Decentralized finance (DeFi) has become one of the most important innovations in the cryptocurrency industry. Instead of relying on centralized banks or brokers, DeFi protocols allow users to lend, borrow, trade, and earn rewards directly on the blockchain. Unlike centralized exchanges, which use traditional order books and intermediaries, DeFi protocols use liquidity pools instead. At the heart of this system are liquidity pools, which are collections of tokens locked inside smart contracts. Crypto liquidity pool is an essential component of decentralized trading, enabling direct token exchanges without the need for traditional order matching. They ensure that there is always liquidity for decentralized exchanges (DEXs) and applications to function.

For newcomers, the idea of adding funds to a liquidity pool can feel intimidating. Questions like “What tokens do I need?” or “How do I get started without making mistakes?” are very common. The good news is that the process is systematic and beginner friendly once you understand the steps. By participating in a liquidity pool, you not only put your crypto to work but also contribute to the efficiency and growth of the DeFi ecosystem.

[ez-toc]

What Is a Liquidity Pool?

A liquidity pool is a digital pool of tokens locked in a smart contract. These pools are used by decentralized exchanges and protocols to provide liquidity for trading pairs.

Instead of relying on traditional order books, which are used for matching buyers and sellers by connecting their orders, DeFi protocols use automated market makers (AMMs). In AMMs, the liquidity pool acts as the counterparty for every trade. Liquidity providers deposit two tokens of equal value into the pool, and traders swap between those tokens directly.

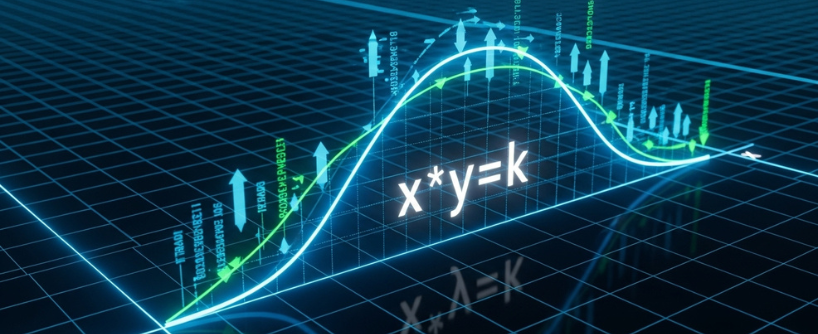

For example, in an ETH/USDC pool, which is a specific token pair, providers deposit both ETH and USDC in equal value. When a trader swaps ETH for USDC, the pool automatically adjusts token balances to facilitate the trade and sets the new market price using a mathematical formula. The most common formula is x * y = k, where x and y are token amounts and k is a constant.

Liquidity providers receive LP tokens, which represent their share of the pool. When they withdraw, they redeem LP tokens for their original assets plus a portion of the fees earned from trading.

Why Participate as a Liquidity Provider?

Earn Passive Income

When users provide liquidity to pools, they enable the DeFi ecosystem to function. Liquidity pools offer participants the opportunity to earn passive income and trading fee rewards. Every trade in a pool generates fees, and as a provider, you receive a portion of those fees based on your contribution. High-volume pools often yield consistent returns.

Support the DeFi Ecosystem

Liquidity pools are important because they make decentralized trading, lending, and yield farming possible, supporting financial inclusion and efficient markets. Without liquidity providers, DEXs would not function. By contributing, you make decentralized trading more efficient and accessible for everyone.

Portfolio Diversification

Providing liquidity exposes you to multiple tokens simultaneously. This allows you to diversify your portfolio and gain exposure to different projects.

Access to Yield Farming Opportunities

In many cases, LP tokens can be staked in additional platforms for extra rewards, creating a strategy known as yield farming.

Understanding Automated Market Makers (AMMs)

Automated Market Makers (AMMs) are the backbone of how liquidity pools work in the DeFi ecosystem. Instead of relying on traditional market makers or order books to match buyers and sellers, AMMs use smart contracts to facilitate decentralized trading of digital assets. The most widely used AMM model is based on the constant product formula, expressed as x * y = k. Here, x and y represent the reserves of the two tokens in the liquidity pool, and k is a constant that remains unchanged during trades.

This formula ensures that as traders swap one token for another, the pool automatically adjusts token prices according to supply and demand. As a result, token prices in the pool are always determined by the ratio of the two tokens, allowing for continuous and efficient price discovery without the need for centralized intermediaries. This approach not only increases transparency but also reduces the risk of market manipulation.

By enabling anyone to provide liquidity and participate in market making, AMMs have democratized access to trading and liquidity provision. They are a fundamental innovation that powers decentralized exchanges and many other DeFi protocols, making it possible for users to swap tokens, provide liquidity, and earn passive income in a trustless environment.

Step-by-Step Guide to Adding Liquidity

Step 1: Choose the Right Platform

The first decision is which decentralized exchange or protocol to use. The most popular platforms include:

- Uniswap (Ethereum): The pioneer of AMMs.

- SushiSwap: Similar to Uniswap but adds incentives like governance tokens.

- Curve Finance: Focused on stablecoin pools, known for efficiency.

- PancakeSwap (BNB Chain): Lower fees and wide pool selection.

- Bitunix: Offers advanced trading features and educational tools to help beginners.

When choosing a platform, consider:

- Security: Has the platform been audited?

- Liquidity: Higher liquidity usually means lower slippage.

- Fees: Different platforms charge different transaction fees.

- Network: Ethereum has higher fees, while chains like Polygon or BNB Chain are cheaper.

Step 2: Set Up Your Wallet

To interact with a DEX, you need a Web3 wallet. The most common options are MetaMask, Trust Wallet, and Coinbase Wallet.

Steps:

- Download the wallet app or extension.

- Create a new wallet and securely store your recovery phrase.

- Fund your wallet with the tokens you plan to provide. For example, if you want to join an ETH/USDT pool, you need both ETH and USDT.

- Keep a small balance of the blockchain’s native token (like ETH for Ethereum or BNB for Binance Smart Chain) to cover transaction fees.

Step 3: Select a Liquidity Pool

Every pool involves two tokens. Popular pools include:

- ETH/USDT

- DAI/USDC

- BTC/ETH

- MATIC/USDC

Stablecoin pools (like USDC/DAI) are less risky since prices stay close to $1. Token pools with volatile assets can yield higher rewards but involve higher risks. Always check the total value locked (TVL) and historical volume before committing.

Step 4: Acquire the Tokens

You must deposit equal values of both tokens. If you want to provide $500 in an ETH/USDC pool, you need $250 worth of ETH and $250 worth of USDC. Use a centralized exchange or DEX to acquire the tokens before you provide liquidity.

Step 5: Connect Your Wallet

On the DEX website:

- Click “Connect Wallet.”

- Approve the connection from your wallet app.

- Ensure you are on the correct blockchain network.

Step 6: Add Liquidity

- Go to the Liquidity or Pools tab.

- Select the token pair.

- Enter the amount for one token, and the system will calculate the other automatically.

- Approve token spending permissions.

- Confirm the transaction.

After processing, you will receive LP tokens, also known as deposit tokens or liquidity tokens, which serve as proof of your contribution to the pool. These LP tokens represent your share of the pool and can be redeemed for your proportional assets and accumulated fees.

Step 7: Monitor and Manage Your Position

Providing liquidity is not a “set and forget” activity. Liquidity pools enable continuous trading, allowing users to trade at any time without interruptions. You must regularly:

- Track fee earnings.

- Watch out for impermanent loss and price slippage as potential risks.

- Monitor associated risks, such as market fluctuations and smart contract vulnerabilities.

- Adjust or withdraw if conditions change.

- Use tools like Zapper, DeBank, or specialized dashboards to monitor your LP tokens and rewards.

Key Risks of Liquidity Provision

Impermanent Loss

Occurs when token prices move significantly compared to when you deposited. If ETH doubles in price relative to USDC, you may end up with less ETH when you withdraw. Low liquidity can increase the risk of impermanent loss and slippage, making trades less efficient.

Smart Contract Risk

Liquidity pools run on smart contracts. If there is a bug or hack, your funds may be at risk. Always use audited and reputable platforms.

High Gas Fees

On Ethereum, fees can be very high. Beginners should consider networks like Polygon or BNB Chain for cheaper transactions.

Market Volatility

Pools with highly volatile assets can result in higher impermanent loss, although they may also generate more fees. Price volatility is a key risk for liquidity providers, especially in illiquid markets where low trading volume leads to greater volatility and slippage. Deep liquidity in pools helps reduce volatility and slippage, making trading more efficient and stable.

Security Measures for Liquidity Pools

Security is a top priority when participating in liquidity pools, as these pools are governed by smart contracts that can be vulnerable to bugs, hacks, or exploits. To protect both liquidity providers and their digital assets, robust security measures are essential.

One of the most important steps is ensuring that the smart contract code behind a liquidity pool has been thoroughly audited by reputable security firms. Audits help identify and fix vulnerabilities before they can be exploited. In addition, many liquidity pools incorporate built-in security features such as reentrancy locks, access controls, and emergency shutdown mechanisms to further safeguard funds.

Liquidity providers can also take proactive steps to manage risk. Using tools like smart contract analyzers and security oracles can help monitor the health and safety of a pool in real time. Diversifying across multiple pools and protocols, rather than concentrating all assets in one place, is another effective way to reduce exposure to potential threats.

By understanding and prioritizing these security measures, liquidity providers can confidently participate in liquidity pools, earn passive income, and contribute to a safer DeFi ecosystem.

Best Practices for Participating in Liquidity Pools

Participating in liquidity pools can be highly rewarding, but it also carries risks such as impermanent loss, smart contract vulnerabilities, and market volatility. To improve your chances of success and protect your capital, follow these best practices:

Start Small Before Committing Large Amounts

New users should begin by contributing a modest portion of their funds to a pool. This provides hands-on experience without exposing the entire portfolio to potential risks. By starting small, investors can observe how impermanent loss, fees, and market conditions affect performance before scaling their positions.

Research Protocol Audits and Security History

Security is the backbone of DeFi participation. Always check whether the protocol has undergone reputable third-party audits and review its history of vulnerabilities or exploits. Projects with multiple completed audits, bug bounty programs, and transparent documentation are generally safer than those without such safeguards.

Diversify Across Multiple Pools

Do not put all your funds into a single pool. Spreading liquidity across different pools and protocols reduces exposure to a single point of failure. For example, combining exposure to stablecoin pools with volatile asset pools balances risk and potential return.

Use Stablecoin Pools to Reduce Volatility Risk

Stablecoin pools such as USDC/USDT or DAI/USDC typically face lower volatility and impermanent loss compared to pools that involve two highly volatile assets. Although yields are often lower, stablecoin pools provide a more predictable return and are ideal for risk-averse investors or those seeking consistent income.

Stay Updated on DeFi News and Regulatory Trends

Regulations and security standards in DeFi are constantly evolving. Staying informed about governance updates, regulatory changes, and new security vulnerabilities allows you to adjust your strategies quickly. Following reputable DeFi news sources, communities, and project announcements is essential for protecting your funds.

Explore Liquidity Mining Opportunities

Many protocols reward liquidity providers with additional tokens through liquidity mining programs. These incentives can significantly increase yields, but they may also inflate token supply and reduce long-term value. Evaluate whether the reward token has strong fundamentals, community adoption, and utility before relying on it as a major source of profit.

Consider Yield Farming for Advanced Strategies

Yield farming takes liquidity provision a step further by allowing you to stake LP tokens in other protocols to earn additional rewards. For example, depositing LP tokens into a yield farming protocol may generate governance tokens or additional stablecoins. While the returns can be substantial, yield farming often introduces extra layers of smart contract risk, so it is best suited for experienced users.

Research Concentrated Liquidity Models

Advanced protocols such as Uniswap V3 offer concentrated liquidity, which allows providers to allocate funds within specific price ranges. This technique improves capital efficiency, increases potential fee earnings, and reduces slippage for traders. However, concentrated liquidity requires active management, as funds may become idle if prices move outside the chosen range.

Monitor Pool Performance Regularly

Passive participation is risky in a fast-moving DeFi environment. Monitor APRs, token price movements, impermanent loss, and changes to pool incentives. Tools such as portfolio trackers and on-chain analytics dashboards can help you evaluate whether your strategy remains profitable.

Plan for Gas Fees and Network Congestion

High transaction costs on Ethereum or other networks can eat into profits. Time your deposits, withdrawals, and rebalancing during periods of lower network congestion to reduce costs. Alternatively, explore Layer 2 solutions or multichain pools that offer lower fees and faster transactions.

Avoiding Common Mistakes

For new liquidity providers, navigating liquidity pools can be challenging, and certain missteps are easy to make. One of the most common mistakes is underestimating the risks involved, such as impermanent loss, smart contract vulnerabilities, and market volatility. It’s crucial to have a solid understanding of how liquidity pools work and the potential downsides before providing liquidity.

Another frequent error is failing to diversify. Putting all your assets into a single liquidity pool can expose you to unnecessary risk if that pool experiences issues. Instead, consider spreading your investments across different pools and protocols to balance potential rewards and risks.

Selecting a liquidity pool without researching its track record or security measures can also lead to problems. Always choose pools with strong reputations, transparent operations, and clear information about trading fees and rewards. Regularly monitoring your positions and being ready to adjust your strategy as market conditions change is key to long-term success.

By staying informed, practicing good security habits, and learning from the experiences of other liquidity providers, you can avoid common pitfalls and make the most of your journey in the DeFi ecosystem.

Frequently Asked Questions

How much should I start with?

You can start with as little as $20 in some pools, but fees can eat into returns if you start too small. A safe beginner range is $100 to $500. This allows you to experience the process without risking too much.

What are LP tokens used for?

LP tokens prove your ownership in a pool. You can use them to withdraw funds, but in many cases, you can also stake LP tokens in yield farming protocols for additional rewards. They are like receipts that show how much of the pool belongs to you.

Can I lose all my funds?

It is possible but very unlikely if you use trusted platforms. Most risks come from smart contract exploits or extreme market crashes. Diversifying across multiple pools and platforms can reduce this risk.

What is impermanent loss in simple terms?

Imagine you deposit ETH and USDC in a pool. If ETH price doubles, the pool balances your share so you have less ETH and more USDC. When you withdraw, your dollar value may be lower than simply holding ETH. However, trading fees you earn can sometimes offset this loss.

Do I pay taxes on liquidity pool income?

Yes, in most countries. Income from fees and farming rewards is taxable. Withdrawing from pools may also create capital gains events. Keep detailed records and consult a tax advisor.

How long should I leave my funds in a pool?

There is no fixed rule. Some people leave funds for weeks to farm fees, while others commit for months to maximize rewards. However, always monitor conditions, as token volatility can affect returns.

Can I add funds to a pool anytime?

Yes. You can add or withdraw liquidity whenever you want, but you will pay gas fees each time.

Are stablecoin pools completely safe?

They are safer than volatile pools, but risks remain. If a stablecoin loses its peg (like UST in 2022), losses can occur. Stick to established stablecoins like USDC and DAI.

What happens if the DEX shuts down?

Since pools are on-chain, funds remain accessible as long as the blockchain is operational. However, if the project stops maintaining contracts, risks increase. Always choose protocols with strong track records.

Can I track my performance easily?

Yes. Tools like Zapper, Zerion, and DeBank display your positions, fees, and rewards in one dashboard. Some even calculate impermanent loss automatically.

Glossary

- Liquidity Pool: A collection of cryptocurrency tokens locked in a smart contract that facilitates decentralized trading.

- Liquidity Provider (LP): A person who contributes tokens to a liquidity pool.

- LP Tokens: Tokens that represent your share of a liquidity pool, which can also be used in yield farming.

- Automated Market Maker (AMM): A system that determines prices and enables trades directly from liquidity pools without order books.

- Impermanent Loss: A risk where token price movements cause a liquidity provider to end up with fewer assets than if they had held them.

- Stablecoin: A cryptocurrency pegged to a stable asset like the US dollar. Examples include USDC, USDT, and DAI.

- Smart Contract: A blockchain-based program that executes automatically when conditions are met.

- Yield Farming: A practice where LP tokens or assets are staked across platforms to earn additional rewards.

- Total Value Locked (TVL): The total amount of funds currently held in a DeFi protocol.

- Gas Fees: Costs paid in the native token of a blockchain to process transactions.

- Slippage: The difference between the expected price of a trade and the executed price.

- DEX (Decentralized Exchange): A platform that allows crypto trading without intermediaries.

- Protocol Audit: A professional review of a DeFi protocol’s code to ensure security.

- Staking: Locking tokens in a protocol to earn rewards and support network operations.

- Governance Token: A token that gives holders the right to vote on protocol decisions.

Conclusion

Providing liquidity is one of the most accessible ways for beginners to join the DeFi ecosystem. By contributing to a liquidity pool, you earn passive income, support decentralized trading, and gain experience with on-chain finance. Liquidity pools facilitate trades by allowing users to swap tokens directly without the need for centralized intermediaries, making DeFi markets more efficient. When liquidity pools open, they present new opportunities for earning and participation, but also introduce specific risks that users should understand.

The process may seem technical at first, but once broken down into steps, it becomes manageable: choose a platform, set up a wallet, acquire tokens, connect, add liquidity, and manage your position. The most important aspect is managing risks such as impermanent loss, smart contract vulnerabilities, and market volatility.

For beginners, the best strategy is to start small, experiment with stablecoin pools, and use tools to track your earnings. With time, you will become more comfortable and ready to explore more advanced strategies. In conclusion, liquidity pools are at the heart of decentralized finance, and participating in them is a powerful way to experience the future of financial systems. Conclusion liquidity pools: they play a crucial role in enabling decentralized trading and yield opportunities, but it is essential to understand the mechanics and risks before participating.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.