At Bitunix, we get the same questions repeatedly: what is copy trading in crypto, what exactly gets copied, why follower results can differ from a lead trader, and what settings matter most.

In this guide, we explain crypto copy trading in plain operational terms. We will walk through how Bitunix copy trading works on the Bitunix exchange, what followers control, what lead traders are responsible for, how crypto futures copy trading is executed, and the most common reasons copied trades fail. Our goal is to help you copy with clarity and discipline.

[ez-toc]

What Is Copy Trading in Crypto?

Copy trading in crypto is a feature that lets you follow a lead trader and automatically replicate their trading actions in your own copy trading account.

When you start copy trading crypto, you are authorizing an automated process. That means our system attempts to recreate the actions of the selected lead trader in your account without asking you to manually approve every trade. Because copying is automated, your copy settings become your first and most important risk controls.

The Two Roles in Crypto Copy Trading

To understand Bitunix copy trading, you need to understand who does what. Copy trading always has two roles.

Follower

As a follower, you choose a lead trader and configure how copying should behave. You control:

- Which lead traders you follow

- How your copied position size is calculated (copy mode)

- How much capital you allocate to copying

- Any advanced limits and caps you enable

- How many traders you follow at once

- When you pause or stop copying

You do not control the lead trader’s decisions, and you do not control market volatility. Your job is to configure risk, then monitor consistently.

Lead Trader

A lead trader is the strategy provider. Lead traders open positions that followers can copy. In a profit sharing model, lead traders can receive a share of follower profits during a settlement cycle.

Lead traders also operate under platform rules. Those rules are designed to protect followers and system integrity, including restrictions against misleading promotion and abusive behavior.

How Bitunix Copy Trading Works on the Bitunix Exchange

On the Bitunix exchange, the follower workflow is designed to be simple, but the results still depend on the settings you choose.

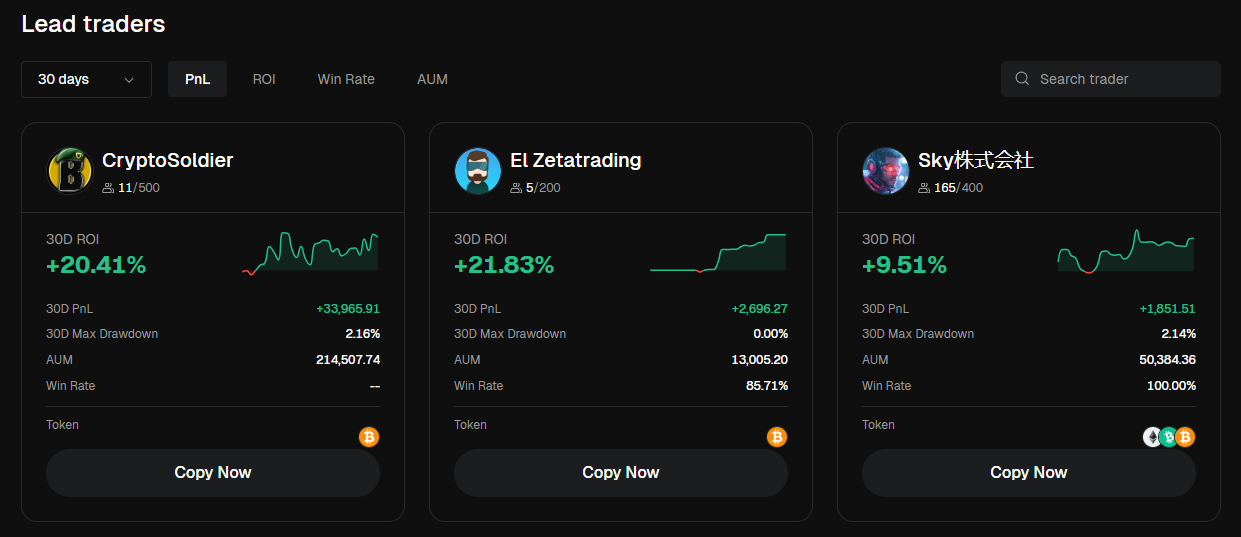

Step 1: Choose a Lead Trader in Copy Square

Copy Square is where you browse lead traders and start copying. You can follow multiple lead traders at once, up to a stated maximum of 10.

Our practical guidance for most beginners is to start with one lead trader. This makes it easier to understand how copying behaves, whether trades are executing reliably, and whether the trader’s style fits your risk tolerance.

Step 2: Choose a Copy Mode and Set Your Copy Amount

Copy mode is one of the most important decisions you make as a follower because it determines how your copied position size is calculated.

We support two core modes that followers commonly use:

Fixed Amount Mode

In fixed amount mode, each copied order uses a fixed margin amount that you set.

Why many beginners start here:

- Your per-trade exposure is more predictable

- It is easier to limit losses during learning

- It reduces the risk of sudden scaling if a trader increases position size

Fixed Ratio Mode

In fixed ratio mode, your position size is opened based on the margin ratio between your account and the lead trader’s account.

Why some followers prefer it:

- It can mirror a lead trader’s scaling behavior more closely

- It can feel more proportional than a fixed amount

Key risk to understand:

Fixed ratio can scale exposure quickly if a lead trader increases size. That is why caps and limits matter more when you use ratio-based sizing.

Step 3: Use Advanced Settings to Set Limits

Copy trading is safer when you define boundaries before you copy. We recommend using limits that prevent two problems:

- Missed copies because your available margin is too low

- Oversized exposure because scaling becomes too aggressive

A clean follower limit set often includes:

- Maximum allocation per lead trader

- A margin buffer so you do not allocate 100 percent of funds to copying

- A personal pause rule based on drawdown

- Tighter caps if you use fixed ratio mode

Step 4: Monitor Performance in My Copy

My Copy is where you track:

- Open positions

- Trade history

- Real-time profit and loss

Monitoring matters because lead traders can change behavior over time, and follower outcomes can drift even when you copy the same trader.

What Gets Copied in Crypto Futures Copy Trading

Most copy trading on derivatives platforms is experienced as crypto futures copy trading. That means you are copying contract positions, not buying spot assets.

Here are the mechanics that matter most.

Copying Operates at the Position Level

Our copy trading operates at the position level. Timing matters.

If a lead trader already has an open position before you start copying them, later changes to that existing position may not automatically create the same exposure in your account. This is one reason followers sometimes feel like they did not “catch” the full trade.

Follower takeaway: you are joining a live execution stream, not importing a trader’s full portfolio history.

Slippage Controls Affect Whether a Copied Trade Executes

In fast markets, the price can move between the lead trader’s execution and the follower’s attempted execution. To reduce uncontrolled fills, copy trading uses slippage controls.

On Bitunix copy trading, a commonly referenced slippage limit for copy execution is 0.1%. When the market moves beyond the allowed tolerance, a copy order may fail to execute.

Follower takeaway: if a strategy depends on ultra-precise entries, it can be harder to copy consistently, especially during high volatility.

Closing and Reducing Positions Use Market Orders

In the copy trading context, closing and reducing positions are executed as market orders. Market orders prioritize execution speed, but they can lead to different fill prices during volatility.

Follower takeaway: even when copying the same lead trader, your exit price can differ.

Why Follower Results Can Differ From Lead Trader Results

A common expectation is that copied results should match lead trader results exactly. In live markets, exact matching is not guaranteed. The most common reasons are operational.

Execution Timing

Copying happens after the lead trader’s action occurs. Even small delays can matter in fast-moving markets.

Slippage and Liquidity

Liquidity can change between the lead trader’s fill and the follower’s fill. Slippage controls can also cause a copy order to fail if price moves too far.

Insufficient Available Margin

If your copy account does not have enough available margin at the moment a lead trader opens a position, the copied trade can be skipped.

Pair-Level Caps

If you hit a maximum margin cap for a specific trading pair, new copy trades on that pair may not be placed until exposure changes.

Costs in Bitunix Copy Trading

When evaluating crypto copy trading, it is important to separate three cost categories.

Trading Fees

Copied trades are still trades. Standard trading fees for the relevant product type apply.

Copy Trading Service Fees

Copy trading programs can include service fees. Under our terms, service fees may be deducted from the digital assets in your account depending on how the program is structured.

Profit Sharing and Weekly Settlement

Profit sharing is the incentive model for lead traders. The typical structure is:

- If you have net profit for the settlement cycle, a portion may be allocated to the lead trader based on the profit-sharing ratio.

- If you have a net loss for the cycle, profit sharing is not charged for that follower for that cycle.

We use a weekly settlement schedule:

- Settlement time: Monday 00:00 UTC

- Earnings calculation period: Monday 00:00:00 UTC to Sunday 23:59:59 UTC

A commonly referenced standard profit-sharing ratio is 10 percent. Ratios can vary by program rules and lead trader category.

Follower takeaway: always evaluate net performance after fees and profit sharing, not only gross profit and loss.

Common Copy Failures and How to Fix Them

Most copy trading issues are preventable once you know what causes them.

Insufficient Funds

What it means: your available margin was not enough when copying attempted to execute.

How to reduce it:

- Keep a margin buffer

- Reduce per-trade exposure

- Avoid copying too many traders that open positions at the same time

Excessive Slippage

What it means: the market moved beyond the allowed slippage tolerance and the copy order failed.

How to reduce it:

- Prefer lead traders who focus on liquid markets

- Be cautious during major volatility windows

- Avoid strategies built on extremely tight entry precision

Margin Cap Reached

What it means: your configured caps for the pair or trader prevented new copy trades.

How to reduce it:

- Set realistic caps

- Review caps weekly and adjust based on observed behavior

Best Practices for Followers

If your goal is safer copy trading crypto, focus on controllable inputs.

Start With Predictable Exposure

If you are new, fixed amount mode is often easier to manage because it makes exposure per copied trade more consistent.

Use a Simple Rule Set

We recommend writing down three numbers before you start:

- Total allocation to crypto copy trading

- Weekly loss threshold that triggers a pause

- Number of lead traders you will copy initially

Review Weekly, Not Emotionally

Because profit sharing is settled weekly, a weekly review routine is practical. Evaluate:

- Whether the lead trader’s position sizing changed

- Whether trade frequency shifted sharply

- Whether you had skipped trades due to low margin

- Whether slippage failures increased

Best Practices for Lead Traders

Lead traders can improve follower experience by trading with follower execution in mind.

- Avoid misleading performance claims and never imply guaranteed returns

- Keep position sizing consistent enough for followers to set practical limits

- Avoid extreme order frequency that makes copying less reliable

- Maintain a strategy profile that explains risk clearly, without hype

Conclusion

Crypto copy trading works best when you understand roles, settings, and execution. On the Bitunix exchange, Bitunix copy trading lets followers choose a copy mode, set allocation, apply limits, and monitor performance in My Copy. Because crypto futures copy trading involves real-time execution, follower results can differ from lead trader results due to timing, slippage controls, liquidity, and market-order exits.

If you want the most reliable experience, keep your setup simple, start with predictable sizing, maintain a margin buffer, and review weekly using the settlement cycle.

FAQ

What is copy trading in crypto?

It is a feature that allows a follower to automatically replicate a lead trader’s trades using follower-defined settings.

What copy modes are available on Bitunix copy trading?

Fixed amount mode and fixed ratio mode.

Why did my copied trade not execute?

Common causes include insufficient available margin, slippage beyond tolerance, or caps reached for a trader or trading pair.

Can my results differ from the lead trader’s results?

Yes. Differences can occur due to execution timing, slippage, liquidity conditions, and market-order exits.

When is profit sharing settled?

Weekly, with settlement on Monday at 00:00 UTC.

Glossary

- Margin: Collateral used to open and maintain a futures position.

- Leverage: A multiplier that increases exposure relative to margin.

- Liquidation: Forced closure when margin becomes insufficient.

- Perpetual futures: A futures contract that typically has no expiry date.

- Funding rate: Periodic payments between long and short traders in perpetuals.

- PnL: Profit and loss on an open or closed position.

- Slippage: Difference between expected price and actual execution price.

- Liquidity: How easily an asset can be traded without major price impact.

- Market order: An order that executes immediately at the best available price.

- Limit order: An order that executes at a specified price or better.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by over 3 million users across more than 100 countries. At Bitunix, we are committed to providing a transparent, compliant, and secure trading environment for every user. Our platform features a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and compliance. With global standards of protection through Proof of Reserves (POR) and the Bitunix Care Fund, we prioritize user trust and fund security. The K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium