Momentum crypto trading has been a popular strategy in financial markets for decades. The idea is simple: assets that are rising tend to keep rising, while assets that are falling often continue to drop. In the cryptocurrency market, momentum is especially powerful because of the volatile nature of the market and the emotional reactions that drive price swings.

By 2025, artificial intelligence has taken momentum trading to the next level. Neural networks and deep learning models now process massive amounts of price and sentiment data to identify momentum earlier and more accurately than human traders can. These AI systems not only recognize trends but also adapt as conditions change, allowing them to respond quickly to changing market conditions and react to new signals in real time. This makes them ideal for navigating unpredictable crypto markets.

This article explores how momentum-based AI crypto trading works, the role of neural networks and deep learning, and how traders can build effective strategies.

[ez-toc]

What is Momentum Trading in Crypto

Momentum trading is built on the idea of capturing profits from strong price moves. A trader enters positions in the direction of momentum and rides the wave as the price continues to rise, exiting when signs of reversal appear.

- Bullish momentum: Entering when assets break resistance levels with strong volume.

- Bearish momentum: Shorting when assets fall through key supports.

Knowing when to sell is crucial in momentum trading to lock in gains before prices reverse. The challenge is timing. Enter too late, and most of the move is gone. Enter too early, and you risk false signals. AI algorithms aim to solve this timing problem by analyzing data faster than humans.

Other traders may react emotionally or chase trends after the initial move, often missing the optimal entry or exit points that AI-driven strategies can identify. Acting in the opposite way of momentum signals—such as buying when prices are already peaking or selling after a decline, can lead to losses rather than gains.

How Neural Networks Improve Momentum Trading

Neural networks mimic how the human brain processes information. In trading, they analyze large sets of historical and real time data to recognize patterns that signal momentum.

- Pattern Recognition: Neural networks have the ability to identify subtle relationships between indicators, price action, and volume.

- Adaptability: Unlike fixed rules, neural networks adjust as markets evolve.

- Multi Input Capability: They process technical signals, investor sentiment, other sentiment data, and on chain activity simultaneously.

For example, a neural network may learn that when Bitcoin volume spikes, RSI trends upward, and social sentiment improves, there is a high probability of sustained momentum.

Neural networks can also personalize outputs based on user data or preferences, tailoring trading signals to individual needs.

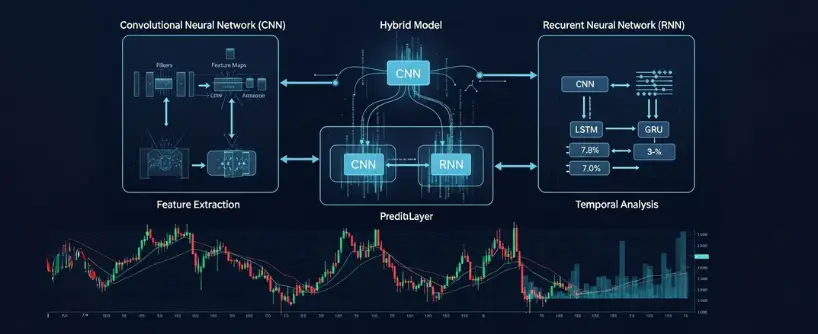

Deep Learning Models for Momentum

Deep learning is a subset of machine learning that uses multiple layers of neural networks. These layers allow models to capture complex, non linear relationships in data and are often built upon principles of technical analysis to interpret market signals.

- Convolutional Networks: Useful for identifying patterns in price charts.

- Recurrent Networks: Effective at analyzing time series data such as price movement, including stock price and cryptocurrency trading data.

- Hybrid Models: Combine different structures to improve accuracy.

In momentum trading, deep learning models can track how momentum builds over multiple timeframes, predicting when rallies are likely to continue and when they are about to fade. These models are capable of making short term predictions as well as identifying longer-term trend directions. They are used to forecast the expected future movement of stock price and cryptocurrency assets, helping traders anticipate both short term volatility and broader market trends.

Building Momentum Based AI Strategies

A strong AI momentum strategy combines inputs, models, and execution rules. AI-driven approaches can create and manage portfolios tailored to different types of investors, optimizing for various asset classes and risk profiles. The platform plays a crucial role in executing AI momentum strategies, providing a secure and efficient environment for trading and portfolio management.

Inputs: Inputs may include a wide range of factors such as price, volume, volatility, and sentiment data. These can be sourced from different asset classes, including stocks, bonds, currencies, commodities, and cryptocurrencies. Data on funds and securities with high liquidity and trading volume are also important for effective strategy development.

Models: Models process these inputs to identify trends and signals, helping to manage exposure to specific assets or risks. They are designed to adapt to changing market conditions, ensuring that strategies remain effective as volatility, trends, and external events shift.

Execution Rules: Execution rules determine how and when trades are placed. Effective rules help manage capital allocation, maximize gains, and increase the likelihood of success and benefit for investments and overall portfolio performance. These rules are essential for capturing momentum while controlling risk and optimizing returns.

Inputs

- Technical indicators: RSI, MACD, moving averages, Bollinger Bands, and closing price.

- Volume analysis: Sharp increases often confirm momentum; tracking prices and their volatility is crucial for accurate analysis.

- Sentiment: Positive or negative chatter amplifies momentum.

- On chain data: Whale transfers and exchange inflows affect strength of moves.

- External factors: Economic news, regulatory changes, and other external factors can significantly influence prices and market momentum.

Models

- Neural networks trained on historical market data.

- Deep learning models that combine price, volume, and sentiment.

- Reinforcement learning to improve strategies through trial and error.

- Models can also incorporate momentum indicator values and other indicator data, such as the position relative to the zero line, to help inform trading decisions.

Execution Rules

- Enter trades when probability of continuation is high.

- Use stop losses and limit orders to control downside risk and manage trade execution.

- Watch key indicators or market signals closely during trade execution to stay informed of changing conditions.

- Exit positions when indicators or model signals suggest reversal; know when to sell by recognizing a clear sign of momentum weakening.

Benefits of AI Momentum Trading

- Faster Reaction: AI identifies momentum early, which can lead to better outcomes and faster decision-making.

- Adaptability: Models learn and adjust to changing conditions, a crucial benefit for success in volatile markets.

- Consistency: Removes emotional hesitation, following data instead of fear or greed.

- Scalability: Can analyze multiple assets simultaneously.

- Leading Position: AI momentum trading puts traders in a leading position to capitalize on trends before others follow.

Risks and Challenges

Momentum-based AI strategies are powerful but not foolproof.

- False Breakouts: Models may misread noise as momentum.

- Overfitting: Strategies that work on past data may fail in live markets.

- Data Dependency: Poor quality inputs reduce accuracy.

- Market Shocks: Unexpected news can override momentum signals.

- Market Volatility: High market volatility can disrupt strategy performance and lead to unpredictable results.

- Negative Trajectory: A sustained negative trajectory in asset prices can challenge momentum strategies and result in losses.

- Exposure: Failing to manage exposure can increase the risk of large losses during adverse market conditions.

This is why traders must combine AI strategies with strong risk management.

Case Study AI Momentum Trading in 2025

In early 2025, Ethereum broke above a key resistance near 4,500 dollars. Neural network models trained on historical breakout data analyzed stock prices and identified an upward trend, flagging strong bullish momentum. On chain data confirmed whale accumulation, while social sentiment turned positive.

AI momentum algorithms triggered long entries across major exchanges. These models also monitored for negative momentum as a warning sign, ensuring timely exits if a downward trend emerged. Within days, Ethereum surged to 4,900 dollars before consolidating. Traders who relied only on basic indicators entered later, but AI powered strategies captured the move earlier and exited with discipline.

This case highlights how neural networks add speed and precision to momentum strategies.

Best Practices for Traders Using AI Momentum Strategies

- Start Small: Test strategies with small positions or paper trading. Remember, examples provided are for illustrative purposes only and do not constitute financial advice.

- Diversify Inputs: Combine technical, sentiment, and on chain data. Understand the difference between backtested and live trading outcomes, as real market conditions can vary significantly.

- Monitor Models: Review performance and retrain models regularly. Past performance is not indicative of future results; always be aware of the risks involved.

- Stay Disciplined: Follow risk rules regardless of confidence in AI predictions.

- Learn Continuously: Use educational resources to understand how AI signals fit into broader strategy.

How Bitunix Academy Helps Traders Learn AI Momentum Trading

Momentum trading with AI requires both tools and education. Bitunix Academy provides structured lessons on neural networks, algorithmic trading, and momentum indicators. Traders can learn how to build strategies, manage risk, and integrate AI with human decision making.

By studying real examples and practicing with simulations, traders gain the confidence to apply momentum based AI strategies in live markets. Search the web for Bitunix Academy to access detailed guides, tutorials, and case studies.

Frequently Asked Questions

What is momentum trading in crypto?

It is a strategy that seeks to profit from strong price trends by entering in the direction of momentum.

How do neural networks help with momentum trading?

They recognize patterns in data and predict when momentum is likely to continue or reverse.

Are AI momentum strategies risk free?

No. They improve timing and accuracy but still face risks like false signals and sudden market events.

Do I need to code to use AI momentum trading?

Not always. Platforms like Bitunix offer tools and pre-built strategies for traders without coding skills.

Is Bitunix Academy useful for AI trading education?

Yes. It provides courses on algorithmic trading, momentum strategies, and AI tools tailored for crypto traders.

Conclusion

Momentum based AI crypto trading using neural networks is one of the most effective strategies in 2025. By analyzing technical indicators, sentiment, and on chain data together, AI systems identify trends earlier and manage trades with precision.

Neural networks and deep learning models give traders a powerful edge, but they must be used responsibly. Risks such as false signals and overfitting remain, making risk management essential.

For traders ready to embrace AI, momentum strategies open new possibilities. With platforms like Bitunix providing execution tools and Bitunix Academy offering structured education, the path to mastering AI momentum trading has never been clearer.

About Bitunix

Bitunix is one of the world’s fastest growing professional derivatives exchanges, trusted by over 3 million users across more than one hundred countries. Ranked among the top exchanges on major data aggregators, Bitunix processes billions in daily volume and offers a comprehensive suite of products including perpetual futures with high leverage, spot markets, and copy trading. Users can trade bitcoin and other major cryptocurrencies on the platform, taking advantage of advanced trading features. Known for its Ultra K line trading experience and responsive support, Bitunix provides a secure, transparent, and rewarding environment for both professional and everyday traders. Bitunix Academy adds structured lessons so you can build skills while you trade.

Bitunix Global Accounts

X | Telegram Announcements | Telegram Global | CoinMarketCap | Instagram | Facebook | LinkedIn | Reddit | Medium

Disclaimer: Trading digital assets involves risk and may result in the loss of capital. Always do your own research. Terms, conditions, and regional restrictions may apply.