,000.

Crypto NEWS

IG Group predicts that bitcoin will reach $125,000

IG Group, a financial trading services provider, released its 2024 market review and 2025 investment outlook on December 23, predicting that Bitcoin (BTC) will reach a price target of $125,000 in the first two months of 2025.

Filippo Diodovich, senior market strategist at IG Group, said that with the appointment of a new chairman of the US Securities and Exchange Commission (SEC), it is expected to bring more moderate crypto regulatory policies, which will rebuild market confidence and drive the price of bitcoin up.

Google will allow cryptocurrency advertising in the UK

On December 23, Google announced that it would allow ads for cryptocurrency exchanges and wallets to be served to UK audiences starting in January 2025.

This policy update requires advertisers to be registered with the Financial Conduct Authority (FCA) in the UK and comply with local laws and industry standards. The move indicates the increased acceptance of the cryptocurrency industry by mainstream tech companies, which could boost the industry’s growth in the UK.