Crypto Weekly Market Overview: Has the market fully entered a bear phase?

Fear & Greed Index

This Tuesday, the Fear & Greed Index dropped to 26, marking a 46% decrease from last week’s 48. As BTC once again tested the $57,000 level, the index has returned to the fear zone, reflecting heightened market anxiety.

Bullish Factors

- The U.S. stock market appears poised to challenge new highs once again, which has provided stability to the current crypto market and may bolster investor confidence.

- After this week’s contract liquidations to lower levels, the market structure has stabilized, and FOMO sentiment is gradually diminishing.

- The expectation of interest rate cuts continues to be a positive catalyst for the cryptocurrency market, potentially driving further capital inflows.

Bearish Factors

- On the daily chart, moving averages are clearly aligned in a bearish formation, and the price is approaching the lower boundary of the Gann box, indicating significant technical pressure.

- The ongoing trend of ETF outflows reflects a retreat of market capital, exerting downward pressure on prices.

This week, it is advisable to focus on:

Tuesday, September 3rd, 22:00

- U.S. August ISM Manufacturing PMI

Wednesday, September 4th, 21:45

- Bank of Canada Interest Rate Decision for September 4th

Thursday, September 5th, 20:15

- U.S. August ADP Employment Change

Thursday, September 5th, 20:30

- U.S. Initial Jobless Claims for the week ending August 31st

Friday, September 6th, 20:30 (UTC+8)

- U.S. August Unemployment Rate

- U.S. August Nonfarm Payrolls

U.S. stock market trends

We can observe that the S&P 500 index, after a period of steady gains, is now approaching its historical highs. Currently, the price is trading above several key moving averages, such as the 5-day (yellow) and 50-day (blue) moving averages, indicating that the short-term trend remains bullish. However, as the price nears these peaks, there has been a noticeable decline in trading volume, which may suggest a weakening of buying momentum.

Over the past few months, the index has experienced several pullbacks, each time finding support near longer-term moving averages, such as the 200-day moving average, before rebounding.

The market’s current focus is on whether the price can break through and sustain levels above these highs, or if it will once again retreat to seek support near the moving averages.

Overall, the technical outlook for the S&P 500 remains strong, but as the price edges closer to its historical highs, investors should closely monitor changes in trading volume and be alert to potential risks of a pullback.

Cryptocurrency Data Analysis

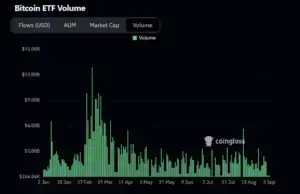

After a week of consistent net inflows, BTC spot ETFs have experienced four consecutive days of net outflows, reflecting the market’s weakness, which is also evident in the recent price decline.

The market has shown signs of weakness recently, with ETF outflows becoming increasingly apparent. While expectations for a rate cut have peaked, BTC’s underperformance relative to the broader U.S. equity market has caused some investors to lose confidence.

As a result, they are shifting towards more stable investment opportunities, seeking safer havens for their capital.

Bitcoin Market Analysis

1. Bitcoin daily chart

Multiple moving averages for BTC are converging, signaling that the market is approaching a decisive moment. The divergence between the 288-day and 576-day simple moving averages is widening, while the 89-day and 144-day simple moving averages have been crossing downward for nearly two months.

Despite this, prices have remained relatively unchanged over the same period. Our view is that the market may experience a deep dip this week before stabilizing and then gradually rising, in anticipation of an interest rate cut. The likelihood of an immediate surge is low, making it an unwise bet.

Shorting now and then going long could feel contradictory and mentally exhausting, so for those seeking a more cautious approach, waiting for the price to stabilize after the dip before going long would be the prudent strategy.

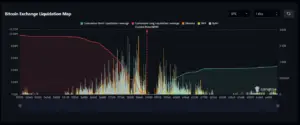

2. Bitcoin Futures Market Data

The current Bitcoin price hovers around $58,995. As the price approached $58,000, we observed a significant increase in long liquidations, particularly when the price dipped close to this level. The red curve sharply declines, indicating that a substantial number of long positions were swiftly liquidated.

At the same time, the cumulative value of short positions has been steadily rising, reflecting a growing market expectation of further declines in Bitcoin’s price. Overall, market volatility is intensifying, especially around the critical $58,000 to $57,000 range, where liquidation activity has become more frequent.

Investors should be cautious of potential sharp price swings, as breaking through key support or resistance levels could trigger a further wave of liquidations.

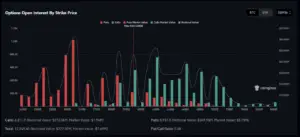

3. Options Market

The Max Pain point is situated at $60,000, indicating that if Bitcoin’s price approaches this level at option expiration, sellers may face the greatest losses. Put option holdings are concentrated around the $55,000 and $50,000 levels, suggesting that some investors anticipate a potential downturn in Bitcoin’s price.

Conversely, call options are more active in the higher price ranges, such as $70,000 and $75,000, reflecting optimism among certain investors about the price’s upward potential.

Overall, the Put/Call ratio stands at 0.48, indicating a significantly higher volume of call options compared to put options, suggesting a generally optimistic market sentiment. However, the distribution of options also highlights some uncertainty, with the potential for significant price volatility as it nears the $60,000 mark.

Altcoin Situation

Trending Projects

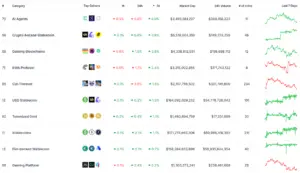

The performance across sectors remains weak, with no clear standouts. This week, the market overall has been lackluster, failing to produce any particularly strong sectors.

Although some sectors that topped the charts last week still hold their positions, their gains have been modest, with the highest increase only reaching 9%. Most sectors have seen their earlier gains largely erased, reflecting the broader market’s subdued performance.

Sectors to watch this week include

AI Agents

The AI Agents sector has a market capitalization of approximately $3.5 billion, with a 7-day gain of 9%, though 24-hour trading volume reached $300 million, reflecting a 6.2% decline. Ranked 70th on Coingecko, this sector has a relatively small market cap and thus limited impact on the broader market.

Previously, we noted that the AI Agents sector is primarily dominated by FET and AGIX, with FET’s market cap already at $2.8 billion.

This week’s gains in the sector largely stem from these two assets. However, after last week’s surge, FET and AGIX have pulled back by 3.9% and 12.4% respectively. This retracement is likely due to market manipulation by major players, as there were no significant changes in fundamentals or news.

Gaming Blockchains

The Gaming Blockchains sector has a total market capitalization of $4.37 billion, with a 7-day gain of 3.8% and 24-hour trading volume of $197 million, showing a 2.1% increase. Ranked 68th on Coingecko, this sector also has a limited impact on the market.

The top three projects in this sector are Immutable ($2.26 billion), Beam ($770 million), and Ronin ($580 million), with IMX leading significantly in market cap, highlighting the competitive landscape. The overall sector’s gains are mainly driven by IMX. However, the gaming sector remains relatively weak, with no major positive news emerging.

Notably, Oasys announced on Thursday that it secured over $10 million in Series D funding led by SBI Holdings, driving the OAS token to a 48% surge this week. This project has also garnered attention in this week’s sentiment recommendations and is worth further monitoring.

Cat-Themed

The Cat-Themed MEME sector has a market capitalization of $2.1 billion, with a modest 7-day gain of 1.5%. The 24-hour trading volume reached $367 million, but the sector saw a 3.5% decline over the same period.

This week’s performance in the Cat MEMEs sector was primarily driven by POPCAT’s strong showing last weekend. While the sector maintained positive momentum this week, the overall strength was lacking.

Additionally, Binance’s announcement of an airdrop of Simon’s Cat for FLOKI holders led to a 60% surge in the token after the Thursday opening, but it later retreated, with the 7-day gain narrowing to 17%, unable to sustain its upward trajectory.

Market Outlook

Overall, the altcoin market continues to fluctuate in tandem with BTC, with no standout sectors emerging in the short term. The difficulty of short-term trading has further increased. With the highly anticipated rate cut approaching in September, market volatility may intensify.

In this context, investors are advised to exercise caution, reduce leverage, and limit short-term trades. Long-term investors might consider gradually increasing their positions at market lows to prepare for the post-rate-cut environment.

Popular Projects

Market Dynamics and Impact of Binance’s Small-Cap Altcoin Contracts

Last week, we highlighted that Binance’s introduction of small-cap altcoins, particularly in the GameFi sector, and related contracts sparked strong market reactions, leading to rapid price surges.

This week, Binance has indeed continued to launch new token contracts, which are worth monitoring closely.

- On August 26, Binance announced the launch of NULSUSDT perpetual contracts, along with DOGSUSDT perpetual contracts at 12:30 (UTC) on the same day, with up to 75x leverage. Following this announcement, related tokens surged by as much as 65%.

- On August 28, Binance Futures announced the listing of MBOXUSDT perpetual contracts, also with up to 75x leverage. This drove MBOX to a short-term gain of over 30%.

- On August 29, Binance announced the launch of CHESSUSDT perpetual contracts, with leverage of up to 75x. This news triggered a 35% surge in CHESS.

Resistance Dog(REDO)

Background and Market Impact

Recently, the arrest of Telegram founder Pavel Durov in France has garnered widespread attention. Resistance Dog (REDO), symbolizing the fight for freedom, has emerged as a symbolic figure of the community’s support for Durov.

This event has had significant repercussions on the market, particularly within the TON ecosystem and related tokens.

Resistance Dog, also known as the “Resistance Dog,” was originally drawn and named by Pavel Durov himself in 2018, serving as an unofficial mascot representing Telegram’s stance against censorship.

The Arrest of Pavel Durov

On August 25th, Telegram’s founder and CEO, Pavel Durov, was arrested in France and detained by agents of the French National Fraud Office, accused of enabling drug trafficking and fraud through his application.

Following this event, the TON ecosystem and its supporters quickly mobilized, with several prominent figures and institutions expressing their support for Durov. DWF Labs co-founder Andrei Grachev and Memeland each purchased approximately $500,000 and $1 million worth of TON tokens, pledging to hold them until Durov’s release.

Justin Sun proposed the creation of a “#FreePavel DAO,” with a pledge to donate $1 million. Tesla CEO Elon Musk also expressed his support for Durov on social media.

Given that Pavel Durov holds citizenship in Russia, France, Saint Kitts and Nevis, and the UAE, the foreign ministries of Russia and the UAE have also been closely monitoring the situation.

As of August 29th, Durov was released on bail after paying €5 million but remains under house arrest in France, prohibited from leaving the country. Additionally, he faces accusations from a former partner of child abuse, currently under investigation by Swiss authorities.

Market Reaction within the TON Ecosystem

The price of TONCOIN, the official token of the TON ecosystem, has closely mirrored the fate of its founder. During the period of Durov’s arrest, prosecution, and subsequent release, TONCOIN’s price experienced significant volatility. Moving forward, it is expected that the price of TON will continue to be closely tied to Durov’s situation.

Community Support and Actions

After Pavel Durov’s detention in France, the TON community launched a “Digital Resistance” movement on August 26th in support of Durov.

The community changed the token’s logo to Resistance Dog and encouraged users to post with the #FREEDUROV hashtag, add “FREE” emojis to their usernames, and change their profile pictures to Resistance Dog. Several exchanges also updated the TON token logo to match Resistance Dog.

Outlook

In the short term, exchanges may take regulatory actions, including the potential delisting of TON ecosystem tokens, which could significantly impact their prices.

However, as an independent blockchain project, TON’s long-term value and technical foundation remain unaffected by Durov’s personal legal issues. Investors should closely monitor the ongoing developments.