Ready To Place Your

Next Trade?

Choose a market, set your order, and manage risk in one place.

AI in crypto trading is no longer just a futuristic concept. In 2025, AI crypto trading bots are powering some of the most competitive strategies on both centralized and decentralized exchanges. These bots don’t just automate trades. They adapt, learn, and optimize based on live market data.

But how effective are they really? And are retail traders getting the same advantages as institutions?

Let’s unpack what’s real, what’s exaggerated, and what matters most when deploying AI-driven trading bots in spot and futures markets today.

[ez-toc]

An AI crypto trading bot is a system that uses machine learning and data-driven algorithms to execute trades based on complex decision trees. Unlike rule-based bots that follow fixed triggers (like RSI > 70 = sell), AI bots can process thousands of variables including:

They’re designed to mimic how human traders analyze markets—but faster, with more discipline, and without emotional bias.

| Feature | Traditional Bot | AI Trading Bot |

| Rules | Predefined & static | Adaptive & evolving |

| Data Used | Price & technical indicators | Price, volume, sentiment, macro data |

| Learning | None | Machine learning (supervised/un) |

| Optimization | Manual | Self-improving models |

| Strategy | Technical analysis | Multi-variable decision-making |

While standard bots rely heavily on fixed rules, AI crypto bots can retrain models based on real-world outcomes. For example, if a trading strategy begins underperforming due to a market shift, an AI bot can detect this and modify its behavior without waiting for manual input.

Spot AI trading bots usually focus on trend prediction, entry timing, and dynamic portfolio rebalancing. They operate on non-leveraged positions and often use sentiment analysis to assess long-term momentum.

Futures AI bots, on the other hand, are designed for higher frequency environments. They handle:

Given the risk profile of futures markets, AI bots in this domain emphasize risk control as much as profit generation.

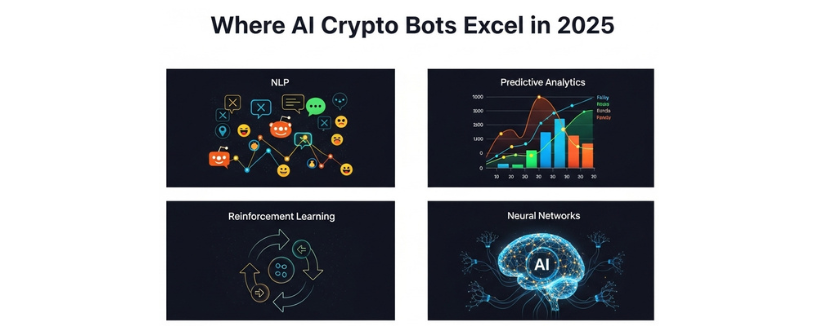

Modern bots often integrate multiple AI frameworks:

Traders often use platforms like TensorFlow, Scikit-learn, or proprietary models built into platforms like Bitunix, which supports low-latency execution needed for fast-response AI bots.

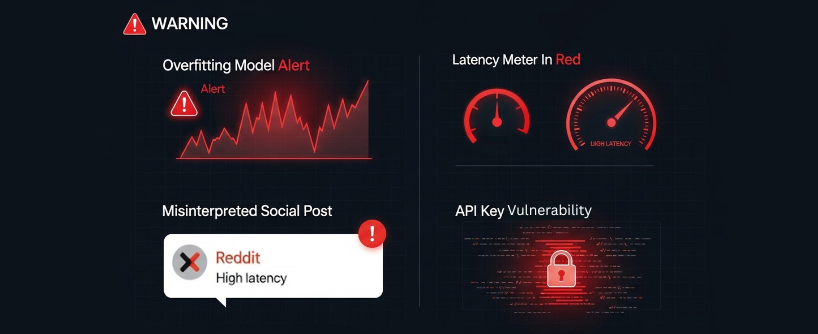

Despite their promise, AI trading bots are not foolproof. Risks include:

Not all bots are equal. Here’s how to evaluate one:

Let’s say you’re using a bot focused on Bitcoin perpetual contracts.

Bot Parameters:

Performance (30-day simulation):

The same bot underperformed in sideways conditions but switched to another mode after detecting volume decay and RSI flattening. This adaptive switching is why many traders prefer AI.

Are AI crypto trading bots better than manual trading?

AI bots offer consistent execution and data-driven decisions, but they require quality inputs and risk settings. They’re most effective when combined with manual oversight.

Do I need coding skills to use AI bots?

Not necessarily. Some platforms offer plug-and-play AI tools, while others require custom integration using Python or JavaScript. Bitunix supports both formats via API.

Are AI trading bots legal and safe to use?

Yes, as long as they comply with the platform’s terms of use. Always protect your API keys and only use reputable services.

Can I use AI bots for altcoin trading?

Yes. Many bots are trained to work across major altcoins and support features like spread monitoring, liquidity checks, and social momentum detection.

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.